Daily Charts - Canadian Inflation 🔥🔥🔥& IPO Pops 📈

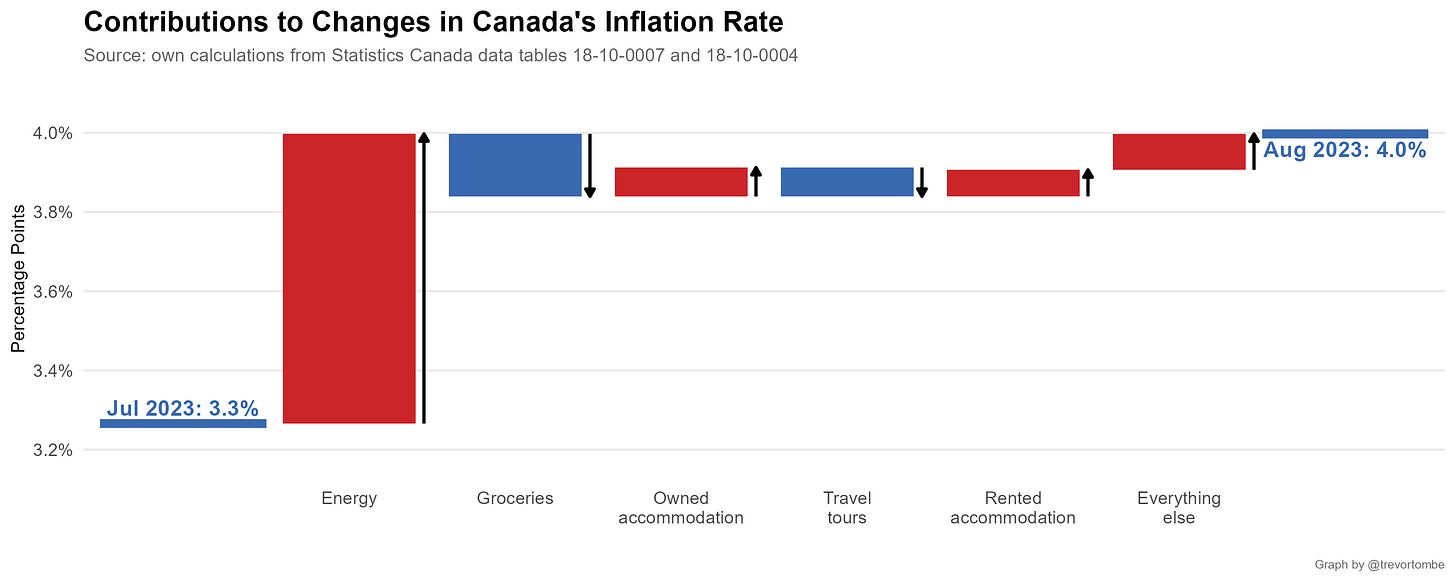

The Canadian 10Y was up double digits on the Canadian inflation print. CPI rose 4.0% (3.8% expected) YoY in August, following a 3.3% increase in July. The headline acceleration was largely the result of higher YoY prices for gasoline in August (0.8%) compared with July (-12.9%).

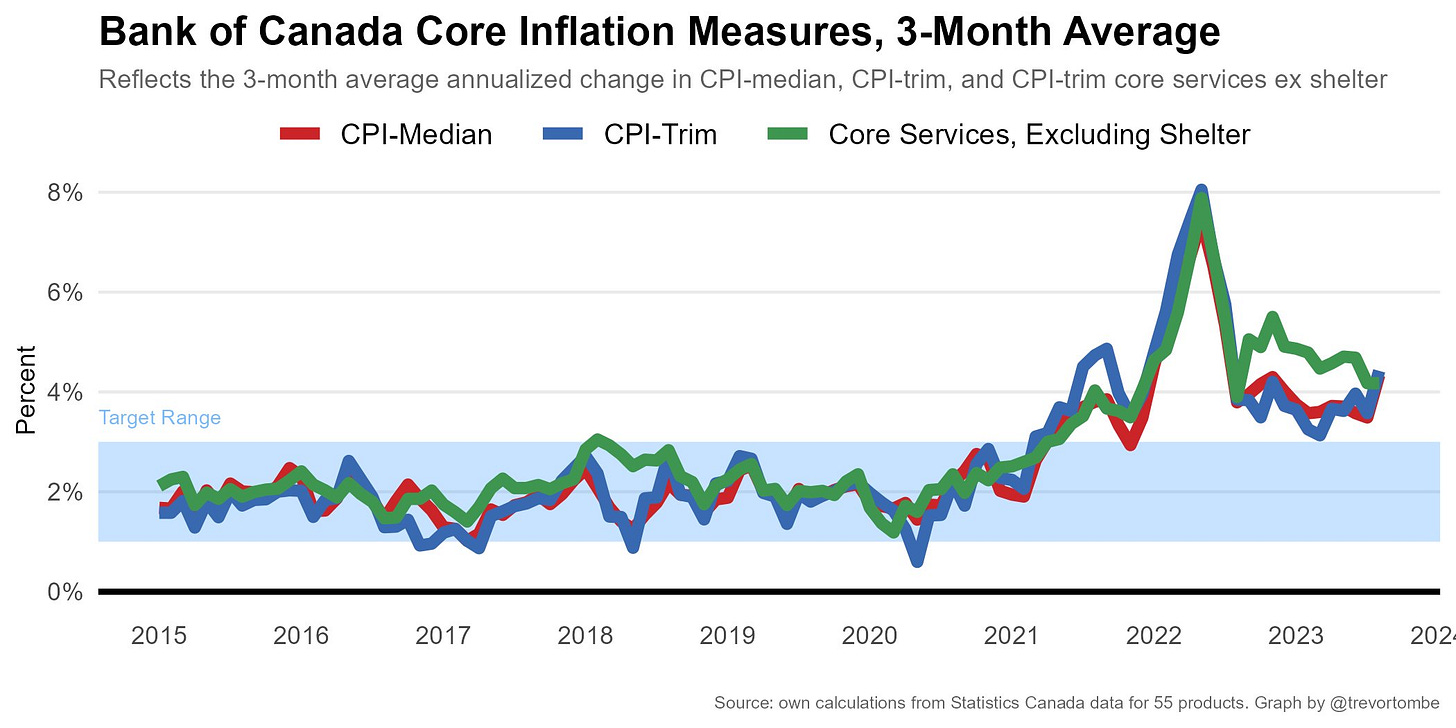

The main core measures the Bank of Canada focuses on all rose, now all above 4% for first time since last year.

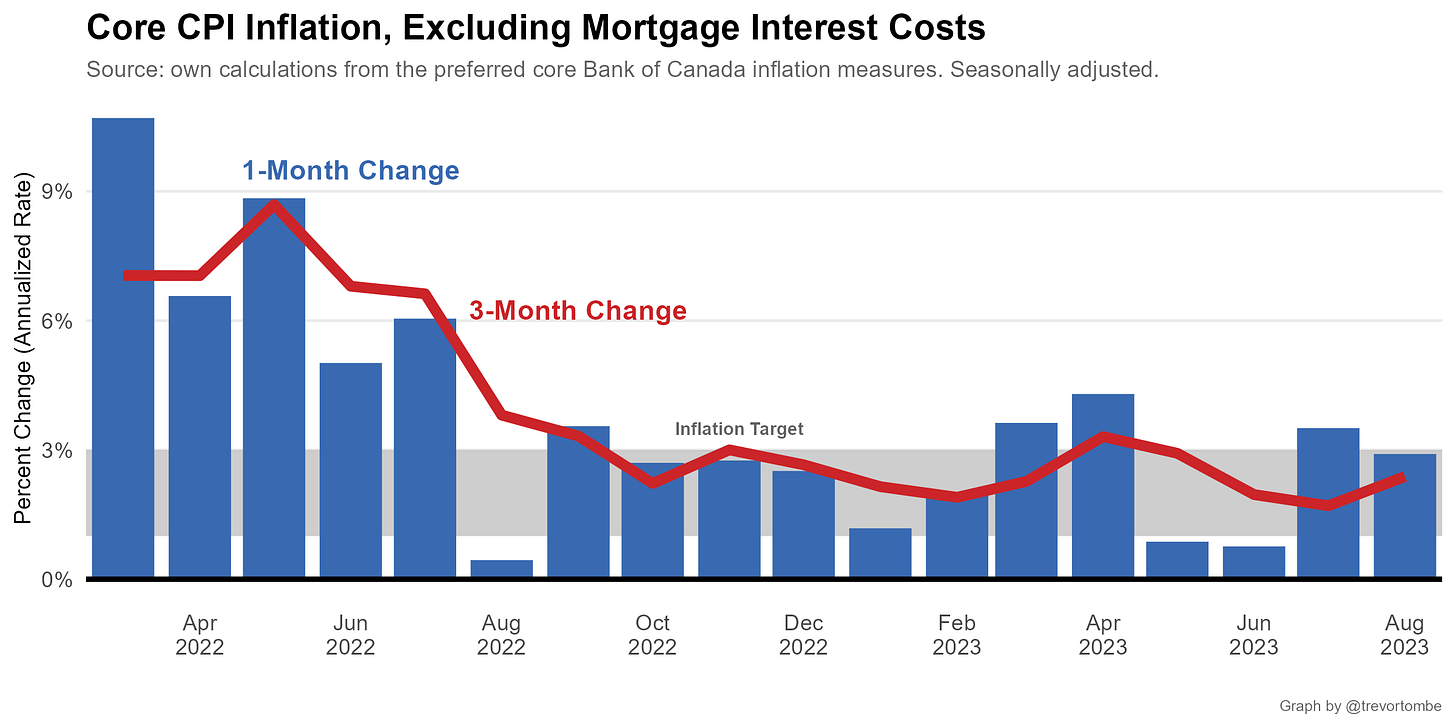

If you rip out food, energy and mortgage costs, maybe it’s not so bad but the 1 month change is still annualizing near the top of the range.

Markets were spooked and if we see another bad print it could mean another hike.

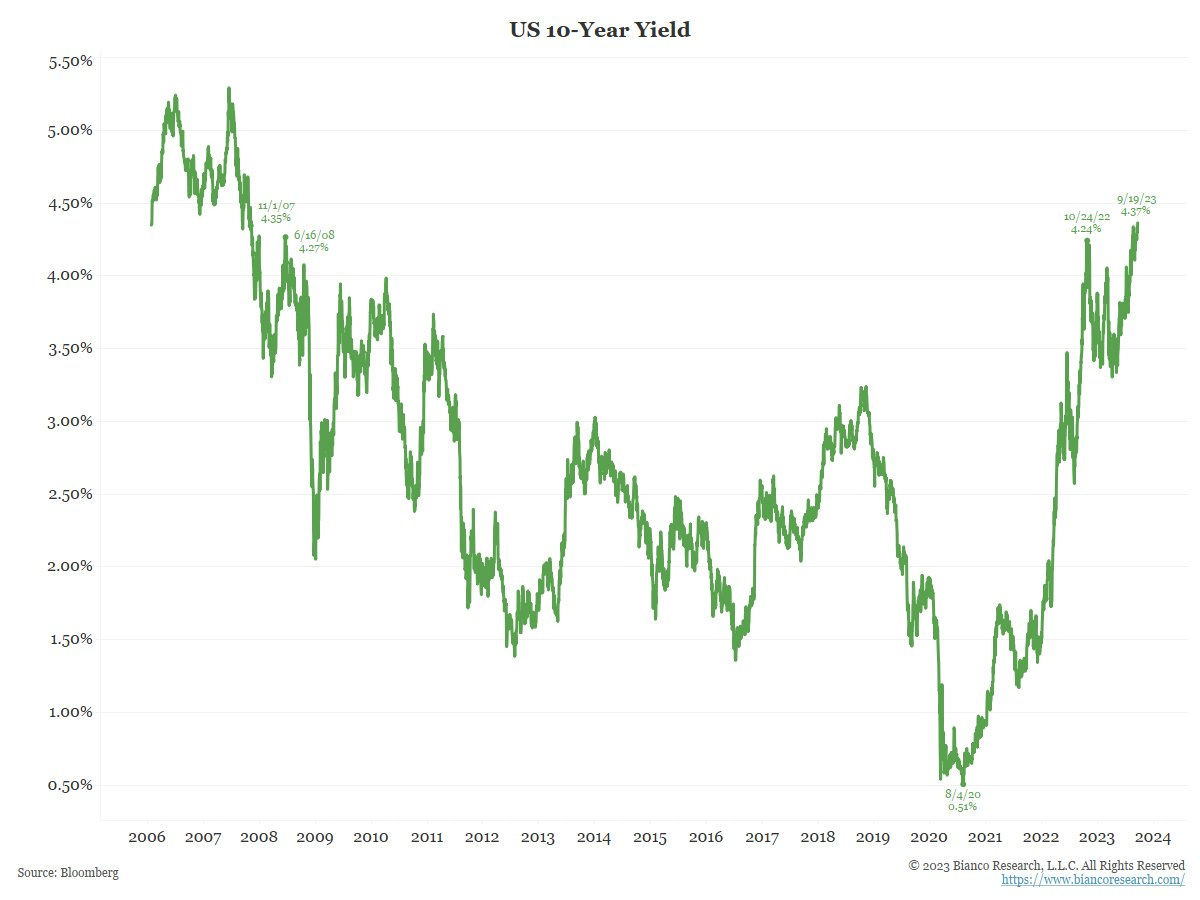

US 10Y treasury yields hitting highest level since 2007. Seems to be driven by rising oil prices. Fed decision today, market is expecting a pause.

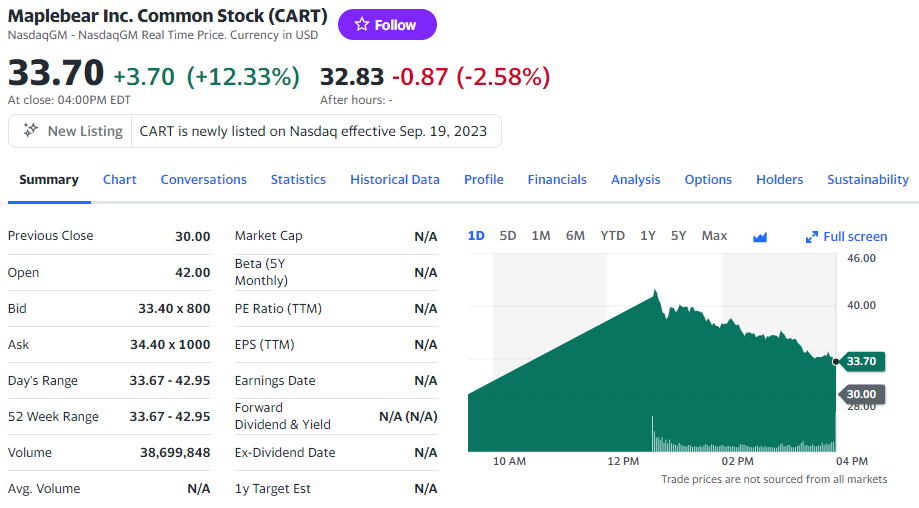

Another marquee IPO yesterday, Instacart opened up 40% to close the day up 12%. The other anticipated IPO this week, Arm, has settled up 8% from where the IPO priced, after being up 30% at one point.

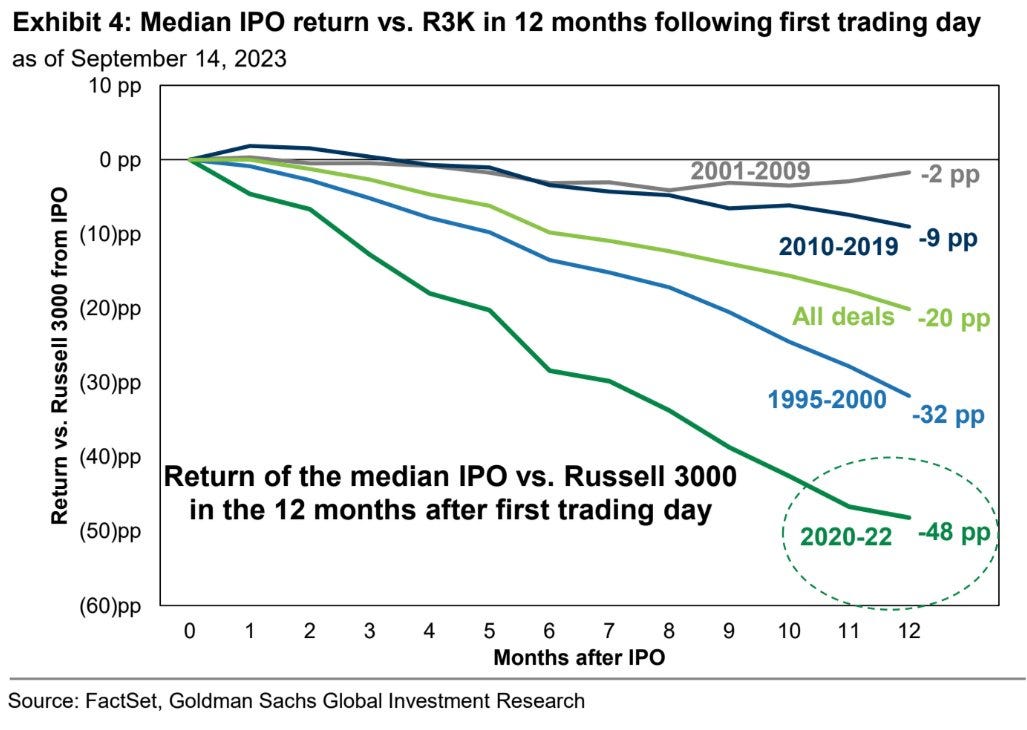

IPO investors have not been rewarded. The median IPO completed during 2020-21 lagged the Russell 3000 by 48% in the first 12 months following its IPO with just 18% managing to outperform.

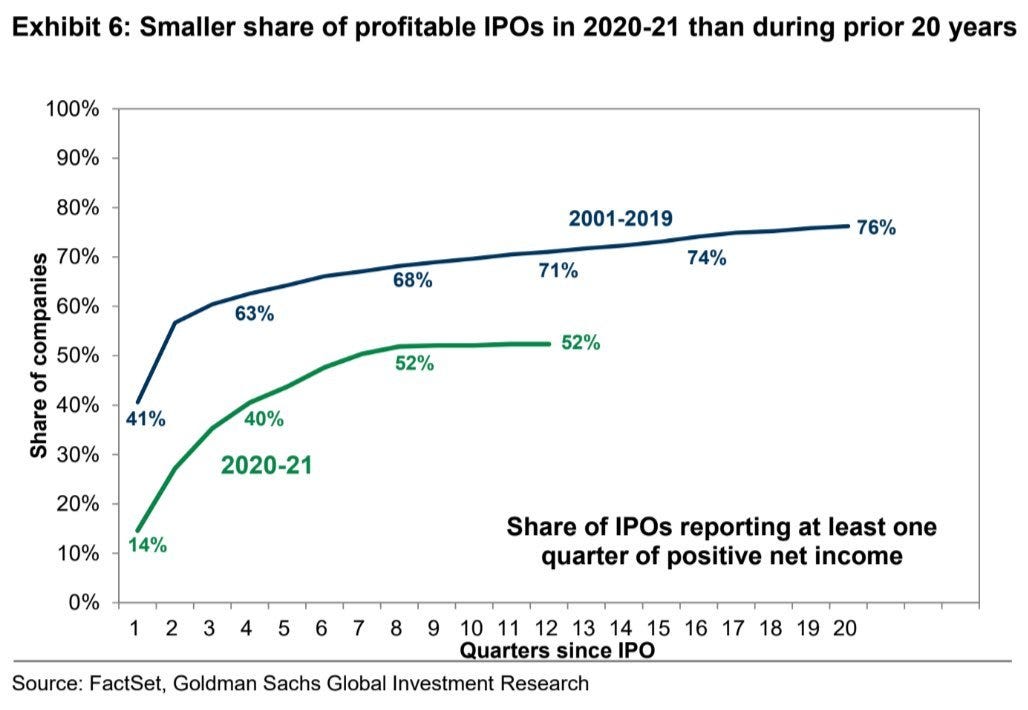

Just 52% of 2020-2021 IPOs were profitable by its third full year as a public company, well below the 71% of 2001-2019 IPOs that turned a profit by year 3. I wish SPACs were included in this data.

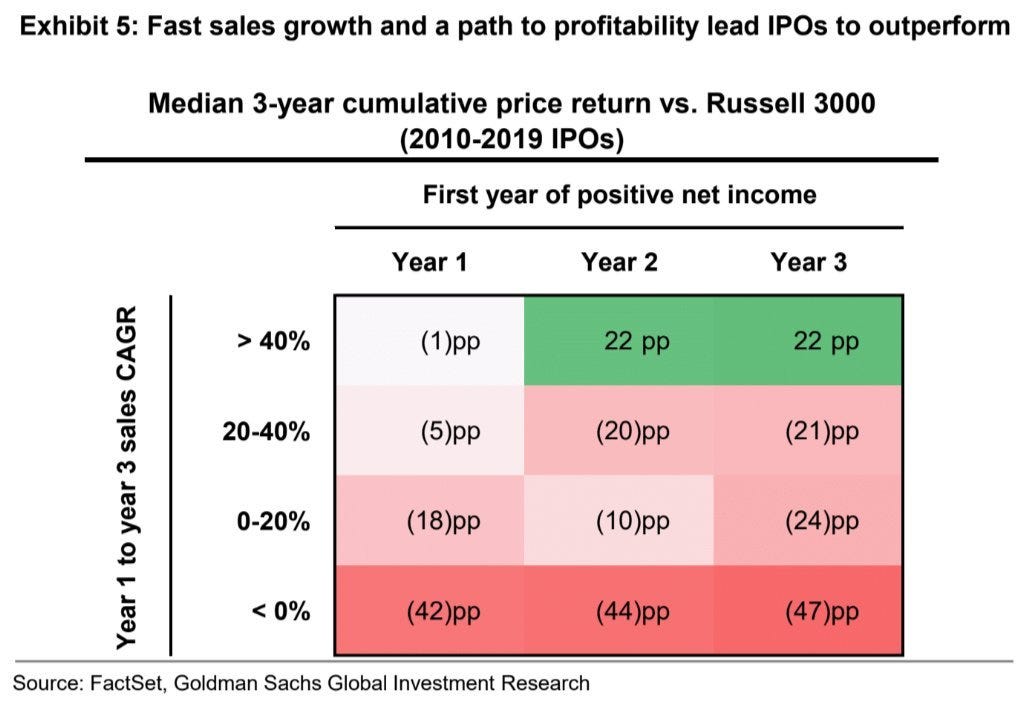

Deals that outperform share two characteristics: Greater than 40% annualized sales growth in their 2nd and 3rd years after flotation and positive net income by their 8th quarterly earnings report.

This was a good podcast discussing how the VC model is broken. Throwing lots of cash for growth at all costs doesn’t make sense. An eco system has developed around this factory system of VC. He thinks talent is going to gravitate towards acquiring profitable small businesses.

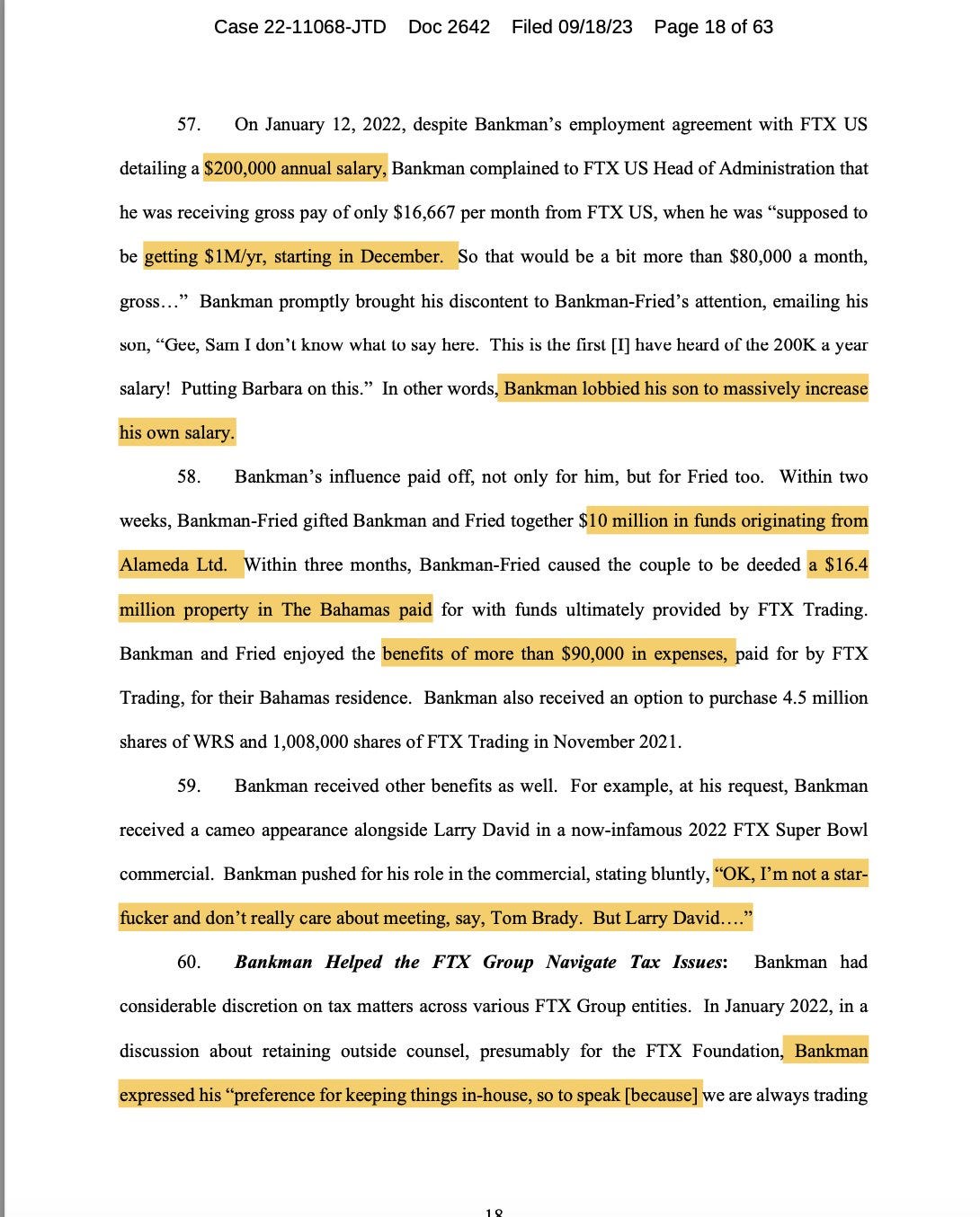

Maybe he has a point, the VC complex created FTX. In the latest twist, FTX sues Sam Bankman-Fried’s (SBF) parents to recover millions of dollars. SBF's father was unhappy with his salary at FTX US so he emailed SBF asking for more money, and then pulled the "I'm telling your mother" Dad move and looped SBF's mom into the email thread. They received millions in gifts and SBF’s dad thinks Larry David is > Tom Brady. A good use of investor funds…

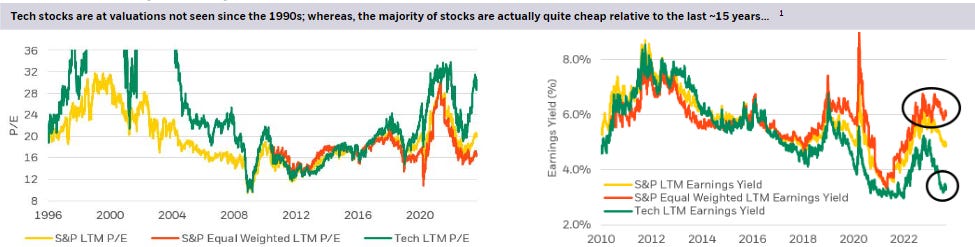

Maybe it is just tech overvalued and the rest of the S&P 500 looks fairly reasonable.

The Nasdaq has destroyed small caps since 2015, the only time we’ve seen outperformance like this was during the dot com bubble.

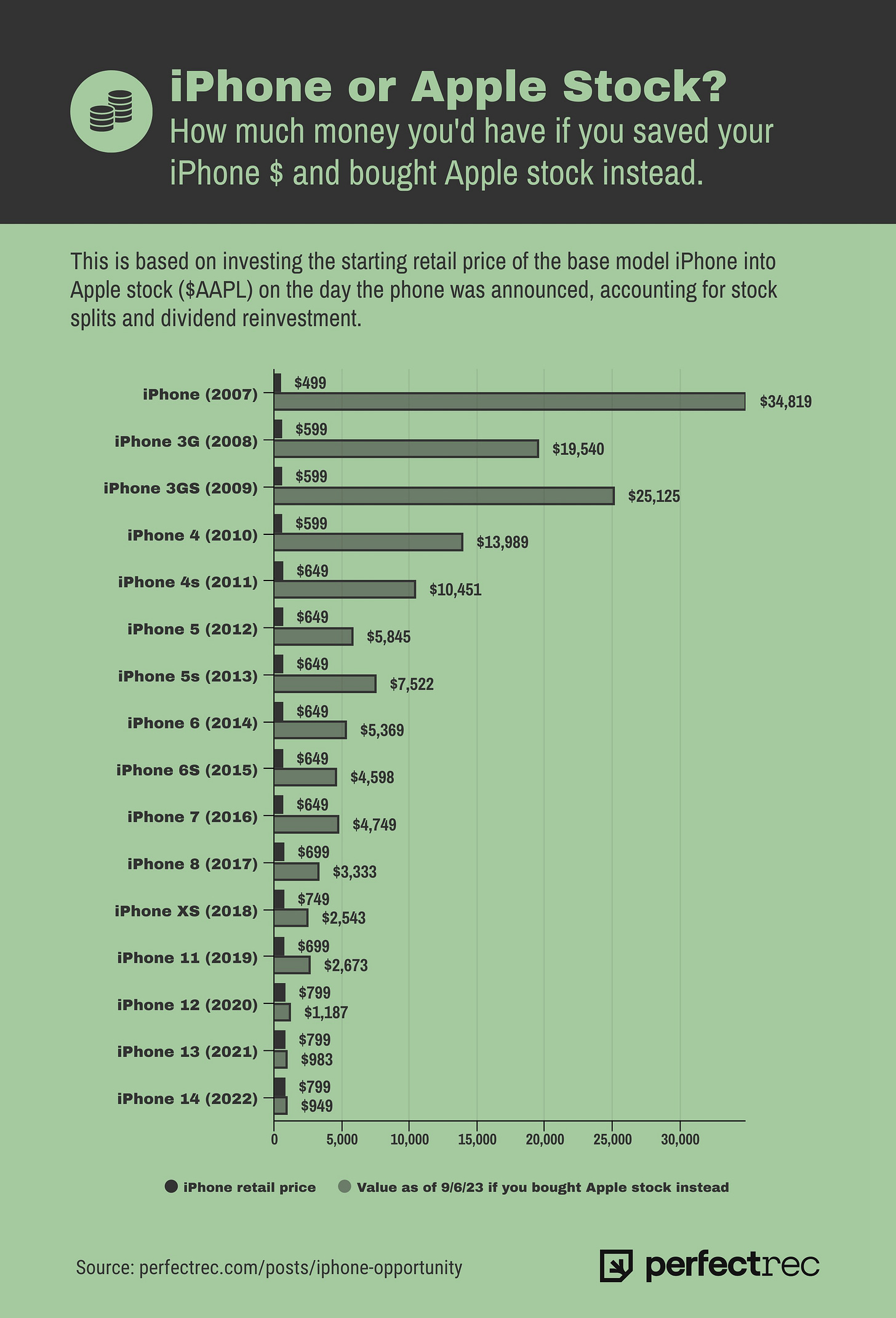

Instead of buying an iPhone, we should have just bought Apple stock.

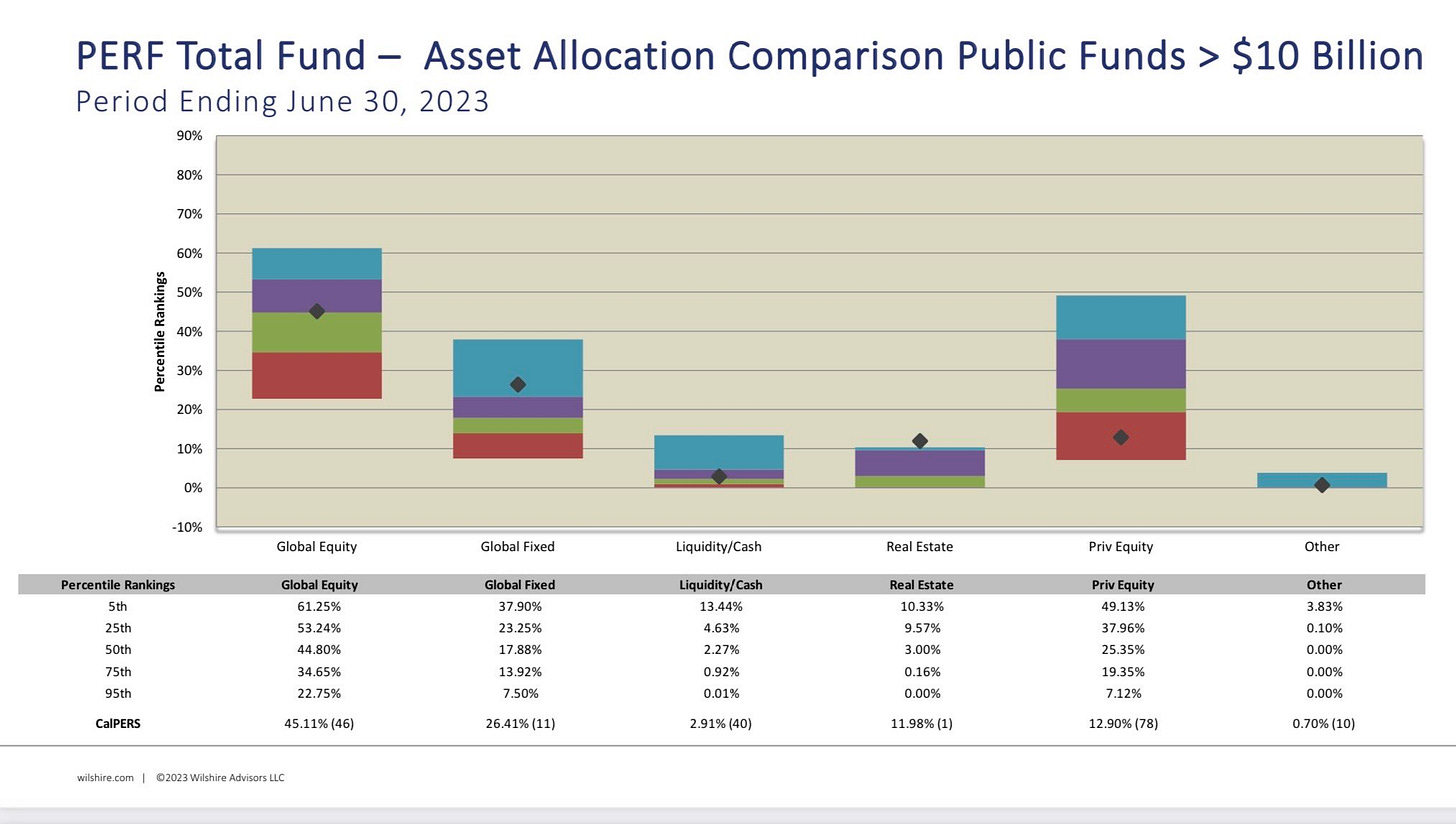

Asset allocation of pension funds > $10B. 5th percentile private equity exposure is almost 50%. That’s a lot of PE. Modest RE exposure.

Interesting behind the scenes look at Elon Musk. They discuss what was happening behind the scene’s during the Twitter take over, why and how he cut 85% of Twitter staff.

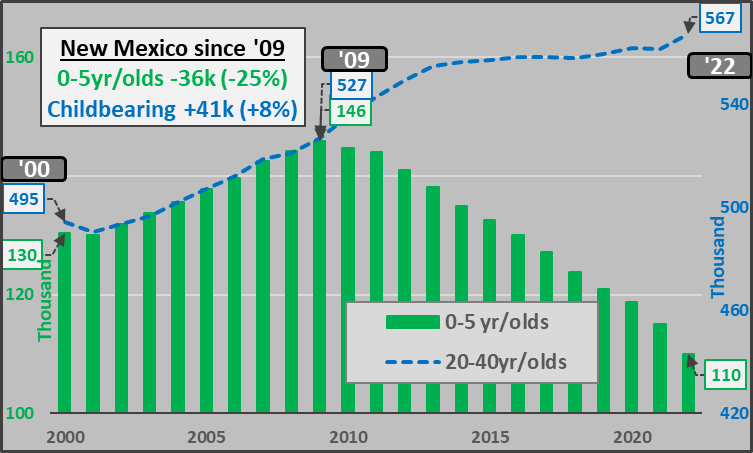

What happened in 2009? Childbearing age adults stopped having kids.