CPI to the Rescue

A slightly better than expected US CPI print Wednesday brought some relief to markets. Inflation is being driven by core services at this point.

Supercore inflation declined but is still much too high for comfort.

Wage inflation declined led by the lowest paid jobs.

S&P 500 revenue per worker has more or less plateaued since 2008.

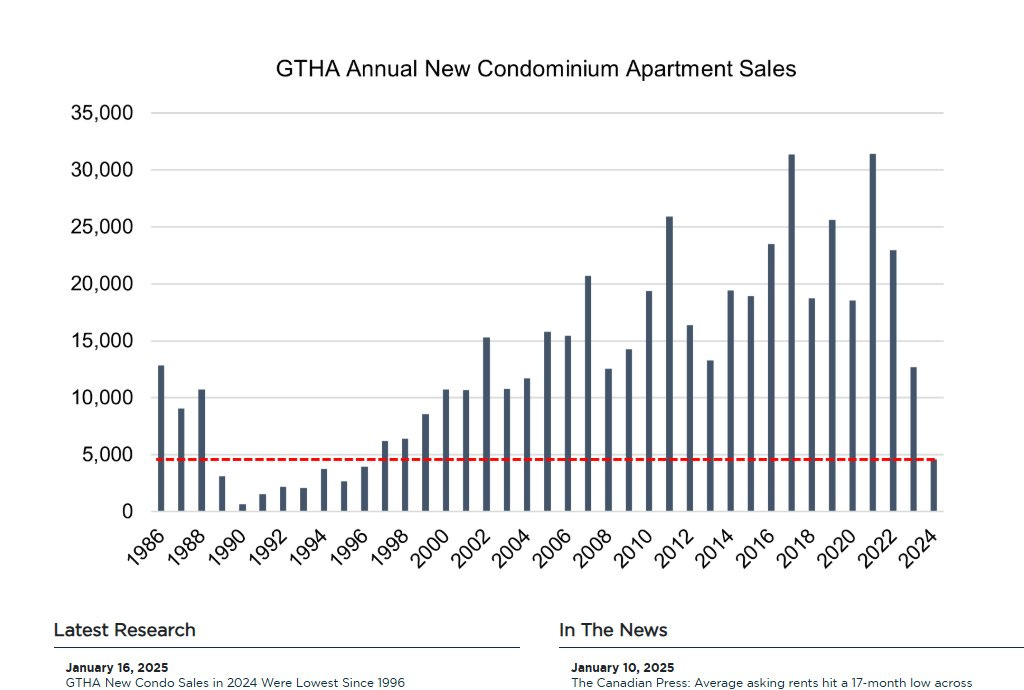

2024 Greater Toronto and Hamilton Area condo sales were at their lowest level since the 90s. Condo prices are still very vulnerable to further price declines.

Short seller Hindenburg announced they were winding down. They were one of the best in the business. Their single name track record is below.

Softness in the US labour market is highlighted by the amount of Top MBA students still struggling to find jobs.

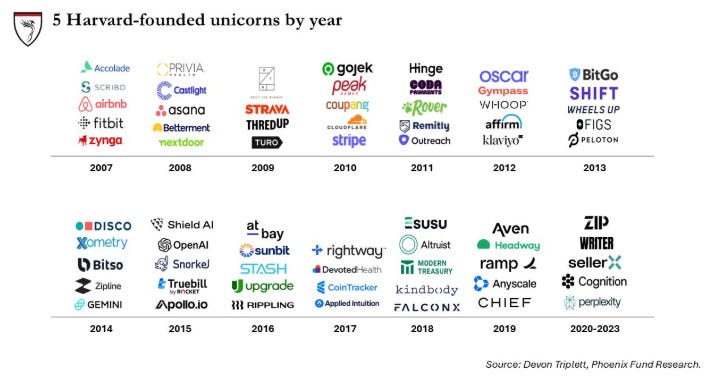

Harvard alumni have founded on average 5 unicorns per year for the past 15 years.

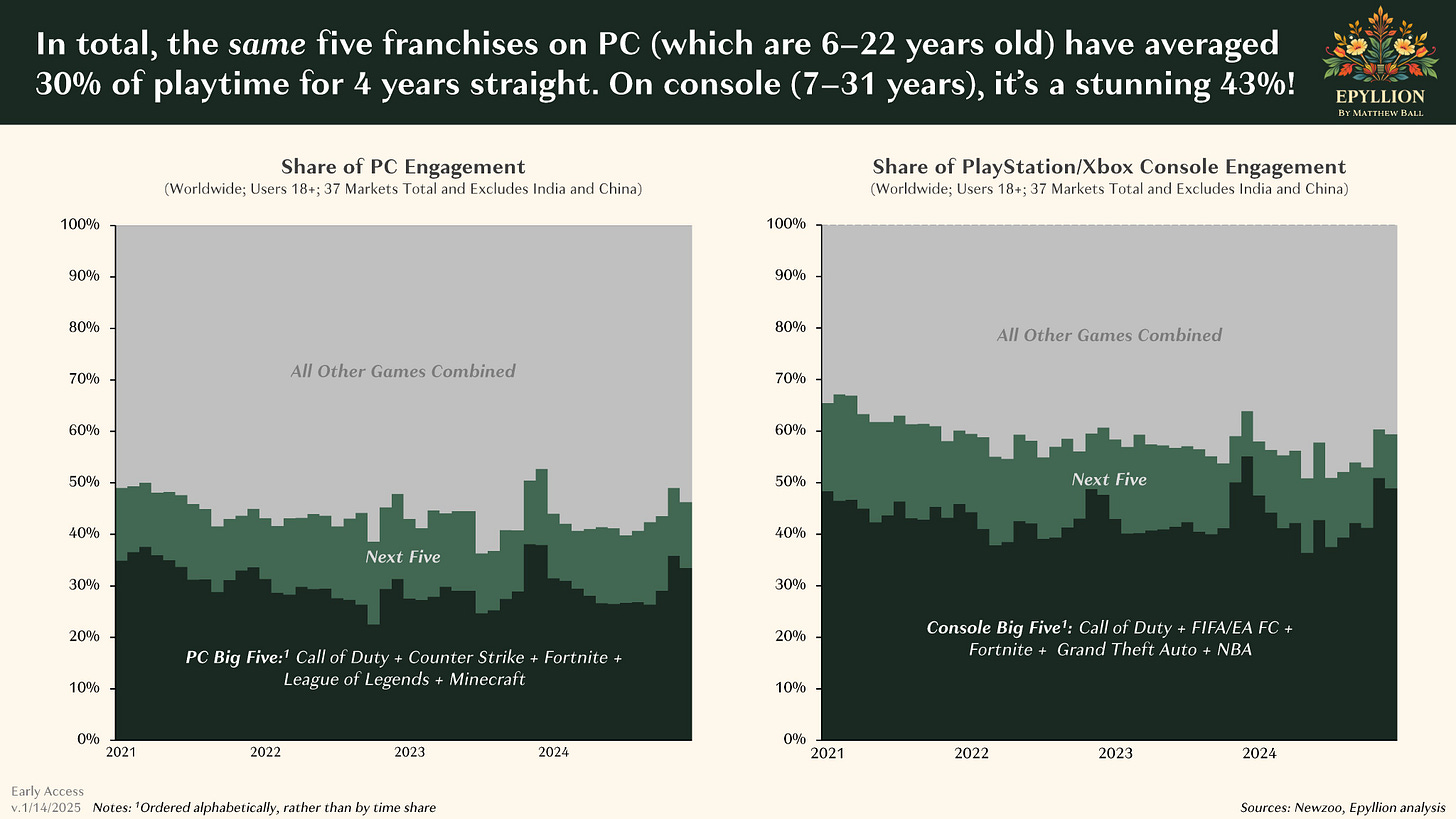

Power laws exist in the video game industry. The top games consistently represent over 50% of engagement.

Meritech had some interesting analysis on public market tech returns.

While venture capital is increasingly dominated by power law companies, i.e., very few companies drive a large share of the industry’s overall returns, the same is true in the public markets. The number of public software companies has grown from ~35 in 2014 → ~125 today (+3.6x), and the total market cap of these companies has grown from ~$200 billion in 2014 → $2.6 trillion today (+13x). Even with more companies at greater scale, only a handful of these companies are responsible for driving the index’s total returns every year, and the trend is becoming more pronounced over time. The following analysis compares the average annual intra-year returns of the top 5 highest returning public software companies in each of the last 10 years against the average intra-year returns of the rest of the public software index. The average return of the top 5 was almost 300% in 2024 and has dropped below 50% in only 3 of the last 10 years. The rest of the index is lagging. While public software is arguably the fastest growing sector in the world, if you aren’t invested in the winners, i.e., top 5 each year, you don’t even beat the NASDAQ ($COMP) over the past decade. The NASDAQ has had a 17% IRR vs. a 14% IRR for public software (less the top 5) for the past 10 years and has beaten all software (less the top 5) in 7 of the past 10 years.

What is even more stark is that the delta between the returns of the top 5 and the remaining ~120 companies is actually widening further over time. See the chart below, which shows the delta (calculated as the percentage difference in returns) between the top 5 and the rest of the pack. For example, in 2015, the 1.7x return of the top 5 divided by the 1.1x return of the other companies results in a 54% delta.

Naturally, the returns are staggering if you pick the winners. However, picking the winners every year is hard, just like in the private markets! Over the past decade, only two companies have appeared more than twice in the top five returners in a given year: $SHOP and $AXON. Even so, there have been durable compounders over time. Below are the top 5 all-time-returning software businesses in our index. The top 4 companies are still public today. Generating best-in-class returns both in the short and long term is becoming increasingly difficult if you’re not invested in market leaders.

The professionalization of NFL kicking. 55 yard kicks went from 24% to 64% probability over the past 25 years. Enjoy the games this weekend.