Daily Charts - CPI & China

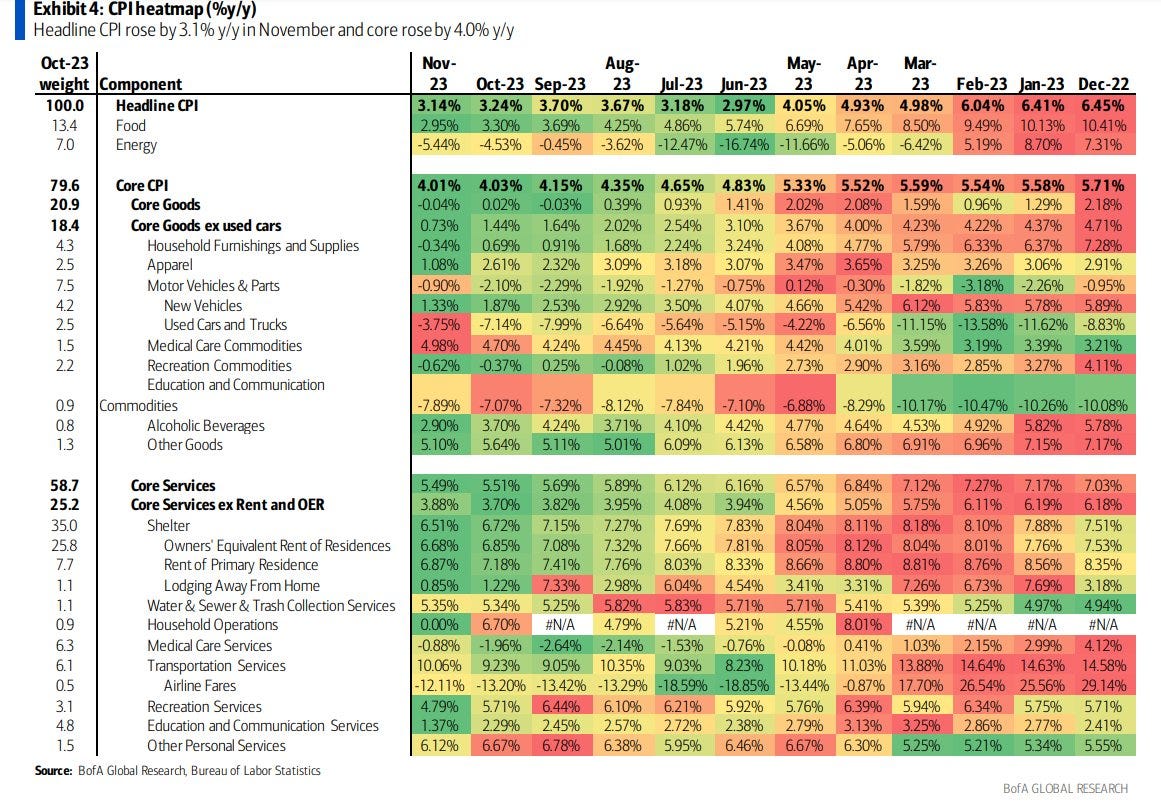

US CPI was more or less in line with expectations, headline CPI was up 0.1% MoM, 3.1% YoY and core CPI 0.3% MoM, leaving core flat at 4.0% YoY. BofA look for core CPI to end 2024 at 3.0% YoY before falling to 2.5% by year-end 2025.

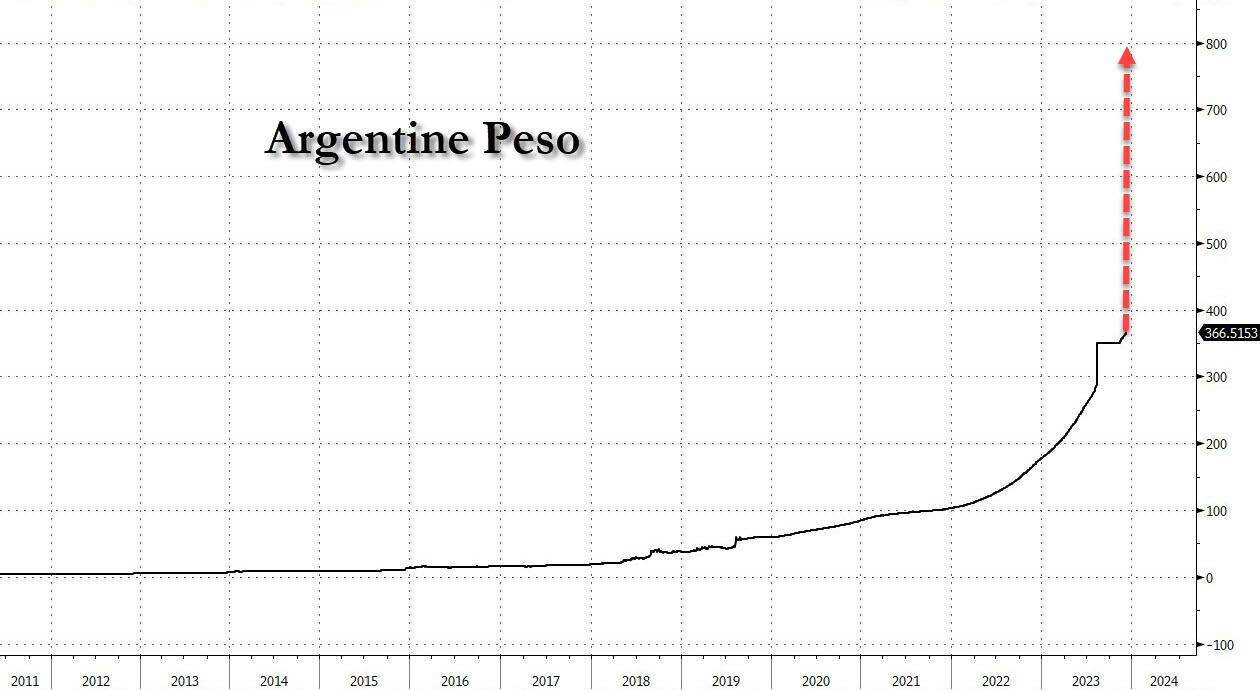

Argentina made a surprise announcement to weaken the official exchange rate to 800 pesos per dollar, a 54% devaluation, Economy Minister Luis Caputo said in a televised address after the close of local markets on Tuesday. That compares with a 366.5-per-dollar level before the address.

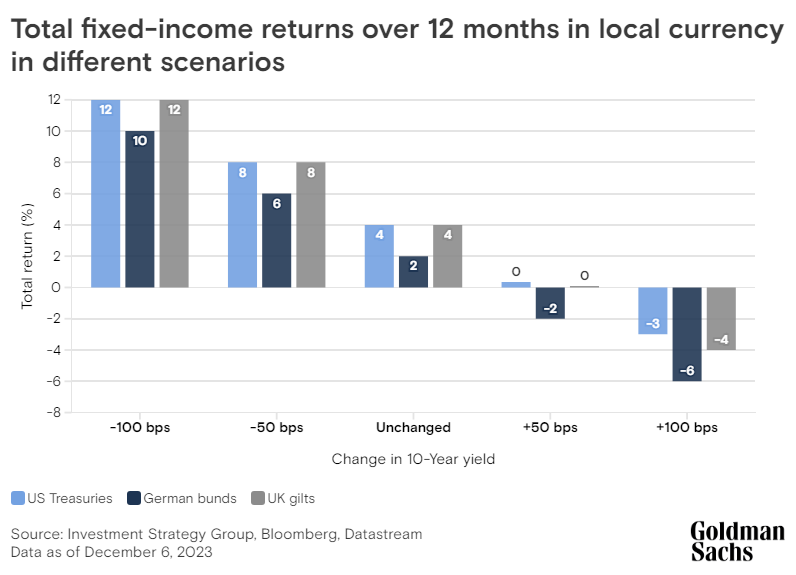

Visualizing the convexity in fixed income, you will be rewarded if we get cuts.

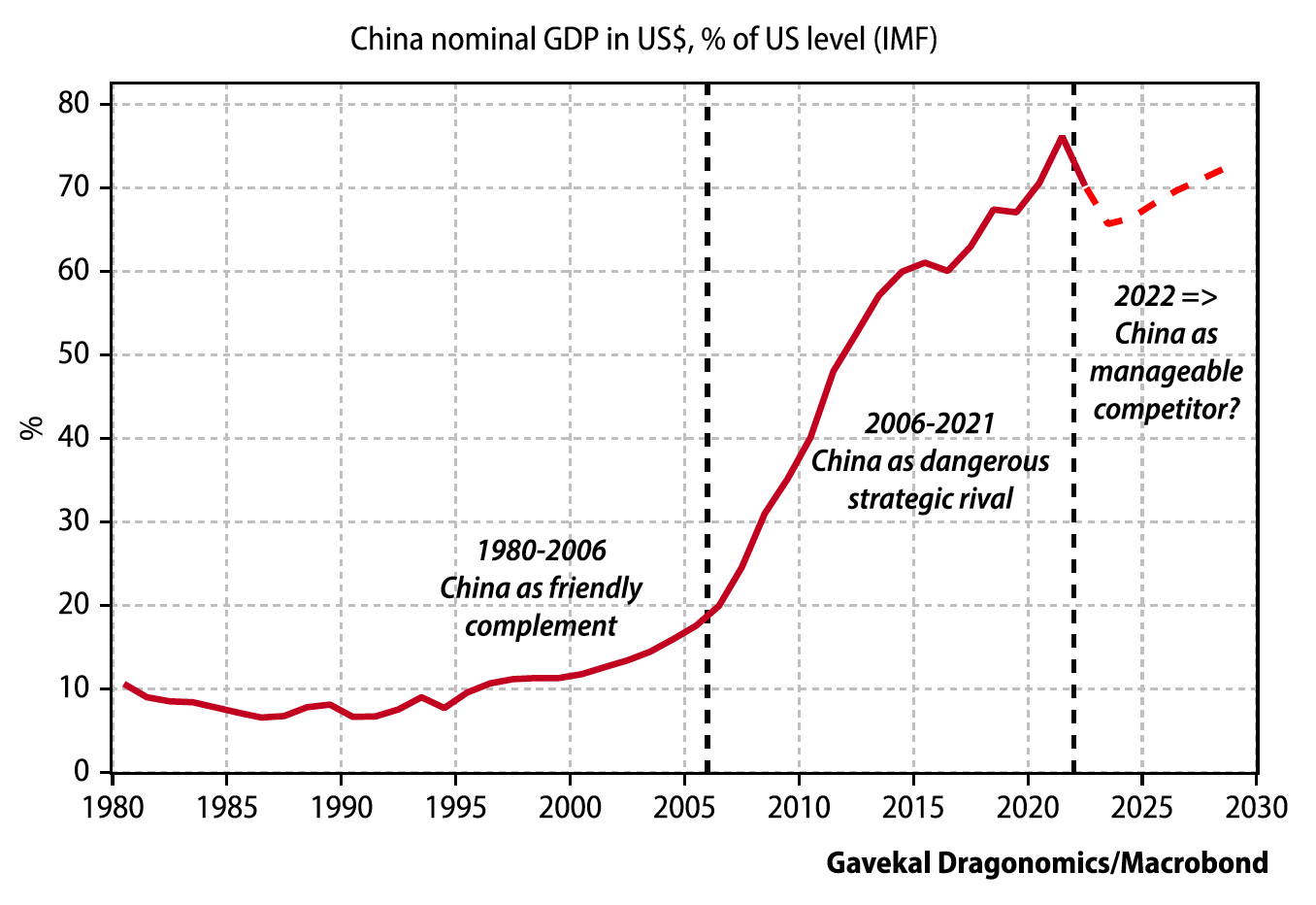

In around 20 years, China went from the size of 10% of US GDP to 70%.

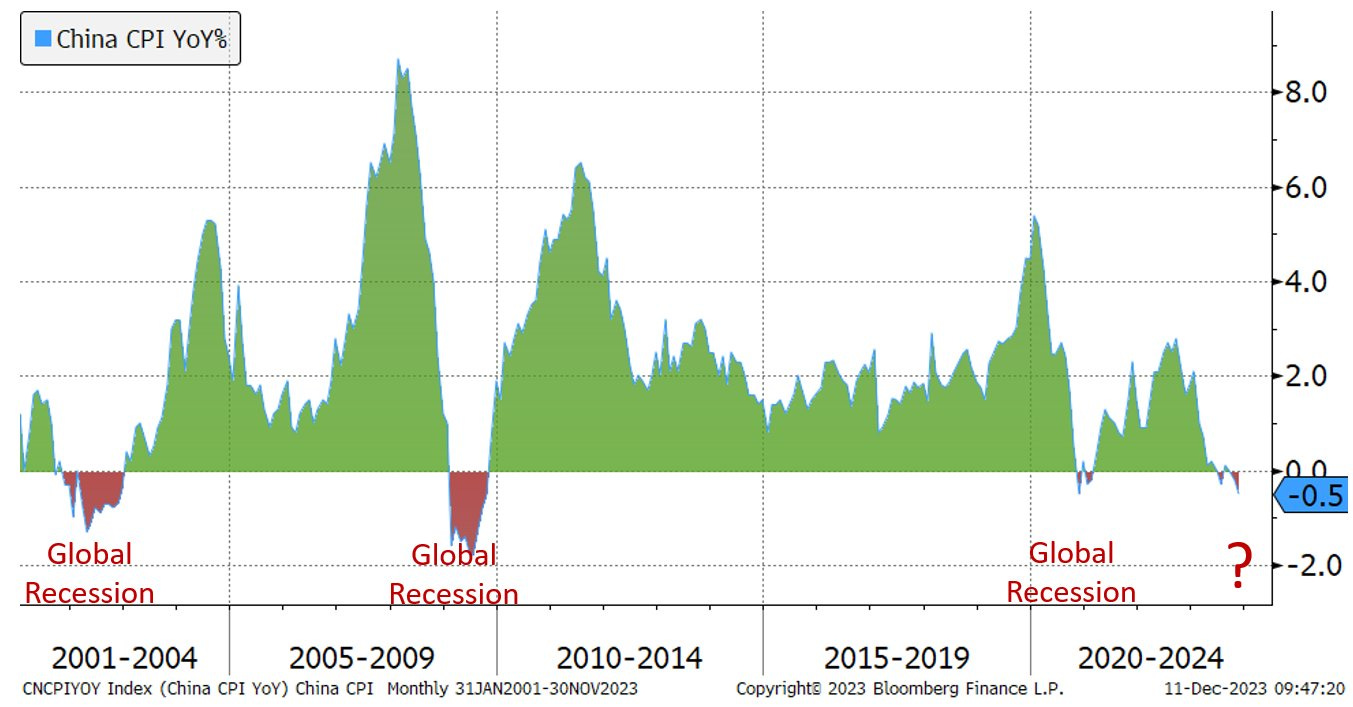

Over that period, China sneezing meant the world would catch a cold. No China growth, meant recessions, is this time different?

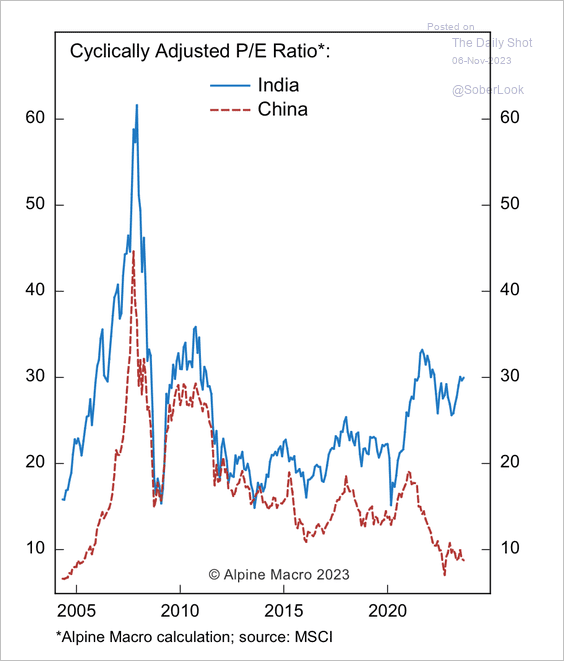

Markets seem to be betting that India will replace China, applying a much richer multiple to Indian markets.

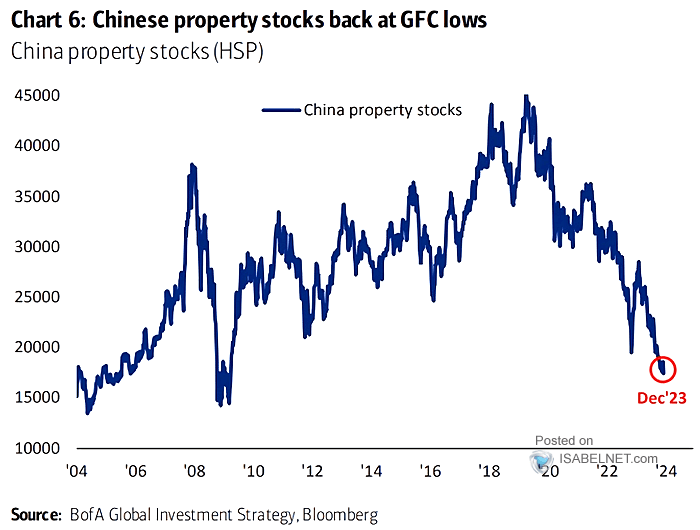

Things are bad in China, Chinese property stocks are back to 2008 levels.

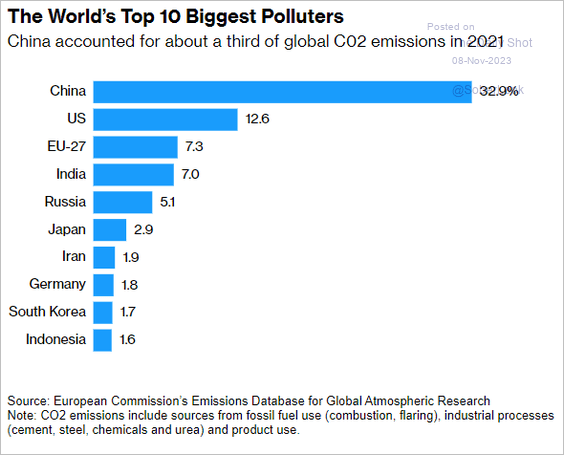

There will be no green revolution without China.

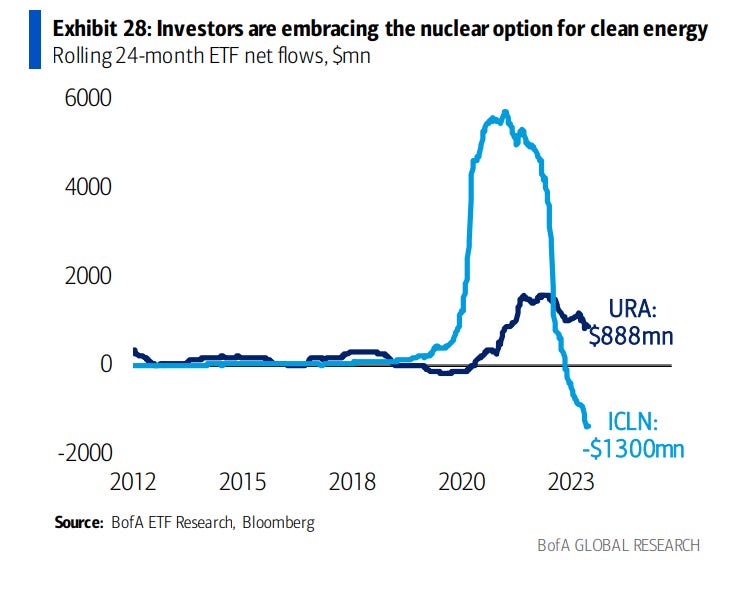

Investors have been embracing nuclear over wind and solar.

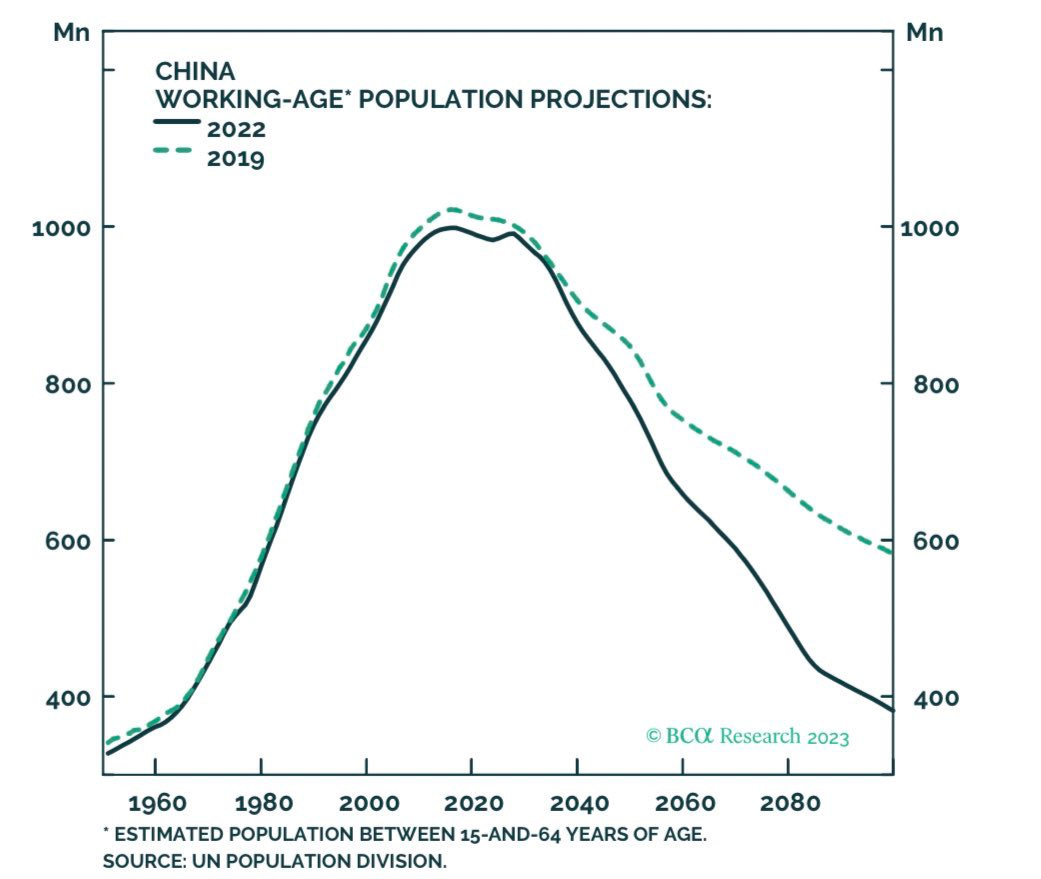

China is racing against an ageing population.

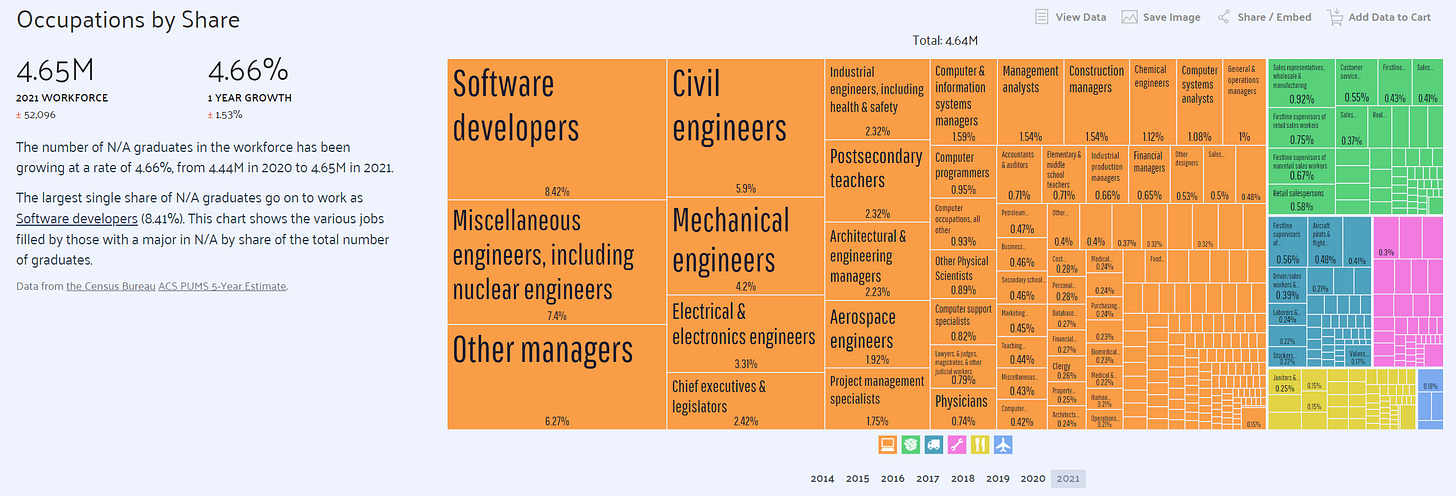

These are big numbers though. There are an estimate 4.65M engineers in the US. In 2020, China awarded 1.38M engineering bachelor's degrees. The comparable American number is 197,000 or just one-seventh of China's total. Can the West remain ahead in technology as China produces 7x the engineers annually?

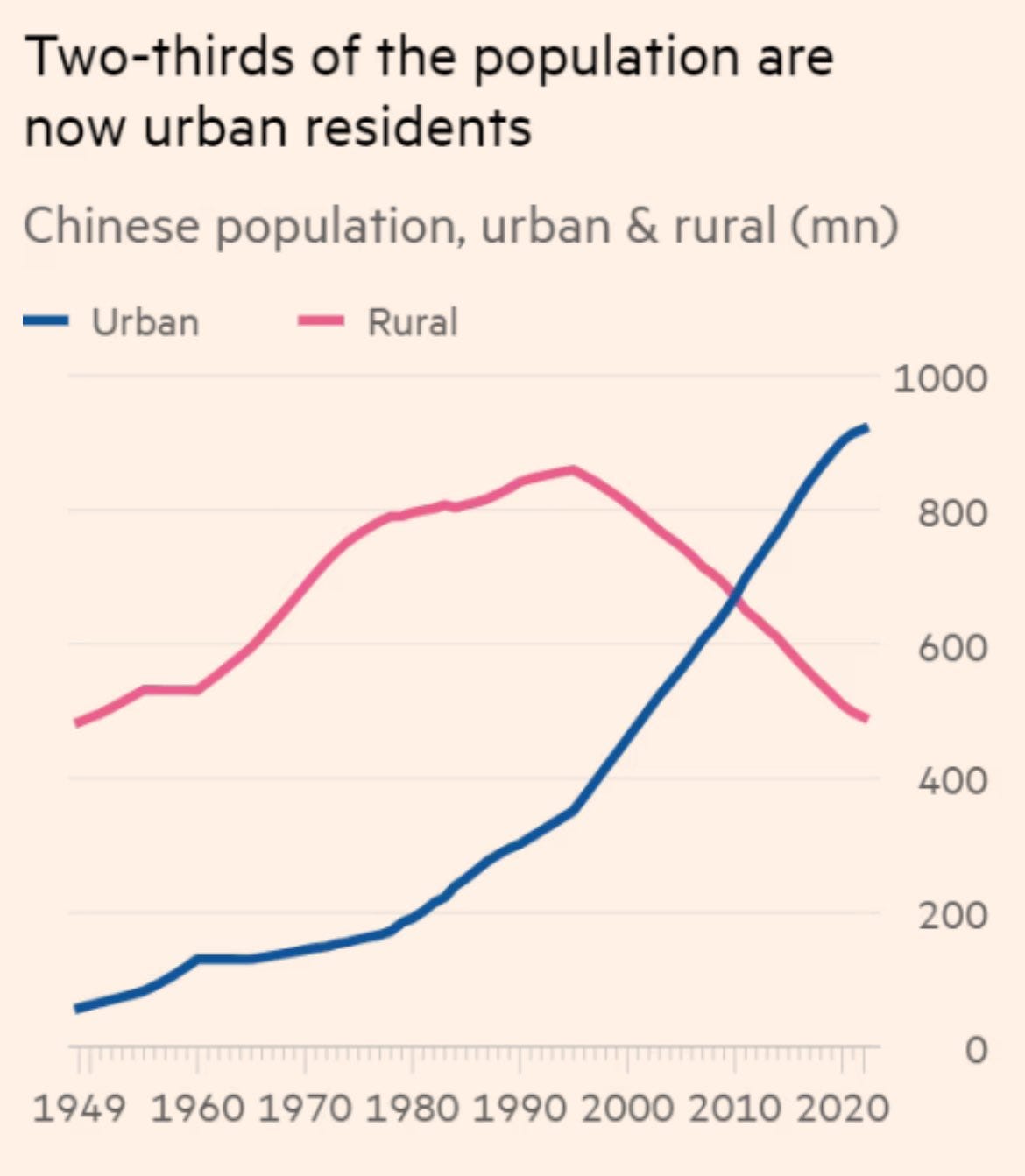

China has undergone massive urbanization since the 1980s.

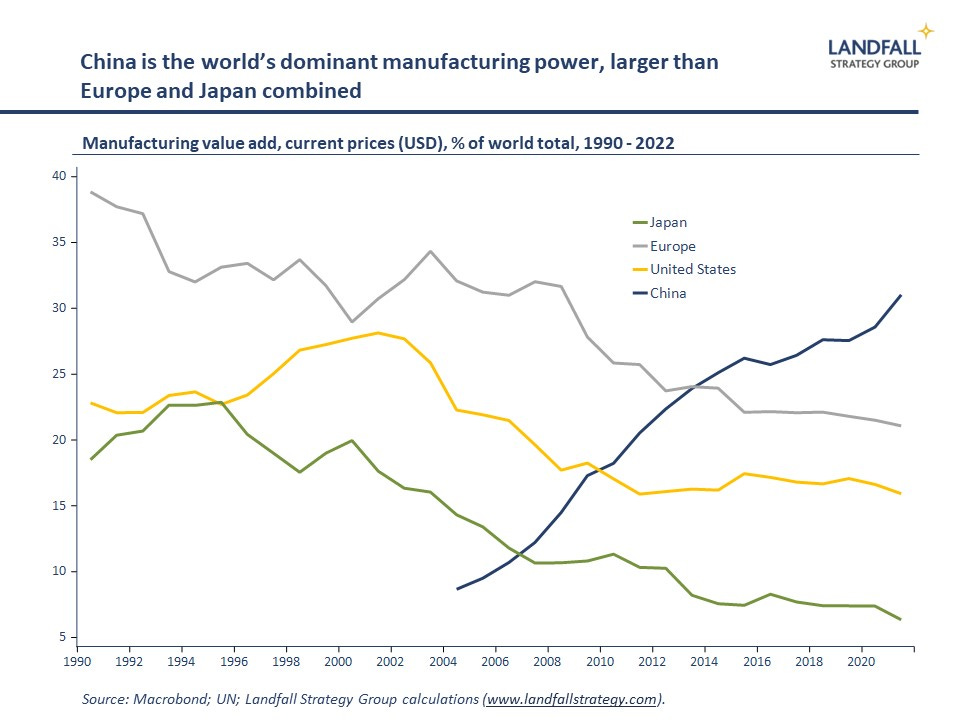

And in the process became the world’s dominant manufacturer.

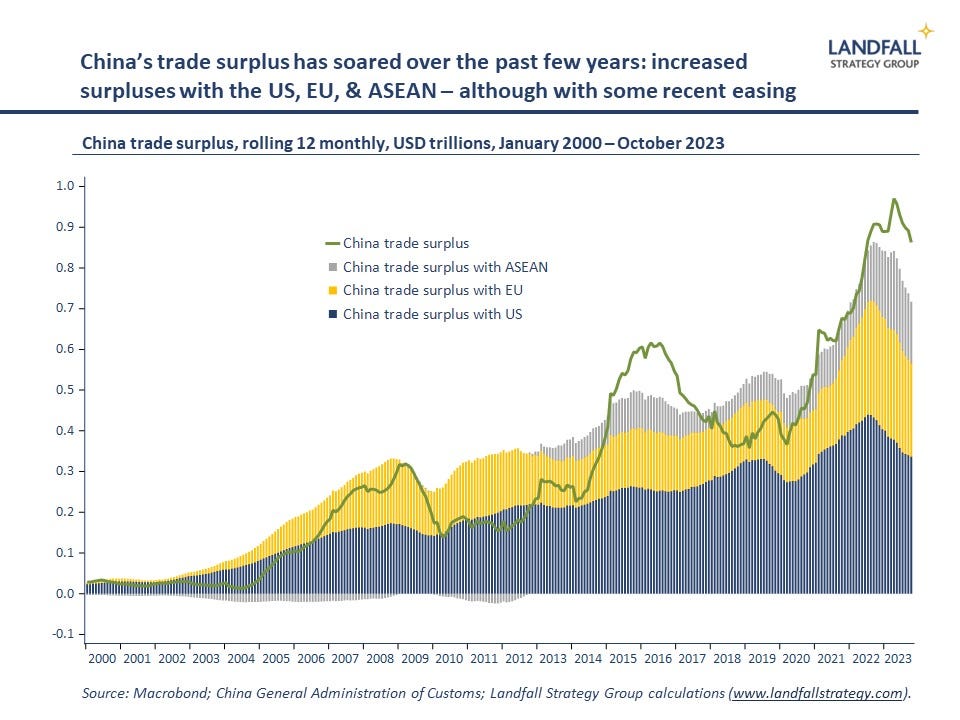

China’s trade surplus sits at almost $1 trillion.

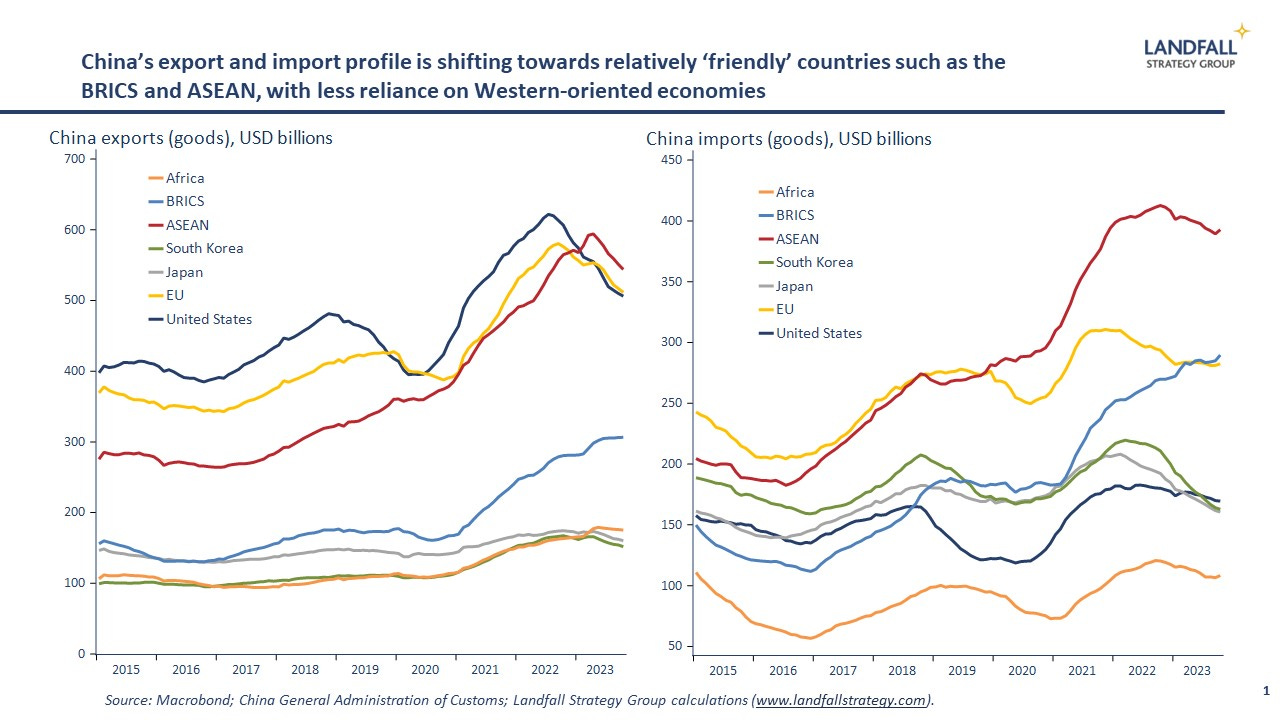

Since Covid, they have focused more trade with the BRICS nations.