Daily Charts - Deglobalization🌏

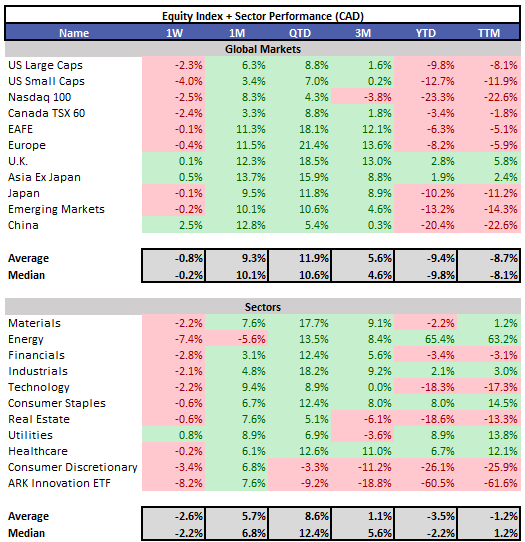

US PPI came in hotter than expected at 7.4% (exp 7.2%) on Friday morning. Markets grinded lower in anticipation of a few notable events this upcoming week. This week, we have US inflation released on Tuesday and the FOMC rate decision on Wednesday, the market is currently expecting a 50 bps hike. Chinese markets were the top performing geography as the country continues to reopen. Energy was the notable loser and utilities were the only sector up on the week.

Yields were up ~10 bps in both Canada and the US WoW. Canadian dollar was down 1.3% against the USD. Crude was off 9% on the week, leading commodities lower, on concerns of a weakening economic picture.

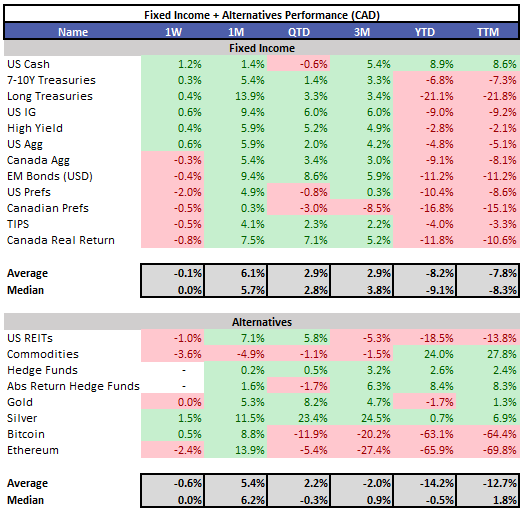

Market narratives are shifting as we approach the peak of the rate hikes, we are going from, “there is a high level of uncertainty about inflation and how high rates will go” to “inflation has peaked and we have a better idea about where rates will peak during this cycle.”

Felix Zulauf is on the media tour discussing his turbulent outlook, a summary can be found here.

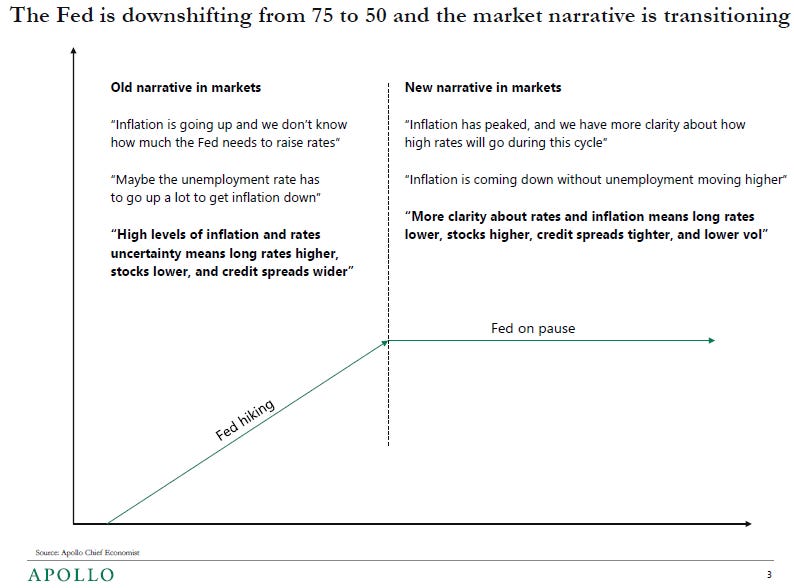

I think we have to first take one step back for the big picture. I think that geopolitics and politics will play a more dominant role. We see the building of two major blocs—a democratic bloc led by the U.S. and an autocratic bloc let by China. And this means that the period of globalization of the past 30 years is over. I think we deglobalize for, let’s say, the next 10 years. That means the world will get less efficient and more inflationary. A safe supply chain will be more important than a cheap supply chain.

What I suggest is that the decade of the 2020s is a transition period where the old system is ending and several entities will collapse, and a new system will be born by the early 2030s. I’m pessimistic for the 2020s and see roller-coaster markets in that very volatile world, but I see a silver lining for the next decade when I think a new, long cycle can start again.

Deglobalization is the reason we are seeing the following. Global foreign direct investment project announcements in the semiconductor sector. This month, TSMC tripled their Arizona chip investment to $40bn from $12bn.

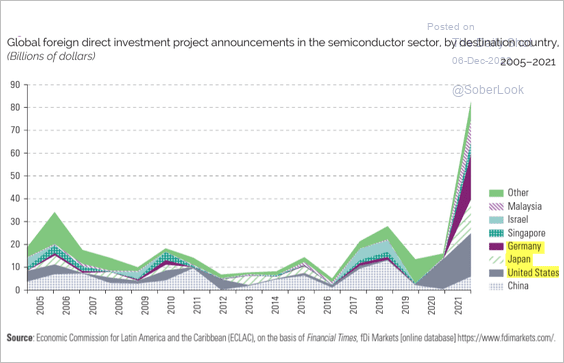

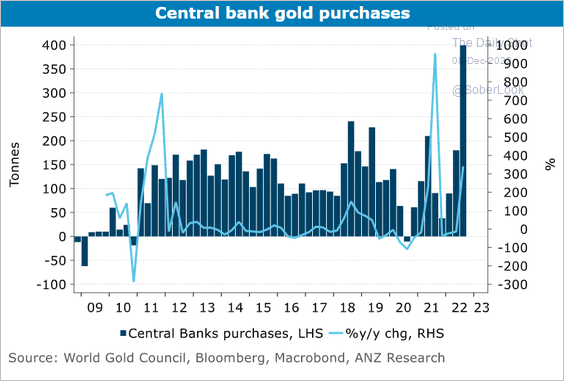

The east is losing trust in the USD, they are now looking for other stores of value. Central banks have ramped purchases of Gold, one of the few non sovereign stores of value.

Biden got a fist bump when he visited Saudi Arabia, this is the welcome President Xi Jinping of China received. Alliances are shifting…

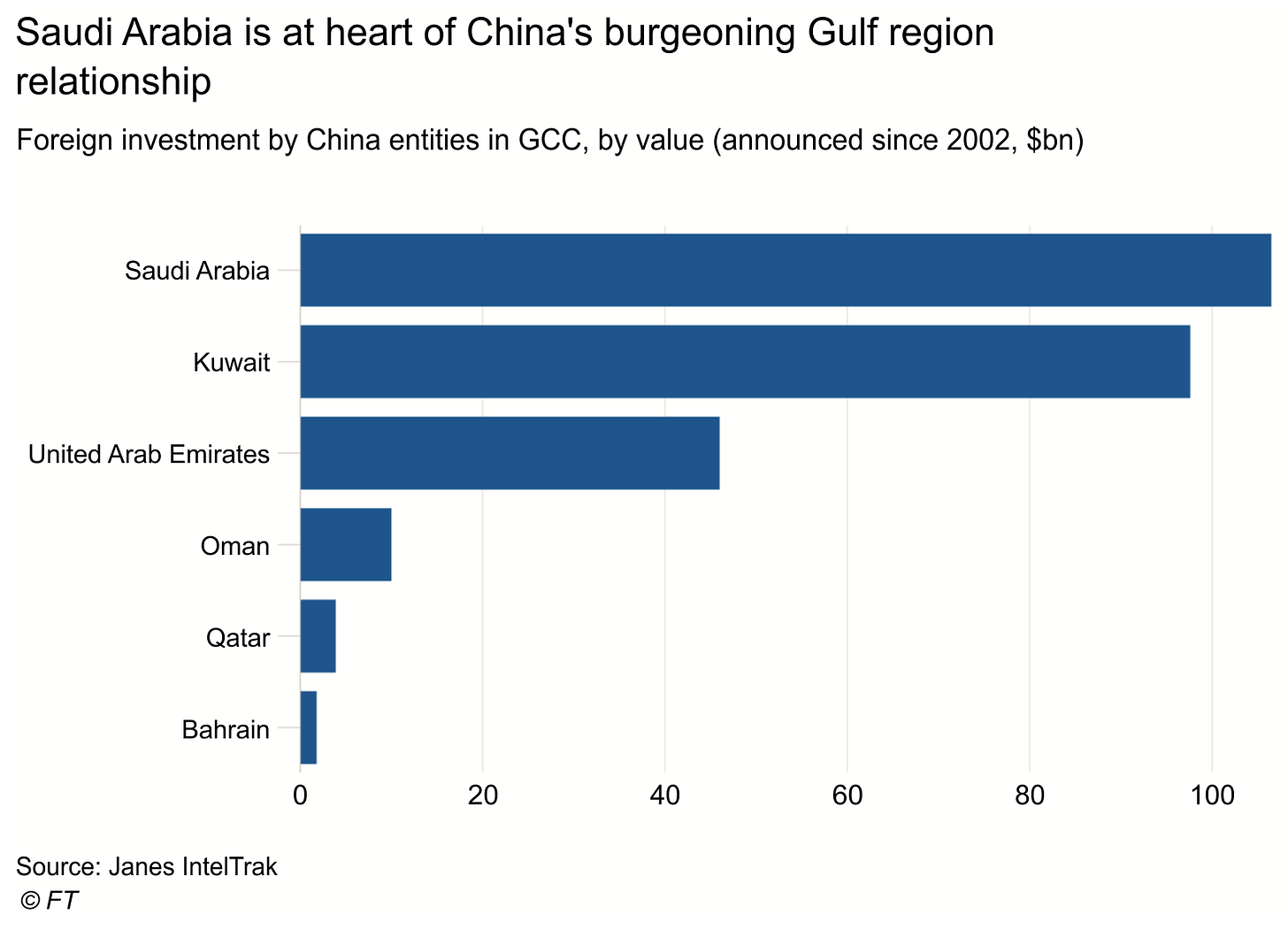

Saudi Arabia is central to Beijing’s growing influence in the region. The Kingdom is the largest recipient of Chinese FDI into the Gulf.

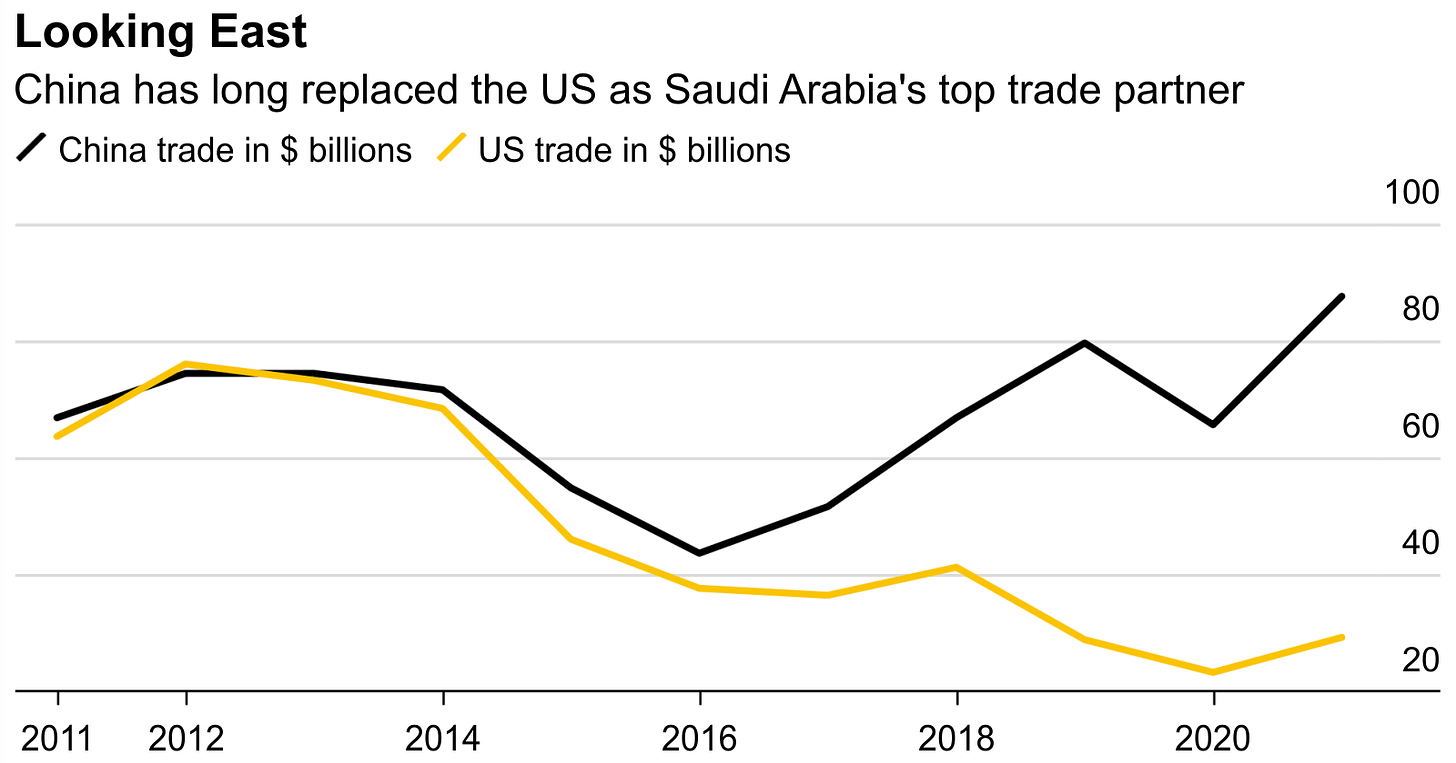

Since 2013, China has become Saudi’s largest trading partner. In 2021, bilateral trade between China and Saudi Arabia totaled $89.1 billion, almost three times the level of trade with the U.S. ($29.3 billion). Saudi Arabian oil last year accounted for 17.4% of China’s total crude imports, worth $35.5 billion.

Emerging markets with large populations are expected to become the largest economies in the world over the next century.

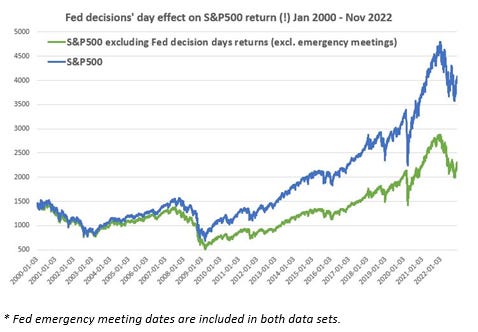

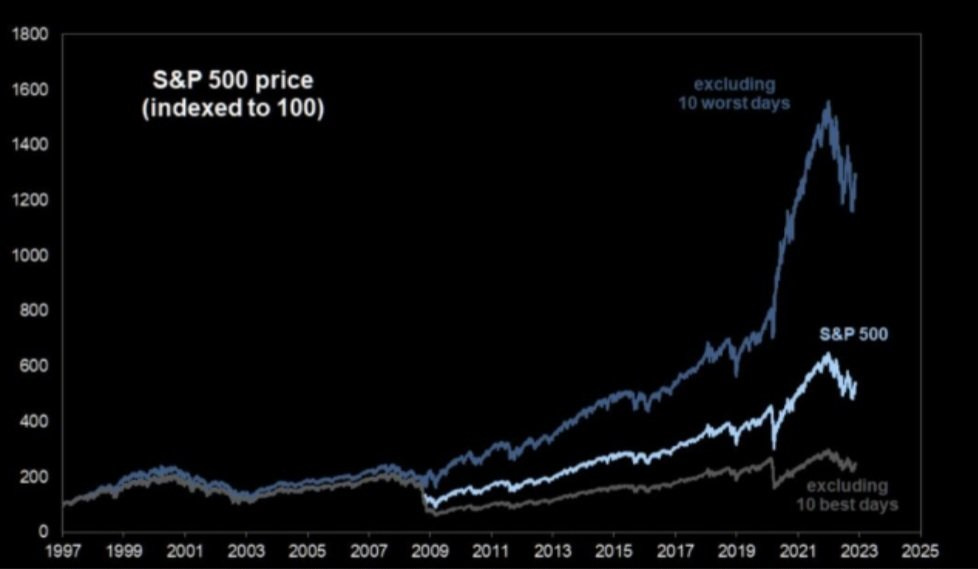

With the Fed decision this week, if you take out the returns of the S&P 500 on the days the Fed announced a monetary policy decision since 2000 the S&P 500 price index annual return would have been less than half (2.1% excluding Fed days vs. 4.6% for all days). The price return is so low over the past two decades because 2000 was a bubble peak and half the S&P 500 total return over since 2000 can be attributed to dividends.

If you figured out a way to avoid the 10 worst days since 1997, your total return doubled.

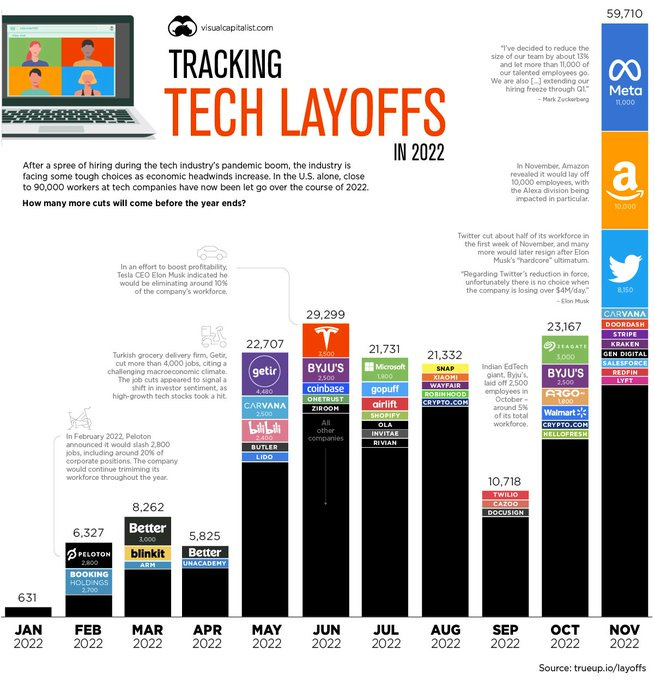

Big tech joined the tech layoffs in November, the layoffs were twice the amount of the previous high for the year. Activist fund TCI is going after Alphabet to reduce headcount.

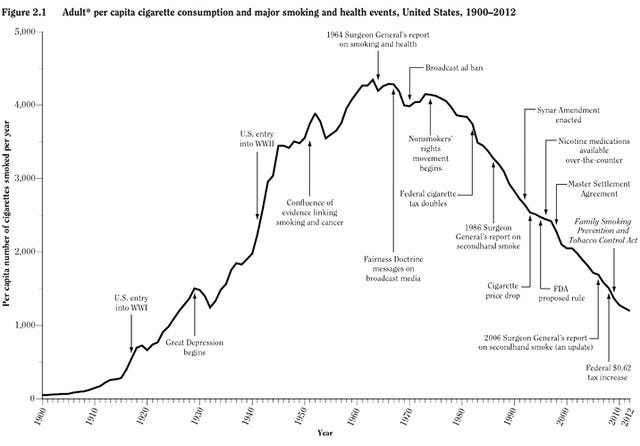

The rise and fall of smoking in America.