Daily Charts - Banks

Survey data suggests by April 2023 almost 80% of California firms see themselves as in the new normal. This is the new status quo, office parks may never be the same again. The last grasp could be higher unemployment giving employers the upper hand forcing employees into the office.

Apple’s global shipments of Macs plunged 40.5% YoY, according to IDC, other PC makers didn’t fair much better.

Torsten from Apollo has some good slides on Regional Banks:

Banks reduced lending activity by a historical pace to reduce risk of running into liquidity issues.

This includes corporates.

Real estate is a similar story.

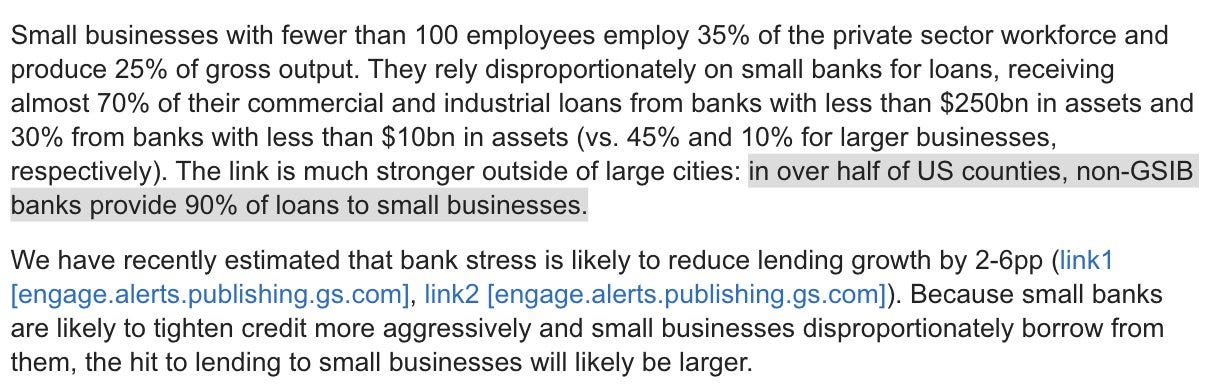

We are about to find out how important regional banks are to the US economy. This is from Goldman:

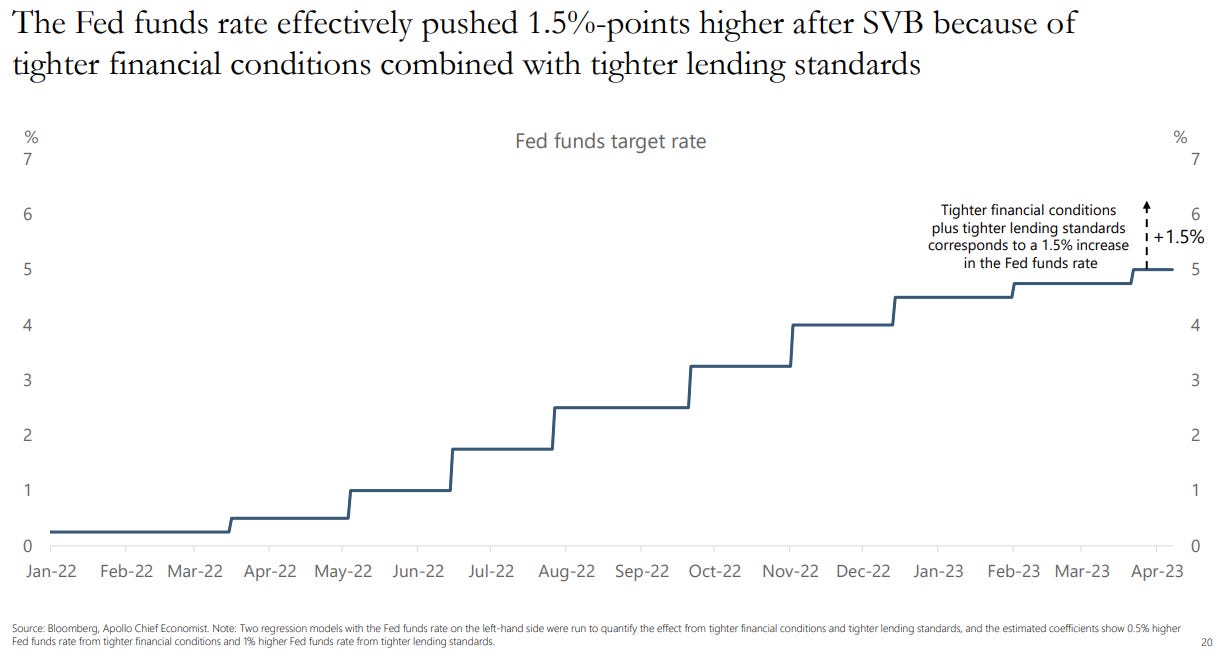

Apollo thinks the withdrawal of bank credit is worth 150 bps of hikes.

Piling onto some of the concerns highlighted yesterday. Tightening credit standards could be the knock out bunch to the economy. At least, that is what Apollo thinks.

Your daily reminder that equities normally fall after the first cut. This is because something breaks and markets panic.

Normally, most of the damage to equity market is done before the officially declared recession.

10yr Treasury yield has now round tripped back to Sept. 2022 levels

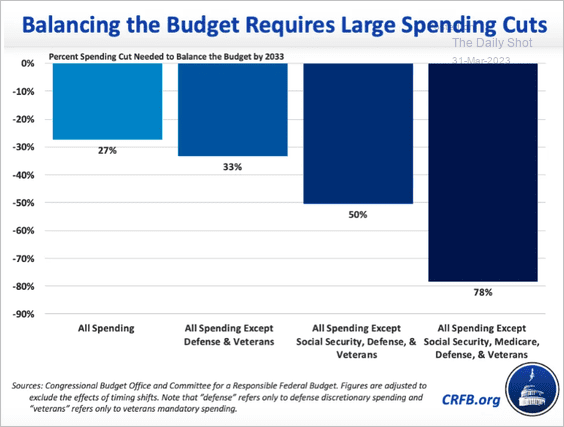

In order to balance the budget, the US Government would have to cut 27% of all spending. Once you start looking into programs that can’t be cut, you realize balancing the books isn’t really feasible.

A breakdown of how the Government collects taxes from you.

US money market funds' balances are not elevated relative to equity and bond market values.

Some interesting thoughts from Buffet on LTCM and leverage. Relevant to high net worth individuals and their use of leverage.