Power of Luxury 👜

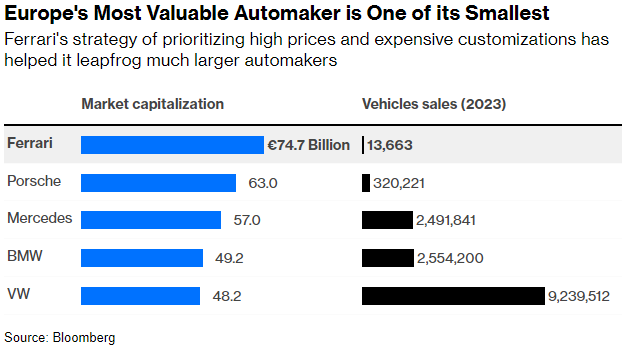

The auto industry highlights the value of luxury business models. Ferrari is Europe's most valuable automaker, while producing less than 1% of VW's output.

For designer luxury goods, it has been a slog in 2024 due to slow demand out of China.

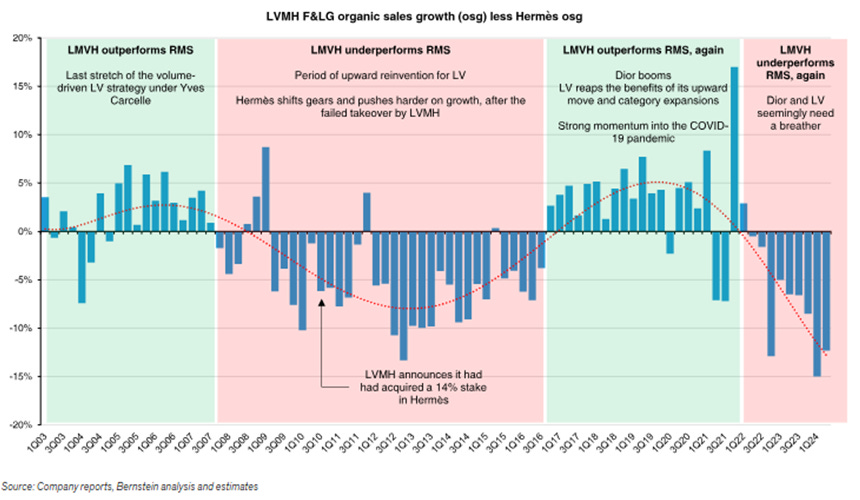

Luxury brands face challenges when they lose relevance, as consumers pay a premium for the hot brand. The following illustrates the sales trends of LVMH and Dior compared to Hermes, showcasing how brand popularity fluctuates.

Greenlight letter leaked, below is the meat of the commentary. The past couple years have been challenging for value oriented investors.

Warren Buffett is, of course, the most successful investor of his generation, and maybe of all time. While Mr. Buffett routinely points out that it is impossible to time the market, we can’t help but observe that he has been one of the best market timers we have ever seen. When the market got too frothy in the late 1960s, he closed his fund. Towards the market bottom in the early 1970s, he re-emerged as a stock picker and then prior to the 1987 crash, he sold everything except a couple of illiquid holdings. Later, he sidestepped the various crises in corporate credit and was well-positioned to capitalize on the 2008 global financial crisis. One could argue that sitting out bear markets has been the underappreciated reason for his outstanding long-term returns. It is therefore noteworthy to observe that Mr. Buffett is again selling large swaths of his stock portfolio and building enormous cash reserves.

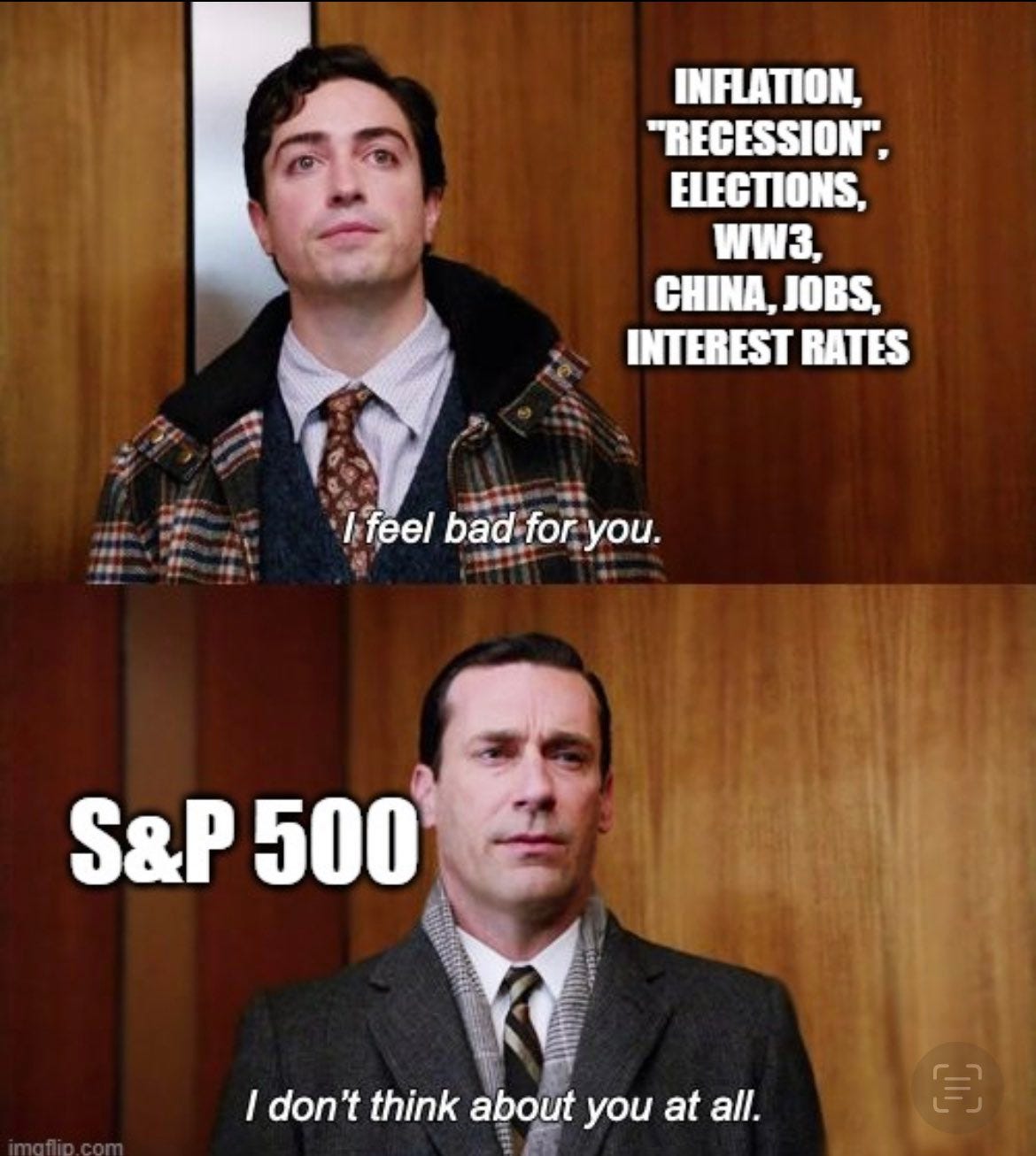

Our sense is that Mr. Buffett’s portfolio adjustments are not a prediction that the market will fall next week, next month, or even next quarter. Rather, these stock sales more likely express a long-term view that right now is not a great time to have a lot of equity exposure, and that the opportunity set is expected to be better at some point in the not-so-distant future. We will avoid calling this market a bubble, and simply observe that the dividend yield is low and the P/E ratio is elevated despite corporate earnings being cyclically high, if not top-of-cycle.

This time, it is not just a handful of high-profile technology companies with nosebleed valuations. In fact, it is easy to find mature, industrial businesses with cyclical exposure and growth prospects that aren’t materially better than the current nominal GDP growth rate that currently trade for 30-50x earnings. Obviously, the market appreciation thus far in 2024 has exceeded the growth rate of revenues and earnings. We think Paul Tudor Jones is right when he says that managing the last third of a great bull or bear market move is often the toughest.

The S&P 500 doesn’t care about the bears.

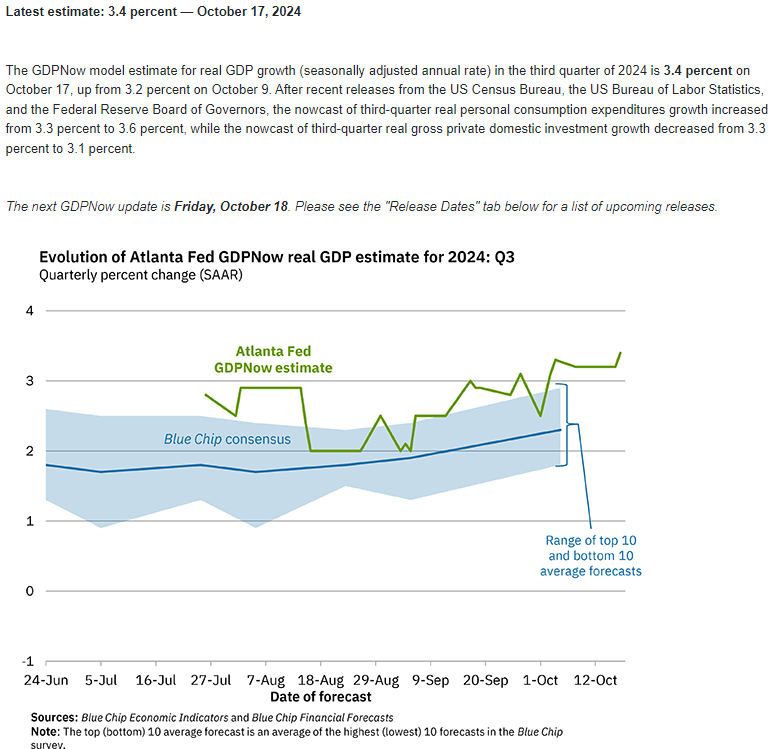

Atlanta Fed real GDP estimate now up to 3.4% for Q3. This is not an economy in desperate need of cuts, plan accordingly.

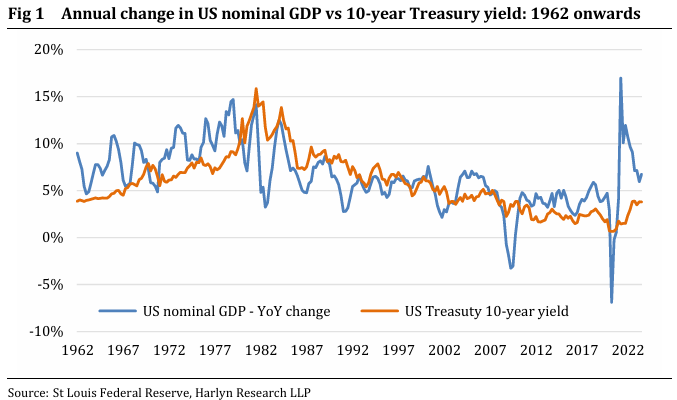

Nominal GDP running above 5%, will bond investors care eventually? From 1962 onwards, yields were on average 56 bps lower than nominal GDP growth. Yields could go higher.

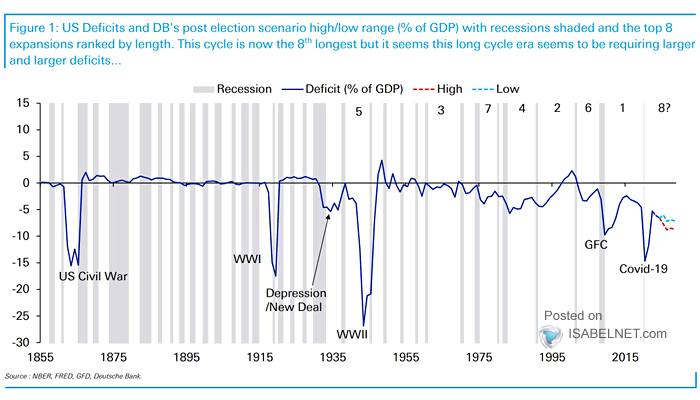

Why is the economy so strong? I think it is mostly the chart below.

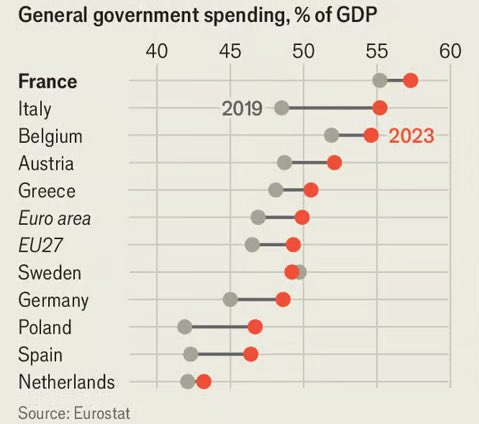

The US isn’t the only government spending more. Europe is in on the party.

The S&P 500 is not necessarily representative of the US economy, a divergence is possible.

Some investors waking up, 5Y inflation swaps with their largest 5 week change since March 2023.

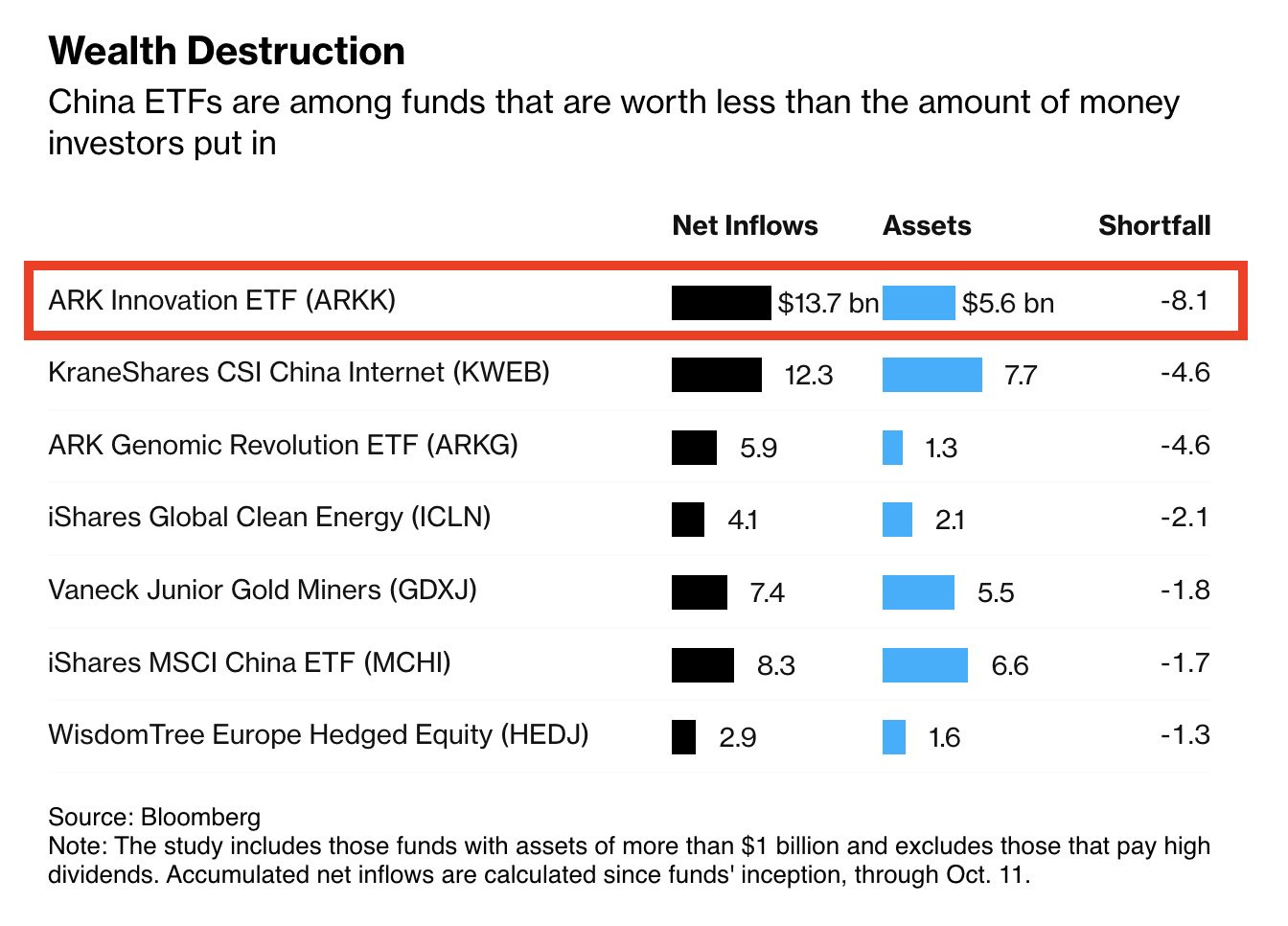

ARKK has been the largest wealth destroying ETF ever.

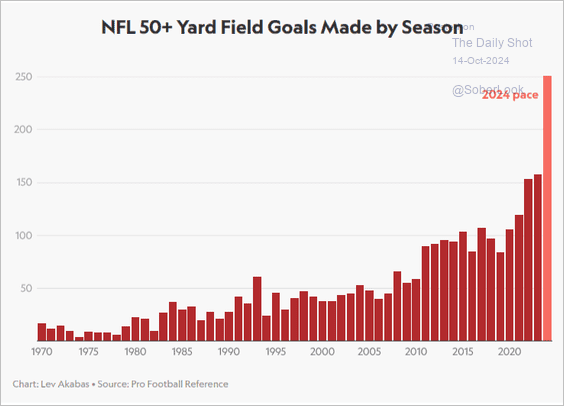

The professionalization of NFL kickers. More 50+ yard field goals are being made than ever before.

Good podcast with Jensen Huang, if you want to get bullish on AI. Pretty cool story about xAI standing up a massive data center in 19 days.