Daily Charts - Canadian CPI, Office & India

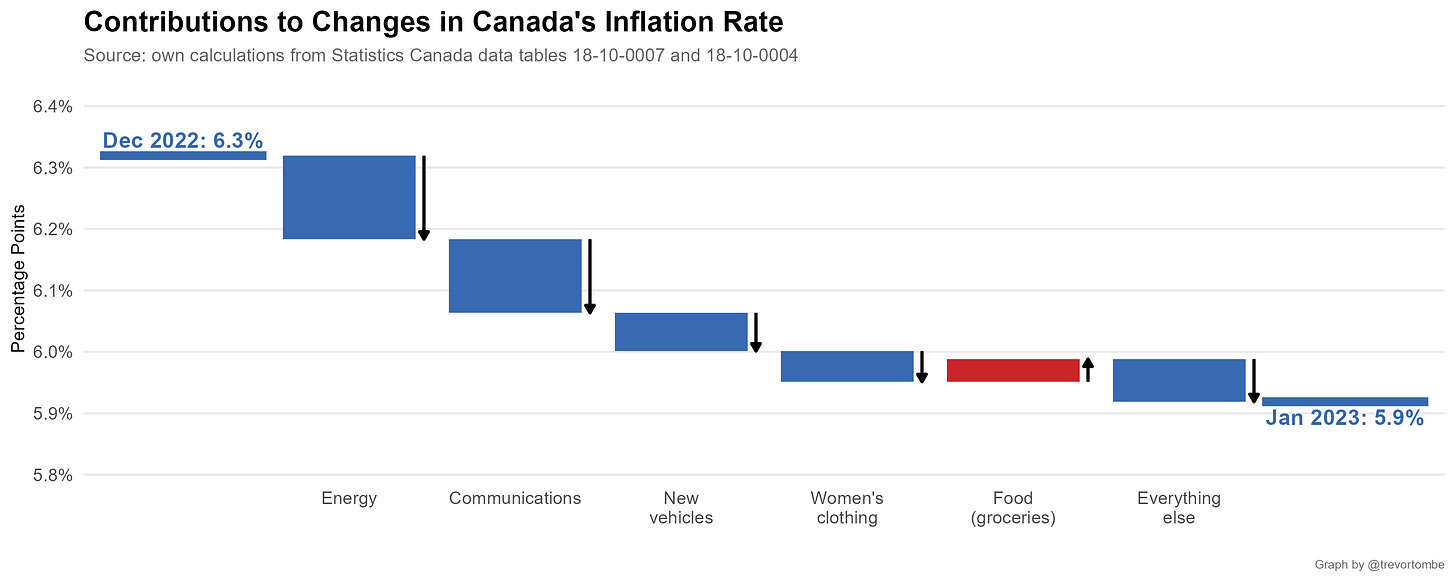

Canadian inflation dropped from 6.3% to 5.9% YoY in January. Energy was the largest driver of the decline, followed by communications.

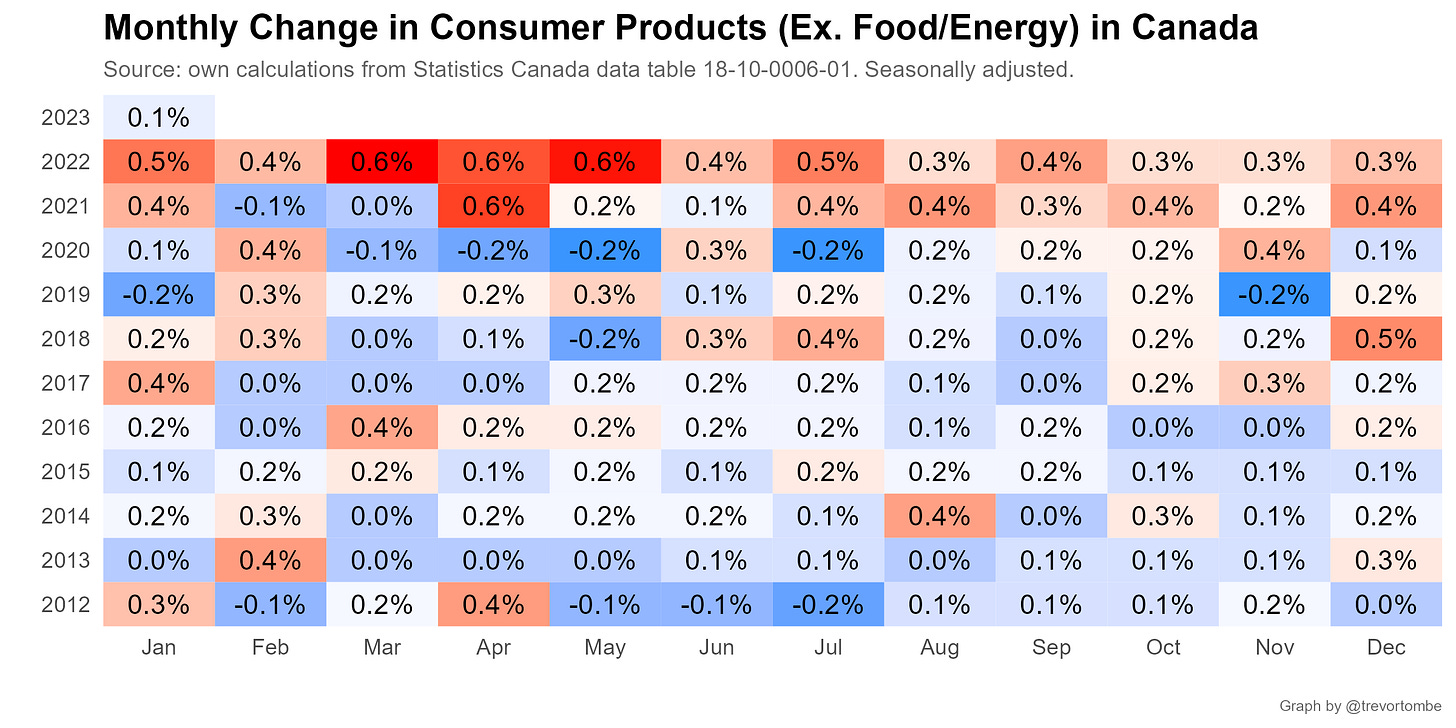

Inflation should continue to fall until at least May as large MoM increases from the first half of 2022 roll out of the calculation. The US should experience a similar phenomenon. You can see the MoM changes below.

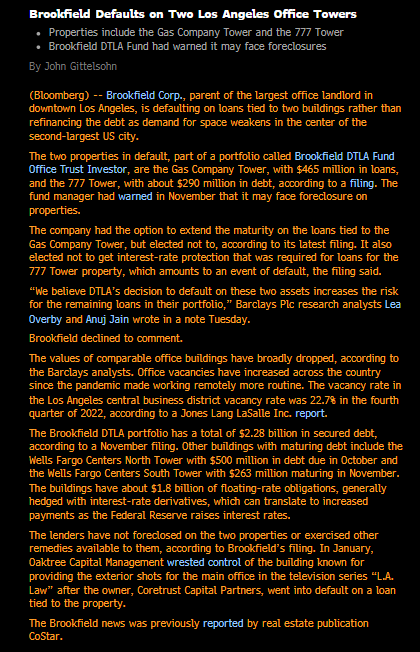

Office continues to make headlines, article in the wsj discussing an upcoming wave of defaults. At one point the solution was conversions to residential, this article in the ft discusses some of the challenges with that. Last week, Brookfield defaulted on loans tied to two prominent LA office towers.

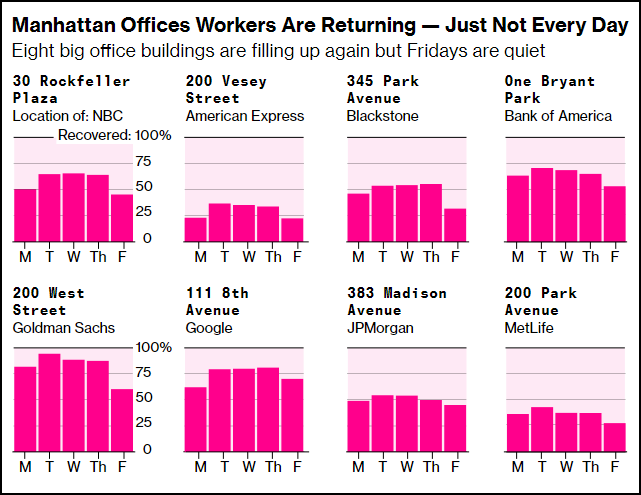

Surprisingly, Google has better office attendance than some financial service institutions in New York.

Sam Zell discusses some further concerns for Office, he says we were overbuilt going into Covid.

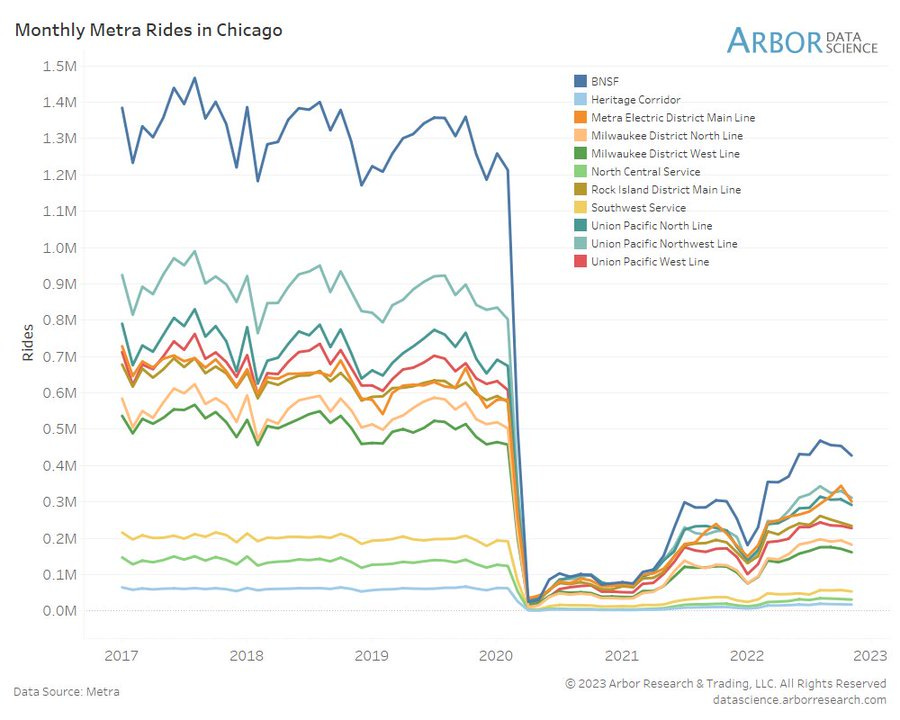

Passenger volumes on the major commuter lines into Chicago’s Loop show how few people are commuting too the office in the Windy City.

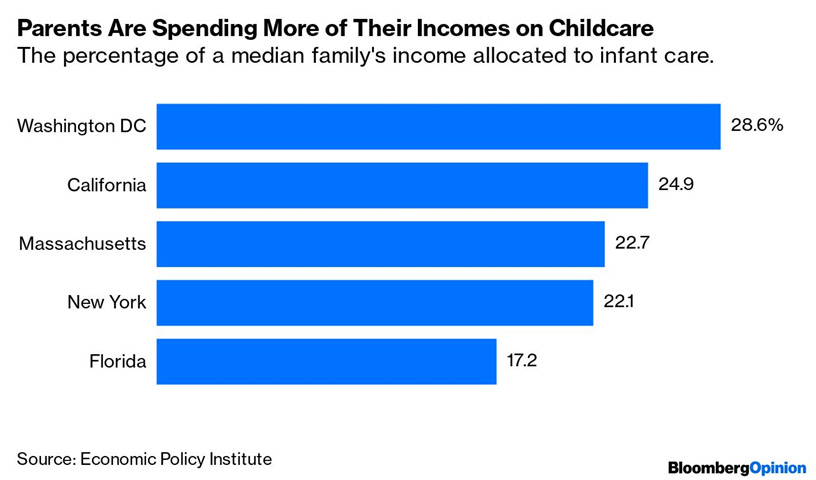

City-dwelling families can spend around 20% of income on infant care alone. If remote work remains, you can expect families to flee cities for more affordable lives.

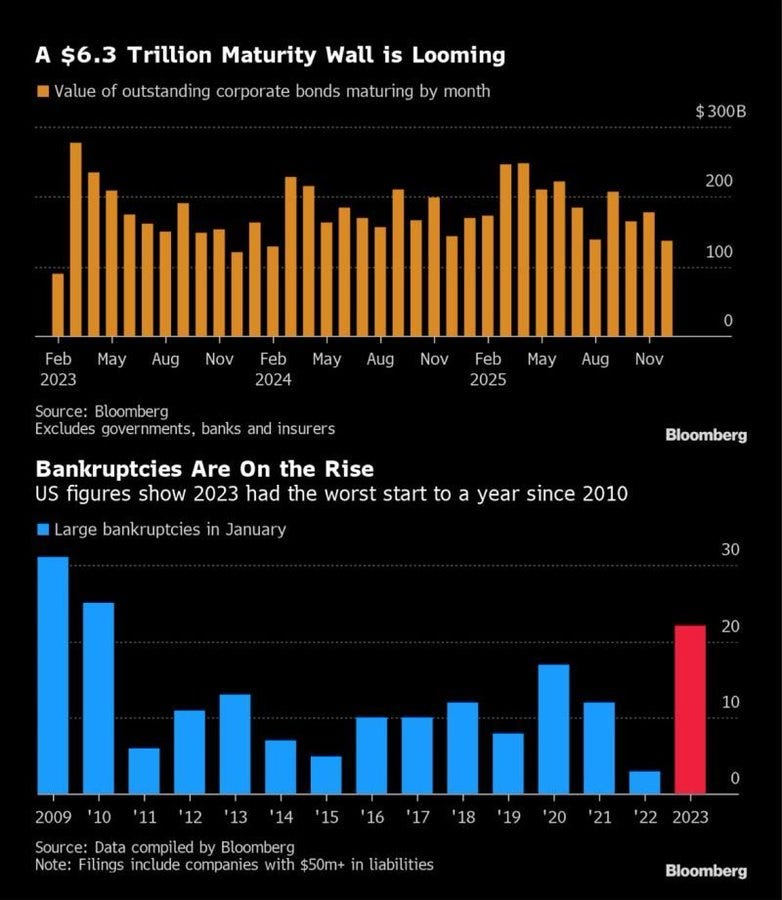

A maturity wall is fast approaching, if rates remain elevated, those companies forced to roll their debt will lead to distressed situations.

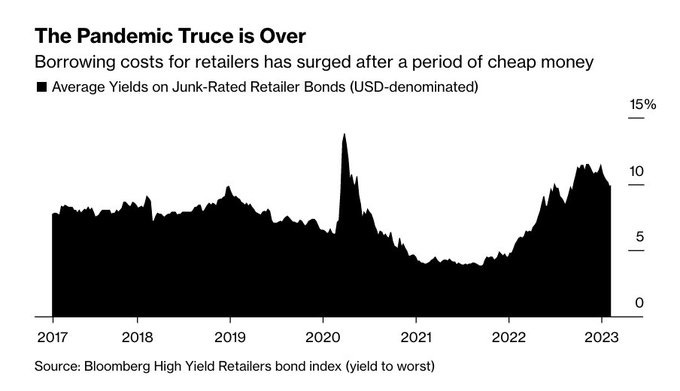

Office is not the only sector showing signs of stress, retailers are seeing borrowing costs rise.

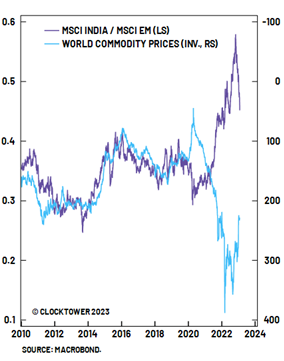

The Adani Group saga is just a spark putting India in the spotlight. Indian asset performance relative to commodities massively diverged post Covid.

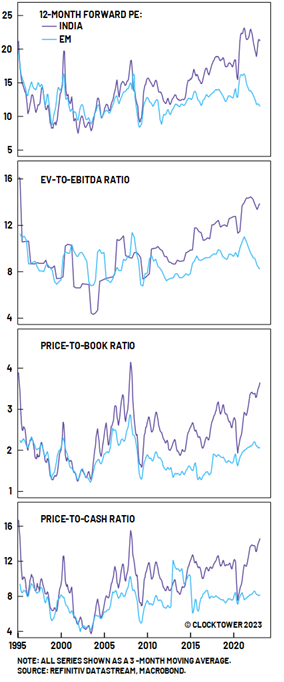

Extended valuations relative to rest of EM, means India has room to fall.

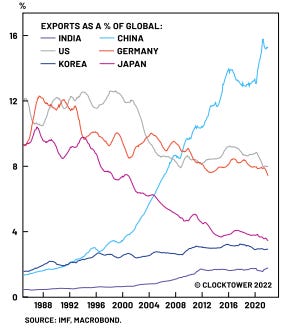

The macro data shows their is no massive global growth story in India yet. We may hear anecdotal stories of companies like Apple diversifying supply chains in India but it is hard to tell from the data.

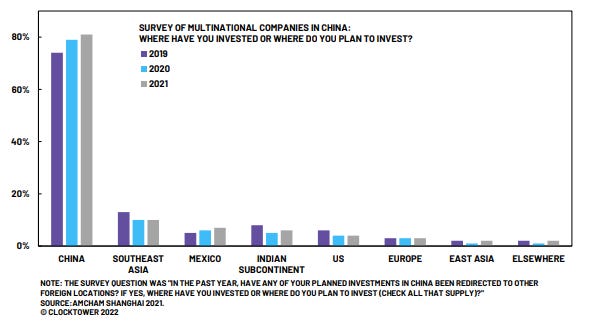

Global corporations continue to favor China, Southeast Asia, and Mexico over India as an investment destination. This after almost a decade of presumably pro-growth Modi reforms.

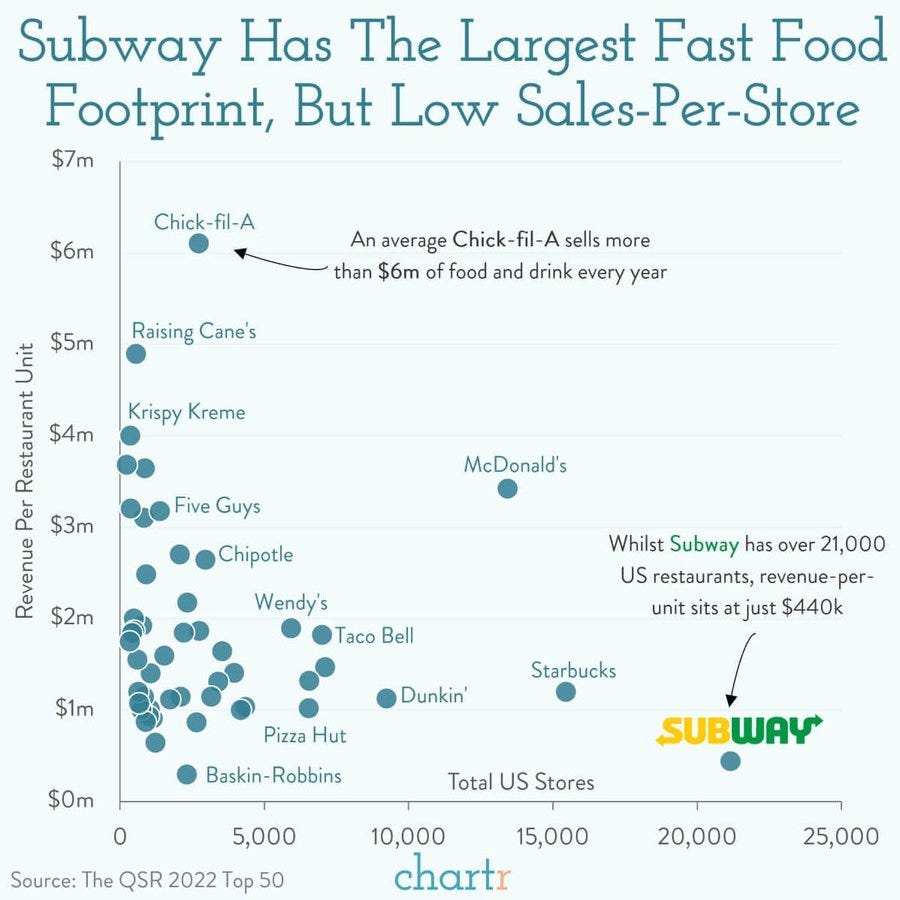

On the real estate theme, Chick-fil-A does over 10x the sales per store than Subway.