Bull or Bear

The macro picture remains highly uncertain. Markets continue to price in a rosy outcome. There is not much margin for error. Money to be made if you correctly call a more than mild recession or reaccelerating inflation correctly. At the same time, so many indicators point towards a recession, it can’t be ruled out when building portfolios.

Where Are We Today?

With US stocks around all time highs. Strong earnings expectations are anchoring the market, they are expected to be up 11% YoY, revisions are holding up better than average.

Corporate spreads, a measurement of fear in the fixed income market show no sign for economic concern.

Bull Case

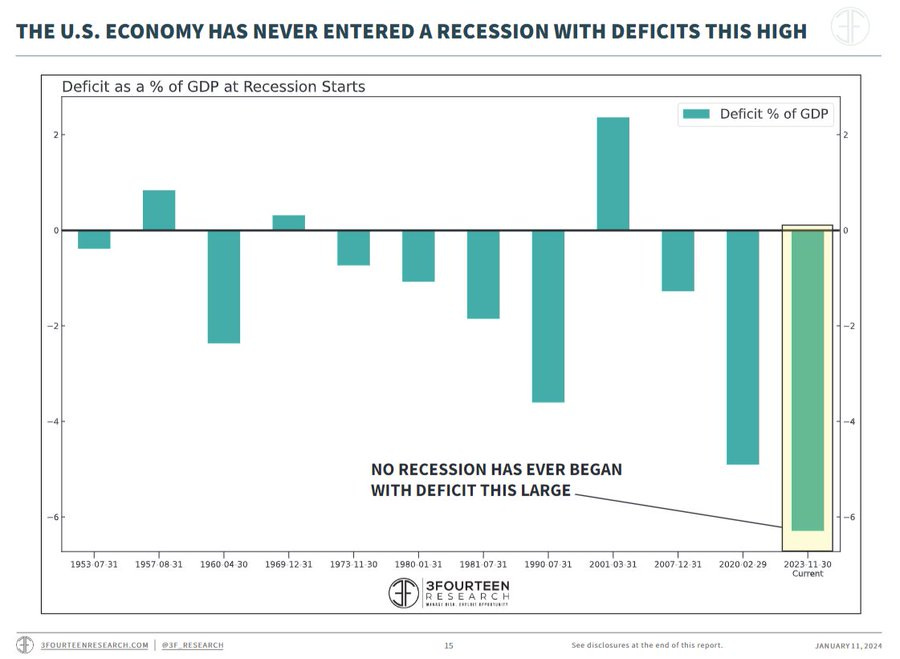

The bull case is predicated on the size of the US deficit. We’ve never entered a recession with a deficit this large. We don’t have precedented for this much stimulus in non recessionary times.

These type of deficits were able to get the US economy out of the global financial crisis.

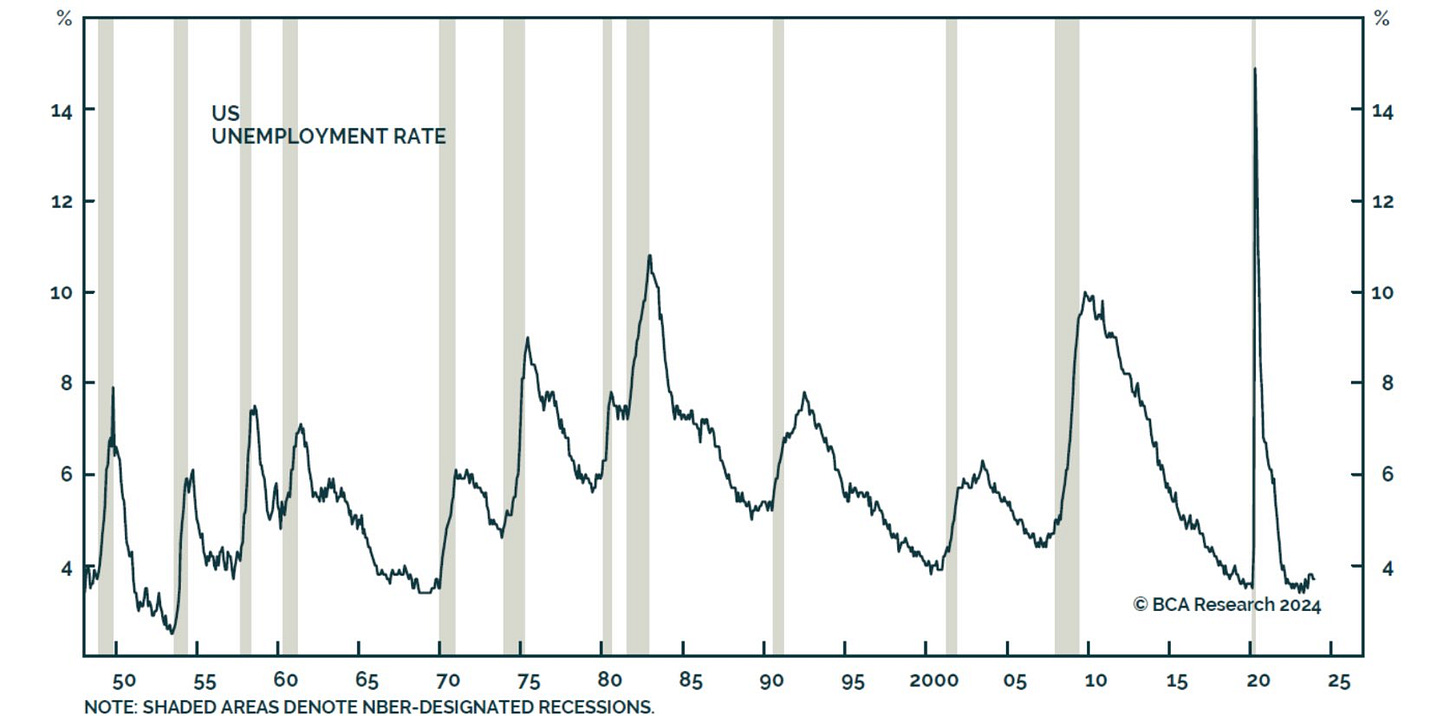

Labour market remains resilient, unemployment rate remain below 4%.

The fiscal bazooka could be sufficient to keep the economy afloat. Additionally, the poor data we are currently seeing could be a function of tight financial conditions in Q3 2023. As the recent easing flows into the data, we could see indicators begin reaccelerating.

Bear Case

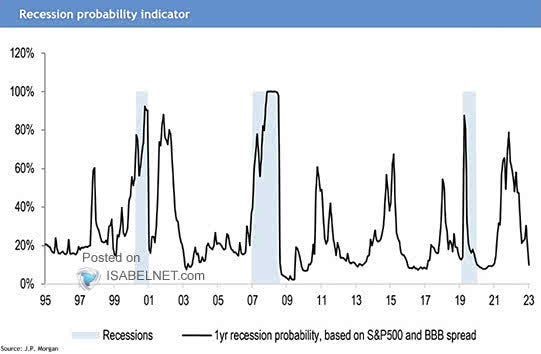

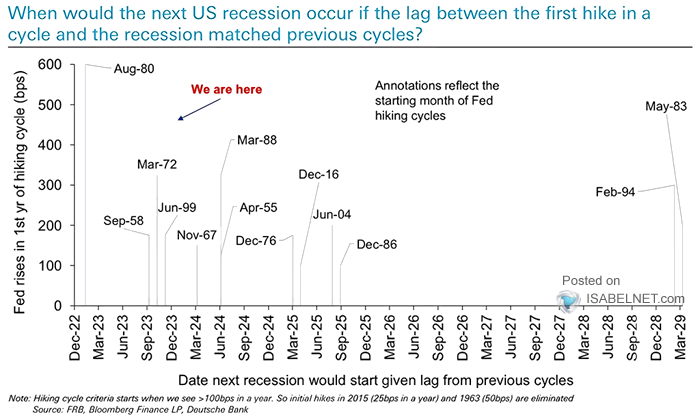

It was a consensus recession headed into 2023; the recession that never happened. Investors thought the speed and magnitude of rate hikes in 2022 would stall the economy. They were looking at the chart below.

Based on the start of the hiking cycle, it is not uncommon to not be in recession yet.

Additionally, the most accurate recession indicator, yield curve inversion was screaming recession.

Leading economic indicators which capture some of the data above and more, undoubtedly show cause for concern.

ISM Manufacturing data shows that almost no industries are reporting growth.

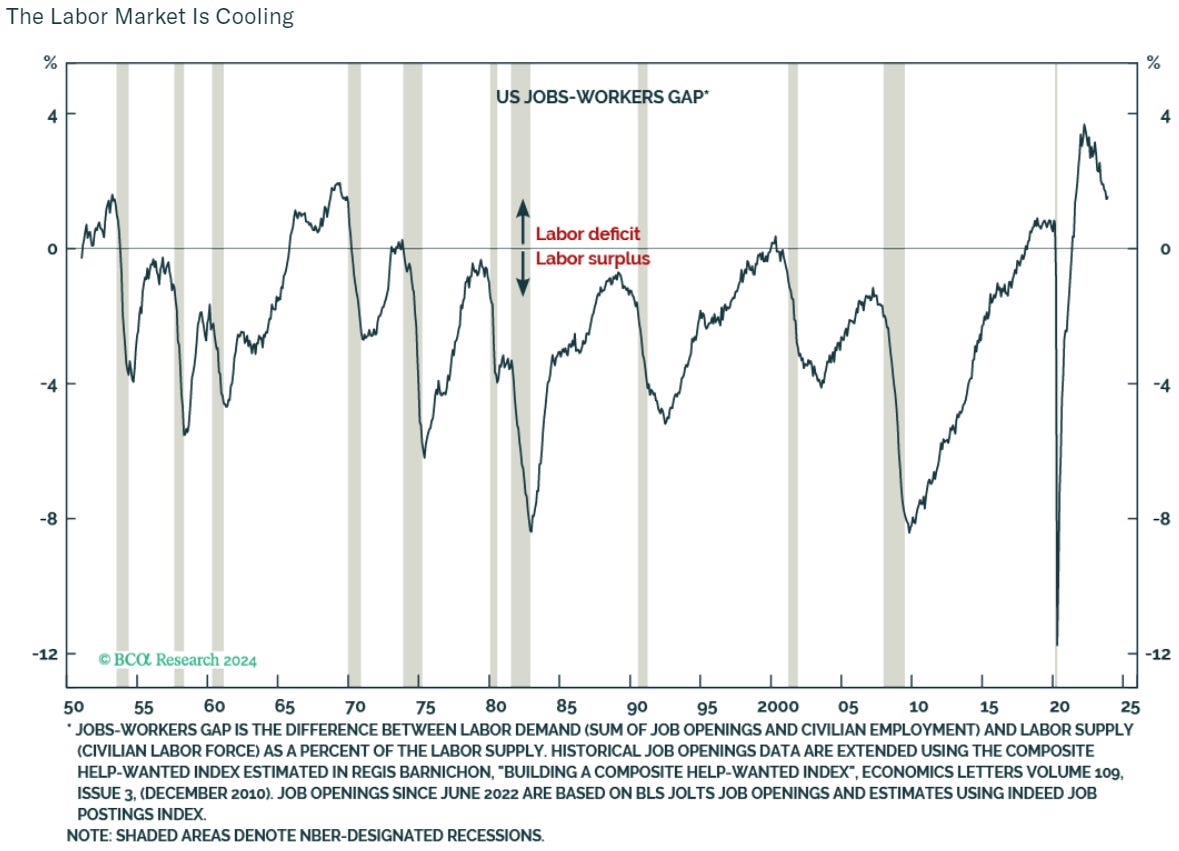

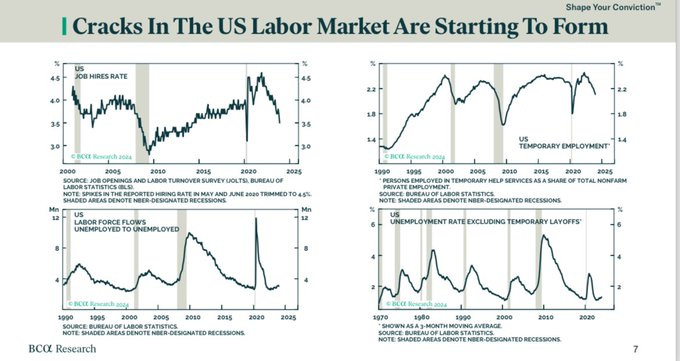

All eyes are on the labour market. That is the last shoe to drop. There are early signs that it is weakening.

Most of the classic indicators such as temporary labour and hire rates are beginning to slow.

looking further under the covers, cyclical employment has turned negative while, noncyclical employment remains resilient. A fact pattern seen in previous recessions.

The unemployment rate doesn’t start rising until the recession starts.

Lastly, core PCE against the NFP wage growth measure, and can be seen as a proxy for corporate revenue vs corporate cost. Past divergences in this series coincided with recessions.

We will be watching whether the Fed can successfully navigate a soft landing.