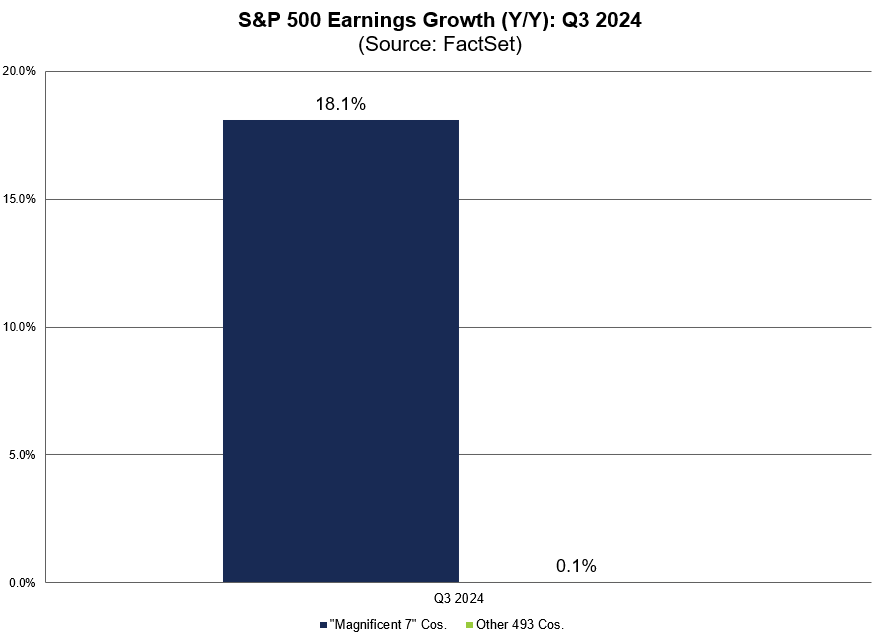

Q3 S&P 500 earnings growth is now expected to be fully driven by the Magnificent 7.

Paul Tudor Jones was on CNBC echoing similar comments to Stan Druckenmiller. Given all the talk about gold, I wonder if we are due for a breather. This reminds me of Jeff Currie marking the top of Copper, earlier this year.

Gold, Bitcoin, Commodities and Nasdaq, no bonds.

All roads lead to inflation.

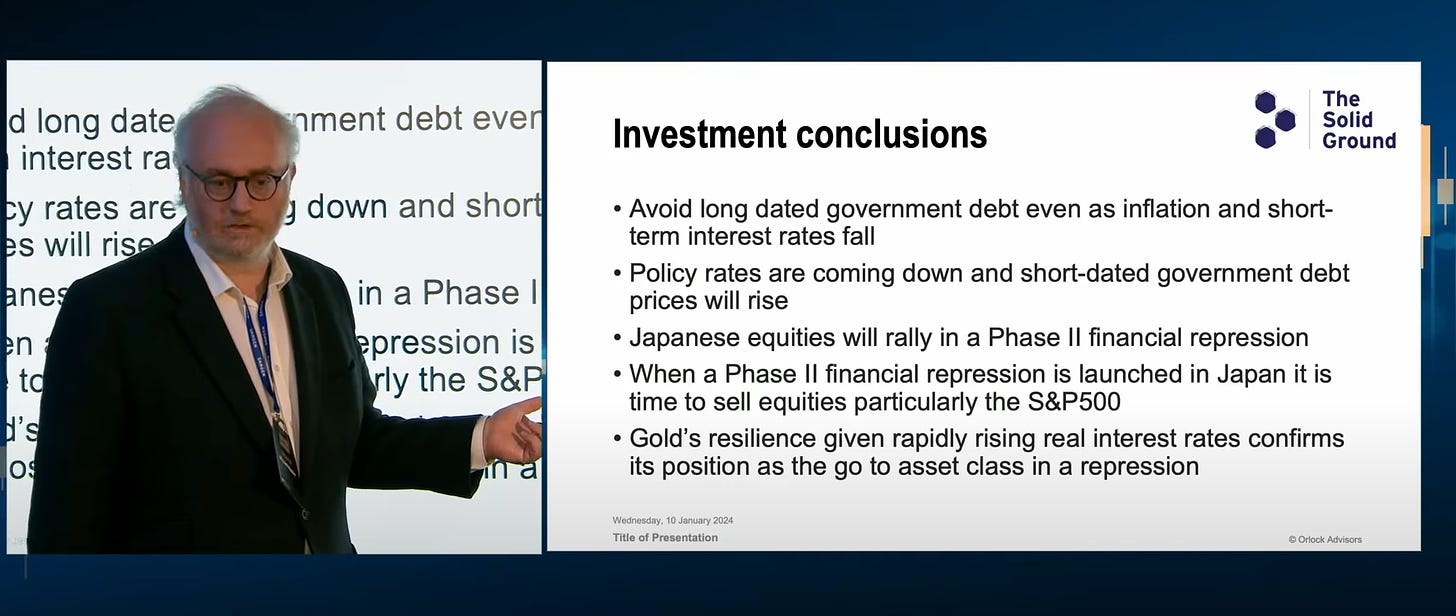

Listened to two talks from Russel Napier last night, he makes some bold calls:

Excessively high debt burdens will be inflated away

Financial repression requires the government to control both bank balance sheets and the actions of savings institutions

Bonds are 'certificates of confiscation'

The euro cannot survive a financial repression

Selected equities offer real returns - some EM, old economy, Japan, Value; not the S&P 500

Inflating away China's debts will require a flexible RMB & a new monetary system

To add from the second presentation, he thinks we will have a deflationary shock in the short term.

UK following in the footsteps of Canada with plans to tax entrepreneurs. This seems incredibly short sighted.

We could be exiting a period of extraordinary returns for many asset classes. I agree with this comment below from a Canadian Entrepreneur.

From GFC to 2021 could be one of the best equity/private equity return cycles in history. A ton of astute PE investors and entrepreneurs did exceptionally well. Some were smart and/or lucky. However too much capital overpaying for suspect or imaginary businesses usually ends badly.

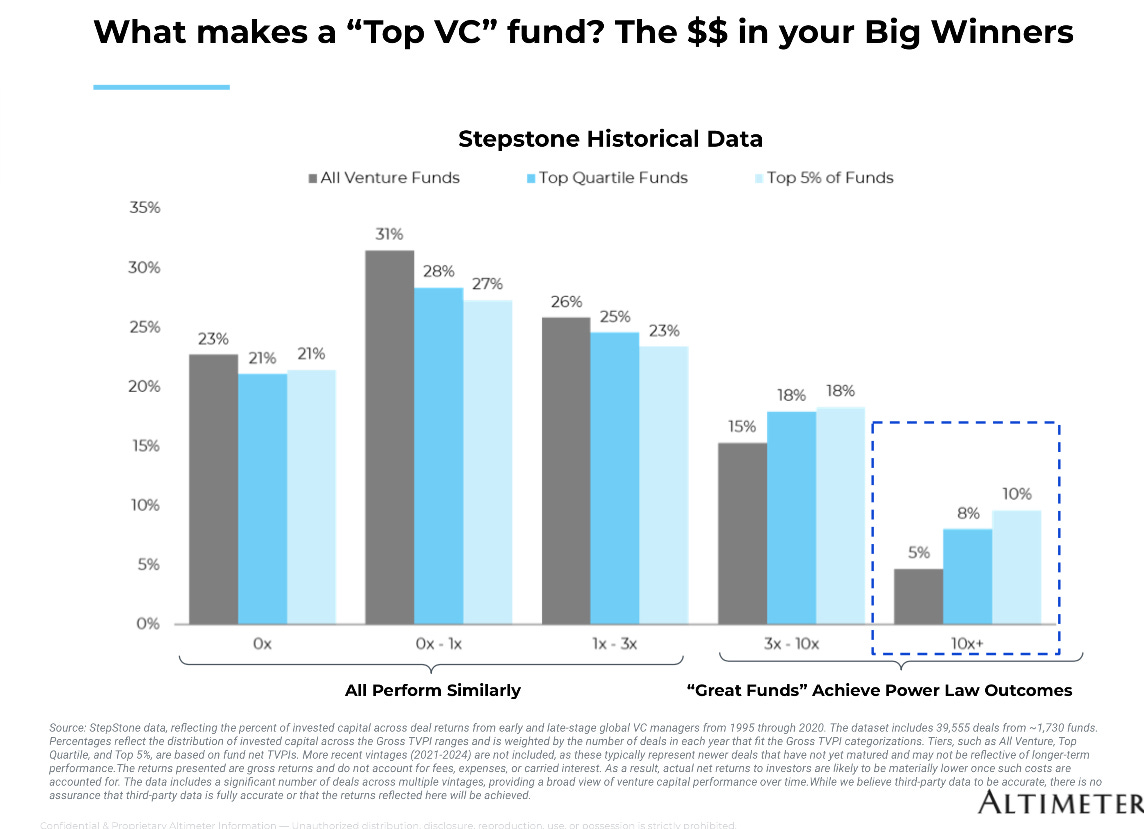

Great Venture funds are differentiated by the amount of 10x investments they have in the fund.

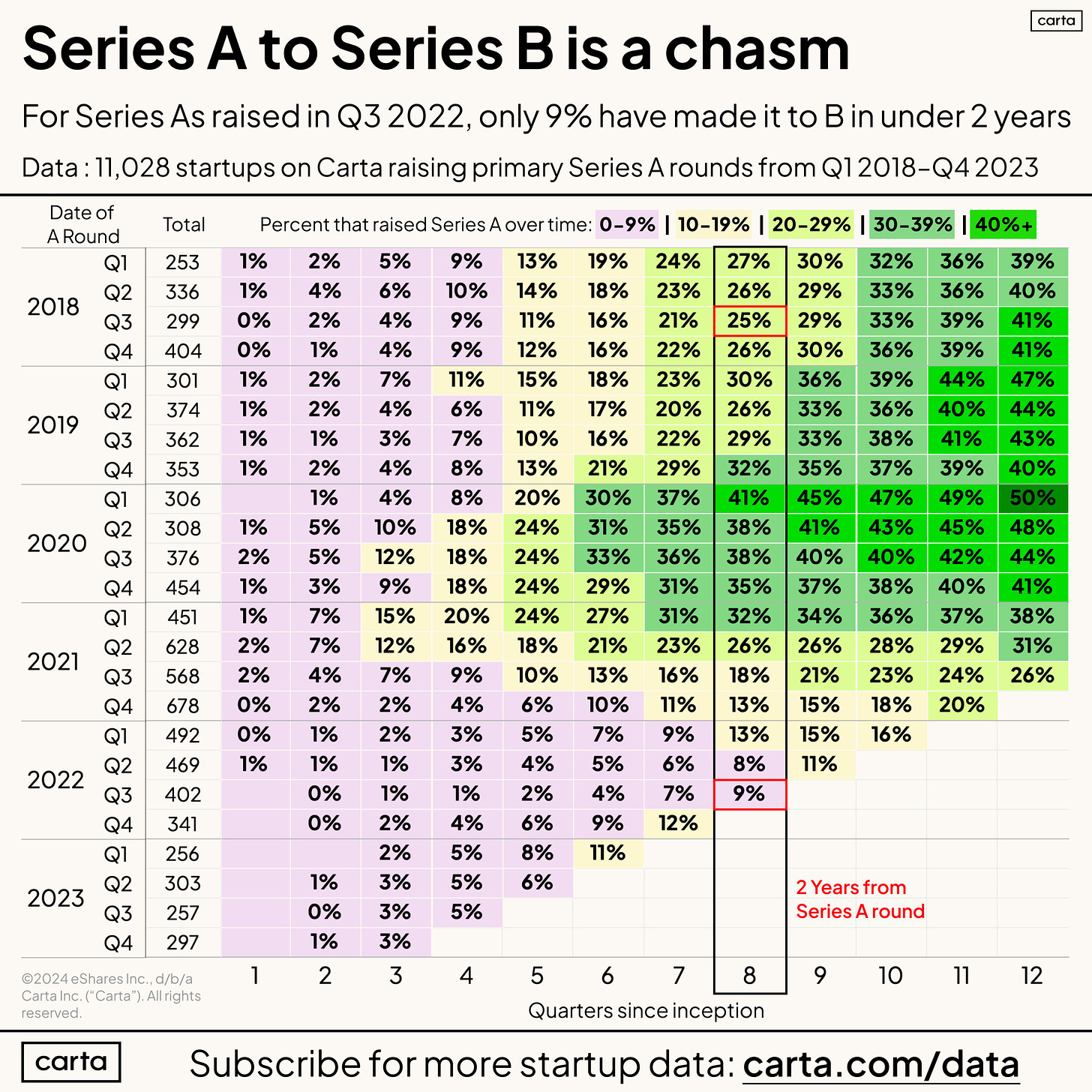

Only 9% of companies that raised series As in Q3 2022, have raised a series B. Compared to 25%-41% making it to Series B in a 2 year period during the go go times.

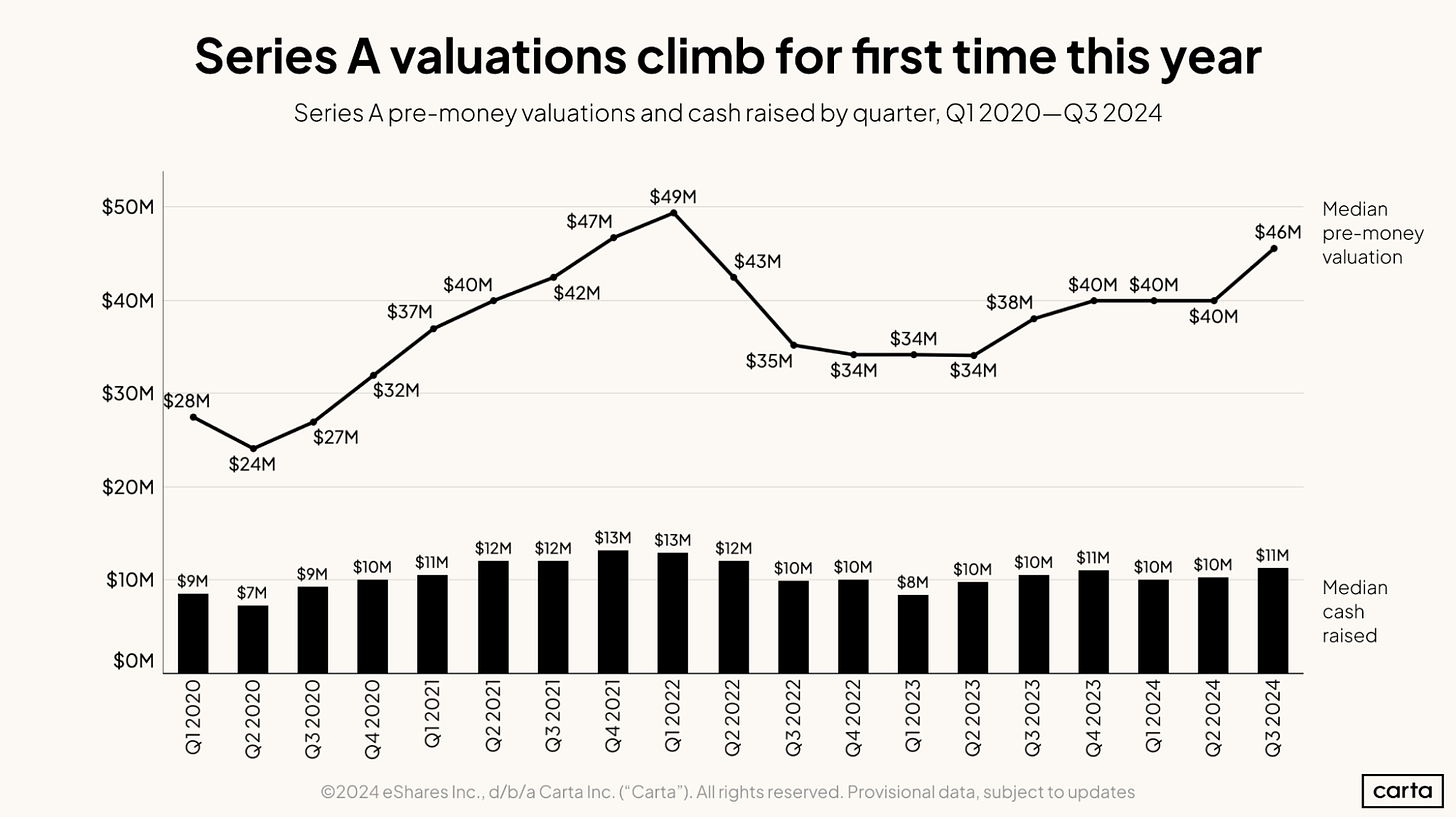

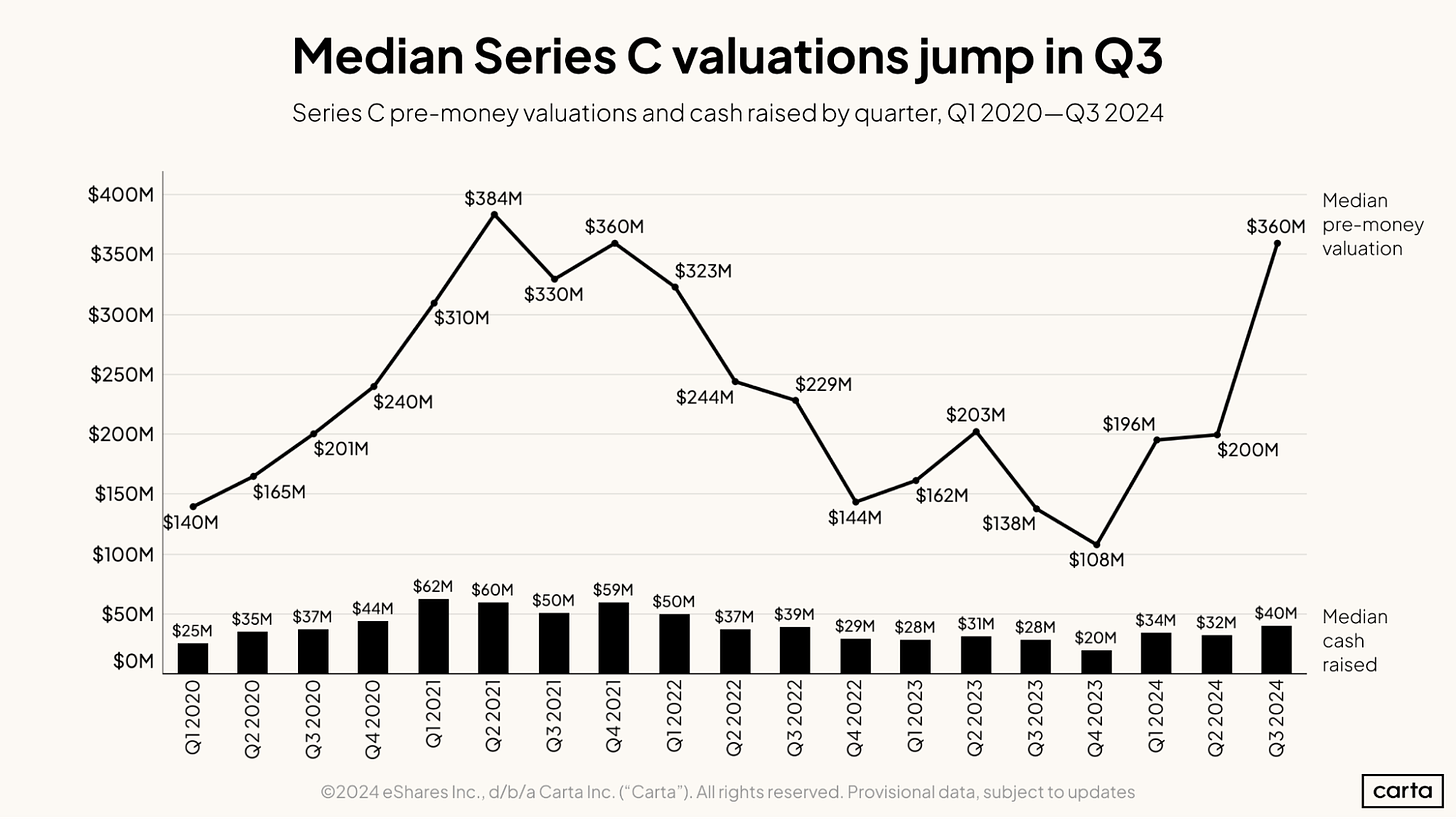

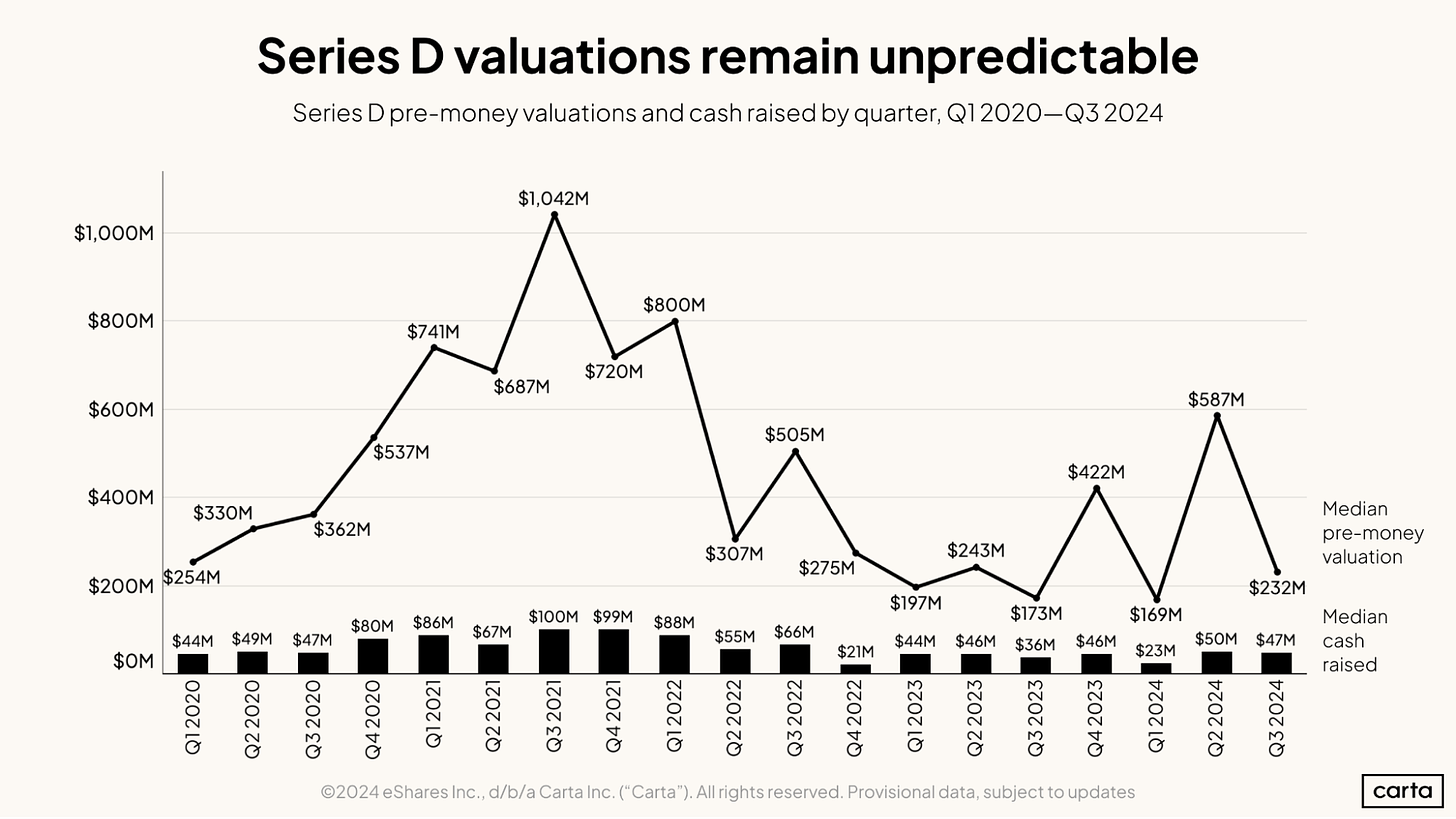

There are signs of a recovery in valuations (Charts for all stages). Seed, series A and series C saw higher valuations in Q3. Series B and later stage rounds saw valuations continue to decline.

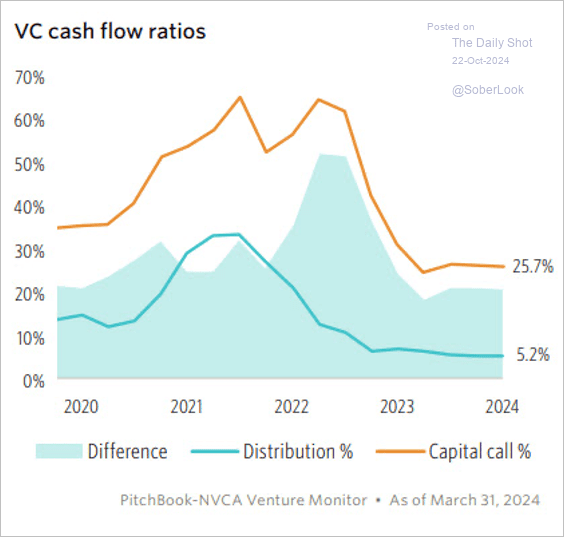

Venture commitments continued to get called but older vintages are not returning capital.

The September employment data caused the shift in rate cut expectations in the US.

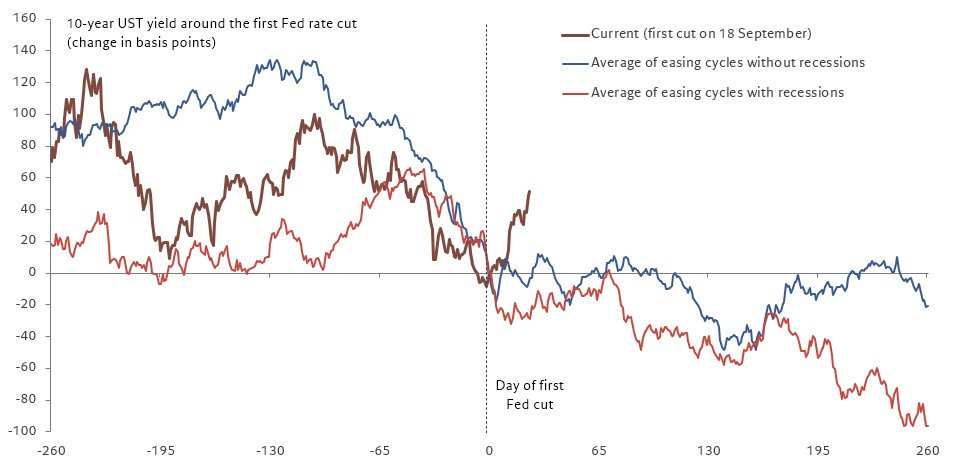

Looking at the 10Y, it caused this time to be different compared to previous first cuts.

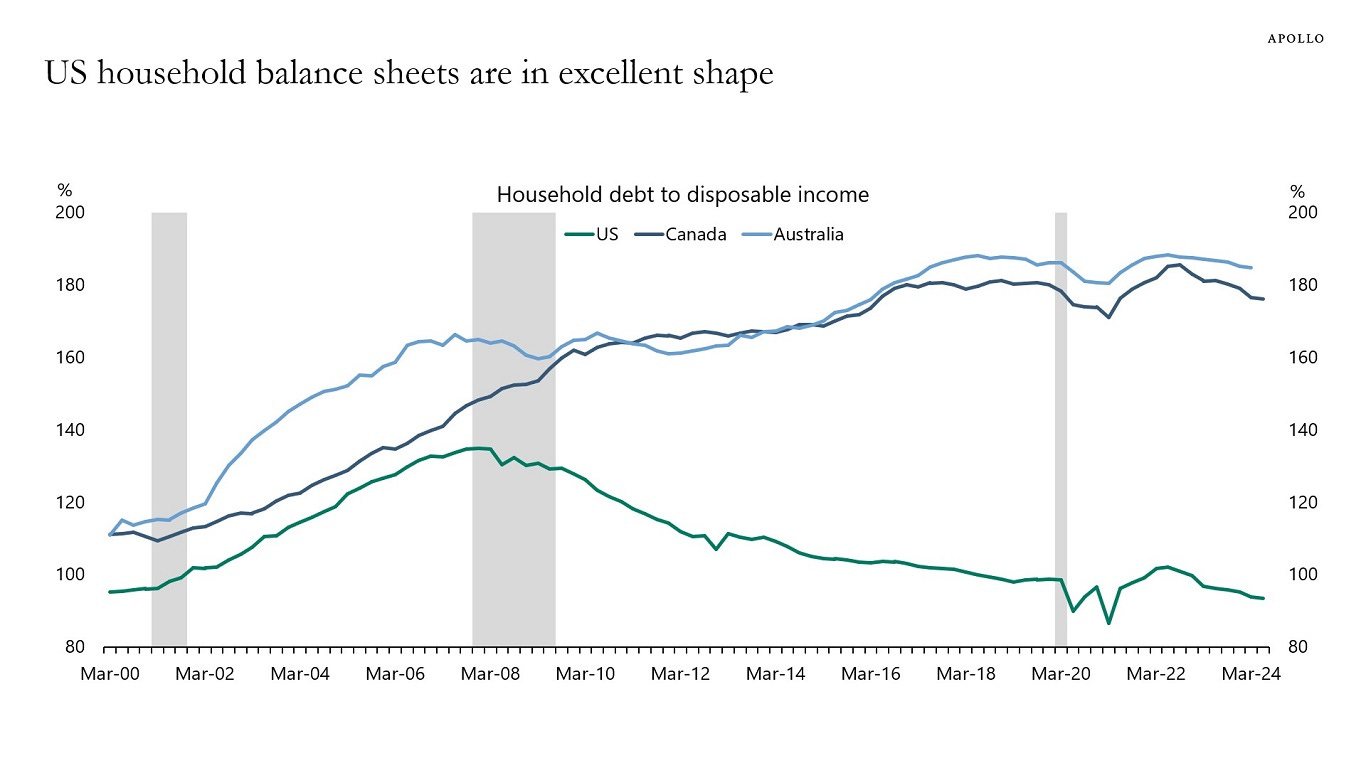

Household balance sheets are in much better shape in the US compared to Canada and Oz.

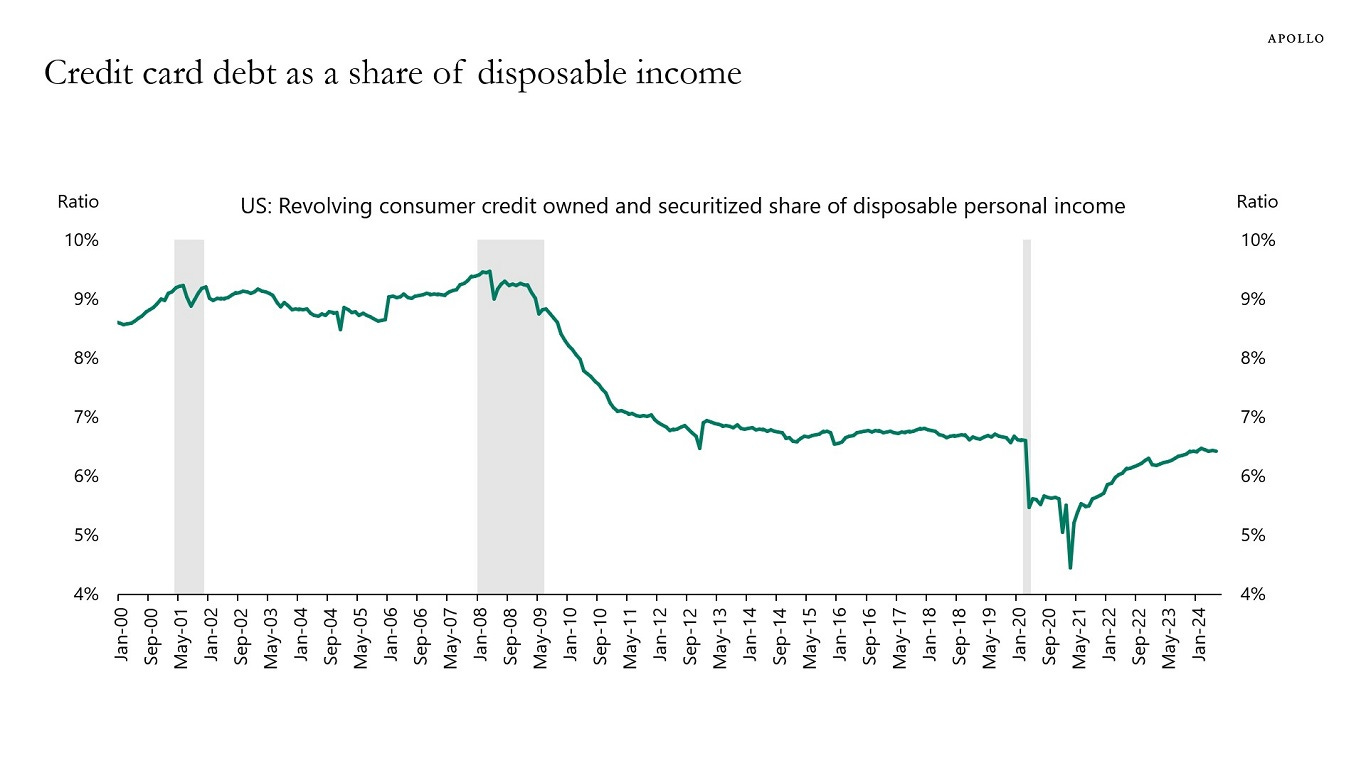

As % of disposable income, credit card debt doesn’t look extended either.

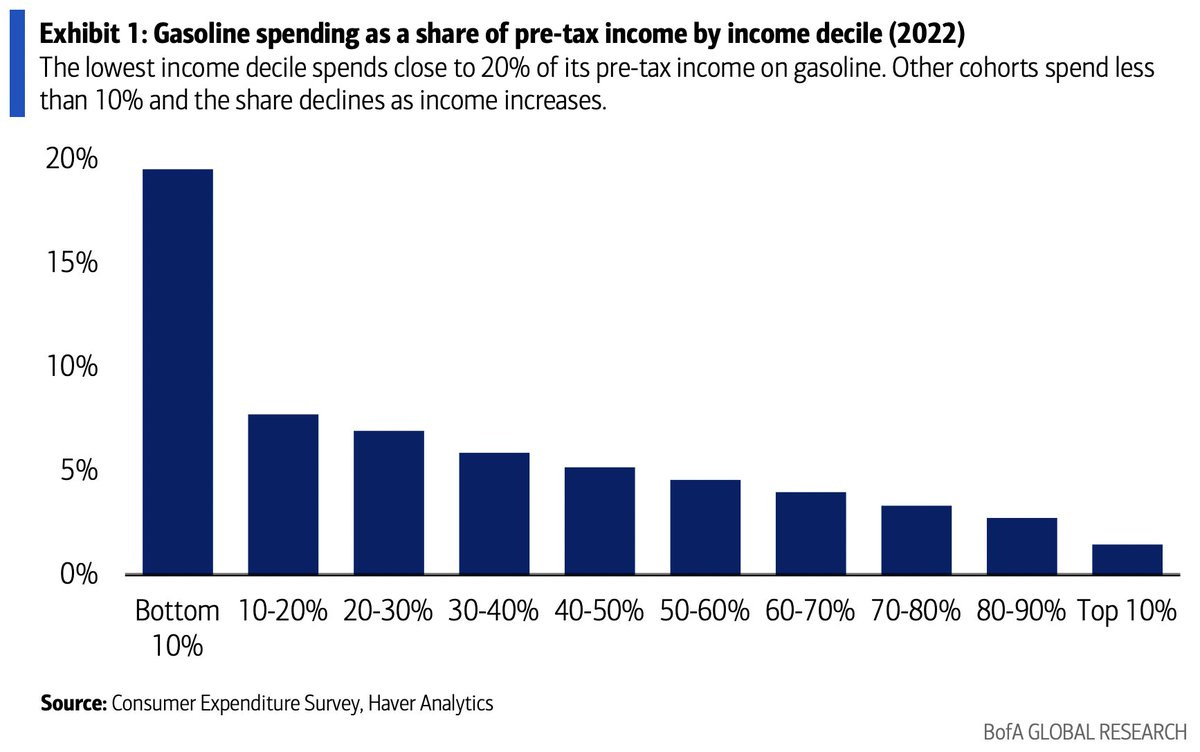

High gas prices disproportionately impact the lowest income earners. At least, high gas prices aren’t an issue right now and why the US is discouraging Israel from retaliating.