Credit/Fixed Income investing is in a funny spot. 73% of the bonds in the world trade at < 5% yield. Yields that barely cover inflation; layer in tax and it is difficult to generate a real return. (Apollo)

Absolute yields look moderately attractive, high yield (HY) bonds offer a 7.5% yield, while investment grade (IG) bonds yield 5%. (Apollo)

However, spreads across both IG and HY are very tight relative to history, raising questions about whether investors are being paid enough for the credit risks they are taking. (Apollo)

Defaults are elevated, particularly in the loan market, suggesting investors should demand wider spreads. (Apollo)

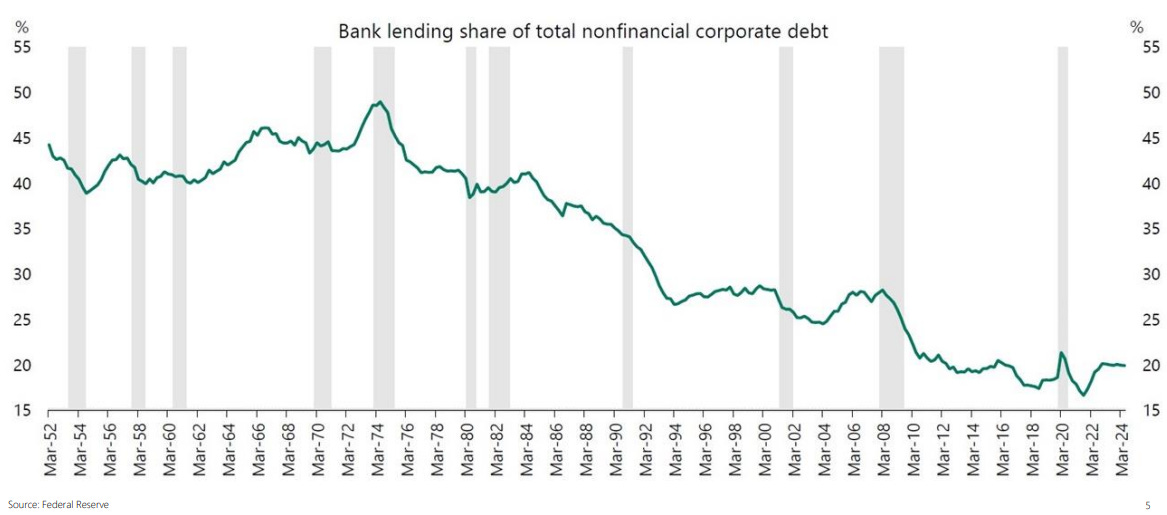

Banks have slowly pulled back from being important lenders across the economy as regulation constrains them and more recently balance sheet problems with unrealized losses and CRE exposures limiting their ability to lend. (Apollo)

One of the solutions, that’s filled the void, as banks stepped back was Private Credit. (Apollo)

With promises of double digit yields and low risk, Private Credit has raised assets. The capital raised for Private Credit has almost tripled in the past decade. Leading to many headlines questioning whether it is a bubble. (Cambridge Associates)

Private credit fundraising hasn't outpaced other private market areas, indicating private equity could generate enough demand for credit deployment. (Hamilton Lane)

So what’s all the hype? Well Senior Direct lending has been the strongest pocket of credit/fixed income markets since 2013. Critics argue this asset class remains untested in a recession; the true risk emerges only when economic conditions worsen. (Cambridge Associates)

Given the strong performance, it is worth a deeper look. The Cliffwater Direct Lending Index (CDLI) returned 11.3% in calendar 2024, 9.5% annualized over the last 20 years. In today’s environment, investors should be thrilled with a double digit return. (Cliffwater)

And even during difficult periods, Direct lending has held up strong given the security’s position at the top of the capital structure. (Hamilton Lane)

The recent rise in base rates, was cashflow that used to flow to equity investors but now is resulting in Private Credit yields in the double digits. (StepStone)

And spreads have not compressed like what is happening in public markets. (StepStone)

So is Private Credit a good investment? The challenge is understanding the risk, which is easier said than done. Headlines certainly suggest, caution is warranted. Tomorrow we will look into some data to unpack it further.

Once again using data distilled into charts you’ve highlighted a largely unrecognized change in the financial system.

As noted Private Credit is stepping in to fill void left by restrictions in bank lending.

It’s worth thinking about how this change in source of finance could affect the financial system during a significant recession.