CPI Yay 🎉

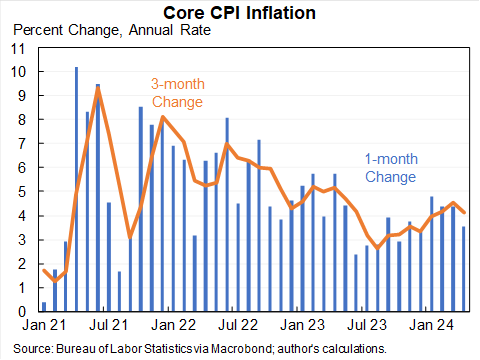

Monthly core CPI inflation came in at expectations, rates fell, equity markets rallied and Bitcoin took off. Core CPI eased off a little from the last few months but still high but not hot enough to hike, so markets celebrated.

Core CPI annual rates:

1 month: 3.6%

3 months: 4.1%

12 months: 3.6%

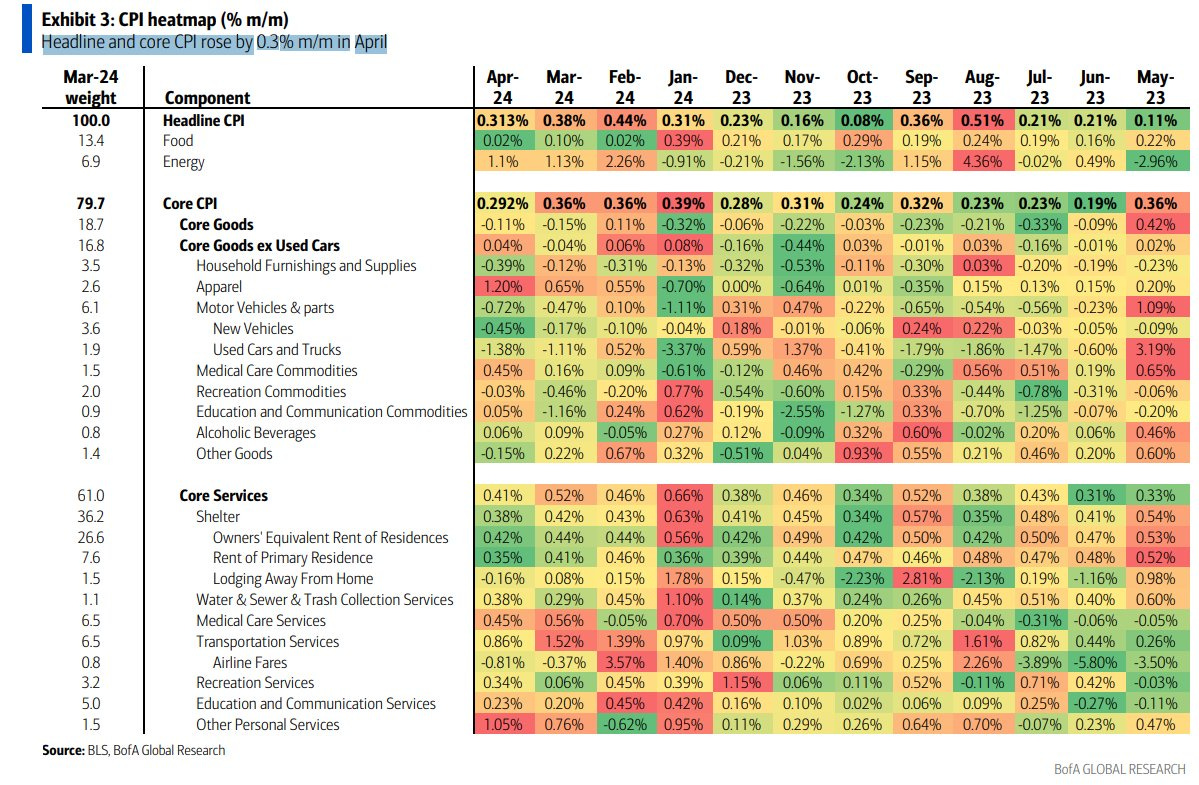

Broken down by category; goods deflation, driven by autos. Shelter still too hot.

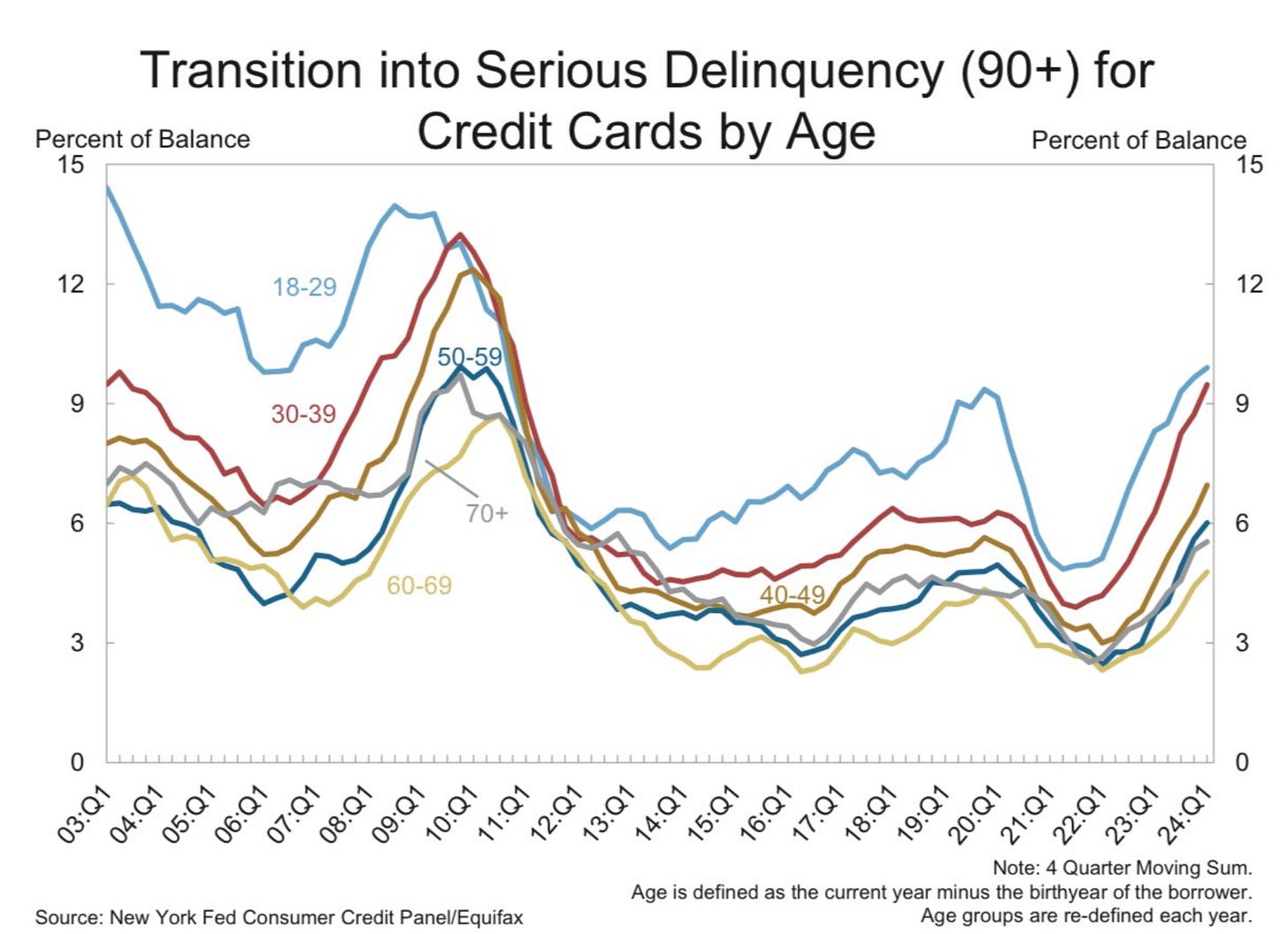

Inflation seems to be breaking the lower end consumer. 90+ day delinquencies for credit cards continue to rise. Given the labour market hasn’t even broken, hard to see these trends letting up.

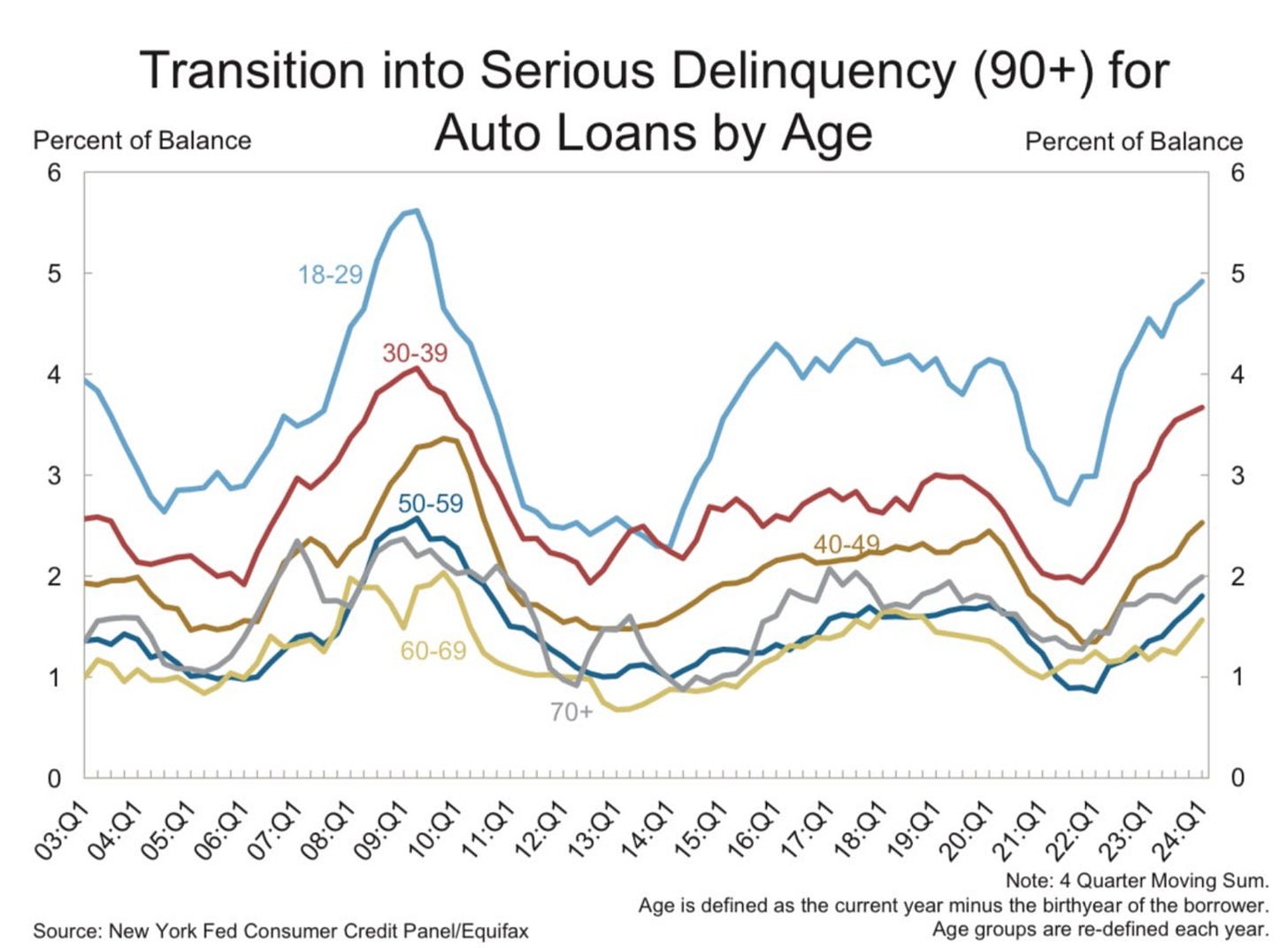

Auto loans are in a similar position. Approaching global financial crisis levels of serious delinquencies.

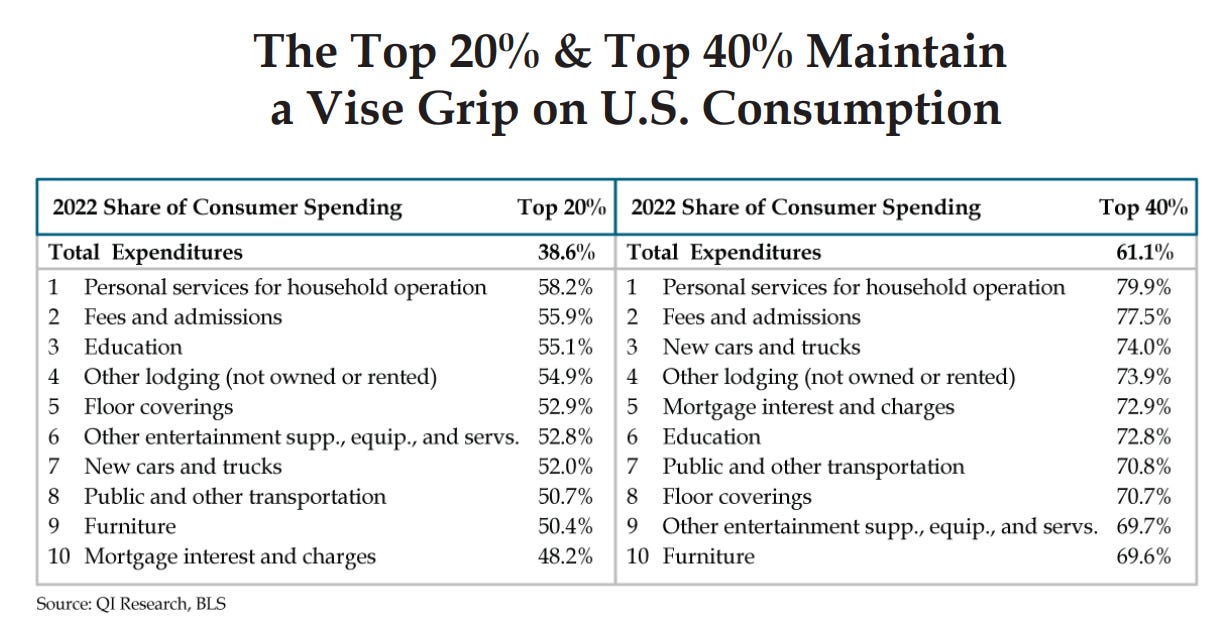

It’s possible that the economy hangs in there if middle and upper class households continue to spend. Top 40% of consumers represent over 60% of total expenditures.

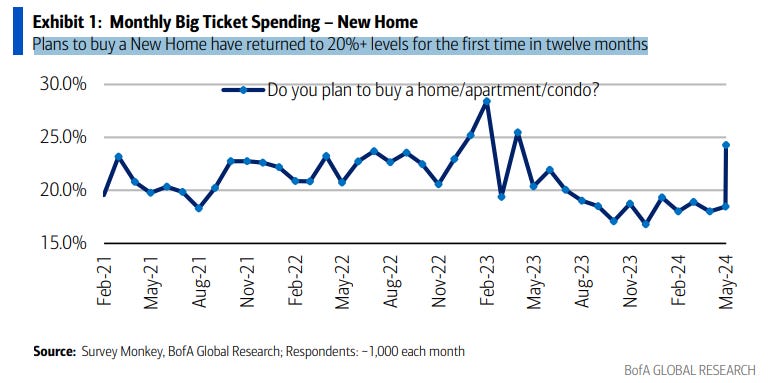

It appears higher end consumers aren’t feeling too much of a squeeze yet, there are ample home buyers waiting on the sidelines. Those planning to buy a home in the next 12 months jumped by 5% in May, likely on hopes of rate cuts.

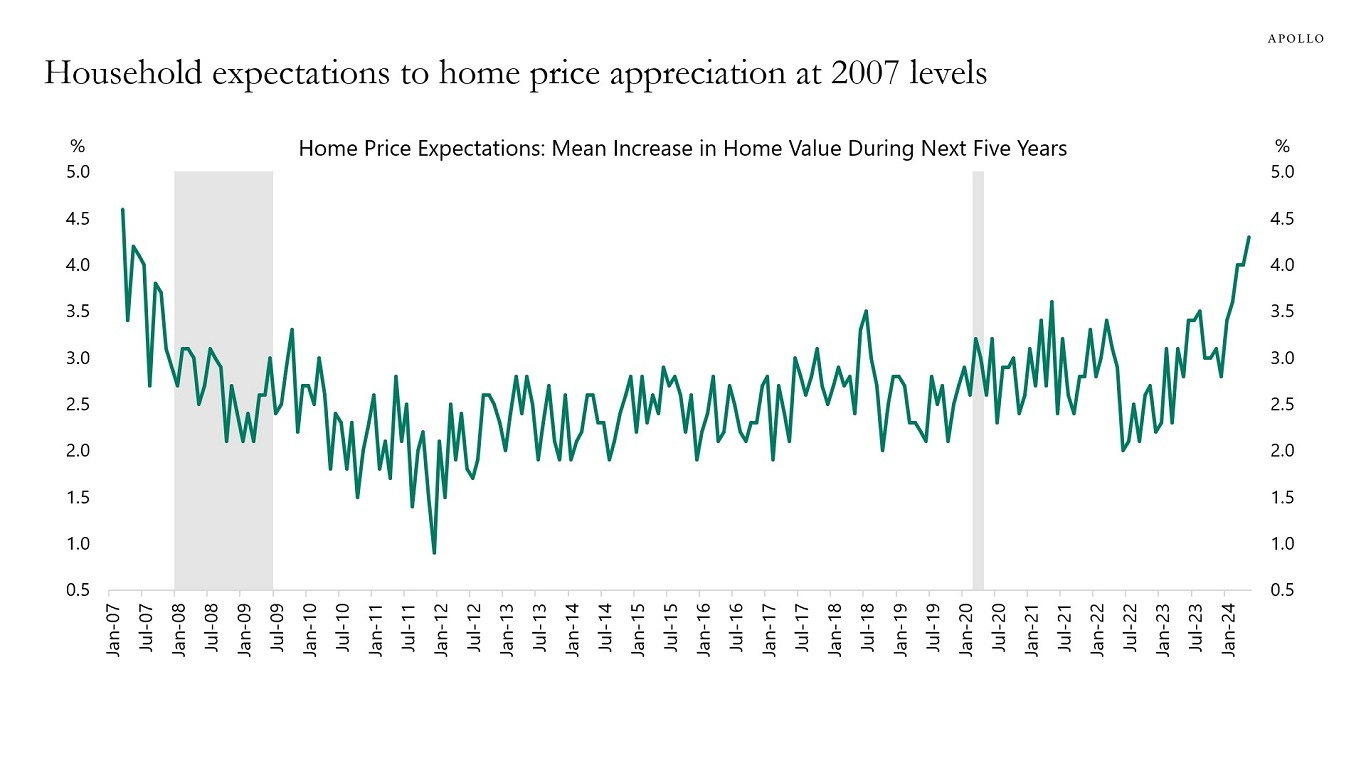

FOMO exists as household expectations for home price appreciation are at there highest level since 2007. Lots of money waiting to get into the market.

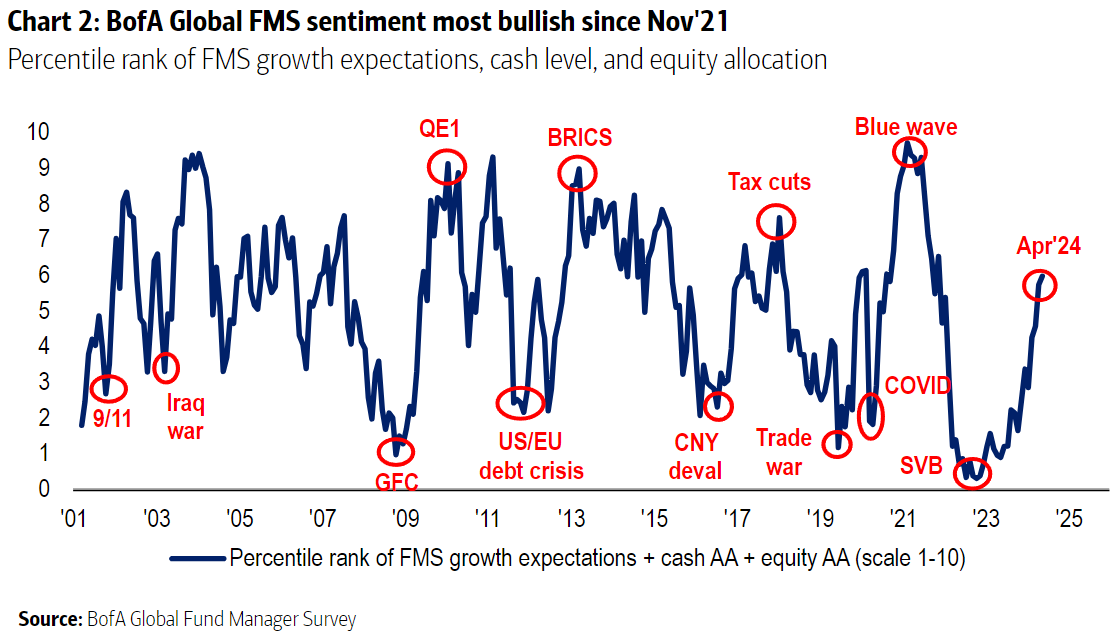

Fund managers are now the most bullish since November 2021.

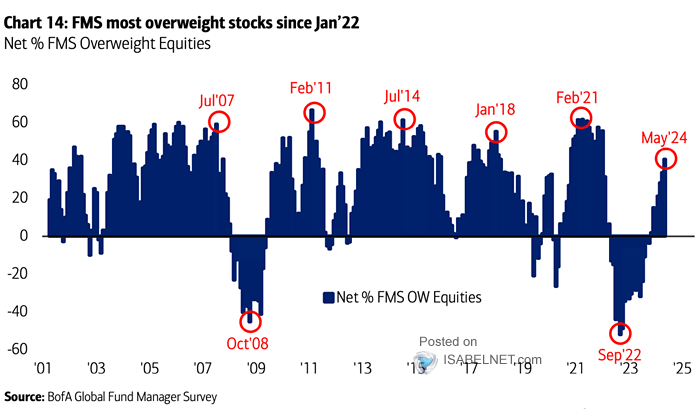

Accordingly, fund managers are most overweight stocks since January 2022.

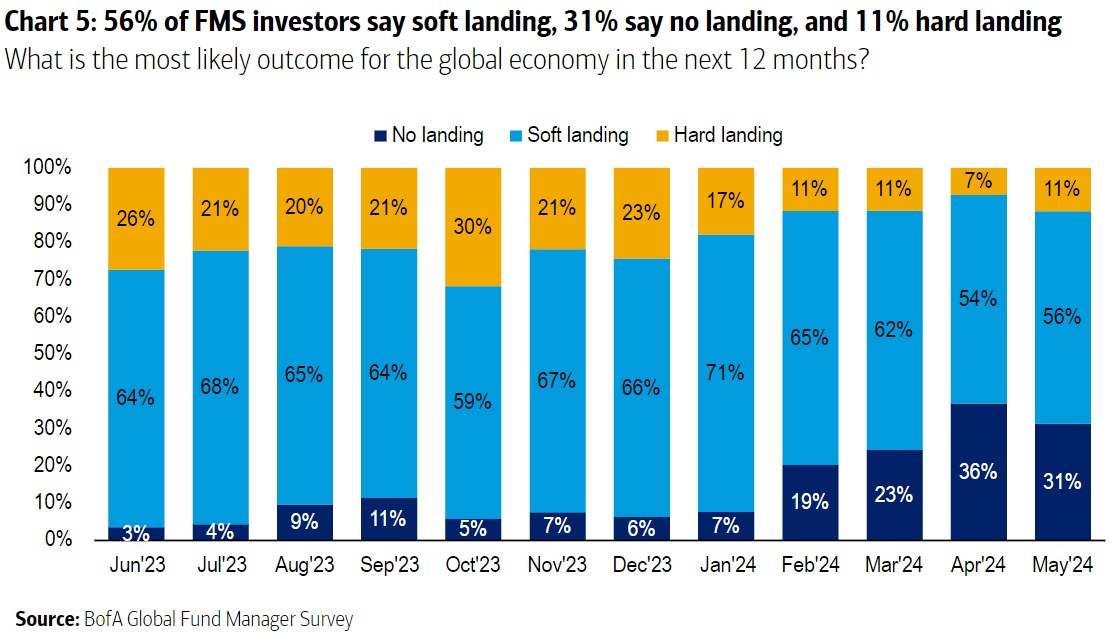

In May, managers shifted expectations from the no landing scenario on softish economic data.

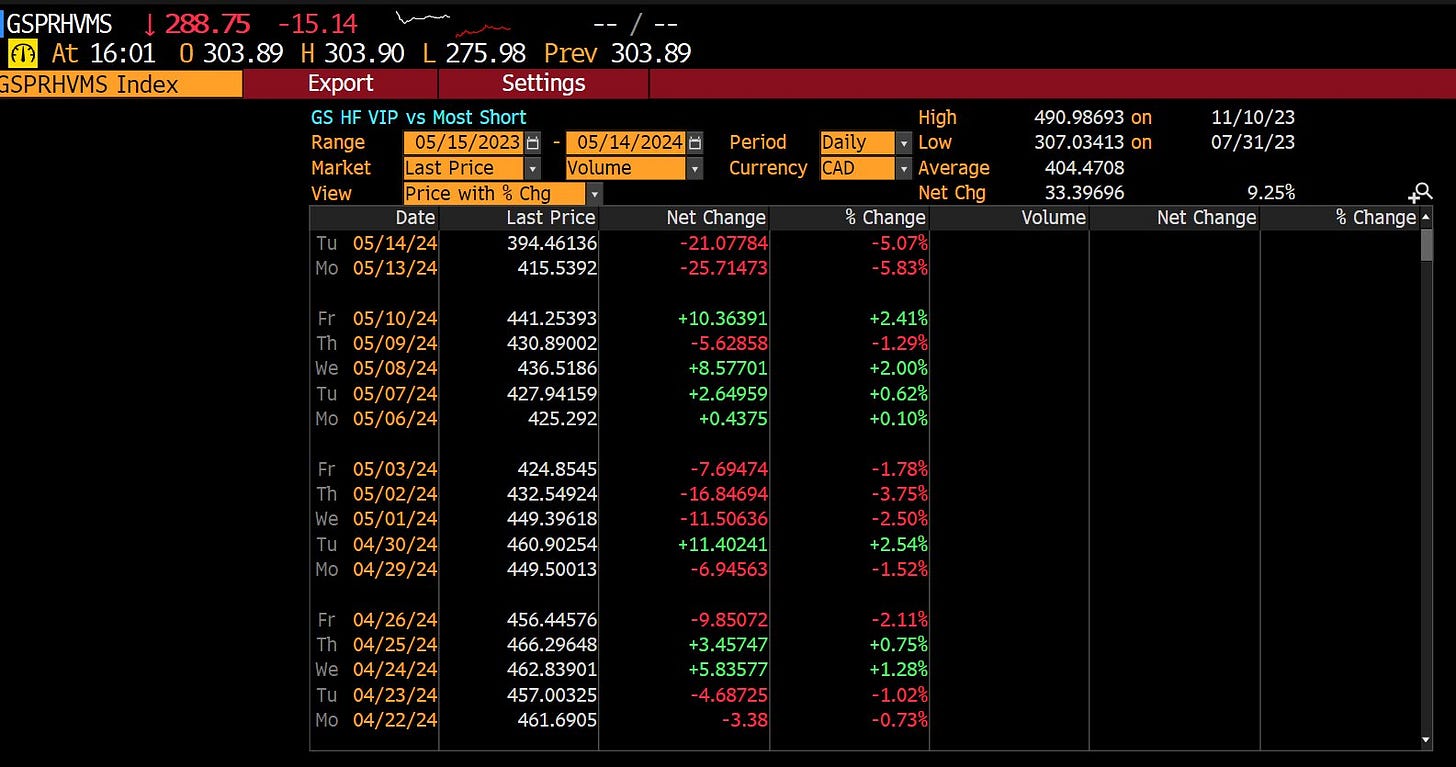

Meme stocks wrecking havoc. Goldman Sachs Hedge Fund VIP longs vs most shorted basket puked by 5.8% Monday, followed by 5.1% Tuesday. Monday was the worst day since 2021 and 3rd worst single day in the last decade for this pair.

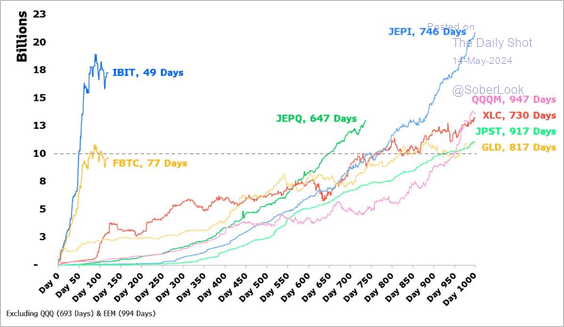

The CPI print sent Bitcoin up 7.6% yesterday. The Bitcoin ETF launch exceeded all expectations. It was one of the most successful ETF launches ever.

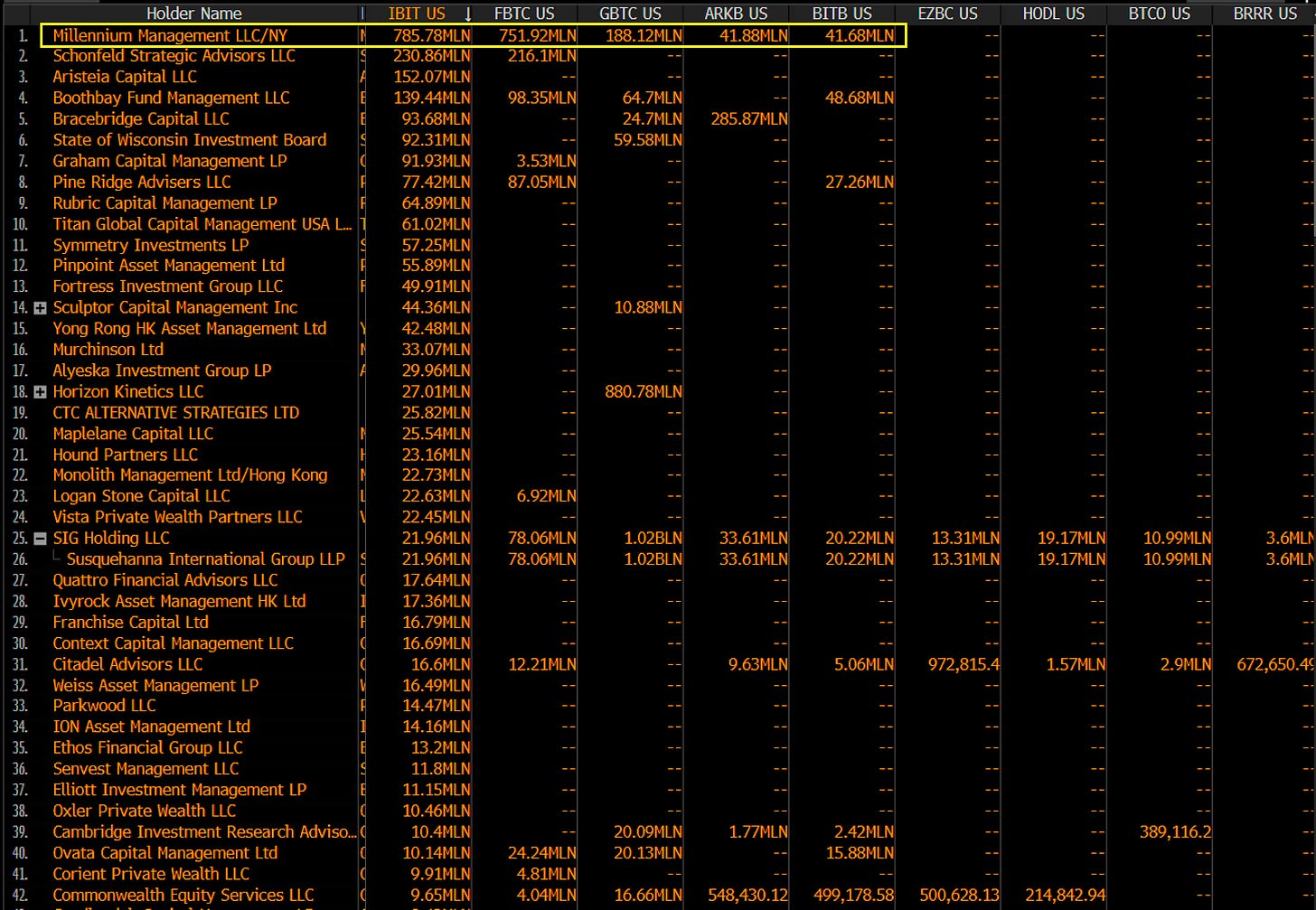

If you are wondering who is buying the Bitcoin ETFs, the deadline to file 13Fs disclosing fund holdings was this week. Millennium bought almost $2B worth; this likely isn’t directional exposure knowing them. The State of Wisconsin Investment Board is the non hedge fund standout on the list, likely a long term hodler.

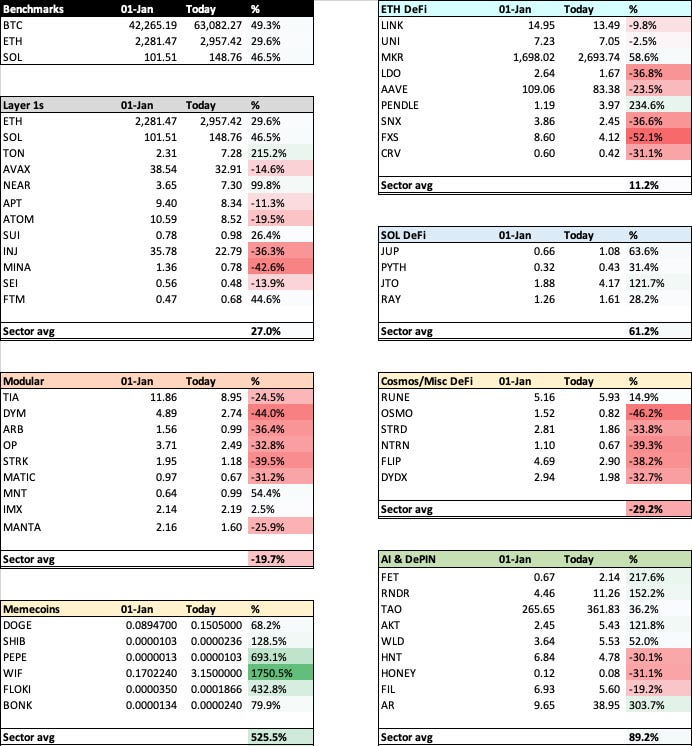

The more speculative crypto tokens have not participated in the crypto rally thus far.