Daily Charts - Canadian Housing & Other Real Estate 🏘️🏢

Dave Rosenberg wrote an article about the Canadian housing bubble, the slowing Canadian economy and unreachable housing supply targets. The article highlights the challenges the Canadian economy is up against and compares many Canadian housing metrics to US housing in ‘08.

The good news? Renters who have been forced to sit on the fence for years will finally have their chance to hop into the housing market at much cheaper levels … and this time next year, the central bank will be forced to cut rates again to combat the recession and ensuing deflation that will come with the downturn.

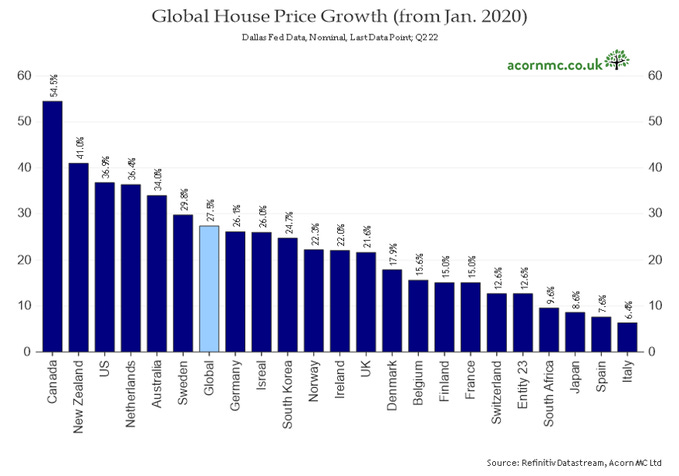

Canada’s housing market has been one of the strongest globally since Jan. 2020.

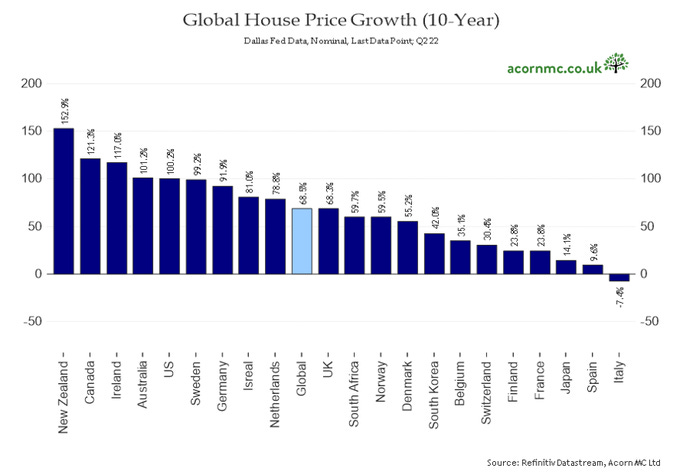

Canada is only 2nd to New Zealand over the past decade.

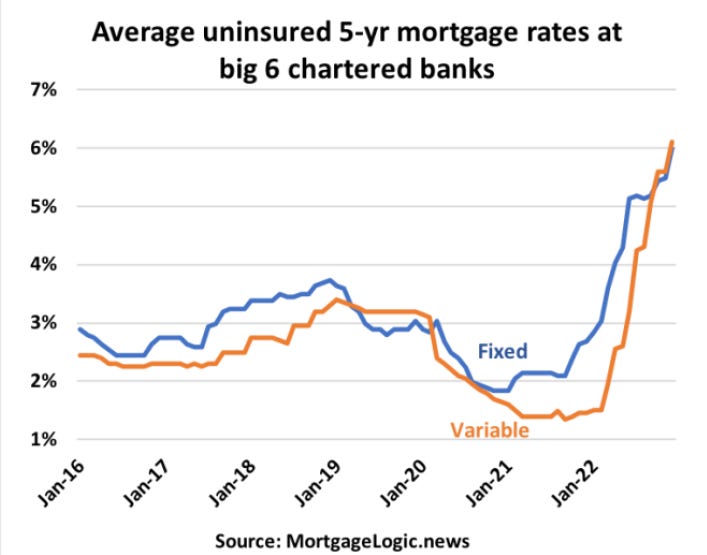

Average mortgage rates at the banks up 0.5% to hit 6.1% (they were 1.3% to start the year) after the Bank of Canada’s decision last week.

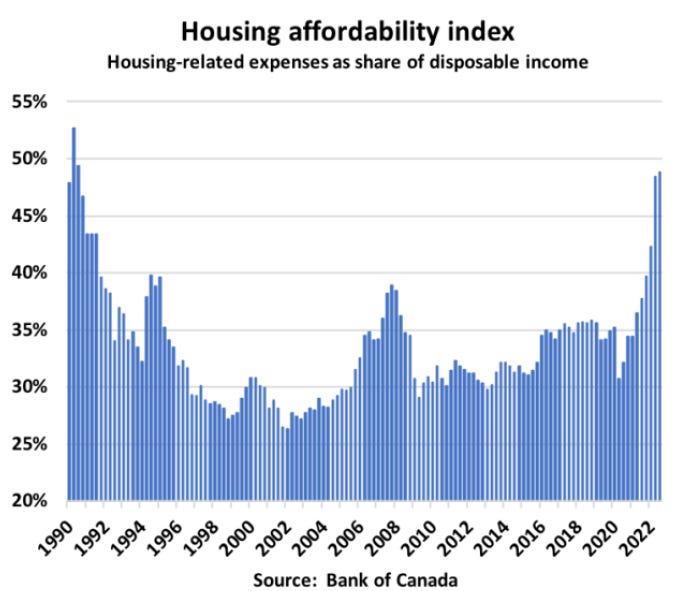

The recent rise in mortgage rates has led to extreme levels of unaffordability.

From Rosenberg:

Homeowner affordability is the most stretched since 1990. Remember what happened when that condition bumped against a vicious rates cycle? Consider this to be a two-standard-deviation event. In other words: extreme. To mean revert this affordability ratio, we would need to have either a drop of 200 basis points in mortgage rates or a 25 per cent plunge in national home prices (or some combination).

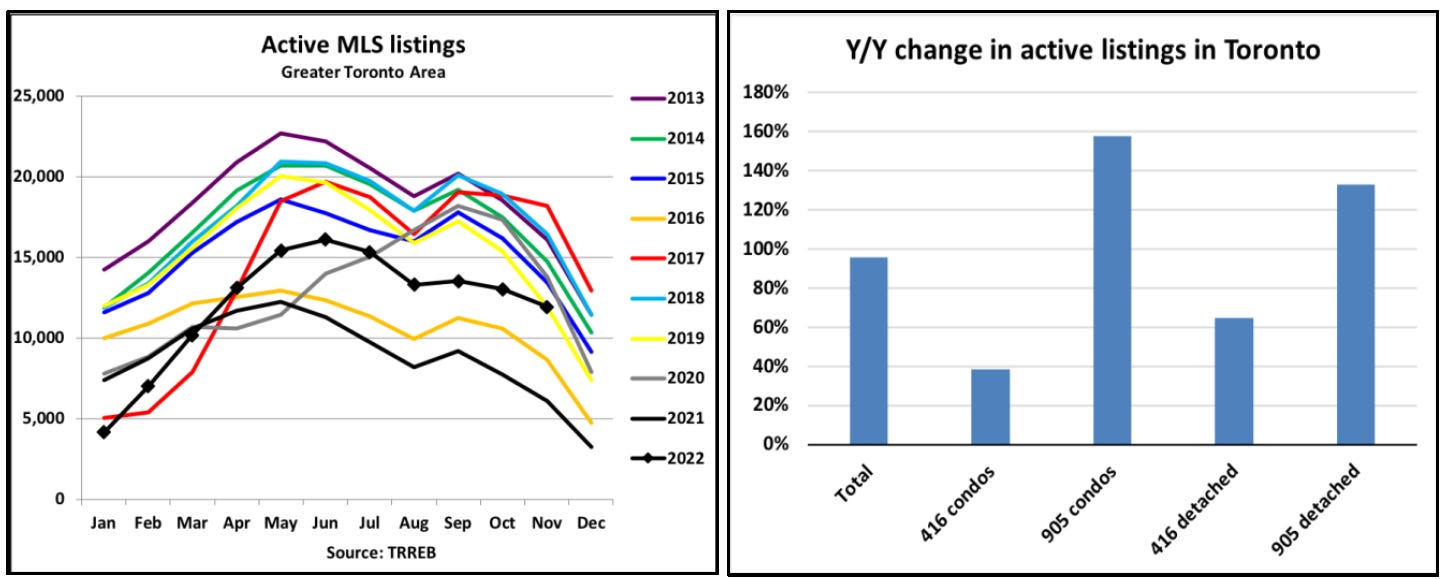

Active listings were almost double where they were a year ago including 160% increase in suburban condos and a 132% jump in detached in the 905. Still, inventory levels are only back to average levels for this time of year

Active inventory is low compared to the previous housing corrections, especially if we add data for the housing crash of the late 80s and adjust for population growth since then.

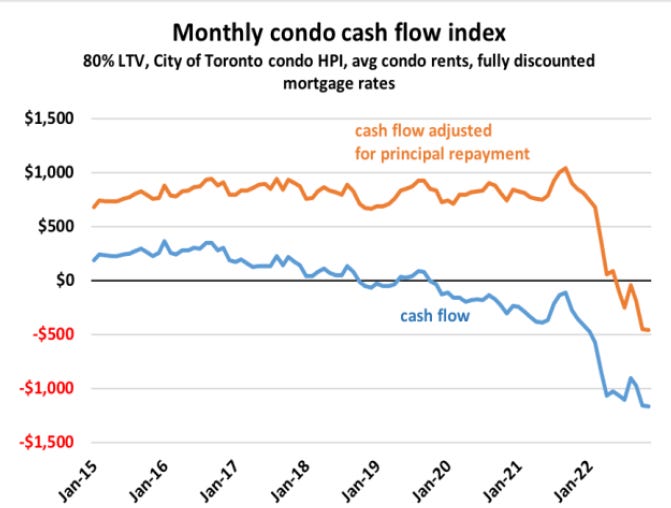

None of this changes rental economics. Headline cash flows on newly purchased units falling to -$1,165 per month. This is not sustainable.

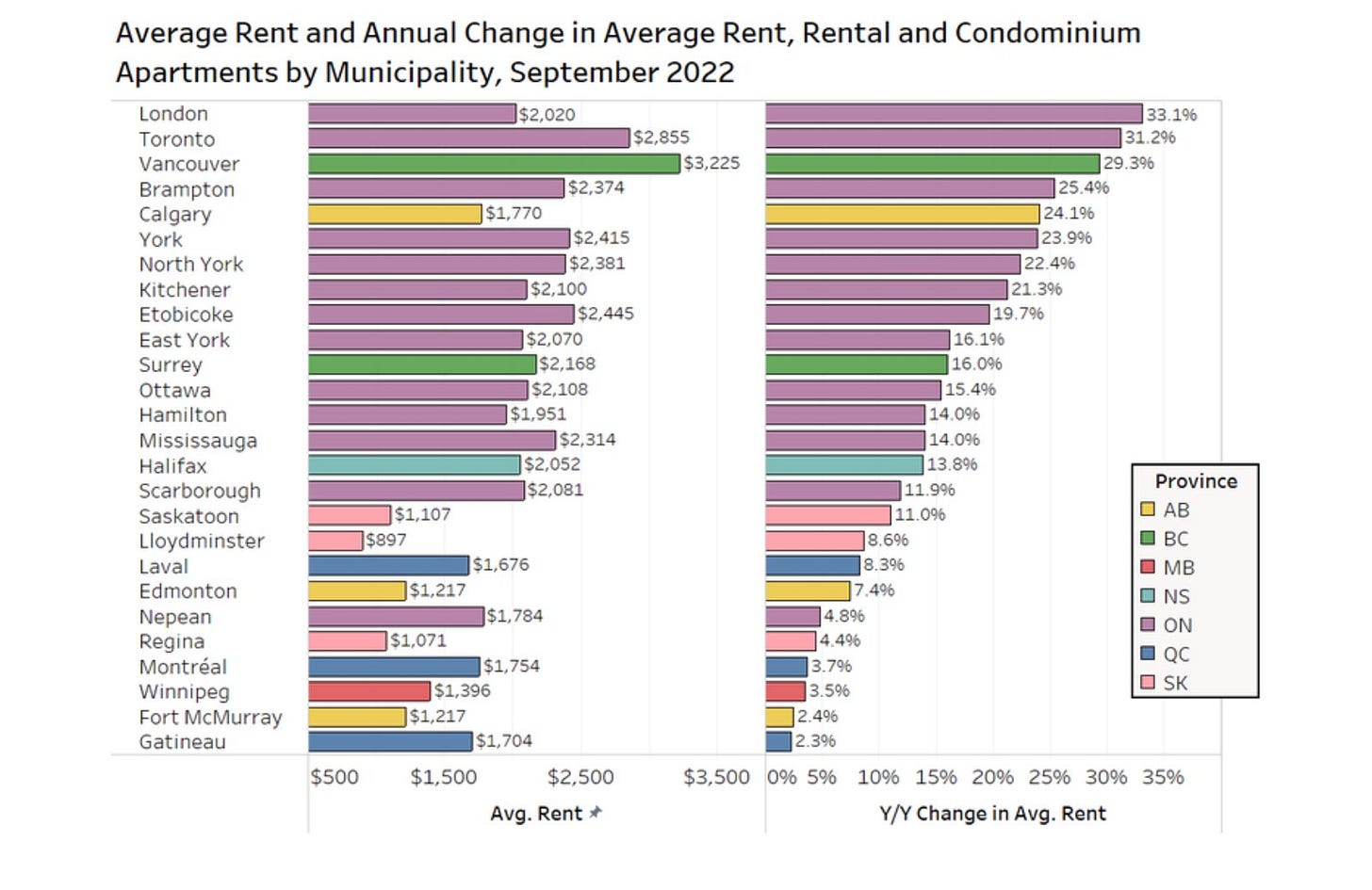

Rent is increasing at an eyewatering pace but it still isn’t enough to keep condos cashflow positive.

Canadians tend to own more equity in their homes than Americans and are better borrowers.

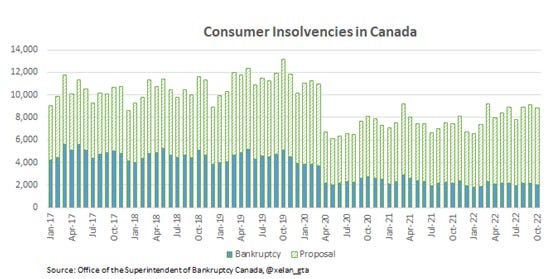

Rising rates have not really hurt households too bad. Consumer insolvencies rose 18.8% YoY in October, still below pre covid levels.

Mortgage Arrears are the lowest since at least 1990. The rate hikes have not caught Canadians offside yet. The longer rates remain elevated, the more mortgages that need to be renewed, maybe then we will see pain. No issues yet.

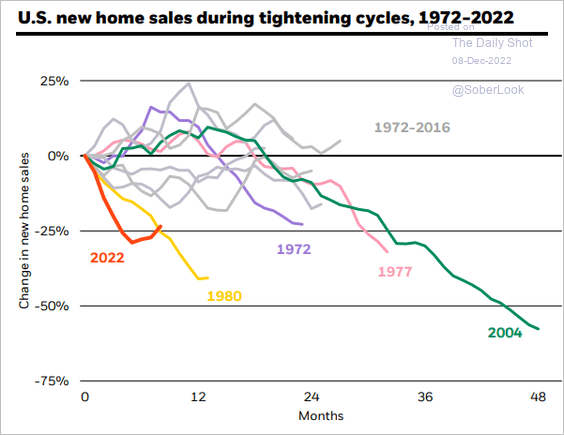

The volume of housing sales is slumping to historic levels due to the rising rates.

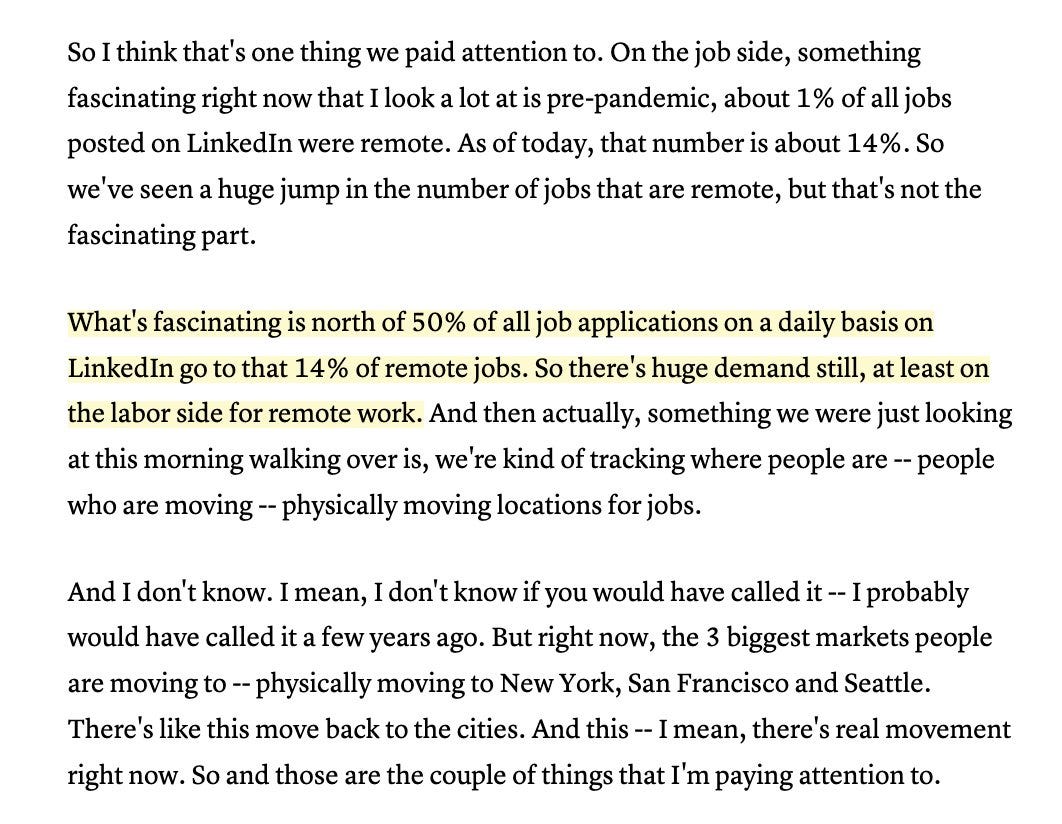

LinkedIn CEO last week:

Pre-pandemic, ~1% of all jobs posted on LinkedIn were remote. As of today, that number is ~14%...but that's not the fascinating part. What's fascinating is north of 50% of all job applications on a daily basis on LinkedIn go to that 14% of remote jobs

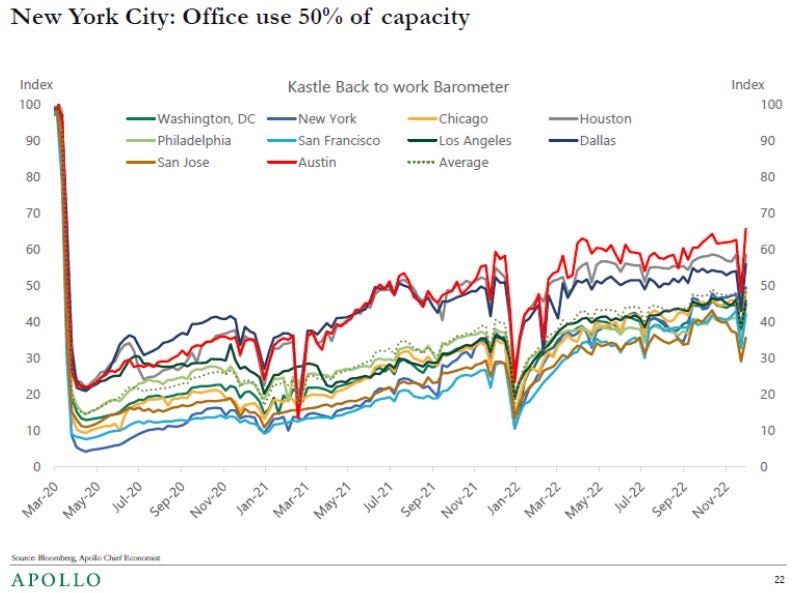

At what point will we agree that office isn’t going back to what it used to be? New York office is at 50% capacity, Californian markets are even lower.

This was a great podcast on Real Estate investing. Bill is the CEO of Four Corners Property Trust, a listed REIT and one of the leading owners of restaurant real estate in the U.S. Their portfolio is made up of 982 properties across 47 states.