Canadian Growth & High Flyers 🚀

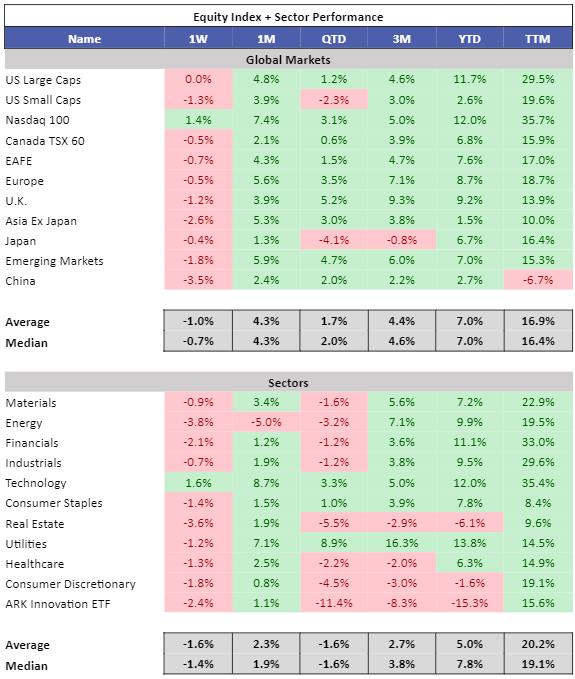

The Nasdaq 100 hit a fresh all-time high last week on the back of gains post Nvidia earnings. Minutes from the two-day Federal Open Market Committee gathering caused some Fed anxiety. The release Wednesday showed that, while participants assessed monetary policy was “well positioned,” various officials mentioned a willingness to tighten further if warranted. Tech was the only sector up on the week and energy was the worst performing sector.

10Y yields in the US and Canada were relatively unchanged on the week, uneventful week for fixed income. Precious metals sold off hard. The big gainer on the week was Ethereum after the SEC surprised markets approving ETH ETF applications. ETH is now outperforming BTC YTD.

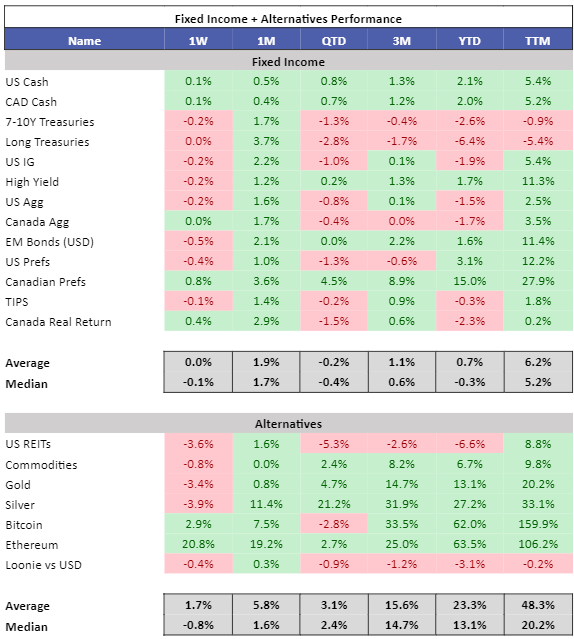

It was the best week for Tech vs. S&P 500 since last November.

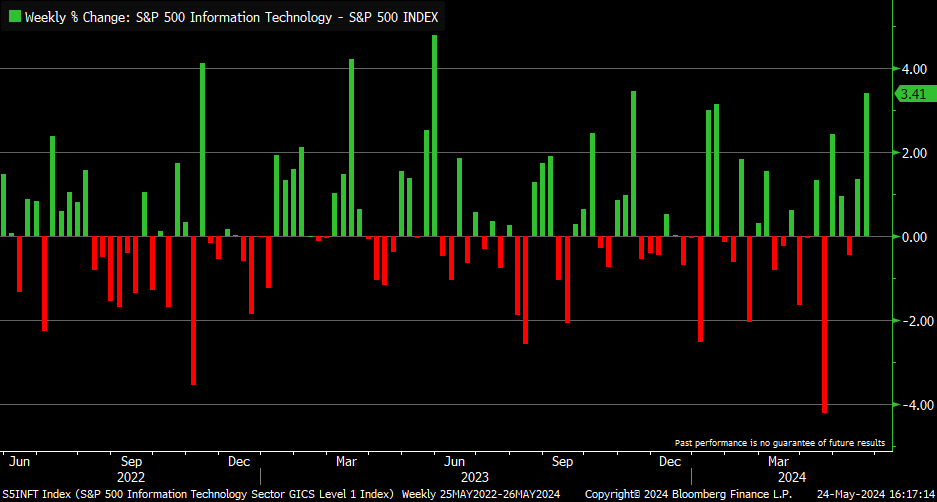

Objectively the growth across some Canadian metros is insane. Kitchener, Moncton and Calgary populations grew 6% in 2023. Are we building enough houses, hospitals, transit and other public infrastructure to accommodate this growth?

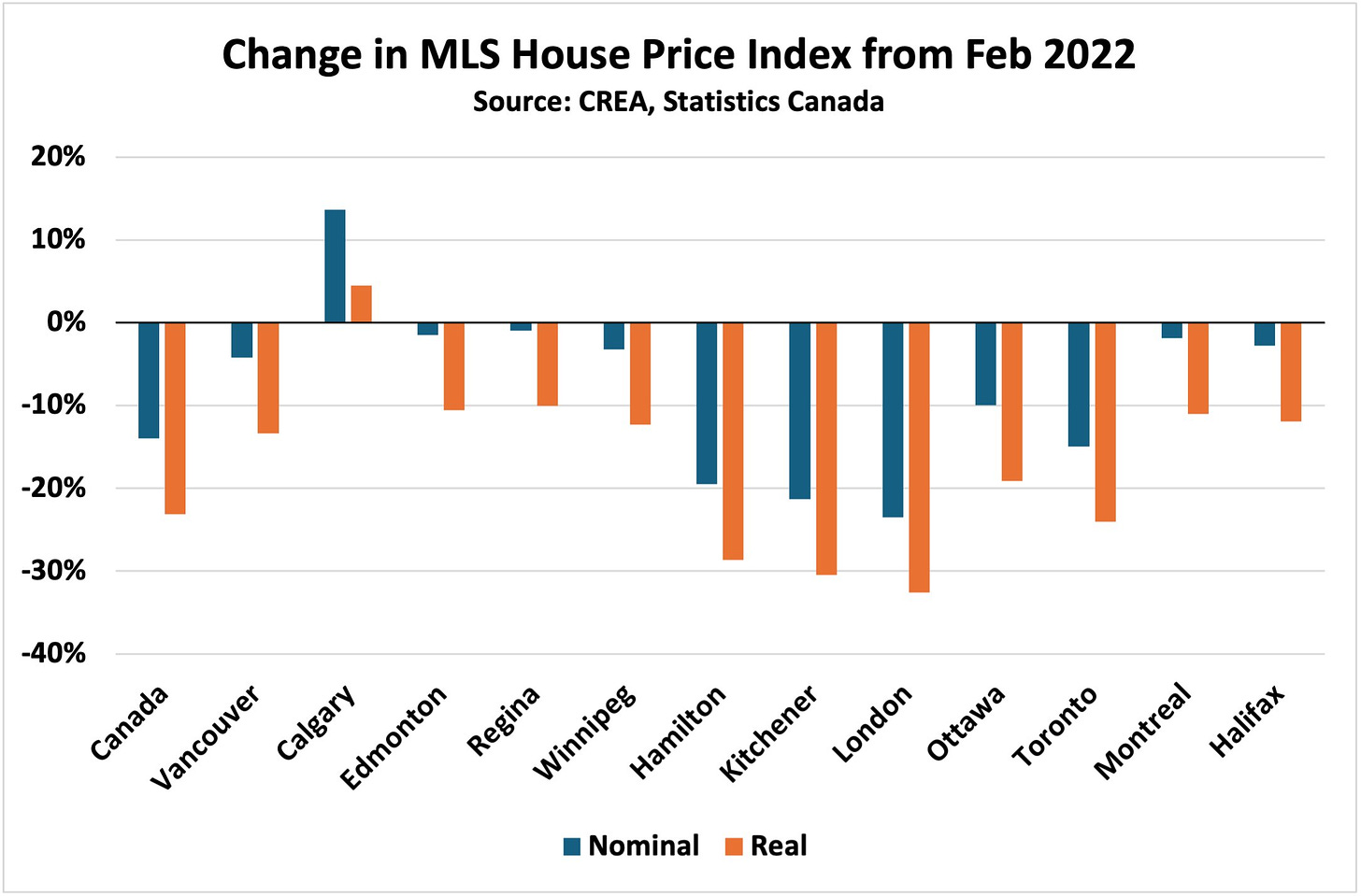

Growth alone isn’t enough to prop up real estate prices. Some metros in Ontario have seen real house prices fall more than 30% from their peak in Feb 2022.

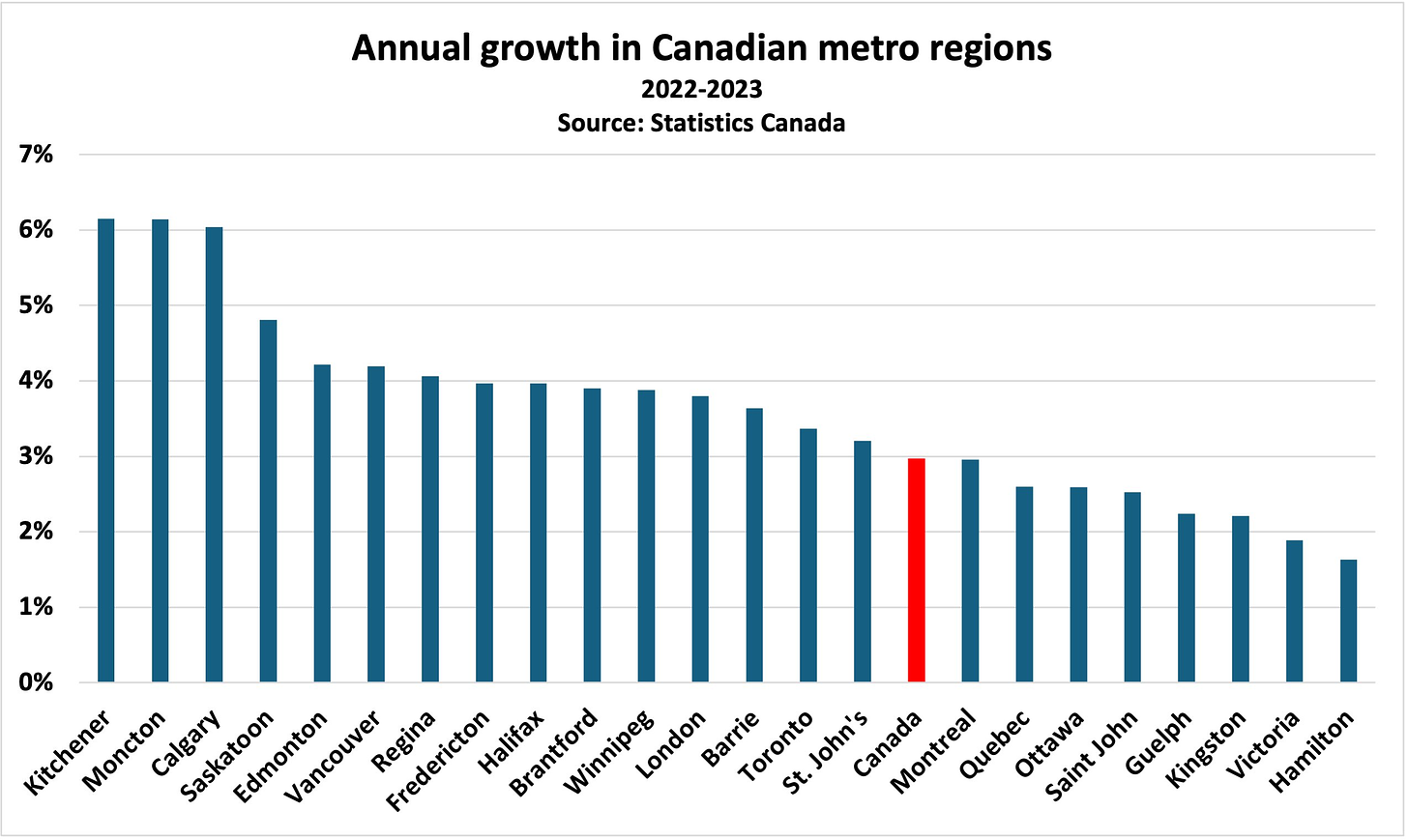

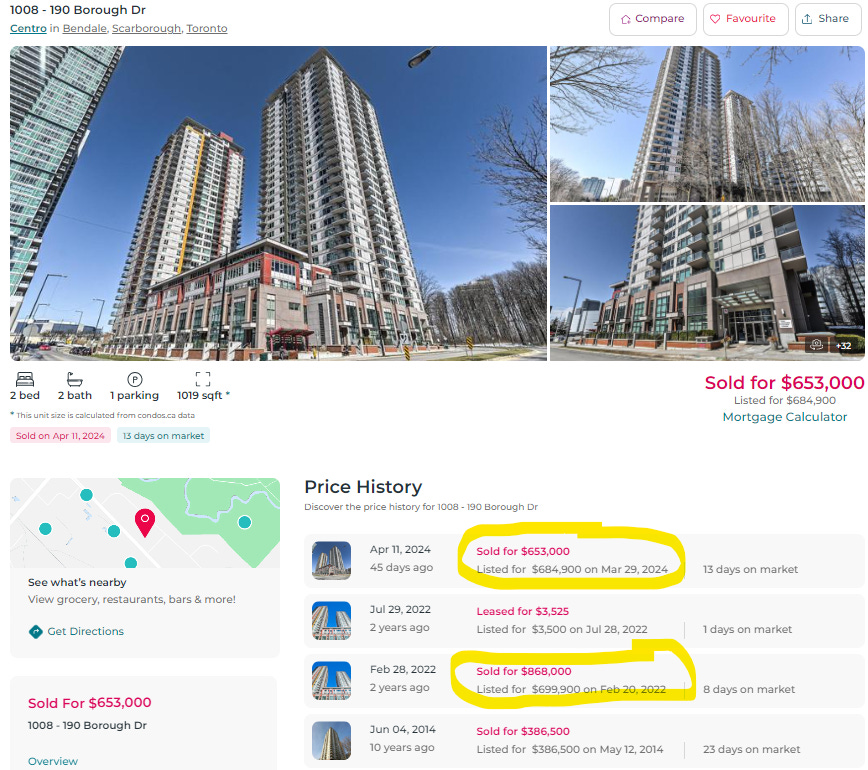

Condo market in Toronto remains the most vulnerable. Below is an example of a 25% loss on a condo. More supply will continue to be delivered to the market.

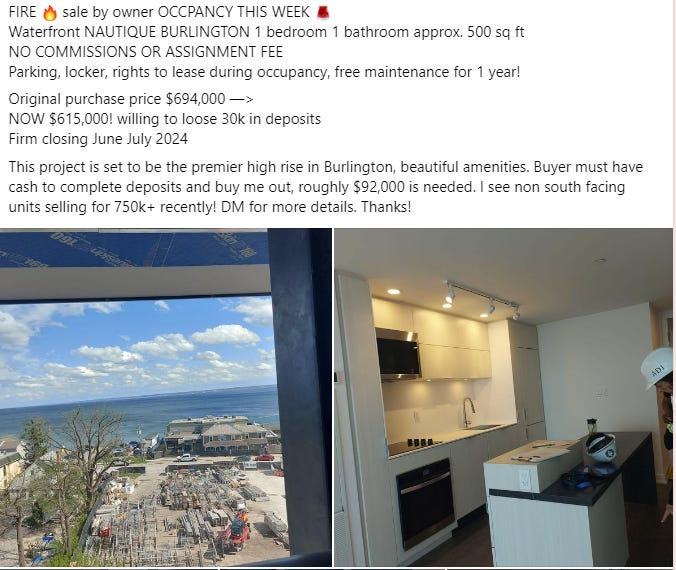

Interesting browsing the GTA Assignment sale Facebook page. Many situations of people walking away from deposits as they can’t close but doesn’t look like crisis levels yet. If rates don’t fall, this is an area I’d expect to see immense pressure.

Per Bloomberg:

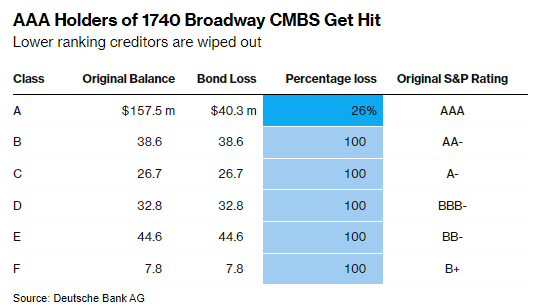

For the first time since the financial crisis, investors in top-rated bonds backed by commercial real estate debt are getting hit with losses. Buyers of the AAA portion of a $308 million note backed by the mortgage on the 1740 Broadway building in midtown Manhattan got less than three-quarters of their original investment back earlier this month after the loan was sold at a steep discount. A few weeks ago, the mortgage’s special servicer and Blackstone agreed to sell the building to Yellowstone Real Estate for roughly $186 million, according to people familiar with the matter. The deal resulted in the repayment of the CMBS. But with additional losses from fees and advances, only $117 million was left for bondholders. Investors in $151 million of lower-rated debt were wiped out, while those holding $158 million of debt originally rated AAA suffered a 26% loss.

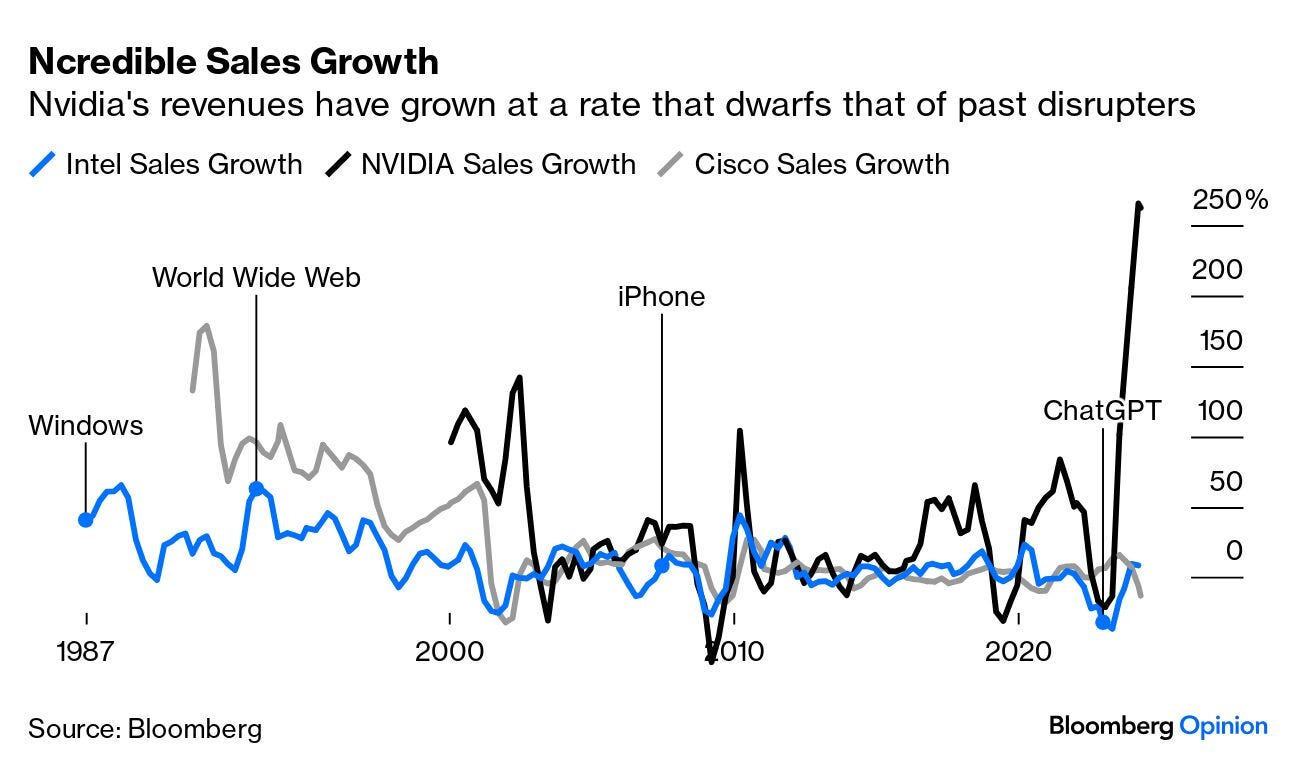

Nvidia sales growth has rocketed but will it continue to be cyclical? It makes valuing Nvidia difficult.

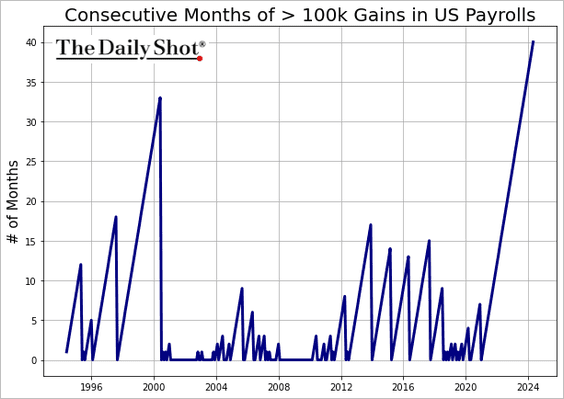

As we flag labour market cracks, it is possible to find reasons to believe the market is still strong. US payrolls have added 100k jobs a month for over 40 straight months, the longest stretch in 30 years.

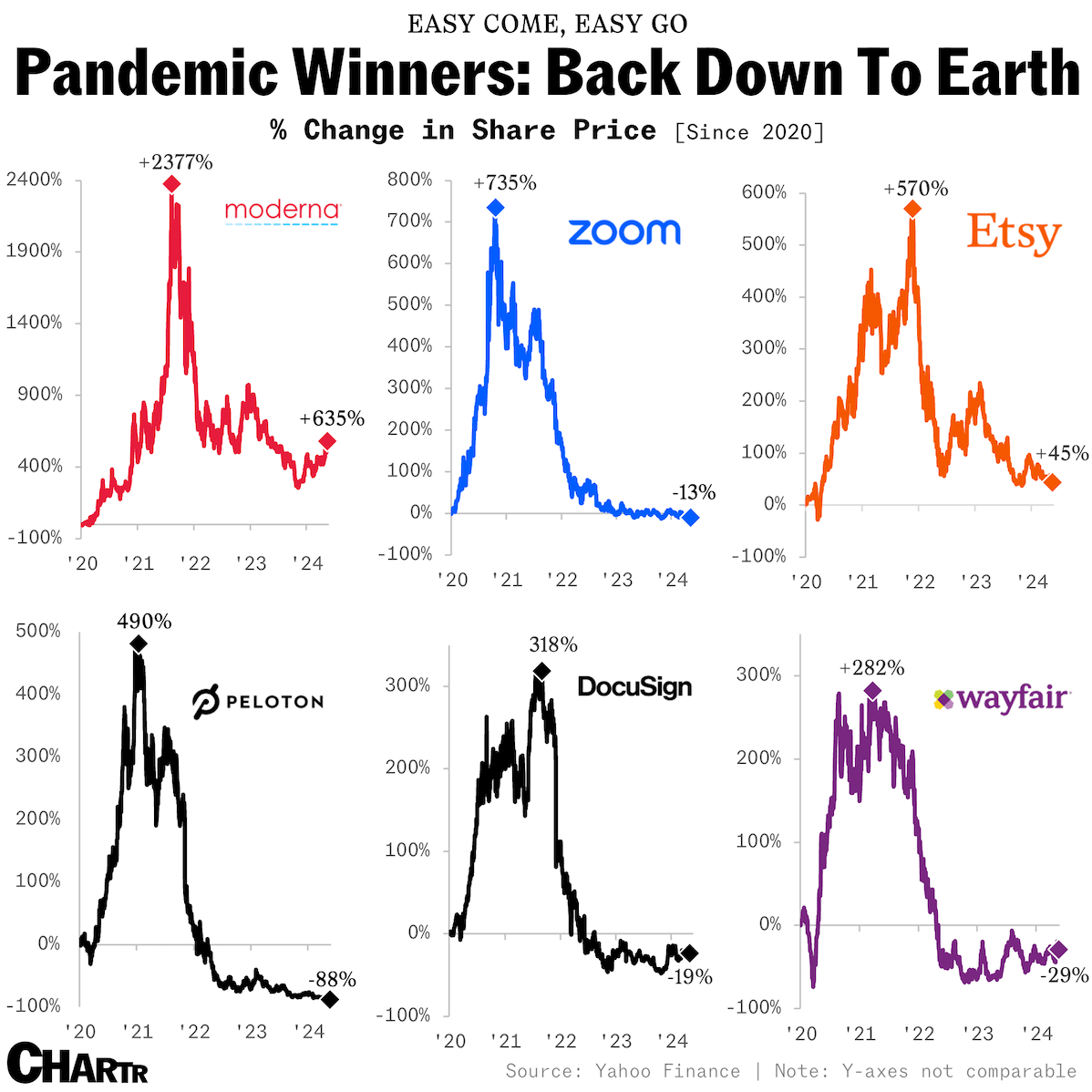

Pandemic winners turned losers. Maybe it was all priced in after all.

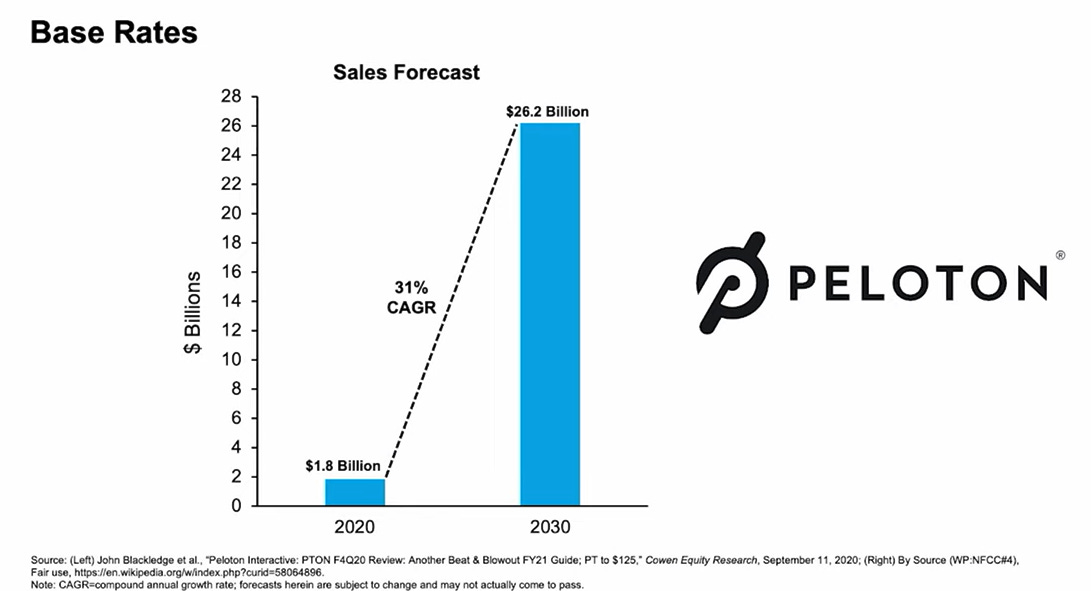

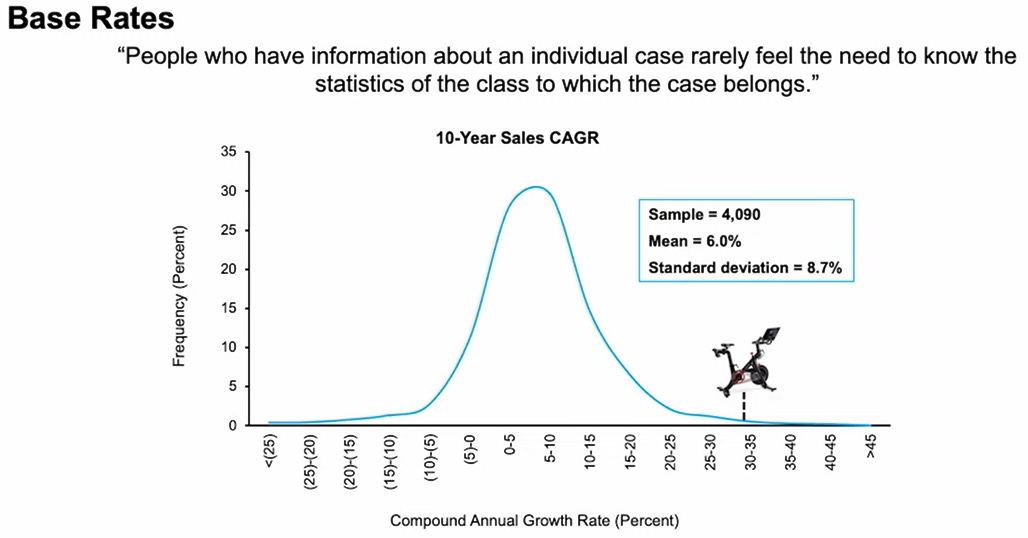

There was one poor Cowen analyst who predicted Peloton would have $26B in sales by 2030 (Actual 2023 revenue was $2.8B).

31% CAGR sales growth would have put Peloton up there as one of the fastest growing companies ever.

Michael Mauboussin speaks more about biases investors succumb to.

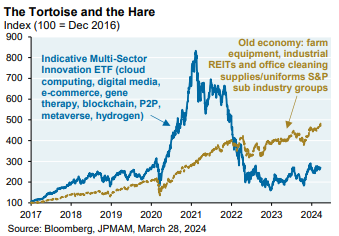

Turns out old economy company stock performance has outshined the high flying tech plays of the pandemic.