A New Inflationary Age?

Gavekal released a great webinar to the public around similarities to the 1970s and whether inflation is the new normal.

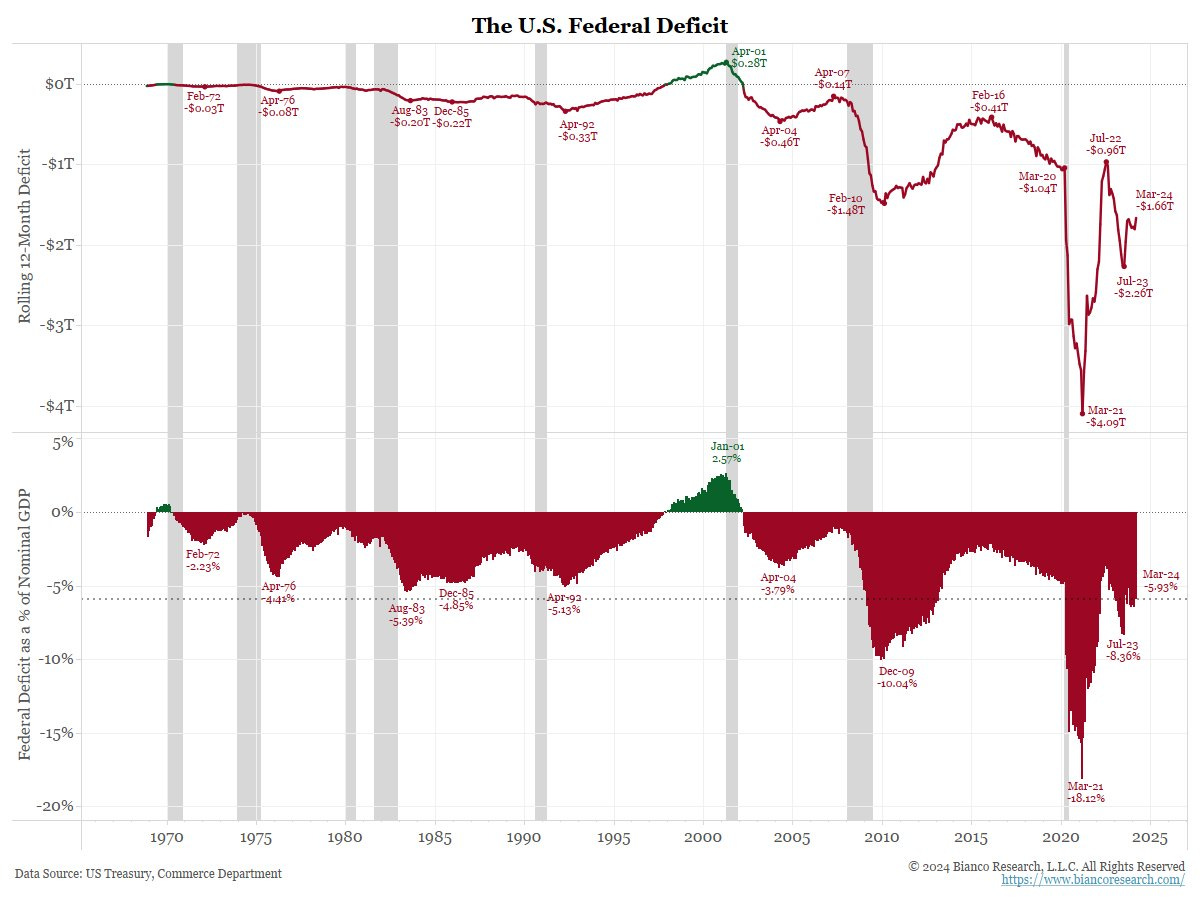

The thesis is underpinned by the unsustainable deficits the US is running. Historically and what Keynesian economics would suggest, is that the size of current deficits should be reserved for recessions. The original Keynesian prescription called for offsetting the budget deficits during recessions with budget surpluses during economic booms, with the budget remaining roughly in balance over time

As we approach the election, neither candidate is suggesting fiscal restraint and large deficits are projected into the future.

The US stands out running larger deficits than other major economies.

The question becomes whether these deficits will allow us to return to levels of inflation seen in previous decades or are we set for a repeat of the 1970s.

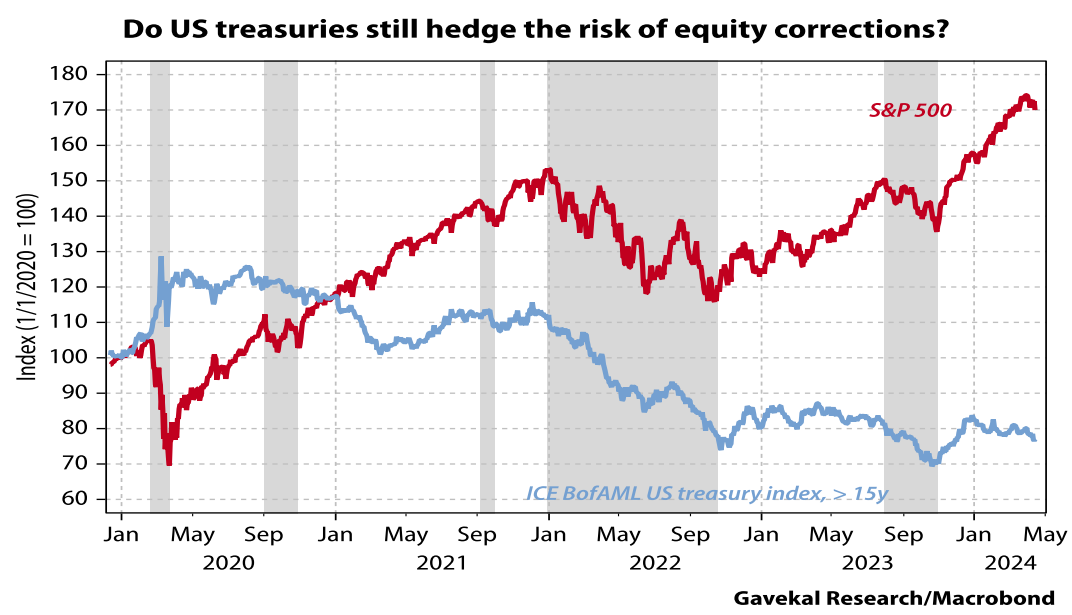

If we are to see persistent inflation, the 60/40 model that has outperformed for the past 40 years will likely underperform as bonds may not preserve purchasing power.

We could already be seeing the starts of this trend. Since we have entered the new era of fiscal spending, developed market bonds have struggled with gold outperforming. The bond returns look even worse when viewed in real terms.

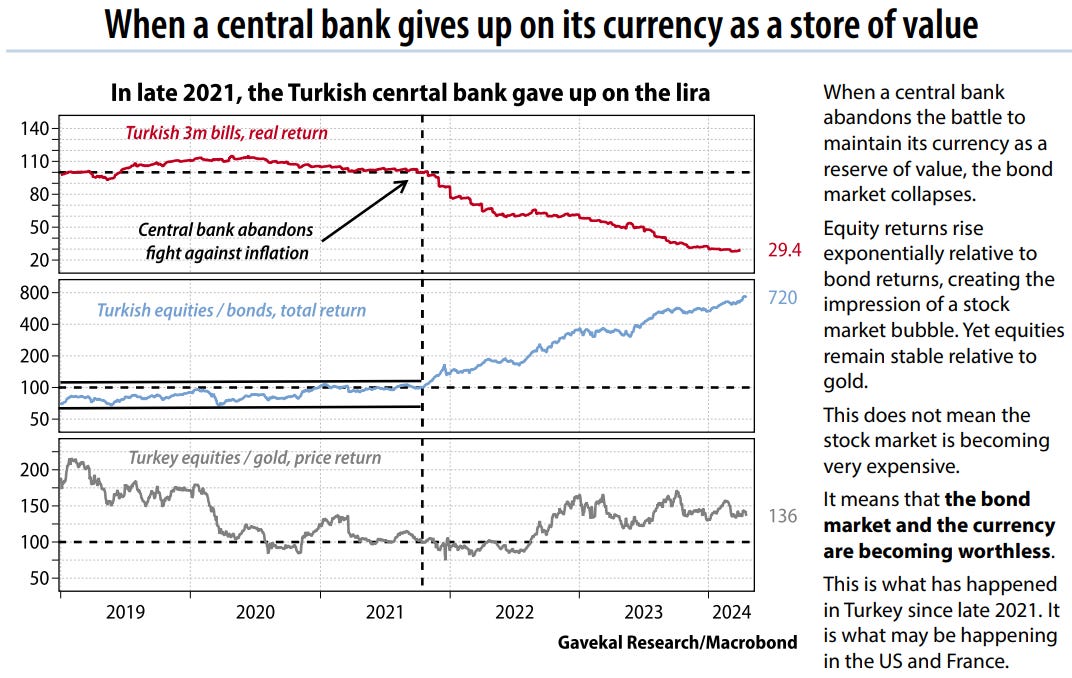

History is littered with bonds that turned out to be worthless, because the currencies in which they were denominated collapsed or disappeared.

If we are entering a new regime we may need to consider new asset classes to protect portfolios. Specifically, bonds may no longer protect portfolios and even worse if they correlate with equities, no longer providing diversification benefits.

The tail case is developed market bonds experience a trajectory similar to what Turkey went through, when they gave up defending their currency. Bonds and cash suffer, equities and gold are better at preserving purchasing power.

Recent US equity outperformance over bonds is noteworthy but hasn’t meaningfully broken out against gold.

A similar trend is underway in France.

Below are the reasons why they believe inflation will remain persistent.

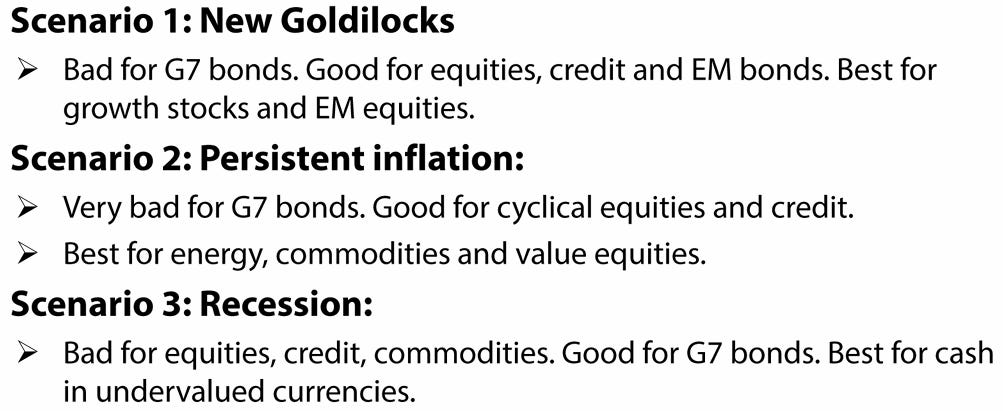

Below is an all weather framework, where assets are divided into regimes they perform best in. We’ve been in the bottom right quadrant for 40 years. Investors are overweight this quadrant due to recency bias. If we see a shift, many portfolios are going to be caught on the wrong side of this regime shift.

The 3 scenarios they see moving forward are below. They now ascribe a 55% probability of persistent inflation. Other comments on asset allocation:

35% of your portfolio in gold, if you can’t do that 100% in equity (This is Charles’ extreme view that fiat is dying)

Borrow in the currencies that have a chance of disappearing (Borrow in USD)

Anybody who buys bonds today, is crazy

China offers good value (I am concerned that if Trump wins, the US could enter further economic war with China, that would burn this view)

Lastly, below is why they see a low probability of a 2024 recession. This has become somewhat a consensus view.

A major regime shift is difficult to call. You are more likely to be correct betting on the status quo but it would be naive to dismiss the possibility and fail to incorporate some of these ideas in your portfolio construction. You want to ensure you have some assets that will do well in the event inflation remains persistent.