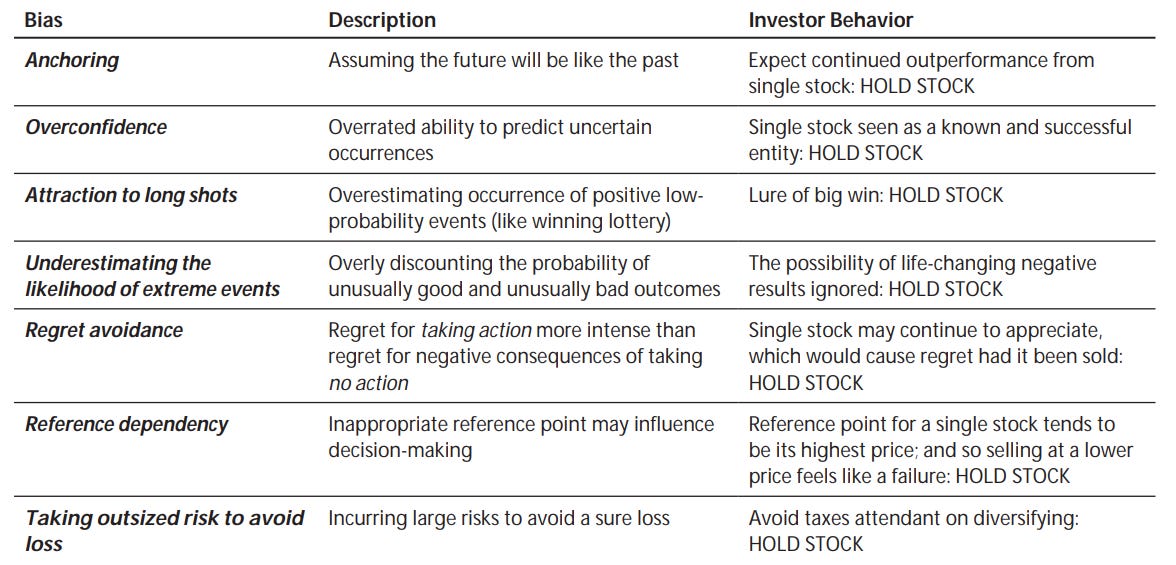

Occasionally, I work with clients whose net worth is largely tied up in a single concentrated position. I wanted to explore what the data suggests, as behavioral biases often lead to the continued holding of that position.

Concentration creates wealth, and it destroys wealth. That is, few family dynasties have been created by starting out with a modest investment in a diversified portfolio, but many such dynasties have been diminished by continued overconcentration in the shares of one company.

Risk of permanent impairment. Using a universe of Russell 3000 companies since 1980, roughly 40% of all stocks have suffered a permanent 70%+ decline from their peak value. For Technology, Biotech and Metals & Mining, the numbers were considerably higher.

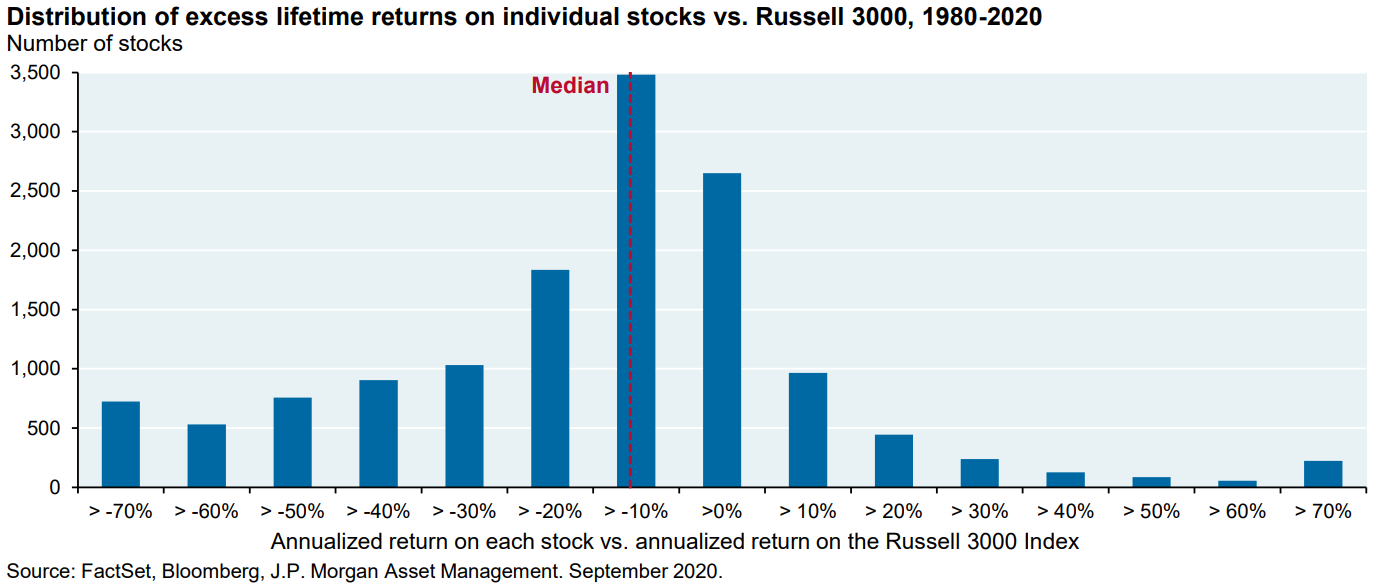

Negative lifetime returns vs. the broad market. The return on the median stock since its inception vs. an investment in the Russell 3000 Index was -54%. Two-thirds of all stocks underperformed vs. the Russell 3000 Index, and for 40% of all stocks, their absolute returns were negative.

Another way to think about concentration risk: how often would a family have been better or worse off owning cash, or the Russell 3000 Index instead of the concentrated position? As shown in the table, around 40% of the time a concentrated position in a single stock experienced negative absolute returns, in which case it would have underperformed a simple position in cash. And around 2/3 of the time, a concentrated position in a single stock would have underperformed a diversified position in the Russell 3000 Index. While the most successful companies generated massive wealth over the long run, only around 10% of all stocks since 1980 met the definition of “megawinners”.

The winners generate enormous excess returns, but the median stock ends up underperforming the Russell 3000 Index.

Our biases tend to make us believe that it is only the “shitcos” that are exposed to these drawdowns but plenty of bluechip firms have experienced significant losses.

Even isolating for some of the best companies in the world within the S&P 500, more than 60% drawdown more than 40% over a five year period.

The sector with the largest number of decliners was healthcare/biotech.

Is it possible to see these collapses coming? A significant portion of catastrophic decliners had ostensibly healthy metrics, 54% were profitable.

63% had net debt-to-EBITDA of 2x or less at their peak.

Most of the catastrophic loss stocks were valued at “reasonable” forward P/E multiples at their peak, and were not signaling either distress or irrational investor exuberance.

Wall Street research also struggles to identify catastrophic risks. As illustrated below, when catastrophic loss stocks reached peak valuations, the consensus was skewed toward “strong buy” recommendations, with nearly half of all stocks projected to have further upside to their price targets.

The data above makes it clear that the average stock underperforms and you are exposed to catastrophic risk. You aren’t going to become a billionaire investing in a diversified portfolio but you are less likely to lose it all.

A diversified portfolio has a much tighter dispersion of outcomes and a higher mean return due to less volatility.

The sticker shock of tax is normally one of the largest inhibitors to selling. Tax rates will differ by jurisdiction but most underestimate that over the long run, a diversified portfolio needs to only outperform by a small margin to breakeven. Remember from 1980-2020, 66% of Russell 3000 stocks underperformed that benchmark. Most concentrated holders, believe they own one of 10% of “megawinners” and decide to let it ride.

It’s pretty simple, diversifying will reduce the likelihood of large drawdowns. For some individuals, it doesn’t matter, they already have more wealth than they could ever spend but others depend on their portfolio to live and large drawdowns could impact their lifestyle. I believe you should secure your lifestyle with a diversified portfolio at the very least.

The pattern is almost perfectly symmetrical: The longer the hold, the greater the upside potential versus up-front sale, but (in all cases save one) the lower the median—and the greater the downside risk.

Frustrating though it may be, decades of research on concentrated stock risk has indicated that it is close to impossible to reliably anticipate event risk for individual companies, which is why some minimal level of diversification is strongly recommended for investors for holders of concentrated stock positions.

Appendix of well known companies that have experienced large collapses.

A rising tide does not always lift all boats: struggling companies with successful competitors. Structural tailwinds do not guarantee success at the individual company level.

It’s not a popularity contest: even companies with widely-adopted products and services can struggle with monetization.

Phenomenal piece ❗️