3% S&P 500 Returns for the Next Decade

S&P 500 hit all-time highs amid gains in most major sectors. The S&P 500 was up for a sixth straight week. Rate sensitive sectors were top performers and energy was worst performing. Most of last week was about the rally broadening out. Canadian CPI came in light, market consensus is a 50 bp cut at the end of the month.

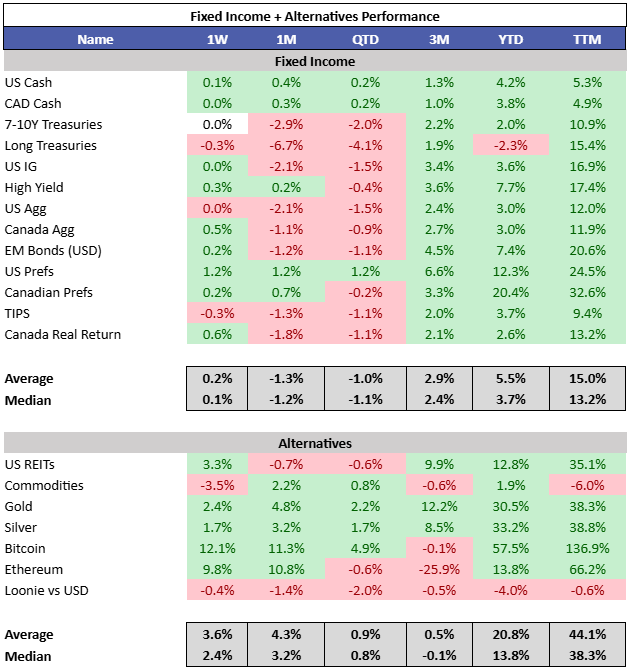

10Y yields were down 7 bps in Canada and up 3 bps in the US. Credit spreads hit 20 year lows. Crude was slammed after concerns of war in the Middle East failed to materialize. Gold had a strong week and crypto was up double digits. Gold crossed $2700/Oz, all time highs.

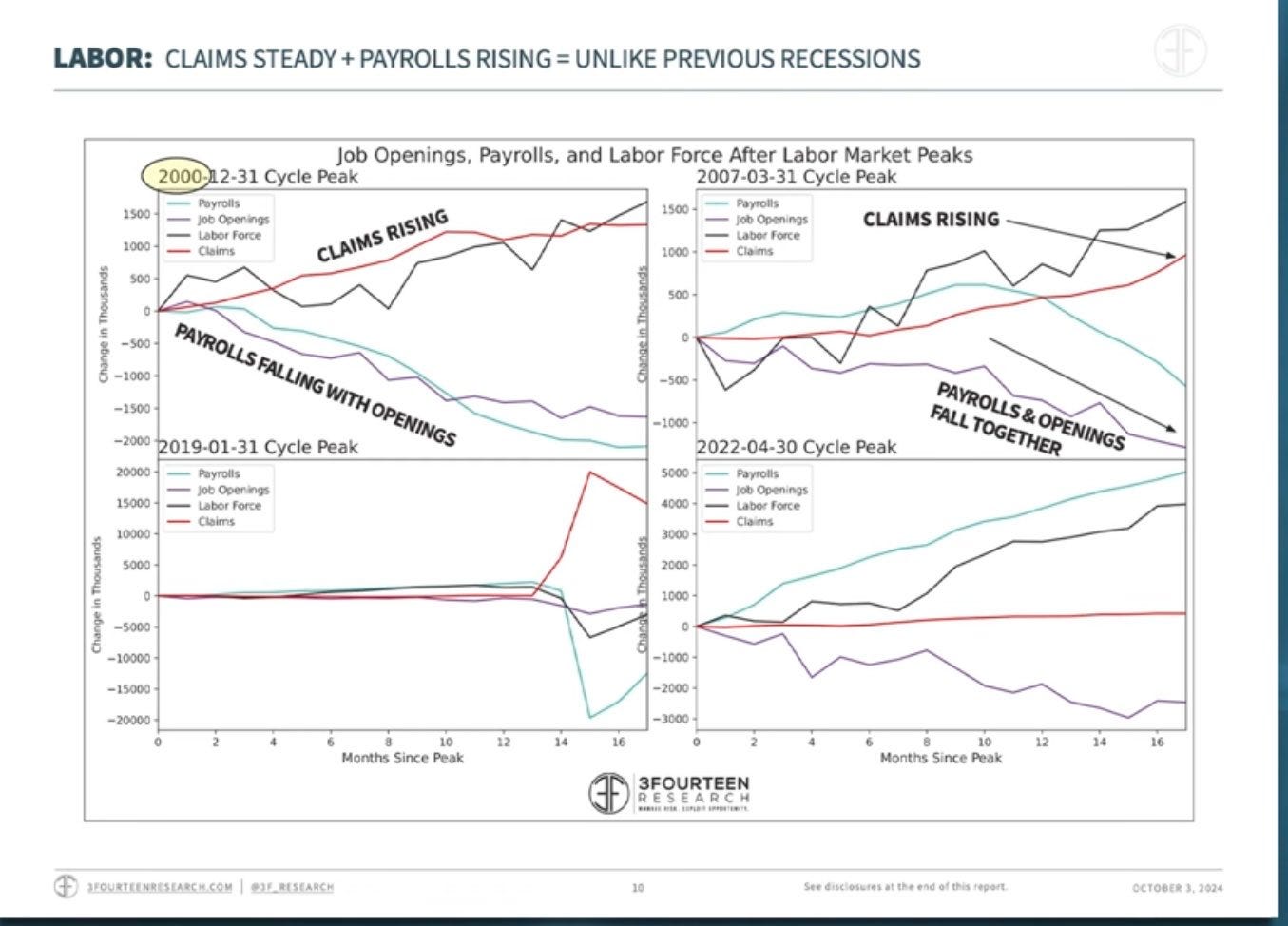

When unemployment rises due to labor supply, it loses its effectiveness as a cycle indicator. Previously, unemployment signaled demand; now, it reflects supply.

Investors remain convinced that the US is the one game in town.

However, Goldman was out last week pouring cold water on the party. The average investor is anchored on the past decade’s performance but it is unlikely to continue.

We estimate the S&P 500 will deliver an annualized nominal total return of 3% during the next 10 years (7th percentile since 1930) and roughly 1% on a real basis.

This is because of the starting point from a valuation perspective. Multiples are likely to be a headwind vs a tailwind. For the first time in 22 years, bonds yield more than the earnings yield of stocks. There isn’t an logical alternative, everything is expensive.

Even backing tech out of the index, the market is expensive in relation to the past 20 years.

Drilling into sectors, energy (XLE) is the only sector that looks cheap on a historical basis.

Looking at the largest companies in the world, it is not a bubble compared to 2000. The market is just broadly expensive.

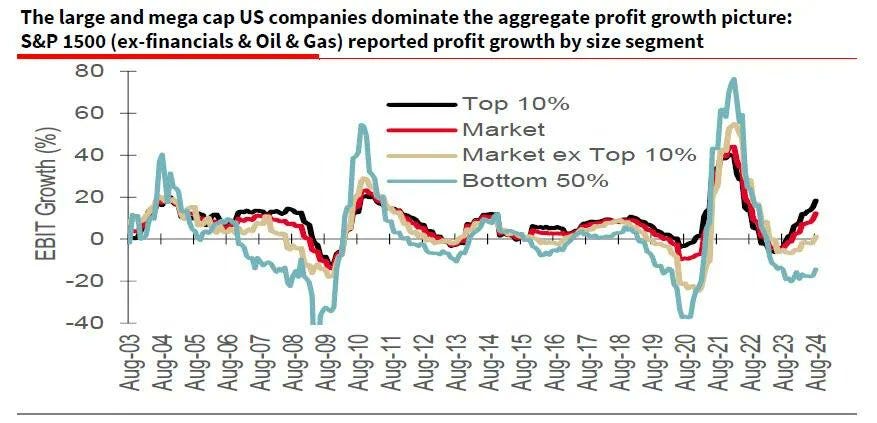

Looking at the large cap S&P 1500 universe, if one excludes just the top 10% of companies profits are flat. And If you exclude the top 50%, then profits are falling sharply.

It was the earnings growth, that propelled US outperformance since 2010. The recent earnings growth is part of the anchoring in US exceptionalism.

Another challenge is the historically high profit margins, which, in theory, should diminish over time due to competition. While profit margins once faced pressure from labor costs, technology now enables companies to replace labor with automation.

It is also extremely difficult to maintain high growth as companies get larger. Only 3% of companies were able to maintain 20% sales growth rates over a 10 year period.

And high margins get competed away.