Daily Charts - BoC with the 🔨

Bloomberg Invest is taking place this week, some good interviews to check out.

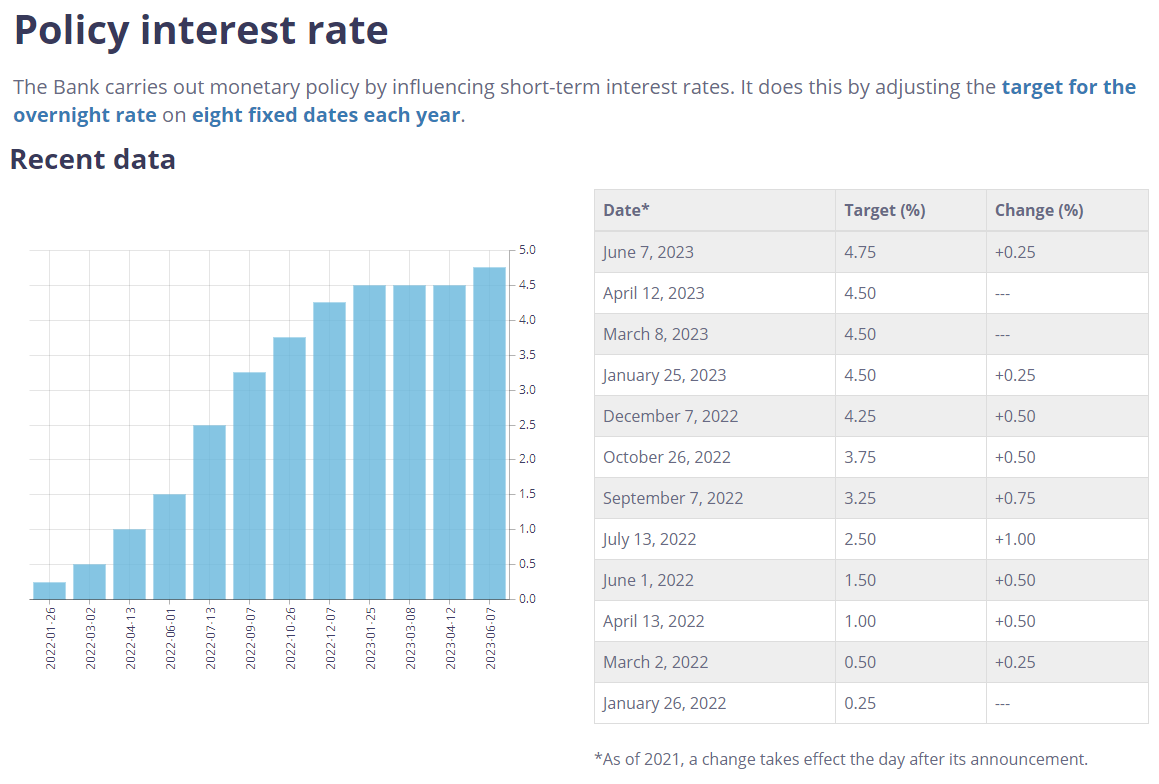

It was being priced at about 50% odds but the Bank of Canada went ahead and ended, their pause, hiking rates 25bps to 4.75%.

Based on accumulation of evidence, Gov Council decided to increase the policy rate, reflecting our view that monetary policy was not sufficiently restrictive to bring supply/demand back into balance & return inflation sustainably to 2%.

3-month measures of core inflation running in the 3.5-4% range for several months and excess demand persisting, concerns have increased that CPI inflation could get stuck materially above the 2% target.

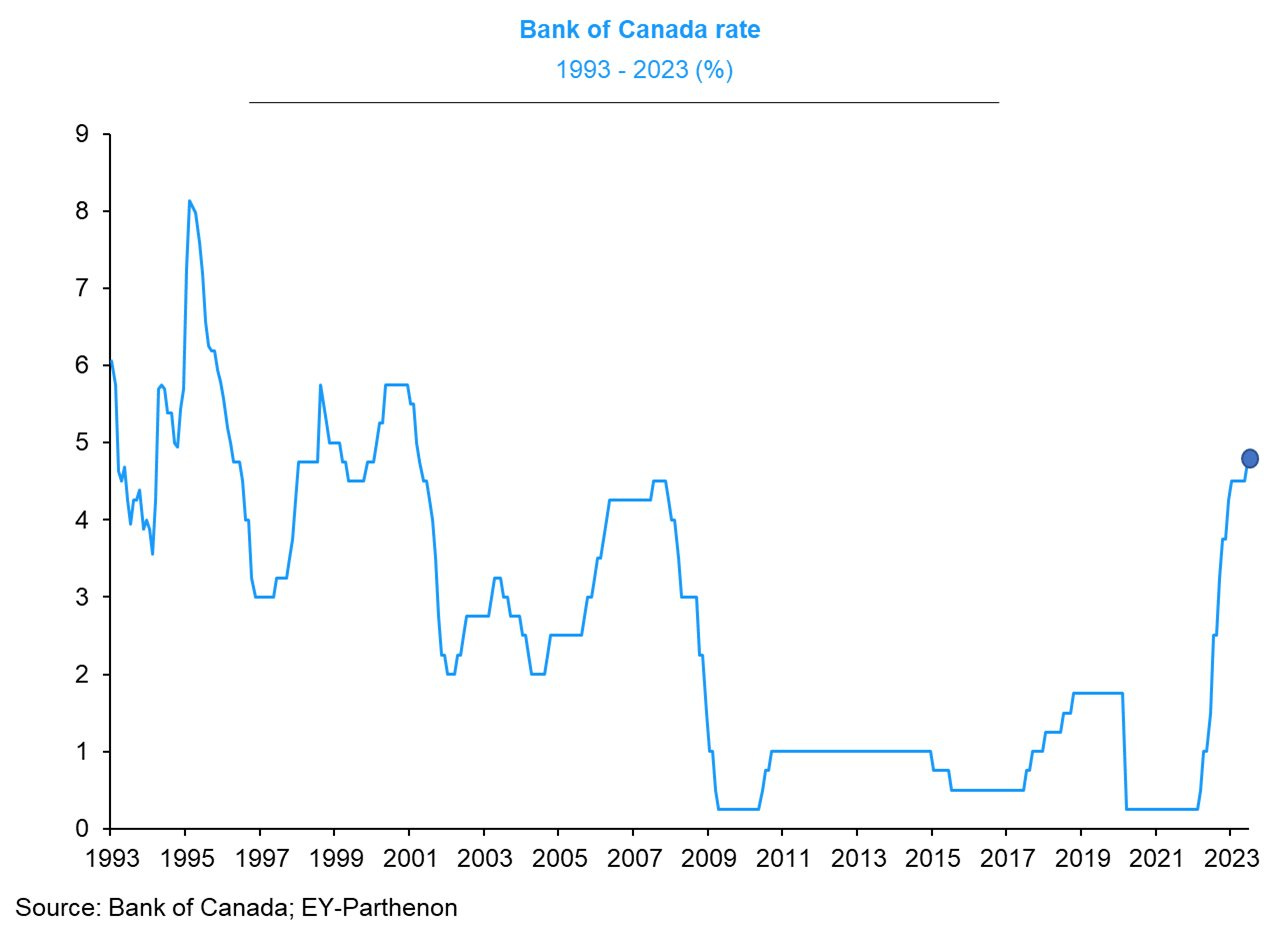

The Bank of Canada Policy Rate is at its highest level in 22 years. Households are highly indebted, what is going to break?

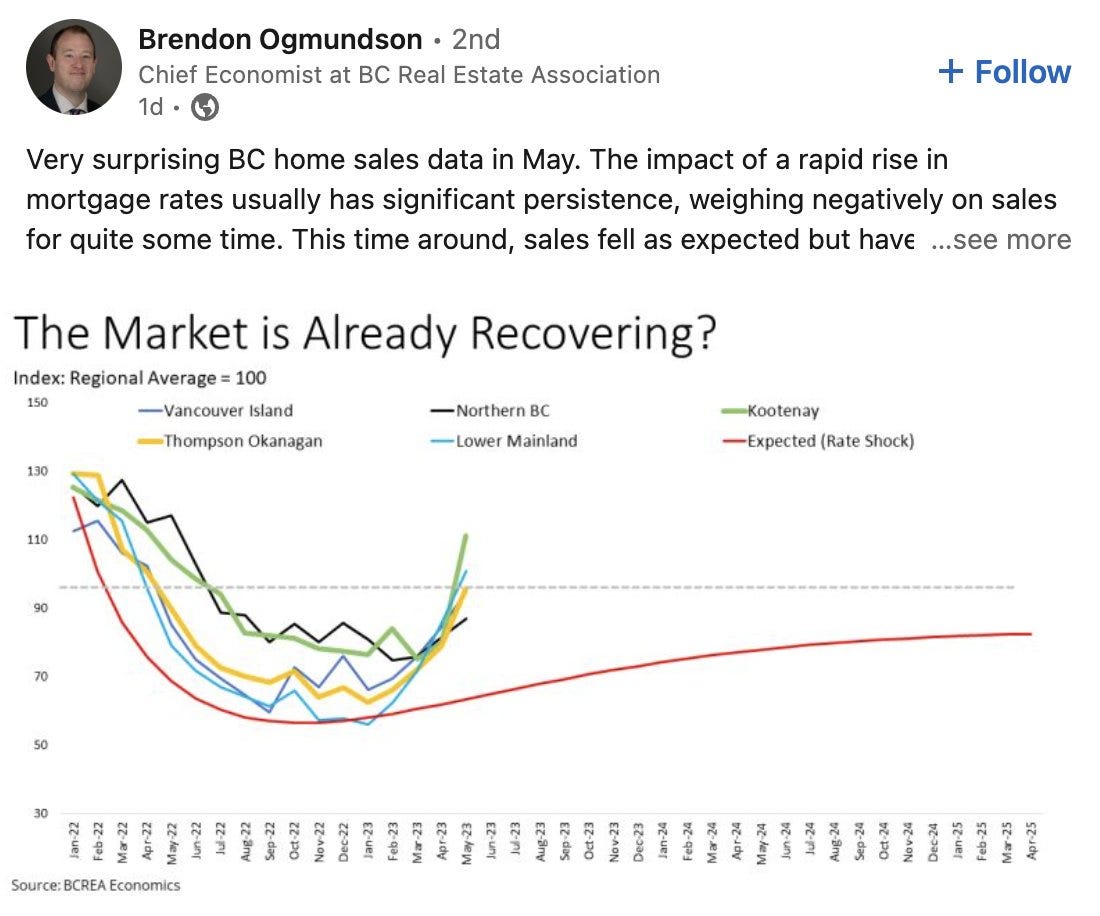

Canadians were waiting for the pause to pile back into their favourite asset class, Real Estate. Some areas of BC were climbing back to 2021 levels.

So much pressure on the housing market in Canada, rates will have to be high a long time to prevent a situation where prices scream higher the moment there are cuts.

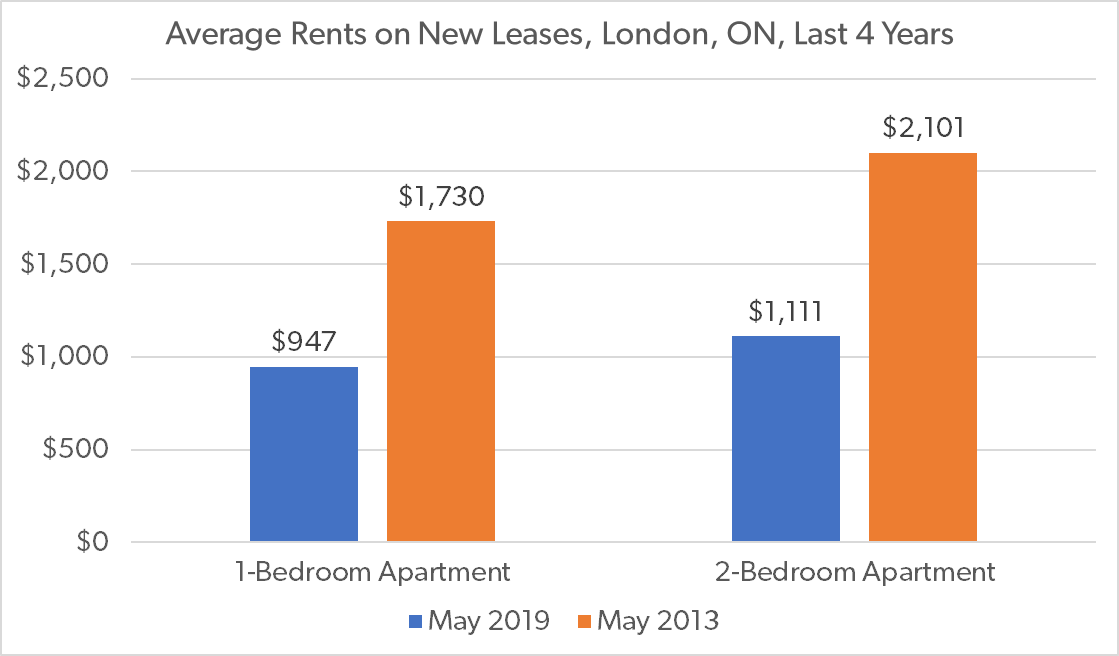

This is what a rental affordability crisis looks like. London, ON, rents on new leases have nearly doubled in 4 years. Do you know many people who have doubled their salary in the past 4 years? Rent strikes and protests are becoming more common (Orange bars should say 2023). People won’t be able to move from their rent controlled units.

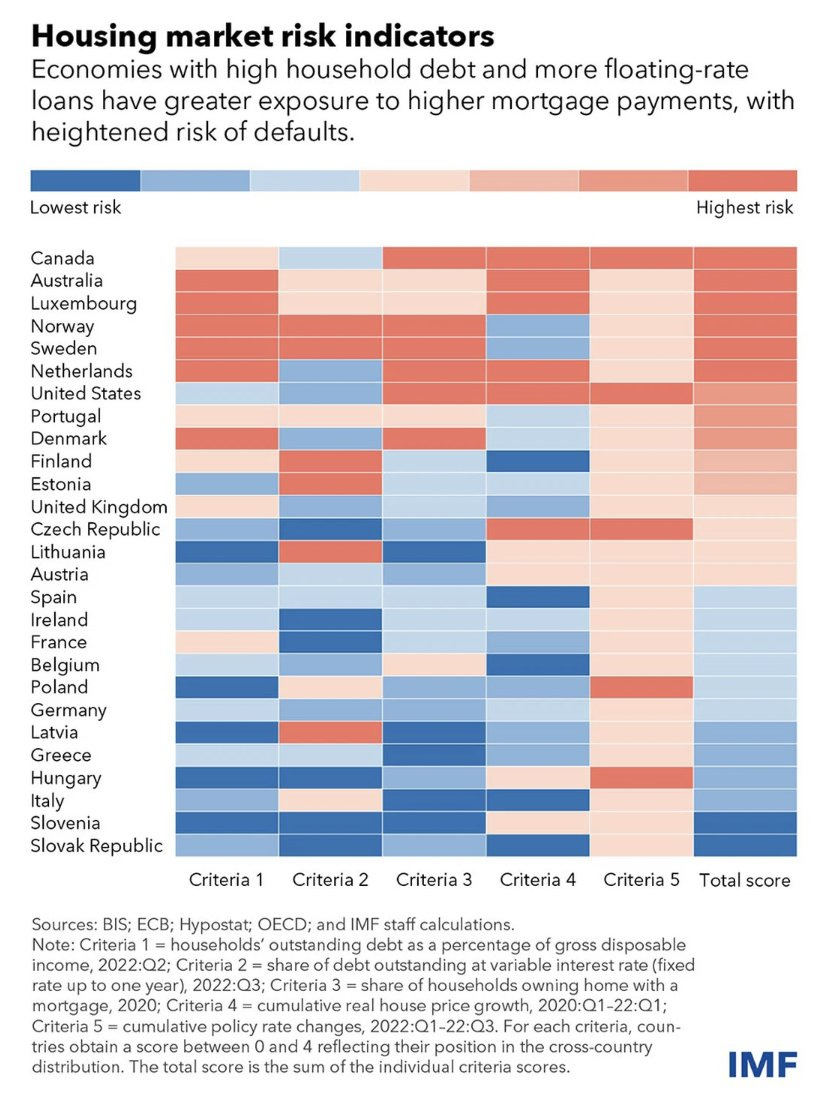

Canada is at the top of the list of the IMF housing market risk indicators.

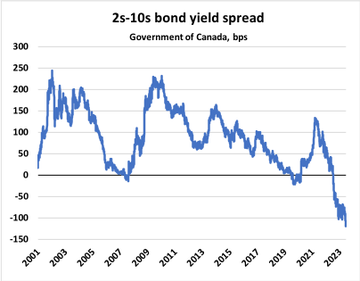

The inversion of the Canadian yield curve is unprecedented.

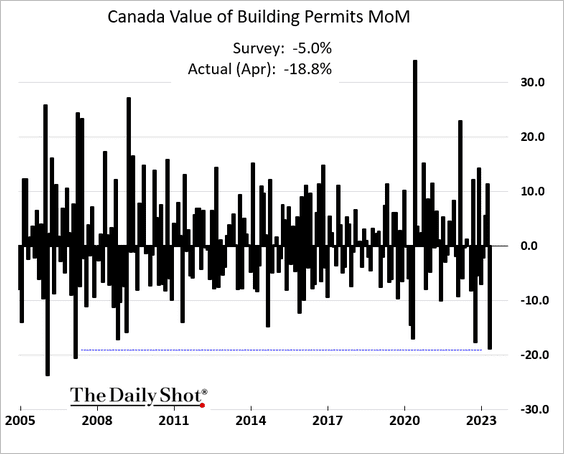

Elevated rates should continue to slow the the economy but Canadian building permits dropped 18.8% to $9.6B in April, similar levels to 2008.

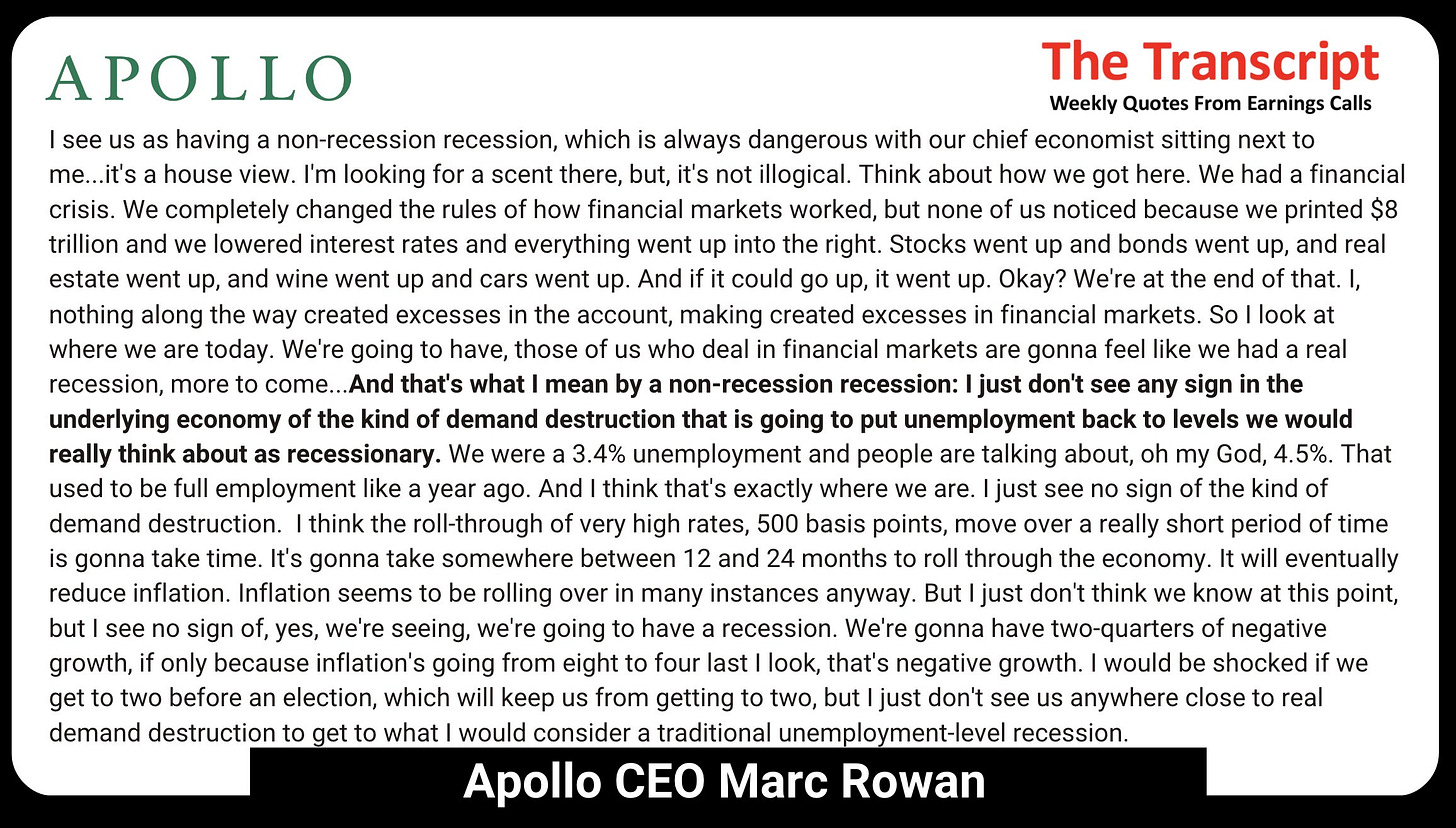

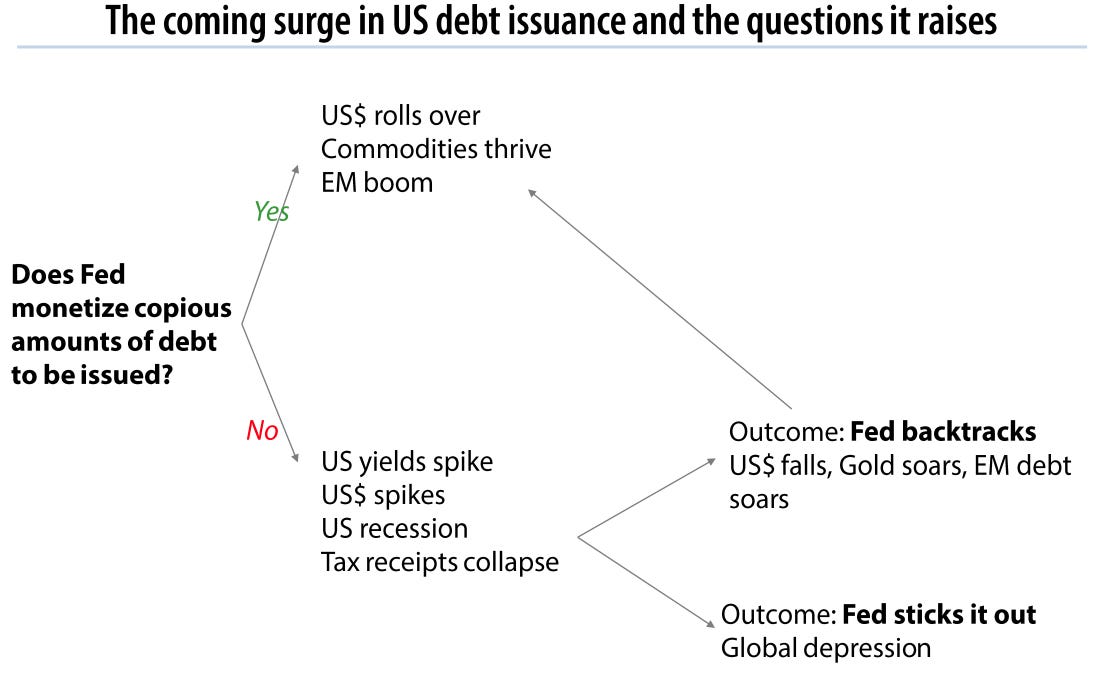

We are still at a very interesting cross roads. The range of potential paths forward are numerous and nobody can be certain. Below is Apollo’s take.

Louis Gave from Gavekal Research thinks we are going to end up in a Japanese style accommodative Fed and maybe even yield curve control. The big question is whether they pivot before they break something and asset prices collapse or the pivot comes after a crisis.

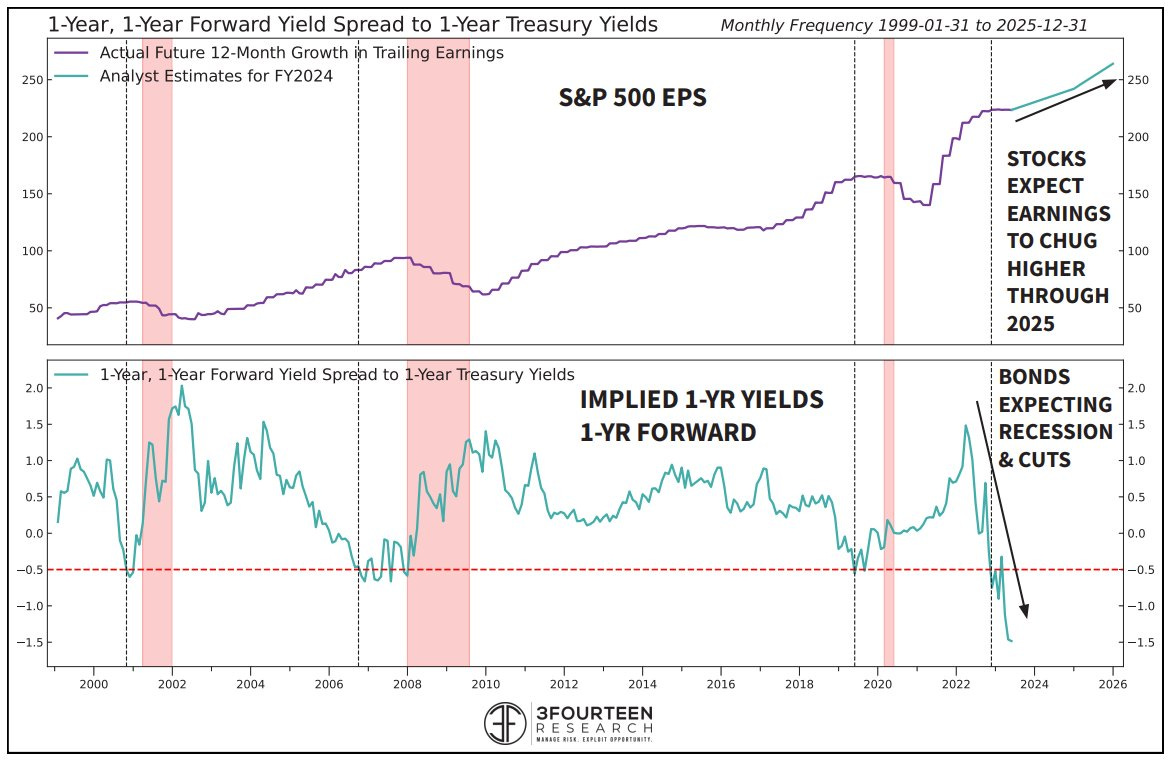

You are seeing the divergence in views between the futures stocks and bond are pricing in. S&P 500 EPS expected to grow by ~10% per year through 2025. 2yr Yields (1 yr yields, 1yr fwd) are implying the most dramatic Fed cut cycle ever.

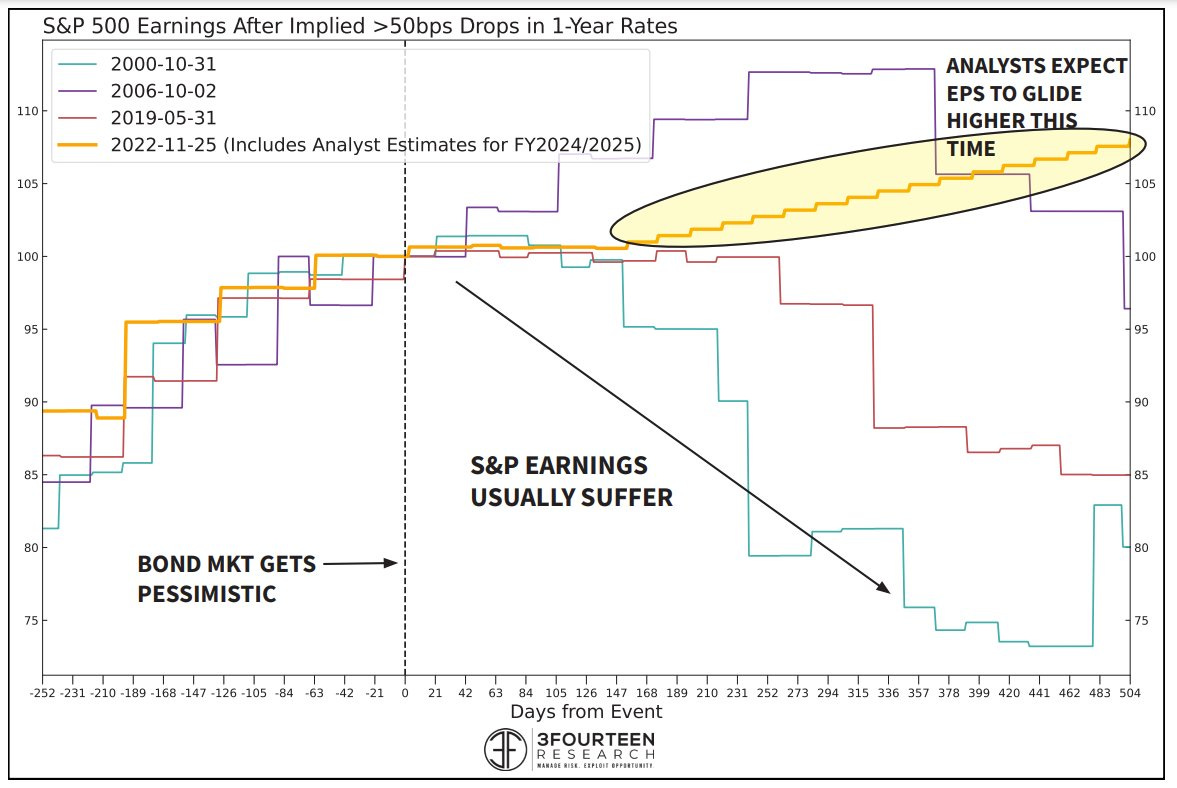

A few anecdotes from when the bond market got this pessimistic: 2000, 2006, 2019, current analyst expectations for 2024/25 (highlighted circle). Usually, EPS suffer.

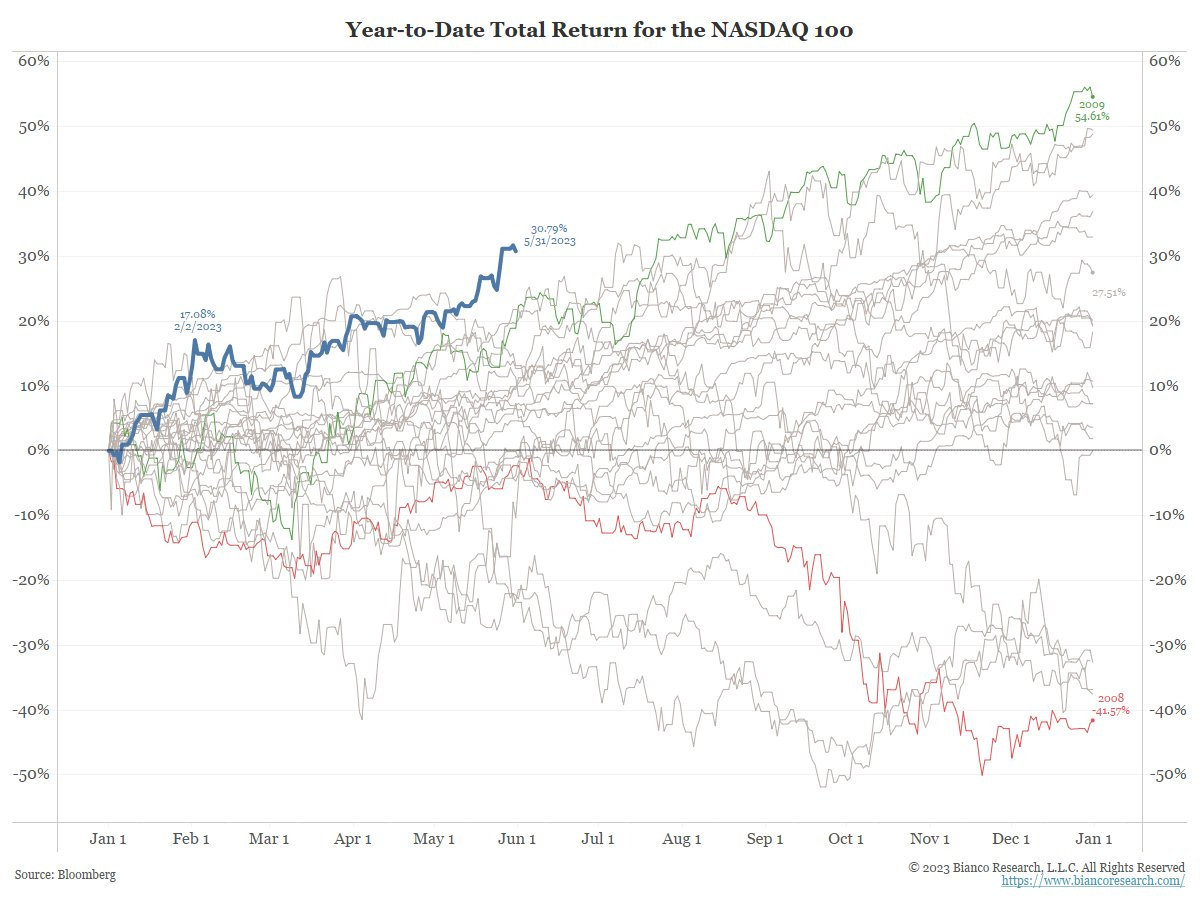

All that pessimism… The Nasdaq 100 has ignored it. It is off to its best start to a year since at least 1999 when total return data began. The index has returned almost 31% YTD on a total return basis, topping the next best five-month start to a year (2003, 22%) by a wide margin.

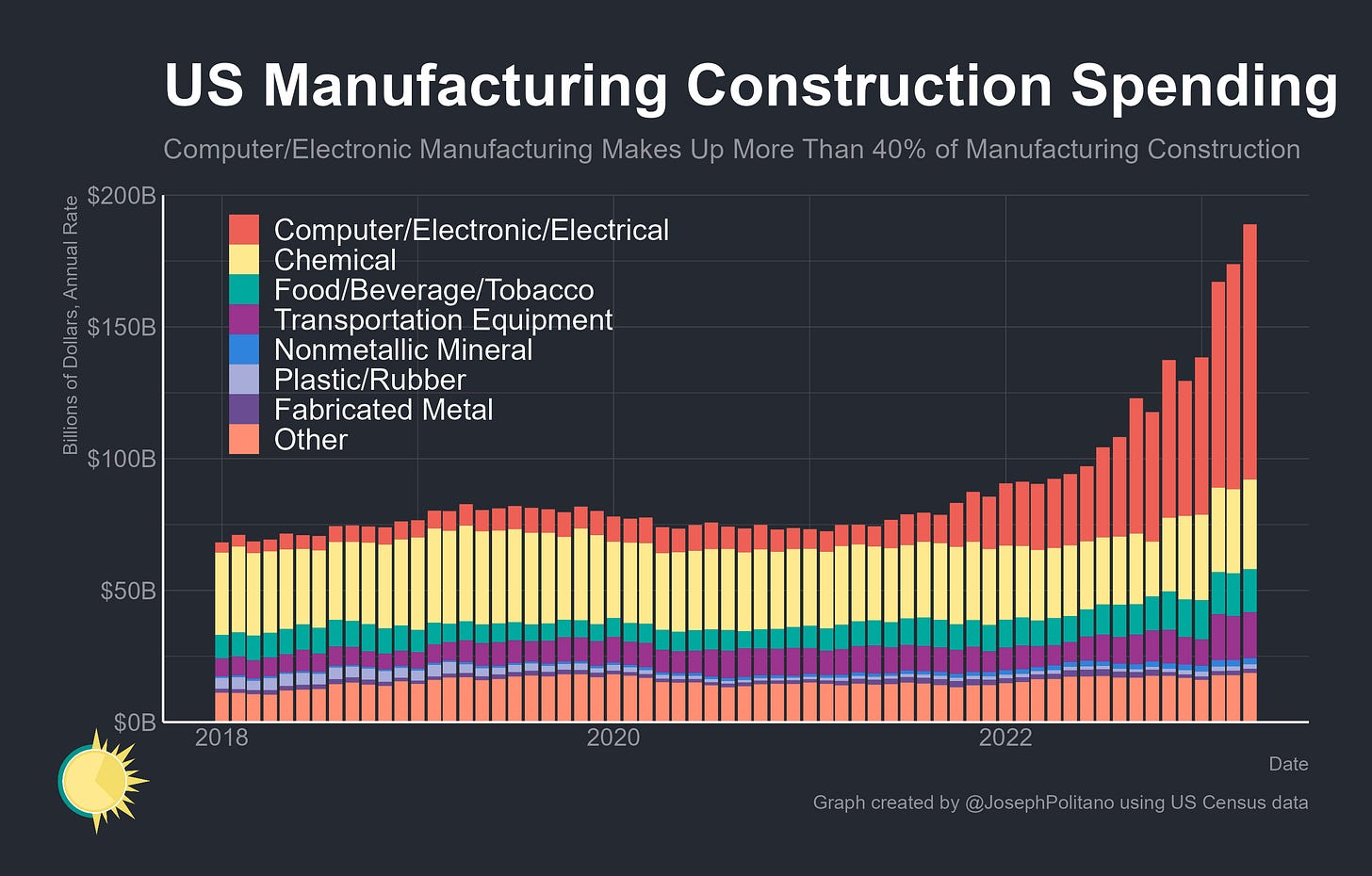

The US manufacturing construction boom is massive. Historic increases in computer/electronic manufacturing thanks to the CHIPS Act, and massive increases in transportation equipment. Some are citing the deficits incentivizing this spend will prevent a recession. too much money flowing into the system.

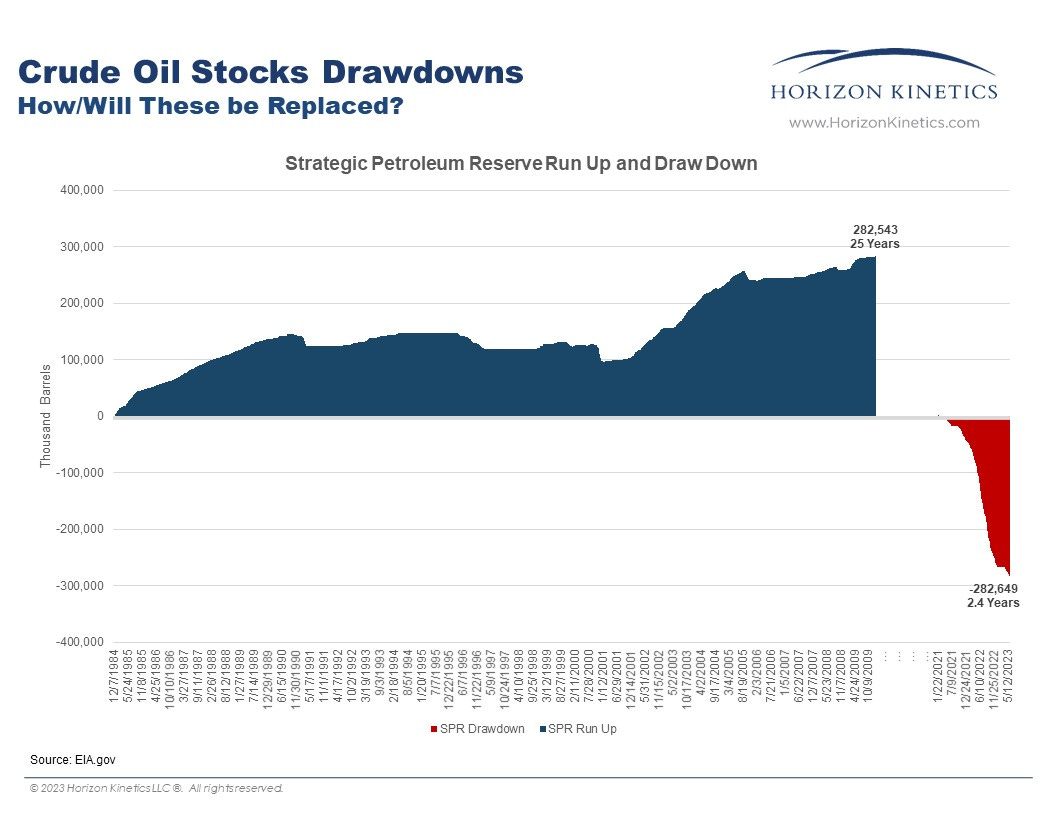

It took 25 years to accumulate the last 283 million barrels in the Strategic Petroleum Reserve. It only took 2.4 years to draw it down.