2025 Predictions

Quick review of the 2024 predictions, they were pretty good. Hard to believe, that the market consensus for the S&P 500 was flat going into the year.

This year, I will aim to be more provocative. We will adopt the late Byron Wein’s definition of a surprise/prediction. Byron defines a “surprise” as an event that the average investor would only assign a one out of three chance of taking place but which Byron believes is “probable,” having a better than 50% likelihood of happening. This is not investment advice.

The S&P 500 is down on the year

US economy is not as strong as it seems on the surface and US growth begins to slow like we see in the RoW

Bitcoin hits $200k before the cycle turns in late 2025

Multiple of Trump’s appointees are shown the door before the end of 2025

Bear market in private markets continues, venture is most vulnerable

US Economy and the S&P 500

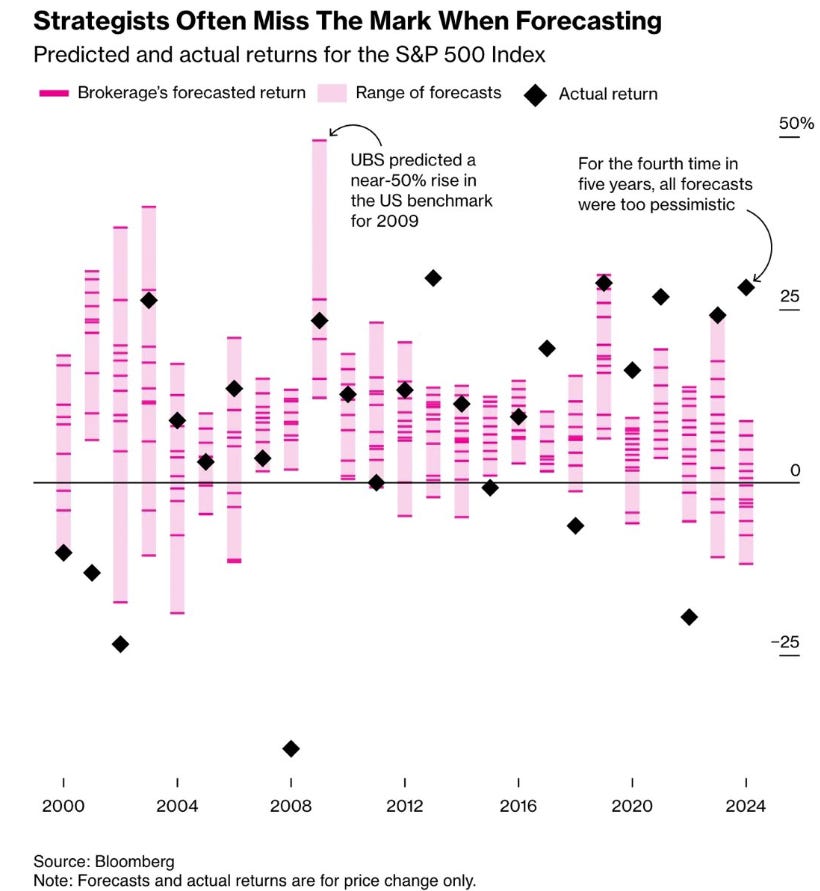

First of all, the Wall Street strategists were very wrong last year.

This wasn’t an anomaly. Nobody has an edge predicting where the broad market is going. So, don’t trust me or anyone who tells you what the market is going to do next year.

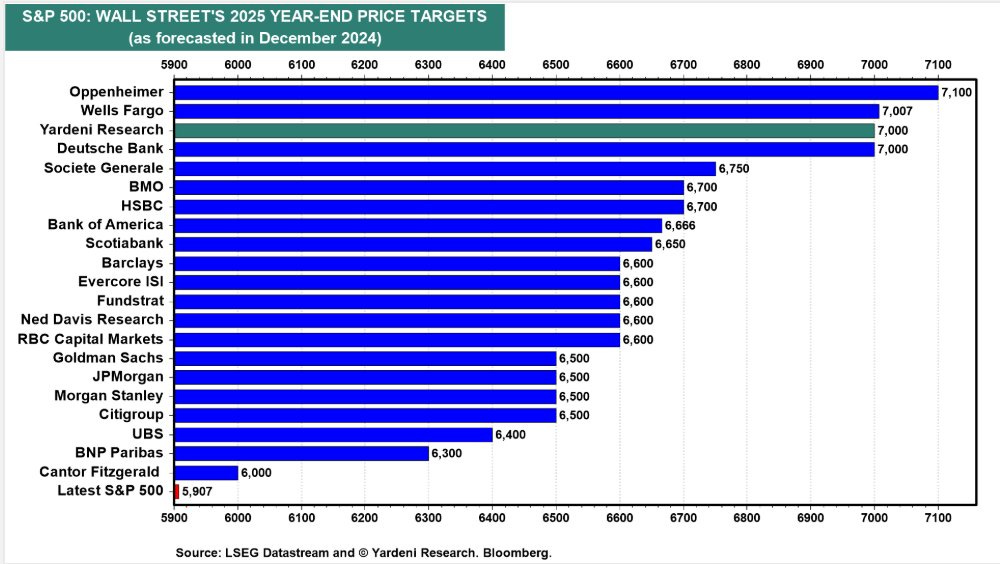

Bringing us to 2025 targets. Strategists are expecting a much better year for stocks. Part of the reason for my call is that it feels like expectations are sky high, multiples are extended and the good news is priced in. Even a strong economy could be derailed by rising yields.

Earnings will have to do the lifting from here and the consensus forecast is for the strongest earnings growth in years.

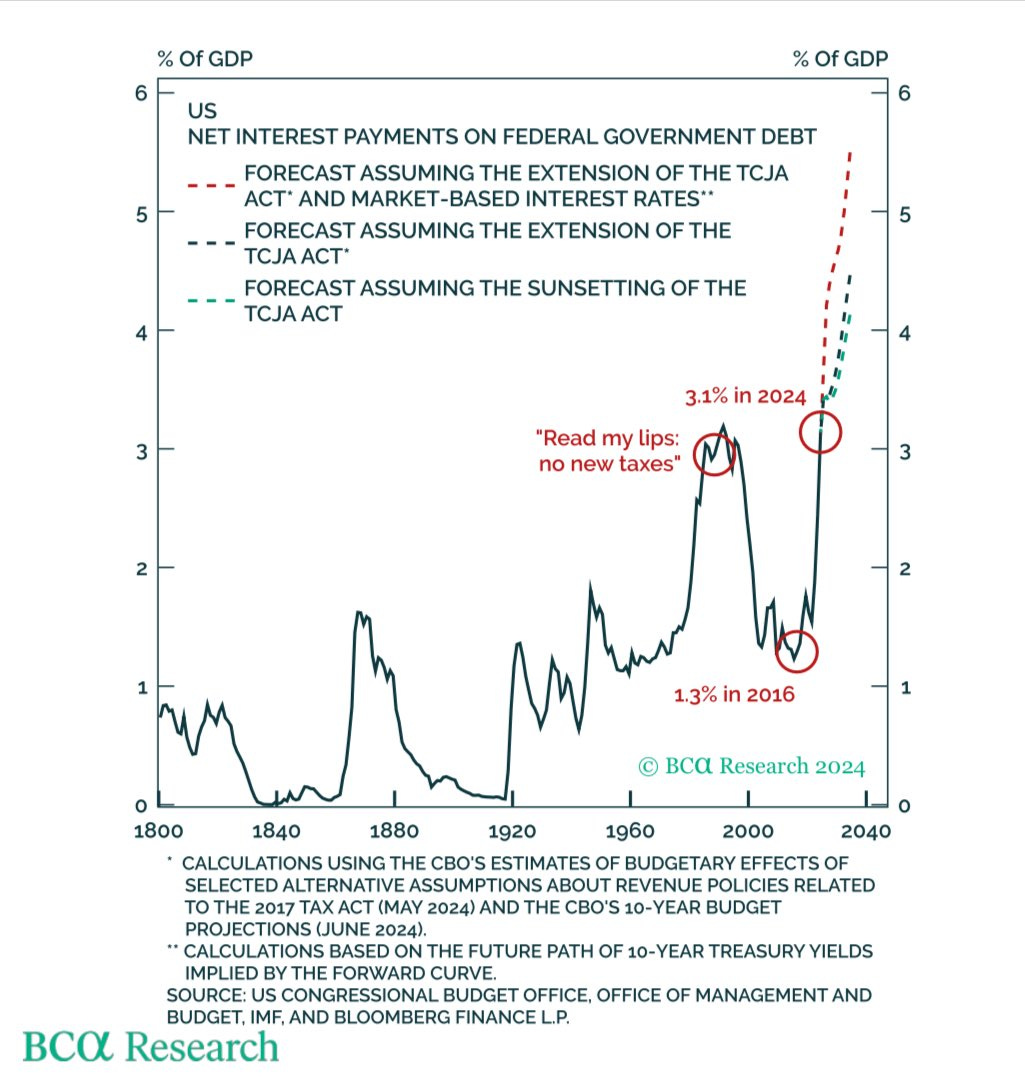

The market may be misjudging Trump. Many of his proposals could harm the economy, such as tariffs, strict immigration policies, and reducing the deficit and government workforce. If I thought the economy was genuinely weak and only sustained by unsustainable stimulus, I would act swiftly to limit the damage early in my term and there is precedent. Musk cut over 50-80% of Twitter within weeks of taking over the business.

Economic weakness that leads to lower yields would kick debt issues down the road as the government funds itself at much lower rates. You would also want to get the weakness out of the way earlier in your term, rather than later. You could have 3 years of recovery to be remembered for.

Additionally, lower yields would achieve another objective of weakening the dollar.

The reality is, Trump blabs, many of his promises contradict each other and it’s uncertain what will actually happen.

Bitcoin

Not over thinking this one. The BTC cycle tends to result in 3 years of outperformance. Secondly, if I was a politician interested in self enrichment, my friends and I would buy as much BTC as possible and then I would have my country endorse the asset.

The challenge with sizing up here, if you’re wrong, you will be very wrong.

Other Questions on My Mind

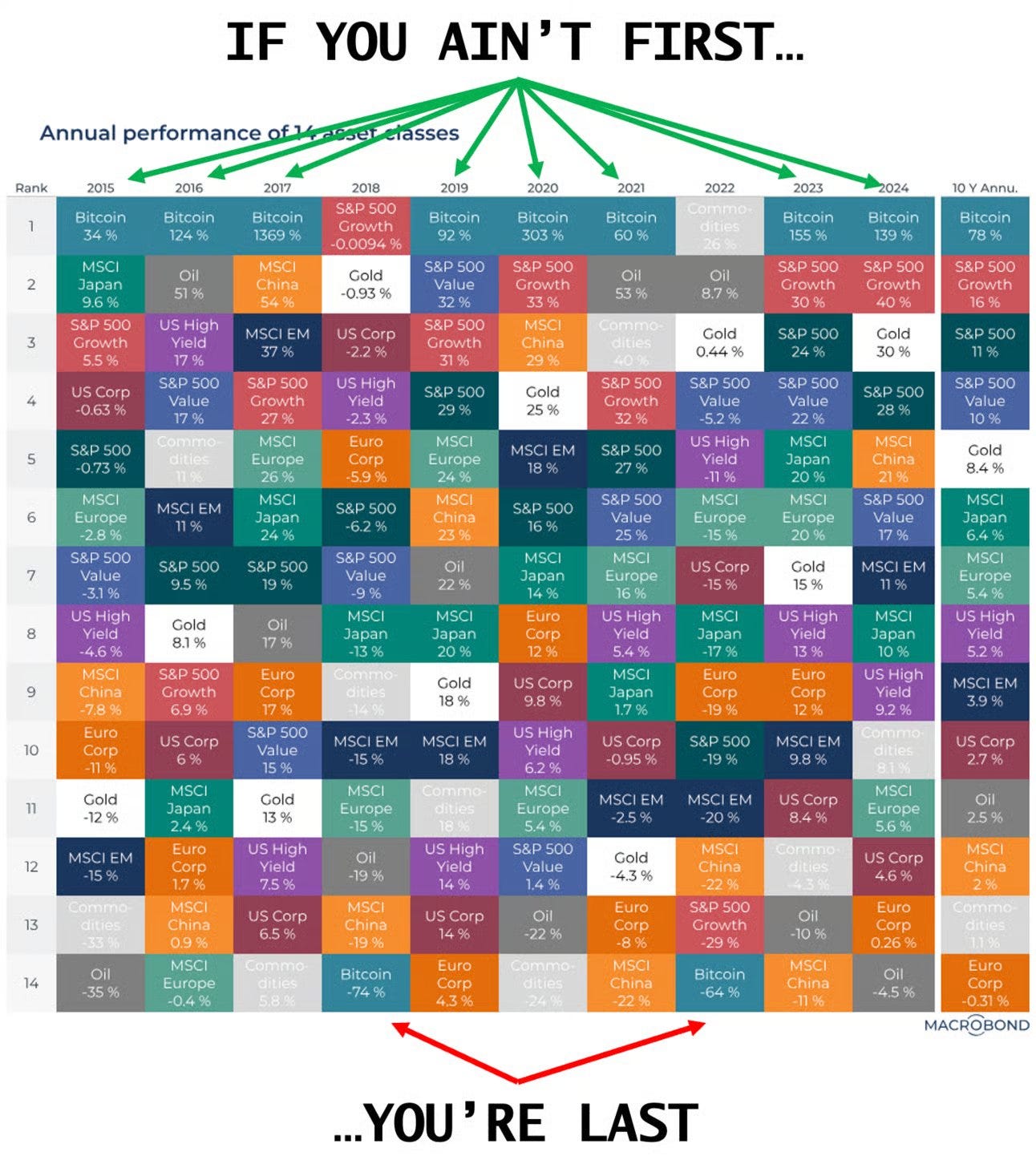

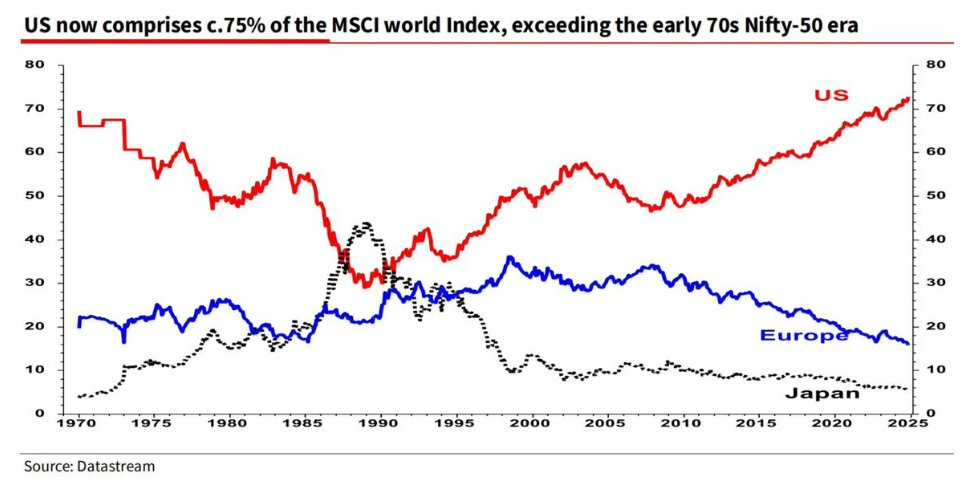

With US equities comprising 73% of the MSCI World and a large portion of every portfolio, successfully calling this position determines a portfolio managers success against the benchmark. Delving deeper, it could be further distilled to getting the Magnificent 7 right. If you expect US equities to deliver more than 6%, overweight. Otherwise, diversify.

Easier said than done.

US growth has trounced world value for most of the past 15 years. Betting against US exceptionalism has been a pain trade.

Does the S&P 500 market cap weighted or equal weighted index outperform next year? What about 5-10 years?

Seems like an easy decision to diversify but this would have been the wrong answer in most years for the past decade. There are also many companies outside the Mag 7 trading at valuations (see COST or WMT) and the Mag 7 are arguably generational companies.

Under appreciate how much stronger the market cap weighted index was last year.