2024 Predictions

Final numbers are in for the 2023. The year saw markets claw back losses from 2022 and it was a risk on environment despite regional banks failing in March and tightening financial conditions in Q3 providing a bit of a scare. The Nasdaq was the top performing index, technology was the top performing sector, both led by the performance of the Magnificent 7. China was the lone major market in the red as the their reopening from Covid disappointed and stress in the property sector was worse than expected.

Average year for fixed income with US 10Y yields finishing the year flat. Canadian fixed income outperformed US indices with the Canadian 10Y down 19 bps in 2023. The Canadian dollar surprised up 2.3% against the USD on the year, mainly driven by the surprise pivot in December and easing US financial conditions. Commodities were down on the year led by energy. Strong year for gold as it finished the year around all time highs. Bitcoin was the top performing investment on my screener, up 150% but it is still far from its November 2021 highs.

Predictions for 2024 (Not investment advice)

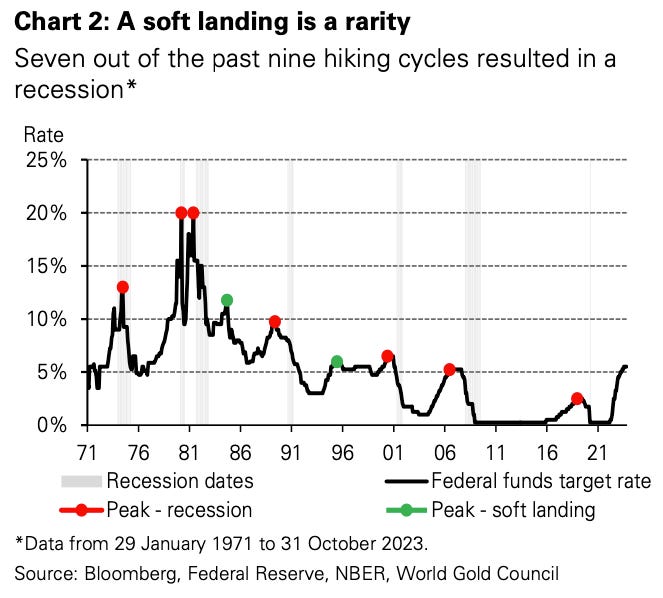

Current consensus is we get interest rate cuts, a decent economy and higher earnings. Yes, a soft landing is possible but historically it is the exception not the rule and therefore should be discounted appropriately.

I was a believer in the sequence laid out below to resolve any residual inflation pressures (full paper here); can be summarized as higher for longer until monetary policy produces a recession.

However, Jerome Powell decided to deviate from “The Script” and is easing ahead of schedule in hopes of manufacturing the soft landing.

The theme for 2024 is, “Don’t fight the powers that be”. The Fed showed their hand in December and I believe the Treasury and Government will do everything possible to juice the economy headed into the election.

Here are my 5 lukewarm, not fully consensus takes for 2024:

S&P 500 ends the year up over 10%

Inflation (CPI) ends 2024 higher than it is now

We end 2024 contemplating hikes not cuts

US Election is going to be a shit show

Bitcoin is the top performing asset class

Would love to hear some hot takes from the readers, comment or email me.

Despite a strong 2023 for equity markets, you would have likely been ahead had you T-Billed and chilled for the past 2 years.

Equities do tend to outperform over the long run. The series is mean reverting, driven by multiples expanding and contracting over a cycle. As multiples expand you have a smaller margin of safety, leading to lower forward returns.

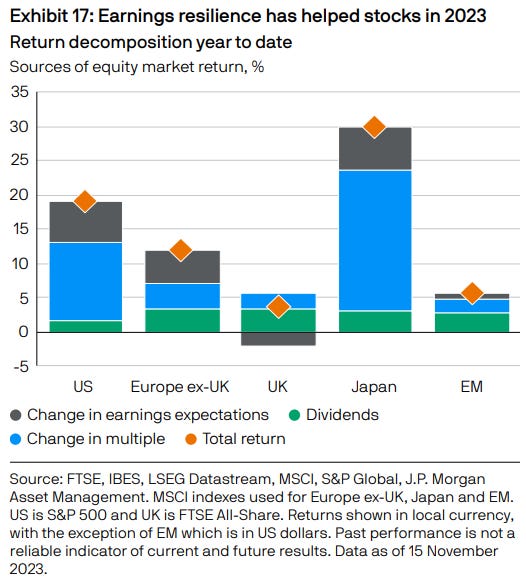

In 2023, US and Japanese equity returns were driven by expanding multiples.

Global equity markets look more fairly valued relative to the past 25 years compared to US markets. Will US exceptionalism continue to persist? Over a long enough period they tend to mean revert.

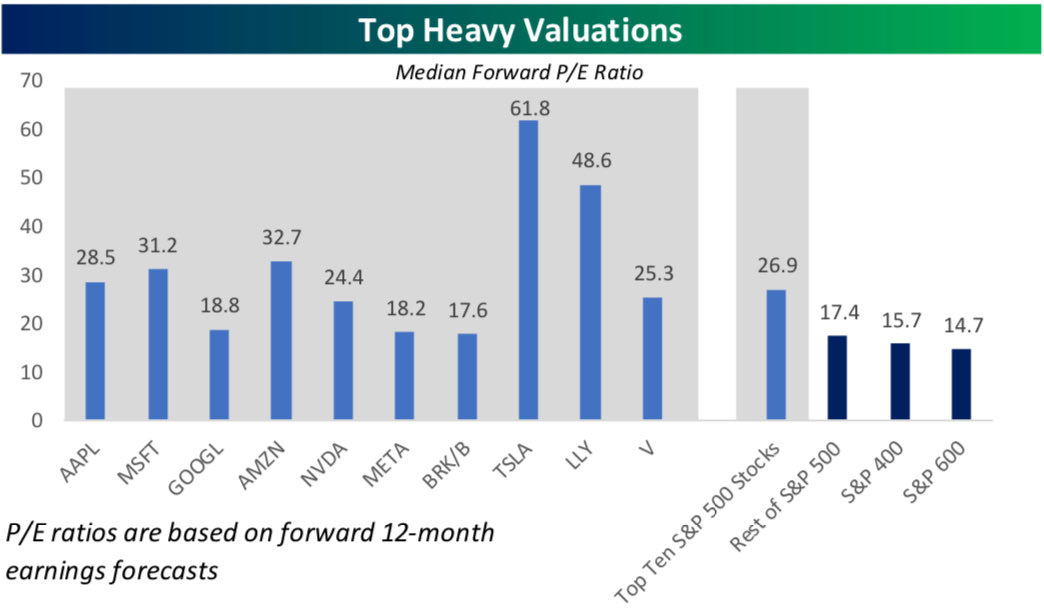

US equity market valuations are skewed by some large stocks. Excluding the top 10 stocks, US markets look more in line with the historical average.

Looking at these valuations relative to growth rates, Apple and Tesla are the outliers. Apple’s valuation perplexes me.

The E (earnings) could fall and tends to contract in a recession. JPM flags as inflation falls, sales will slow and corporates could continue to feel wage pressure squeezing margins.

Current consensus is 11% earnings growth in 2024. In 2023, earnings are expected to be flat YoY.

Corporate margins have continued to expand since 2000. Earnings were historically known as a mean reverting series but maybe something has changed. I wonder if is related to technology and offshoring.