21 Lessons

I really enjoyed this presentation from Russell Napier on Twenty One Lessons from Financial History for the Way We Live Now. I found the 20 min mark most interesting, where he discusses how debt problems in the West will be dealt with. Spoiler: Your savings may be mobilized. All lessons below:

Spend as much time analyzing supply as you do demand.

GDP growth has no relation to future equity returns.

Gordon Pepper’s Law: When you see something unsustainable, calculate the maximum period of time that you think it can persist. Then double it and subtract a month.

Never think about anything else when you should be thinking about the power of incentives. When forced to choose, governments will give up control of the exchange rate.

Governments like markets as long as markets produce the prices governments want. Governments aren’t neutral and they take sides.

Mean reversion of corporate profits to GDP is strong: In a free society, this will remain true.

Assess monetary policy based on both the quantity of money and interest rates.

The most dangerous form of speculation is the reach for yield.

Populism is not a threat to countries with strong constitutions.

The best way to predict if a country will default on its debt is if they have previously defaulted on their debt.

When equity valuations are high, they fall slowly with inflation and quickly with deflation.

Never buy emerging market equity in a country with an overvalued exchange rate.

Tourism is the best indicator of an overvalued exchange rate.

Always buy equities when the CAPE is lower than 10, with three exceptions: when you believe communism or fascism will occur; when you suspect your capital stock can be destroyed by war; or if your currency has entered a new currency regime with an overvalued exchange rate like Greece in the eurozone.

Democracy is more suited to operation of capital controls than the free movement of capital.

Government does not have to print to inflate away debts because they have citizen savings (using financial repression) so hyper inflation will not occur in developed world.

Technology never defeats inflation.

Monetary systems fail about every 30 years.

Money is almost always in disequilibrium.

Never trust a forecast that has a decimal point.

Extrapolation is the opiate of the people.

Palmer Luckey (Some say he is the next Elon Musk) says we should strive for abundant, cheap nuclear energy in the US. This is how we can reindustrialize North America (link to video).

I’d also be remis if I didn’t comment on Palmer’s aesthetic… Wow.

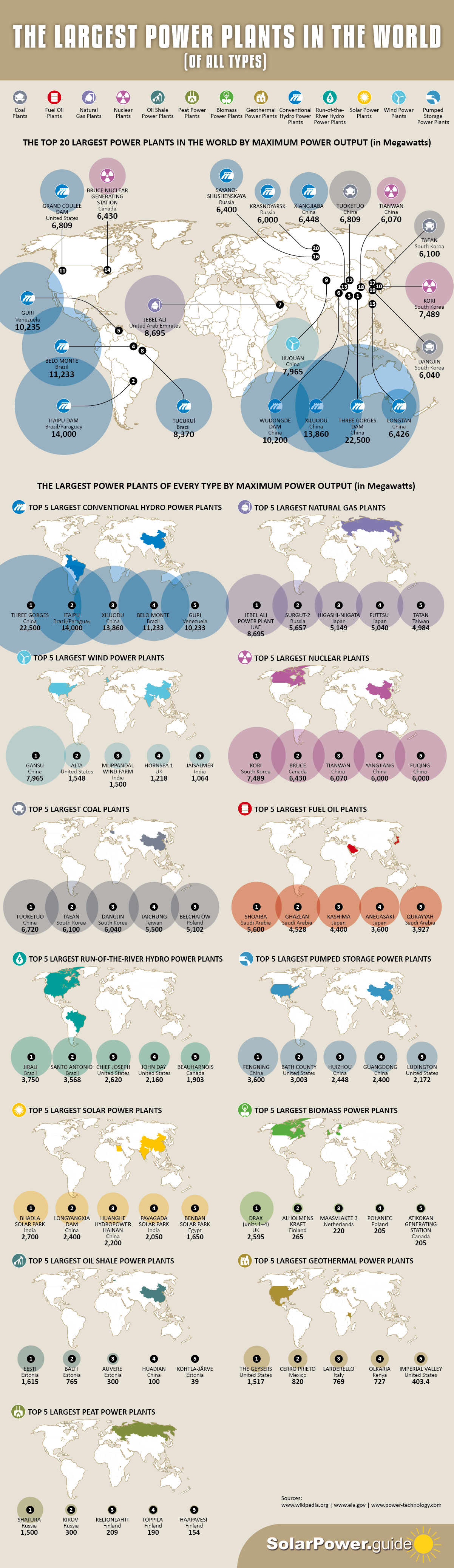

The Three Gorges Damn is the largest power plant in the world.

Bruce Power Generation Station on the shores of Lake Huron produces ~30% of Ontario's electricity at 30% less than the average residential price of power and is the 14th largest power plant and 2nd largest nuclear plant in the world.

Surprised to see a lack of mega projects in the US.

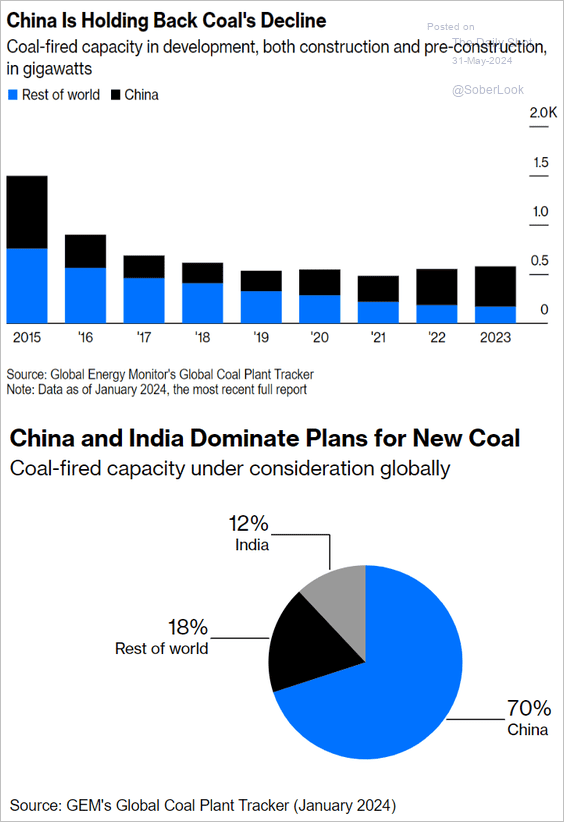

While the rest of the world phases off of coal, China continues to bring on more capacity.

Maybe the lack of US mega projects is because peak US industrial dynamism is behind us. Never good to see the top private employer in a big state and former global champion (Boeing) in crisis mode but maybe it’s a sign of the times.

Walmart is the largest private employer in almost half of all states.

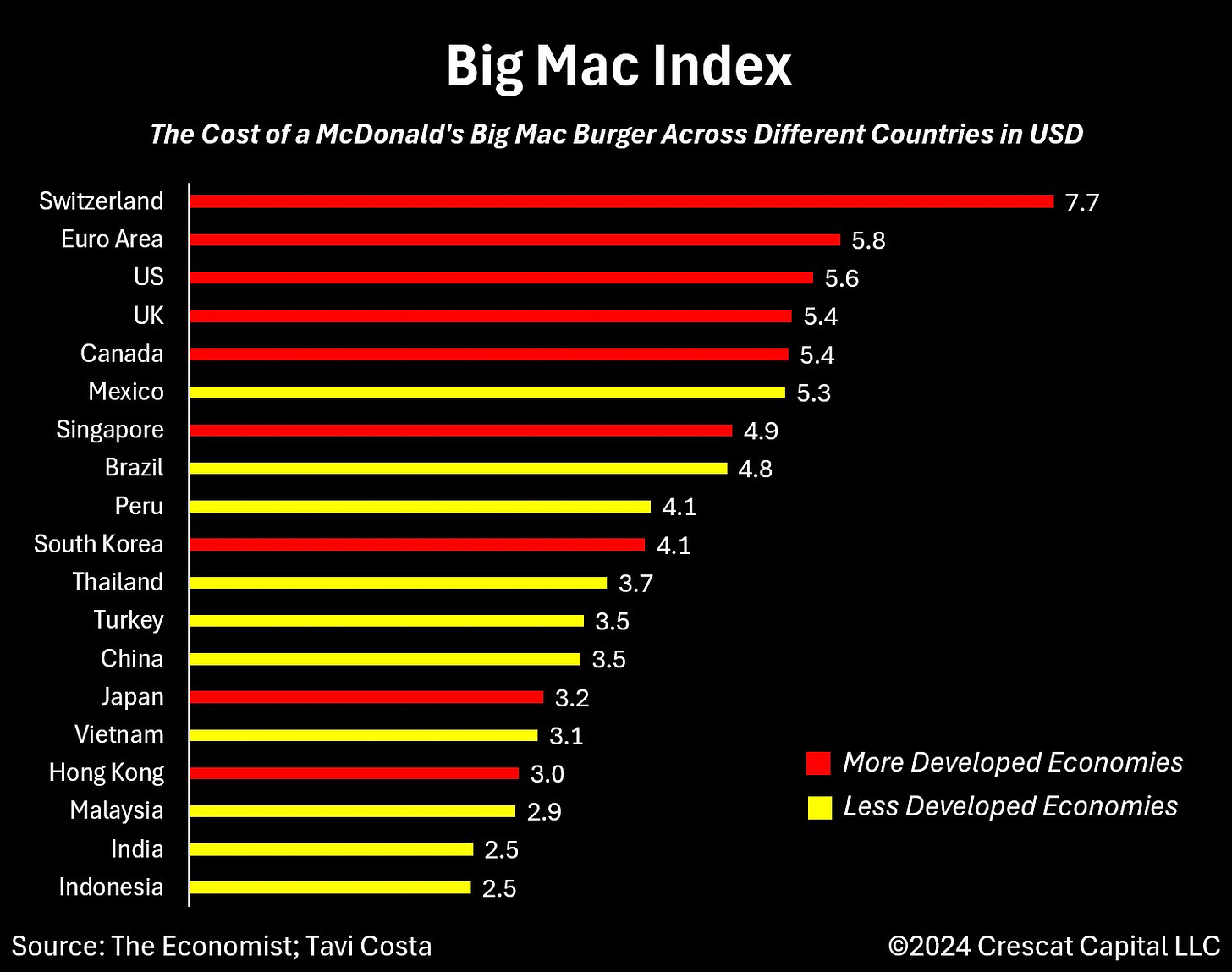

According to the Big Mac index, Asian currencies are cheap. Russell Napier had a cool comment on this, if you want to find a currency to short, go to the Rockefeller Center at Christmas, listen to the languages being spoken. If you notice a trend, the visitors who can afford that trip may have an overvalued currency.

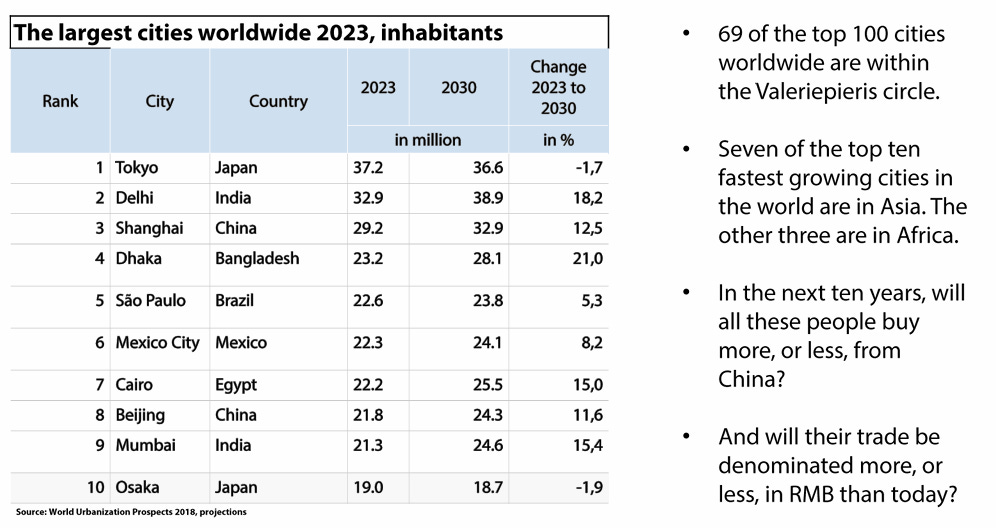

The largest cities in the world are mostly in emerging markets.

69 out of the top 100 largest cities and half the world’s population lives in this circle (Valeriepieris circle).

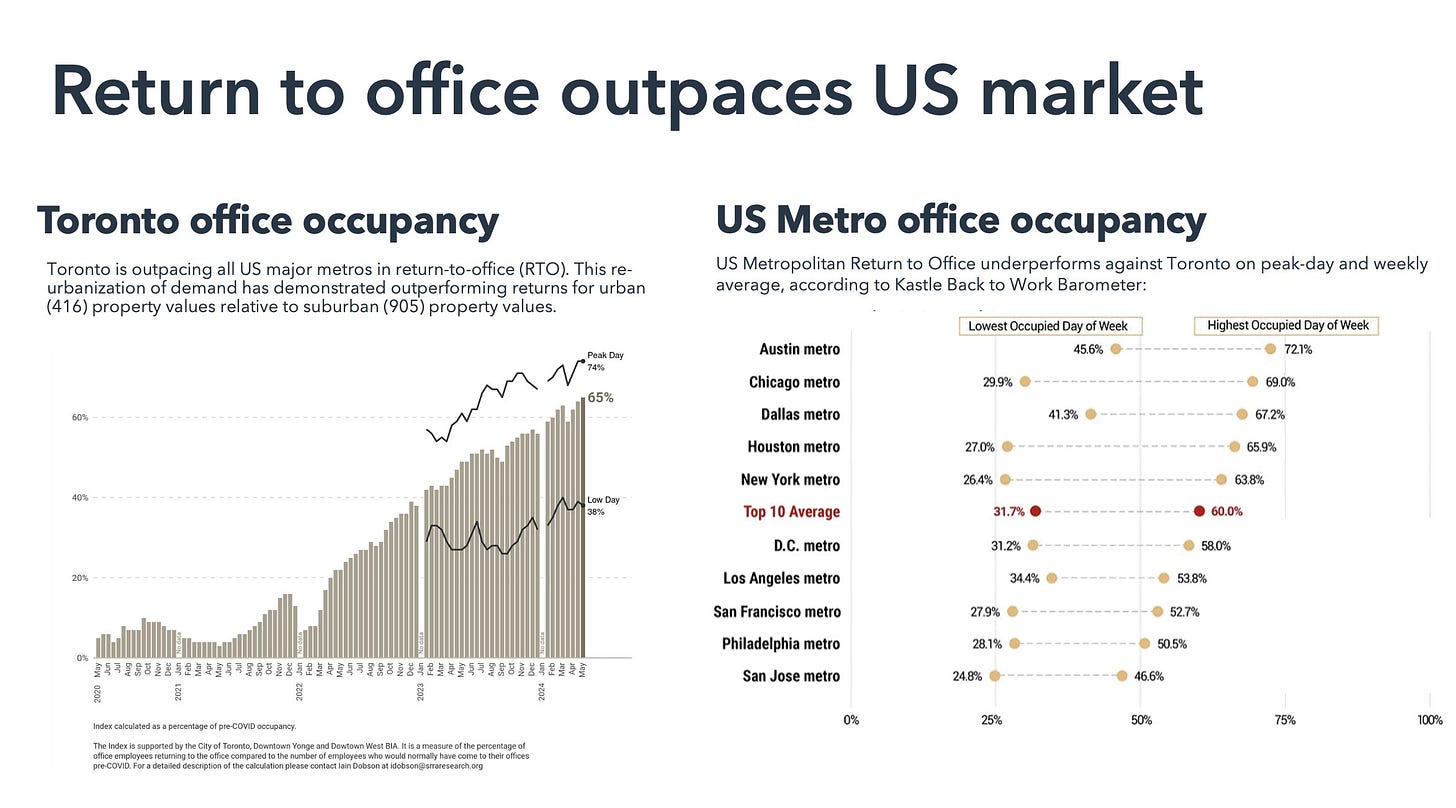

According to data from SRRA and Kastles, the return to office in Toronto is now outpacing many American metros. On both the peak and low day, office attendance is 10% higher in Toronto over NYC.

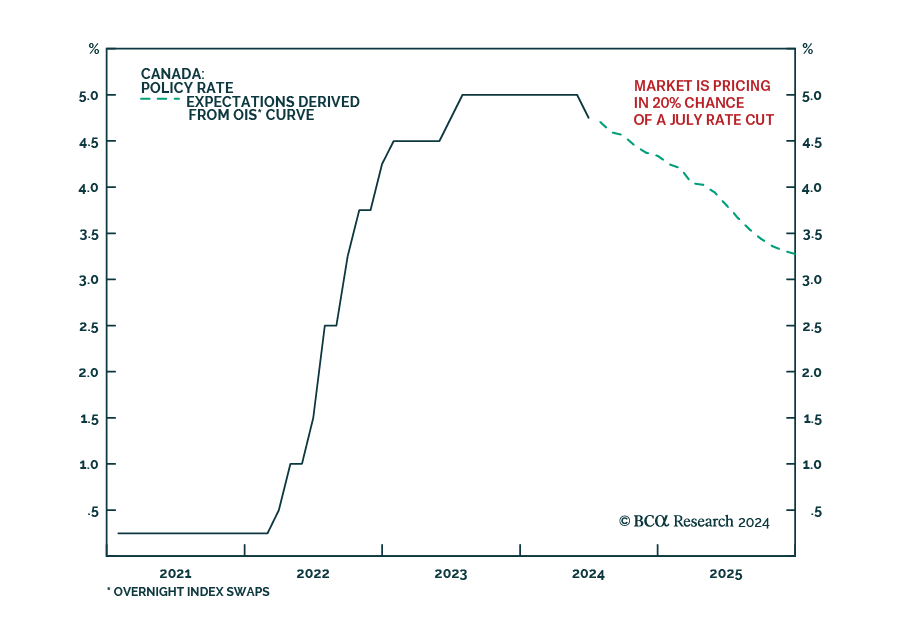

The market is currently expecting another cut in Canada in July or September. It will be dependent on data between now and those meetings.

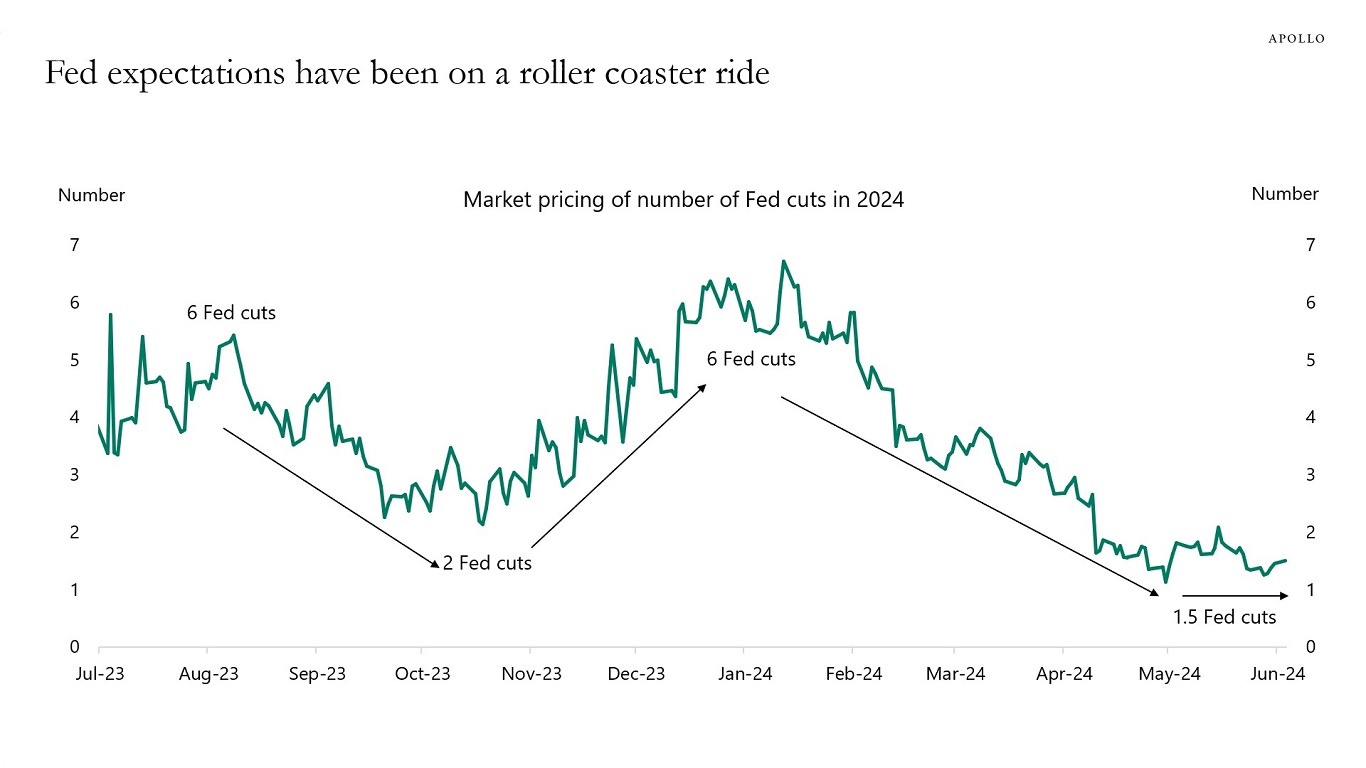

As G7 rate cuts commence, be prepared that current forecast for future cuts are likely wrong. See the markets expectations for 2024 cuts below.

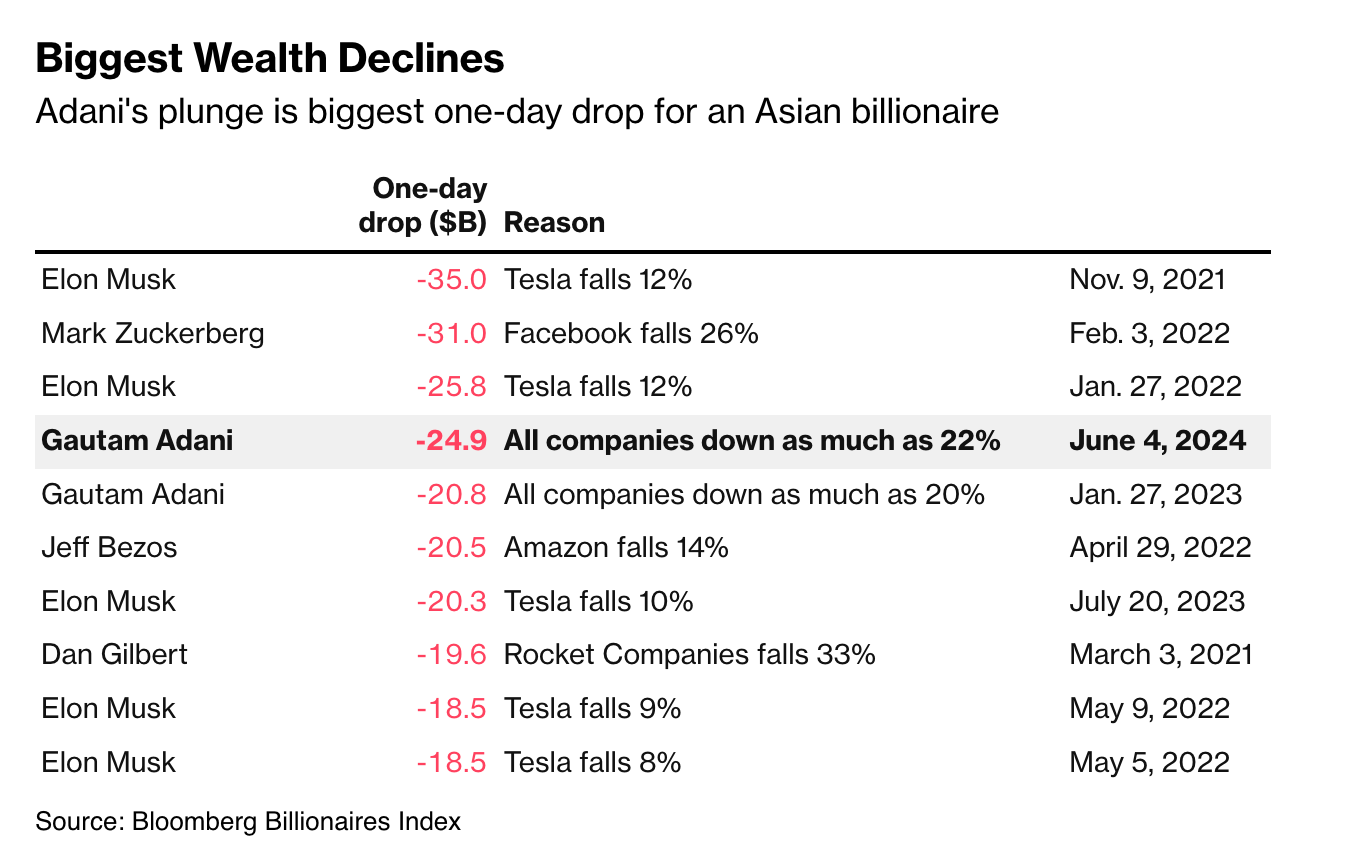

Imagine losing $35B in a day.

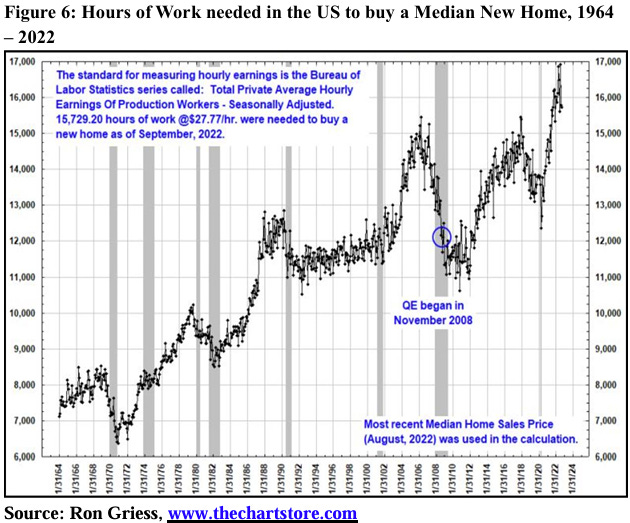

It now takes the average US worker about 16,000 hours to afford a home, double what it was in the 70s. This is why Millennials are angry and why some question if the American Dream still exists for the average person.

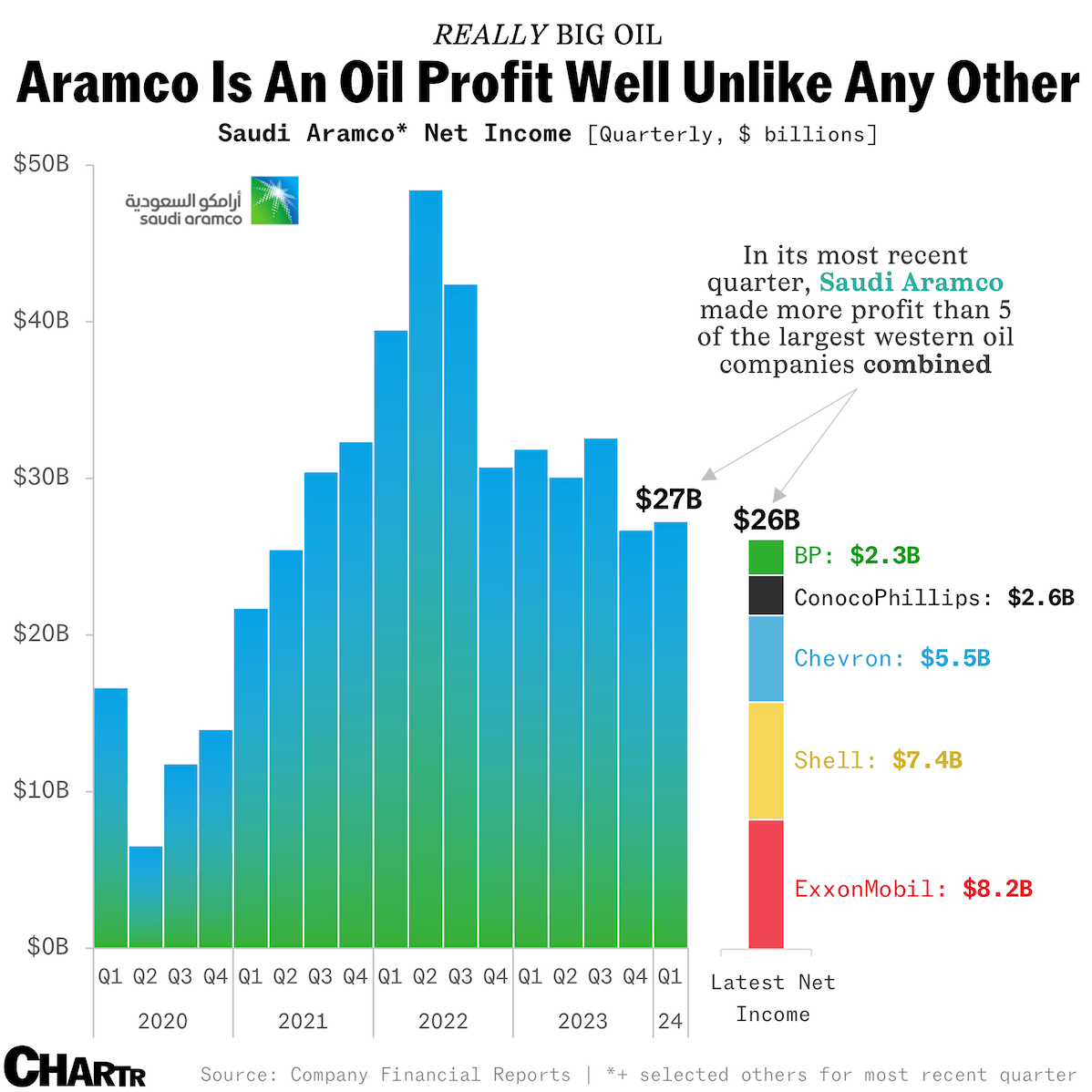

Aramco makes Western oil majors look like small potatoes.