What Are The Family Offices Up To?

Sweden's central bank has now cut interest rates for the first time in 8 years. The Riksbank delivered its first rate cut for this cycle by cutting the policy rate by 25 bps to 3.75%. The Riksbank is the second advanced economy to begin cutting, following the Swiss National bank.

Often times, the slow and steady approach to cuts is derailed by an event partially caused by higher rates sending volatility soaring and forcing the Central Bank’s hand.

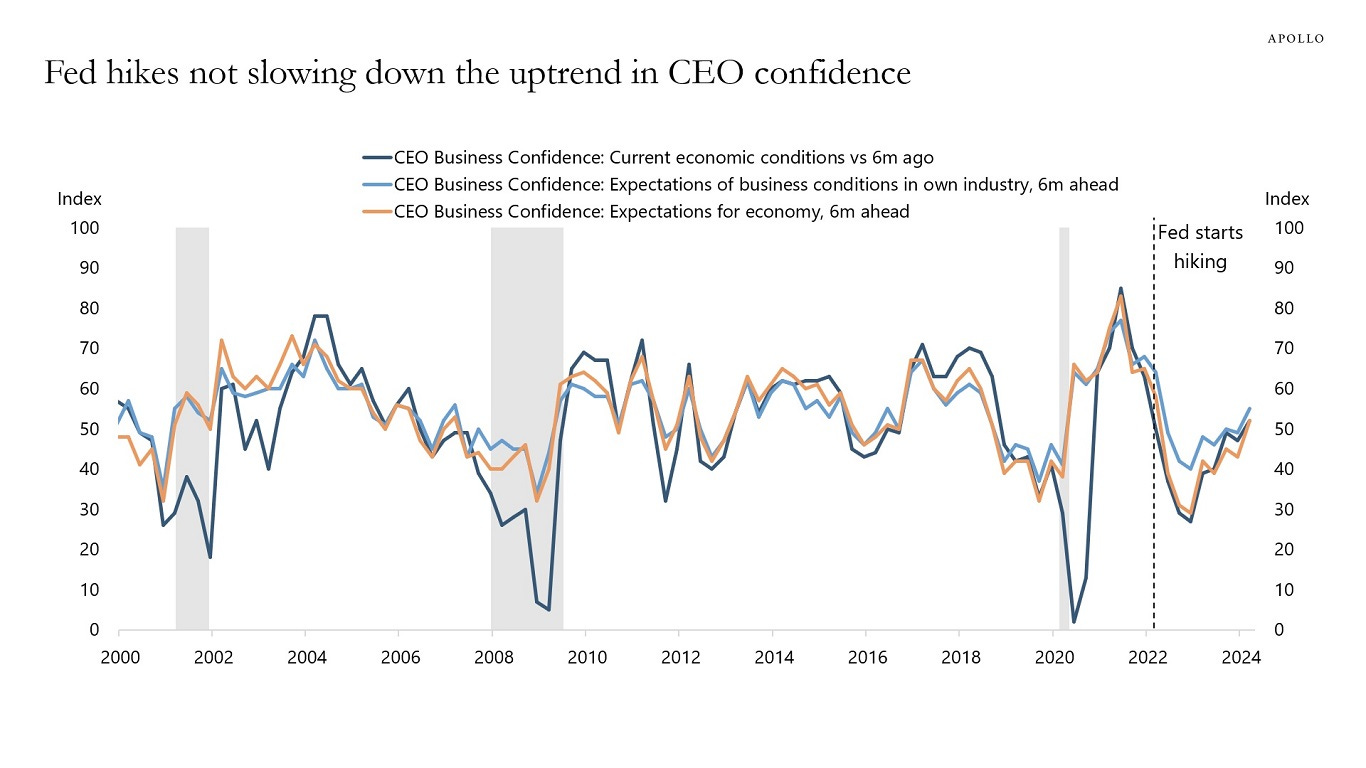

CEO’s are becoming more confident in the economy.

However, the spread between US ISM New Orders and Inventories has begun to decline, as new orders are decreasing at a faster pace than inventories, typically a leading indicator for the manufacturing industry.

Tech is expected to be the earnings growth engine of the S&P 500 over the next 2 years.

JP Morgan interviewed 190 Family Offices with an average $865M under supervision (full report), highlights below:

The biggest gaps or room for improvement family offices see are in cybersecurity services (40%), family governance and succession planning (31%), and family wealth education (31%).

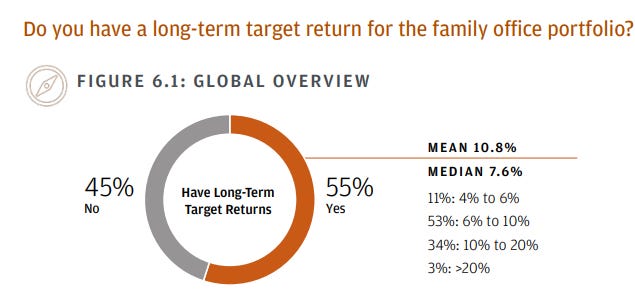

The average family office portfolio target return is around 11%.

The average portfolio allocation to alternatives is a notable 45%.

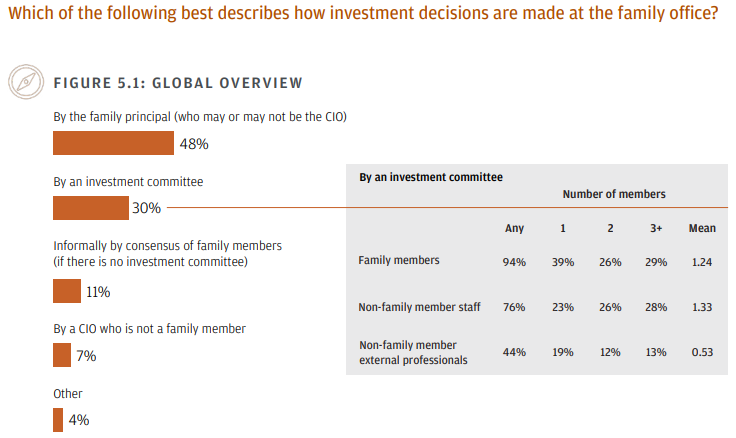

While many family offices do engage robust investment teams, when it comes to actual decision making, authority most likely lies within the hands of a single family member.

With average family office operating costs at $3.2 million annually (median $1.3 million), expense management is a key area of focus.

The number one priority of the Family Office is to manage financial assets with the second being succession planning and preparing the next generation.

Majority of investment management & admin is typically done in-house. The other service that is typically offered in-house is concierge & lifestyle services.

Half the time a family principal is the final decision maker and in another 30% of instances an investment committee comprising of family and non-family members makes the decisions.

Just over half of Family Offices have a formal return target. The most common range is between 6 to 10%.

Benchmarking is often overlooked by less sophisticated investors. It’s important and easy to keep a scorecard of performance. Smaller Family Offices tend to use a relative benchmark and larger, likely more sophisticated Family Offices create detailed composite benchmarks based on the strategic asset allocation to track performance.

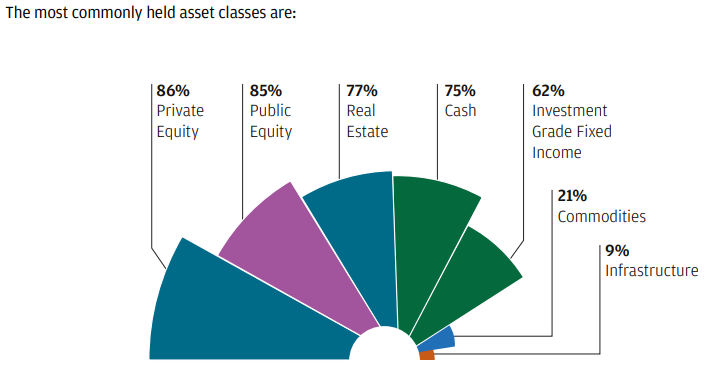

Private Equity, Public Equity, Real Estate, Cash and Fixed Income are the common asset classes held by these Family Offices.

Private Equity, Public Equity, Real Estate, Cash and Fixed Income tend to have double digit weights in portfolios. Larger Family Offices tend to have a slightly larger weighting to alternatives. Despite the recent inflationary bout, Family Offices have limited exposure to commodities.

Citi reports Family Offices are currently most bullish on fixed income, private credit and direct private equity. Most bearish asset class is crypto.

A number of respondents indicate that they have no structured approach to preparing the rising generation. Surprisingly, this was most pronounced with the largest U.S. family offices, where 32% report they lack any type of measures to help prepare their rising generations.