Daily Charts - Canadian Inflation

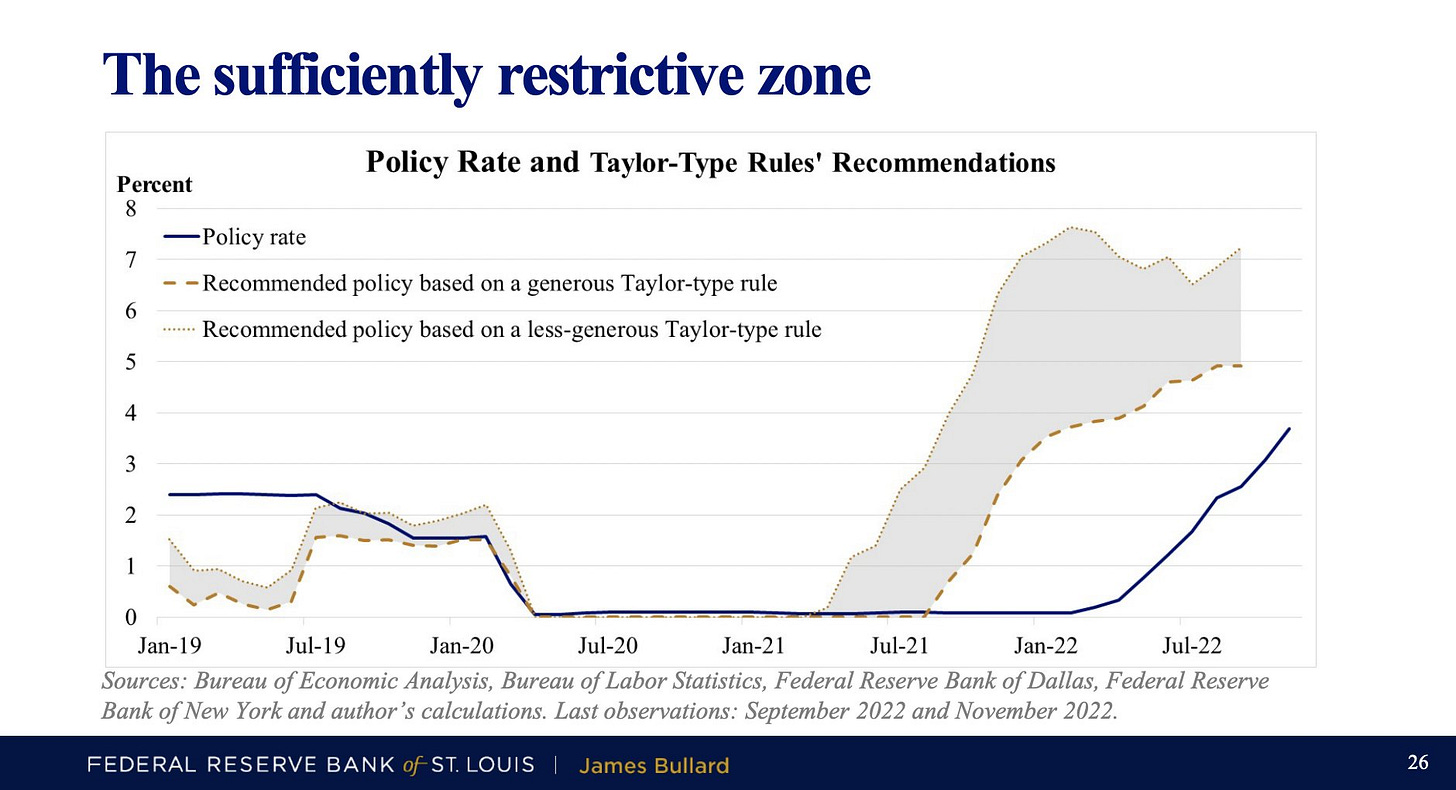

James Bullard President of the St. Louis Fed, thinks the policy rate need to go to 5-7% (Full Presentation).

The chart suggests that while the policy rate has increased substantially this year, it has not yet reached a level that could be justified as sufficiently restrictive, according to this analysis, even with the generous assumptions. To attain a sufficiently restrictive level, the policy rate will need to be increased further

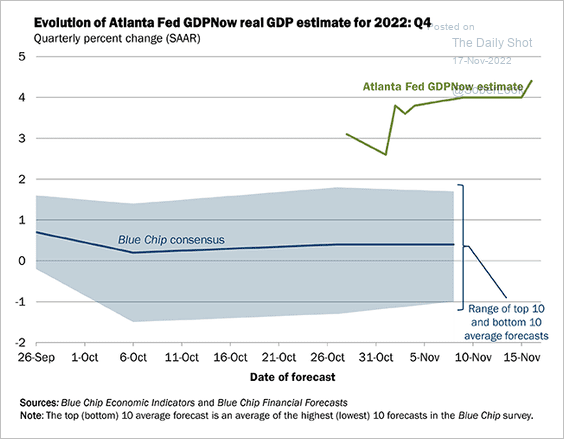

Rising interests take months to flow through the economy. For now, the economy continues to run hot. The Atlanta Fed’s GDPNow model estimate for the Q4 GDP growth jumped to 4.4% (annualized) in response to stronger-than-expected retail sales.

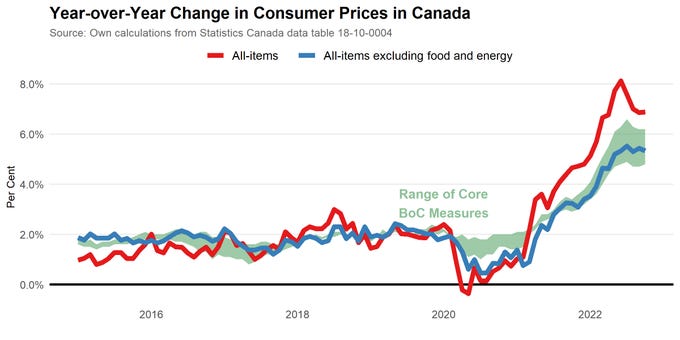

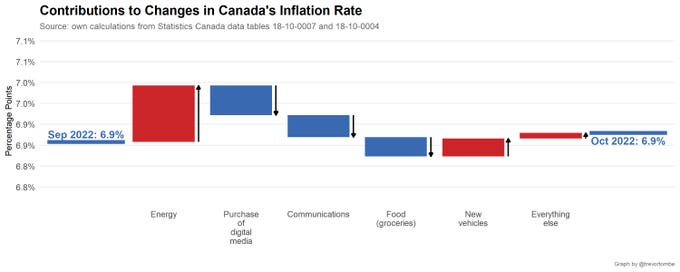

Canadian inflation came in at a steady 6.9% YoY this week.

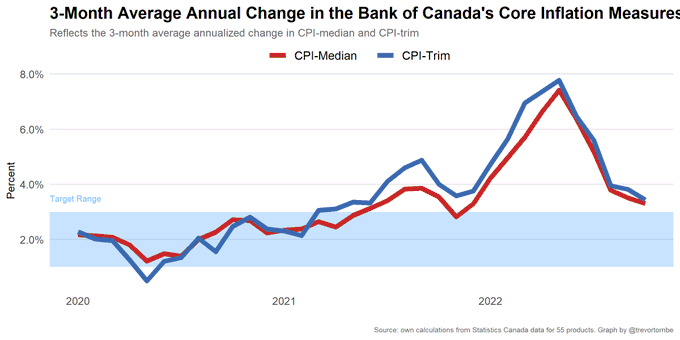

The 3-month average of two key Bank of Canada's core measures of inflation declined. Falling to 3.3 percent and 3.4 percent.

Energy was the largest contributor to inflation this month.

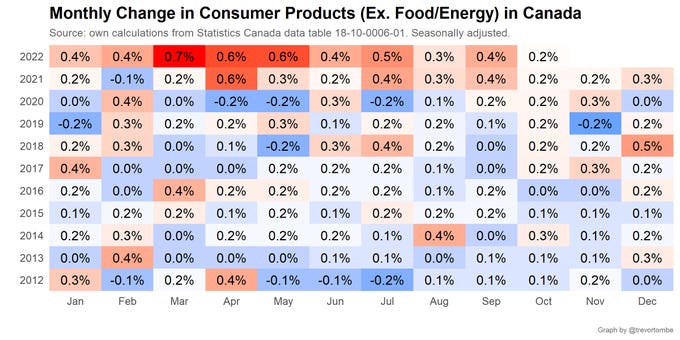

Core CPI (ex food and energy) continues to move in the right direction on the monthly basis. Rising 0.2% in October.

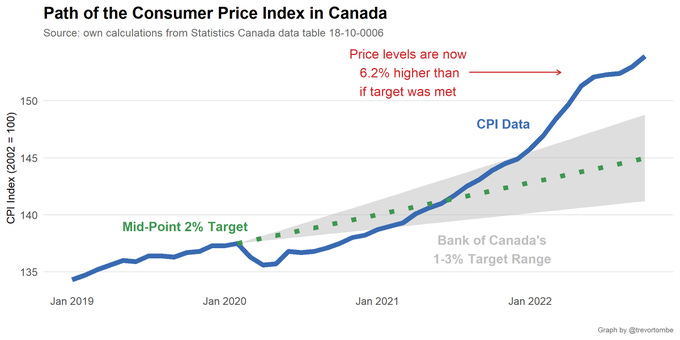

Even if inflation subsides, we have reached what are likely permanent higher price levels. Affordability concerns will persist even as inflation returns to normal.

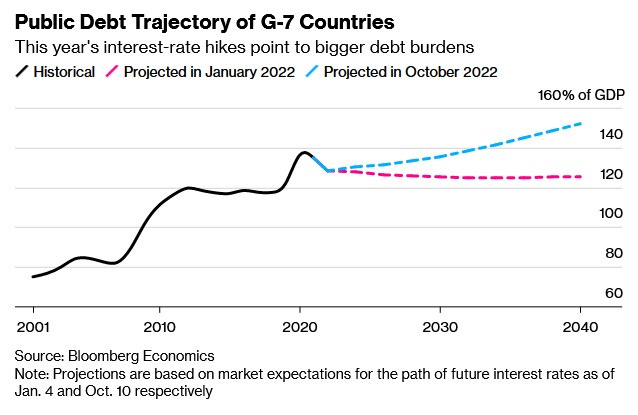

Unsurprisingly, G7 nations were overly optimistic with their debt projections this year.

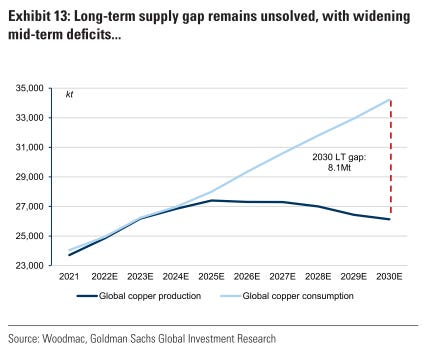

Goldman thinks the world will run short on copper.

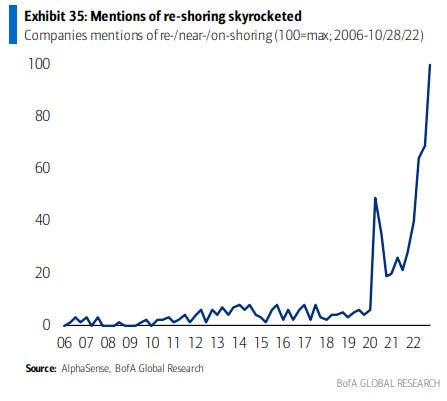

Companies continue to focus on the idea of re-shoring as both the COVID lockdown disruptions and geopolitical tensions encourage management to bring key assets closer to home.

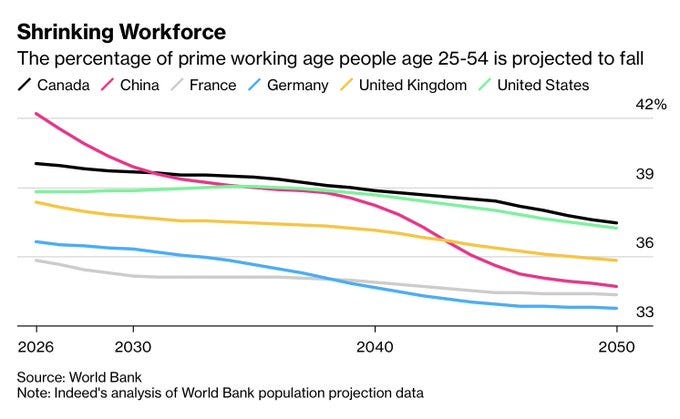

An aging population and reduced immigration have led to a smaller pool of workers. Staffing in will remain challenging for years to come especially, if we look to re-shore jobs.

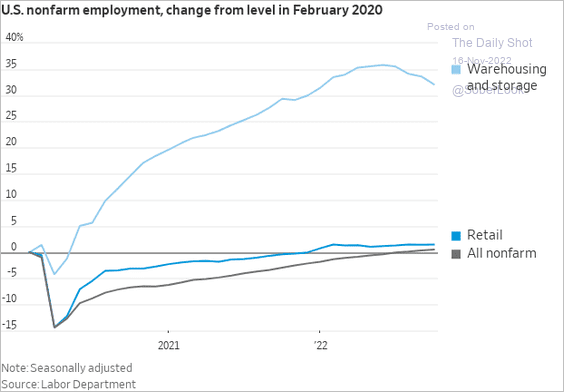

Warehouse employment is up more than 30% since Feb. 2020.

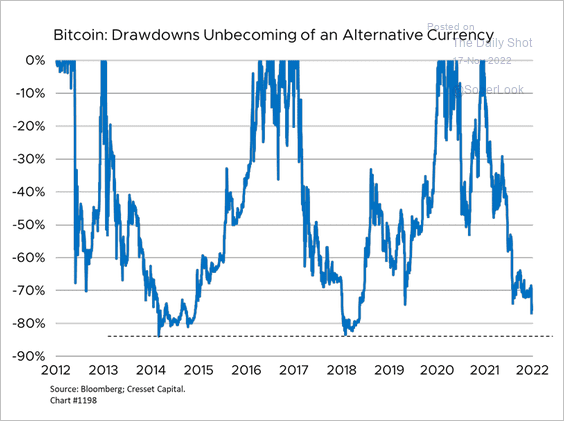

Bitcoin’s drawdown is nearing 80%.

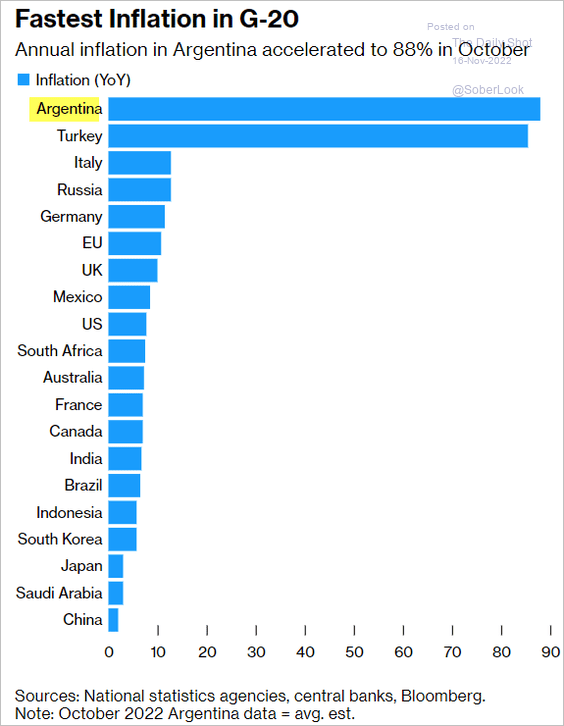

Argentina now has worse inflation than Turkey