Daily Charts - Excellence

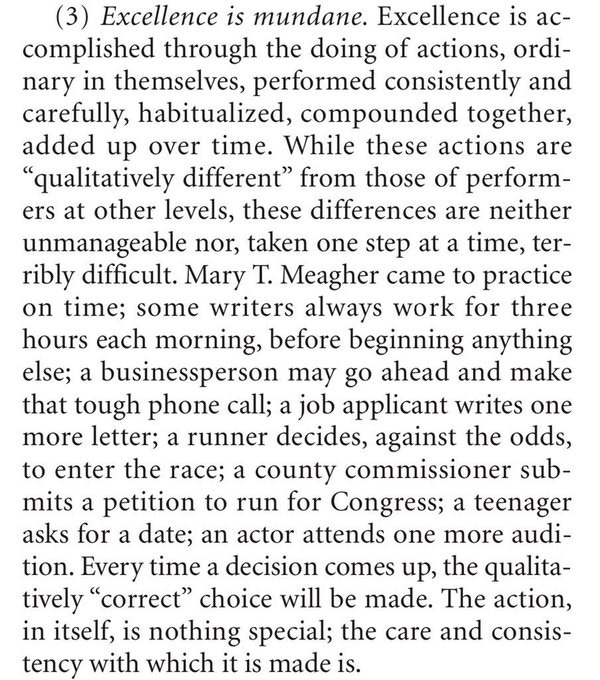

Mundanity of excellence from Dan Chamblis

Here are 12 great quotes from Sam Zell, 2 favourites below.

The first thing you need to understand is how little you know.

Listen, business is easy. If you’ve got a low downside and a big upside, you go do it. If you’ve got a big downside and a small upside, you run away. The only time you have any work to do is when you have a big downside and a big upside.

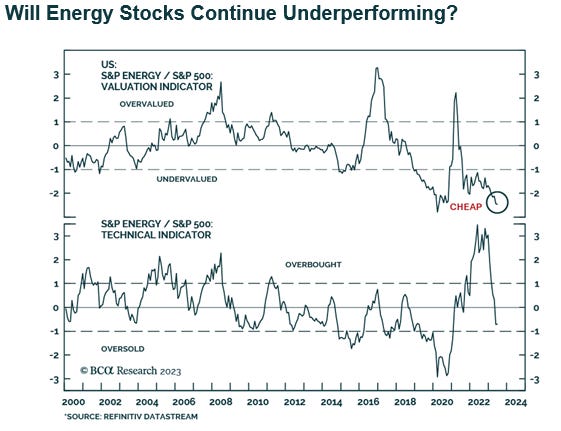

Are energy stocks permanently cheap vs the S&P 500?

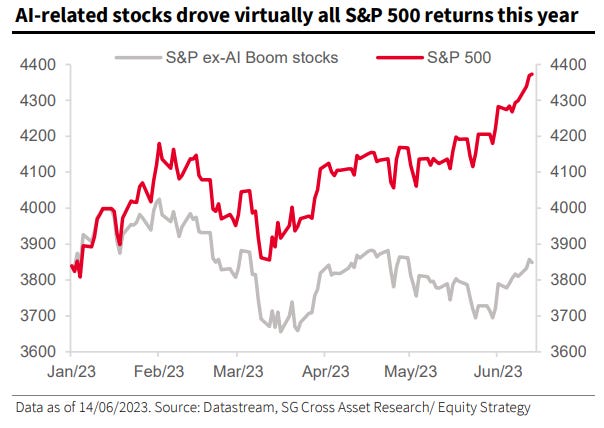

If you didn’t have exposure to AI, you missed out on this rally.

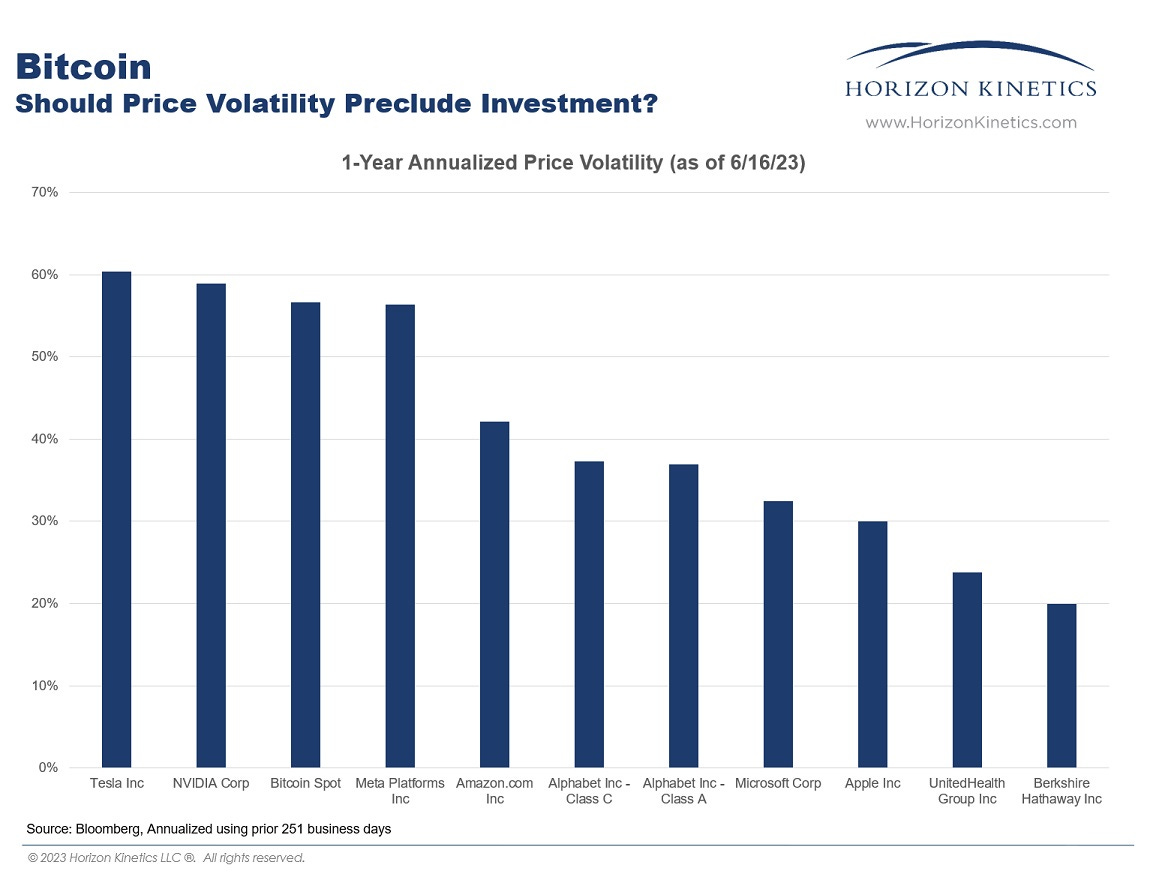

Should the price volatility of an asset preclude its inclusion in a responsibly allocated investment portfolio? The volatility of Bitcoin over the past year has been in line with some of the largest companies in the US over the past year.

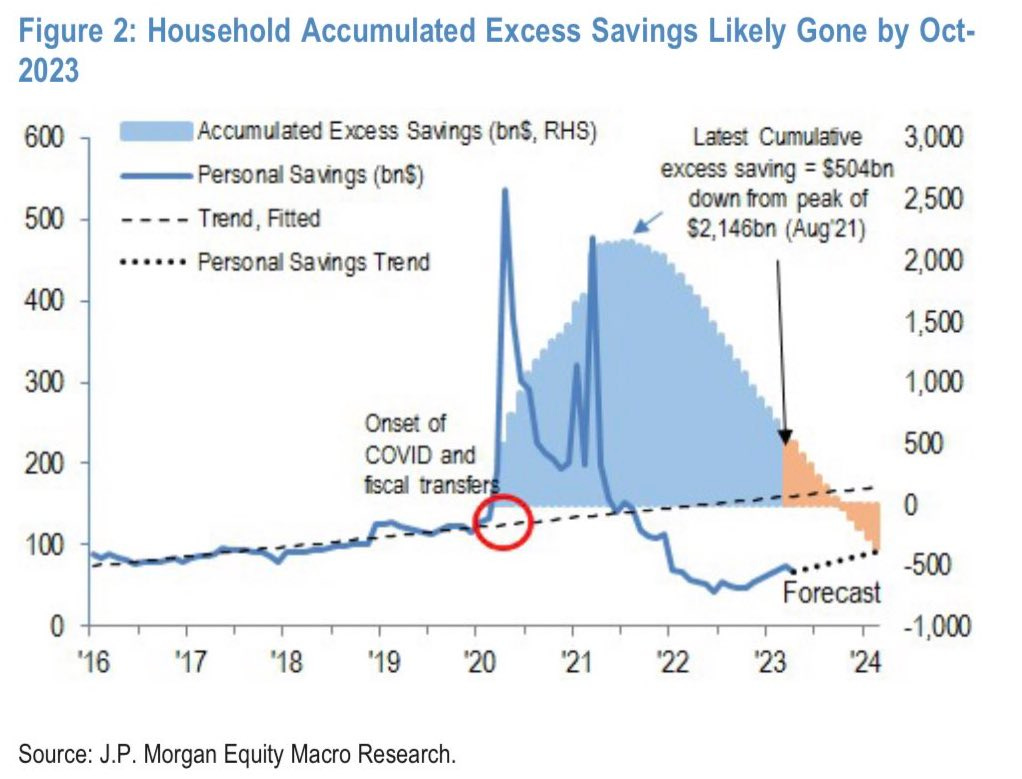

Checking in on why the economy continues to run hot. Excess savings in state and local governments is still elevated and personal excess savings have not yet been fully drawn down.

J.P. Morgan thinks those excess savings will run dry by the end of the year.

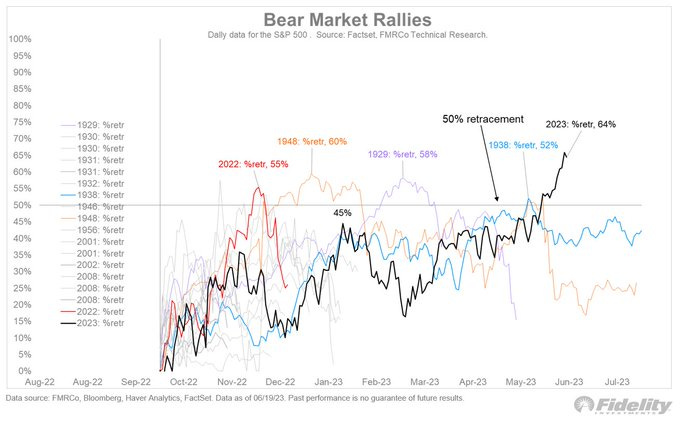

Bear-market rallies generally do not retrace more than half of their preceding declines. The S&P 500 cap-weighted index has retraced 64% of the 2022 decline, exceeding all previous bear-market rallies since the 1920s.

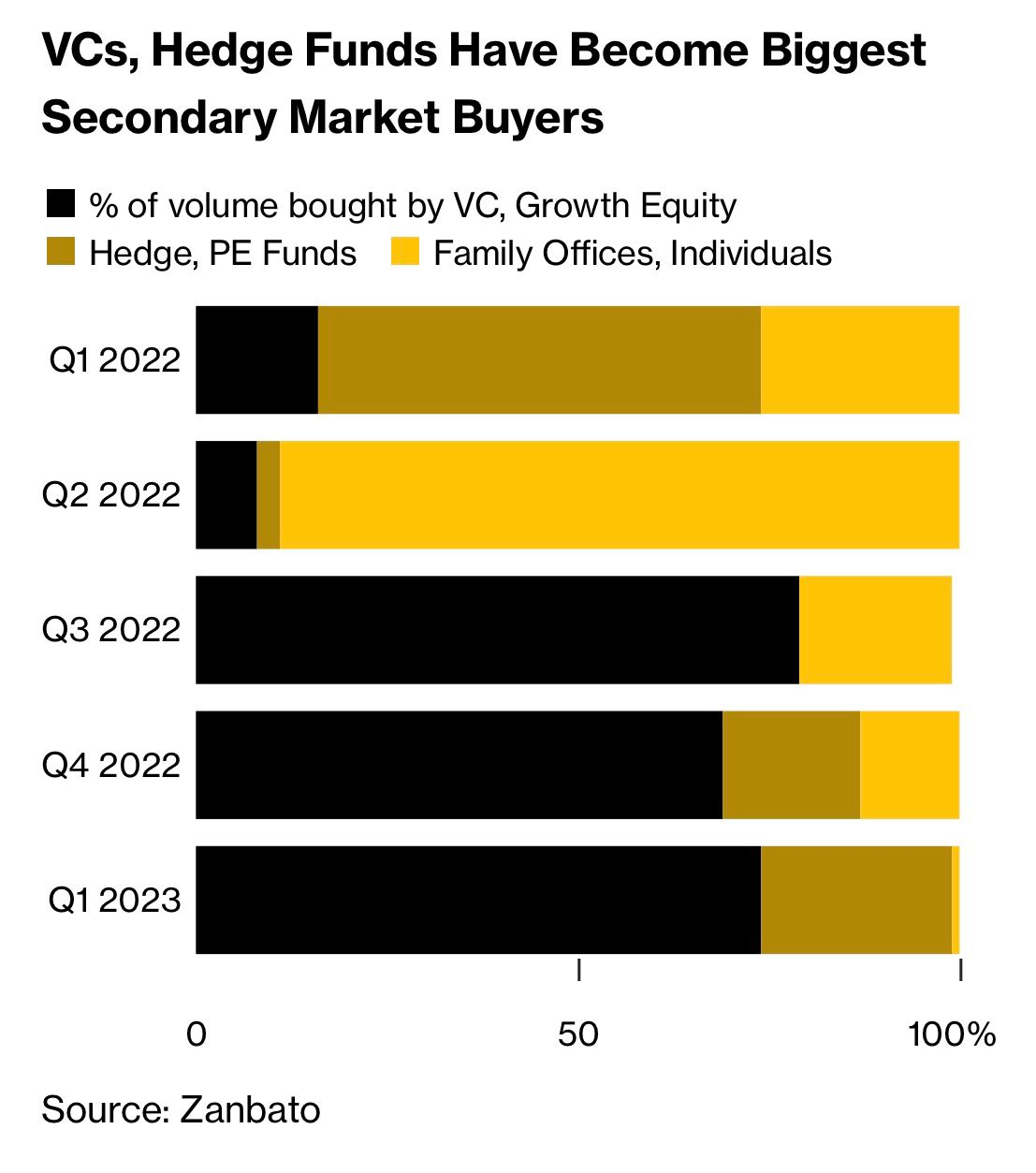

VCs have become big buyers of secondaries.

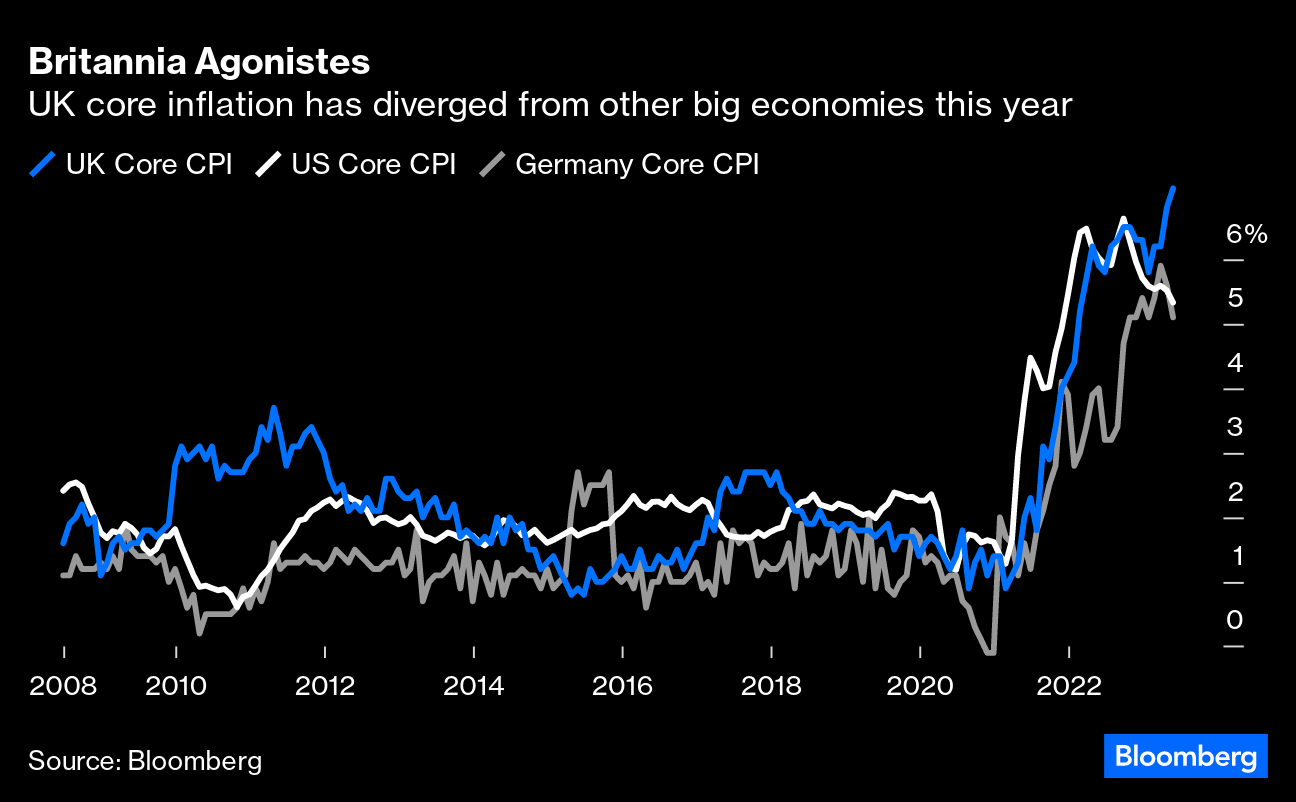

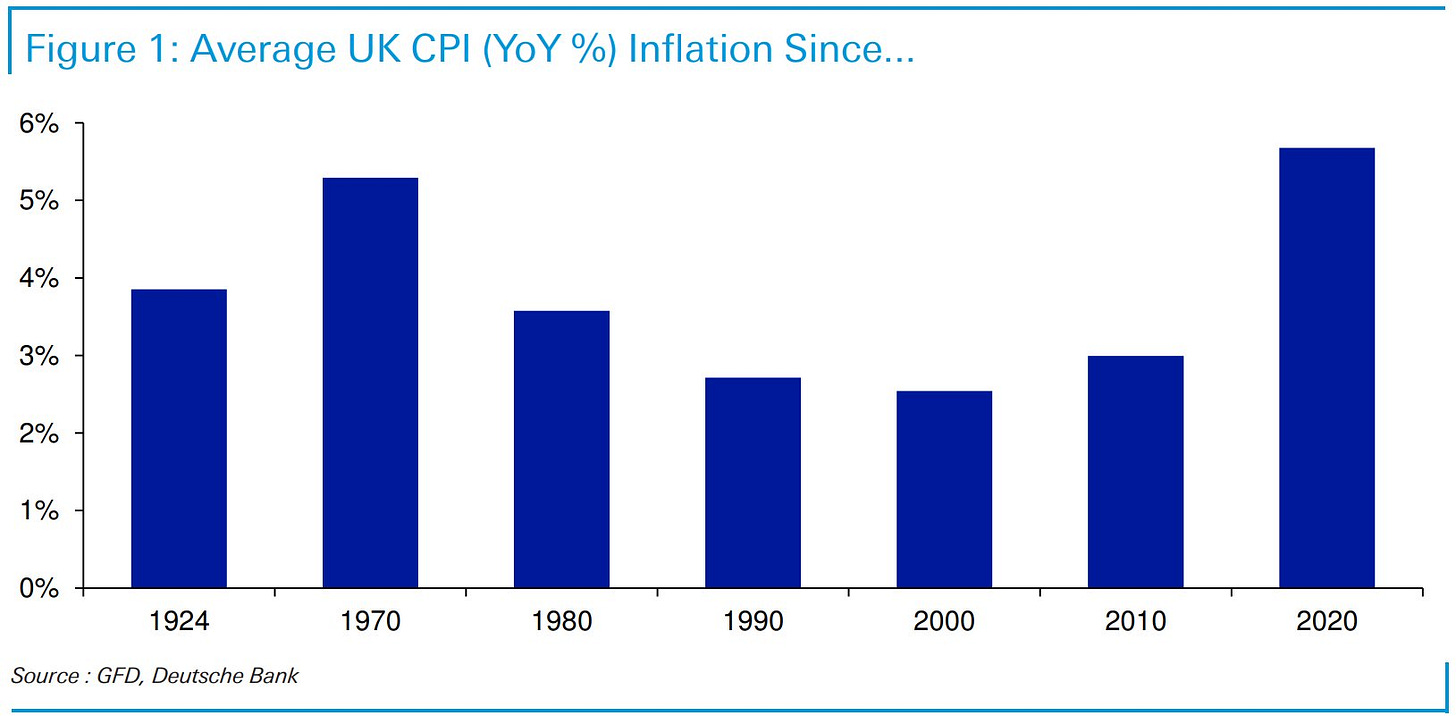

The Bank of England raised rates 0.5% yesterday as core inflation has yet to roll over.

The UK is used to inflation running a bit over 2% but they haven’t seen a decade with inflation this high since the 70s.

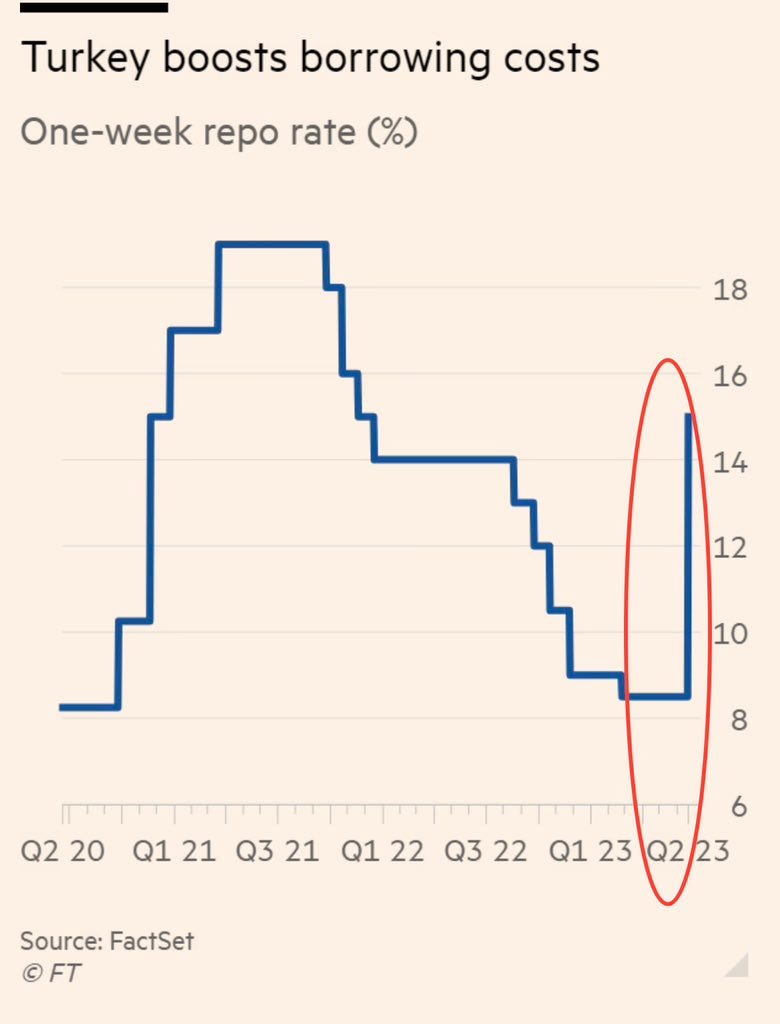

Turkey’s central bank brings low-rate era to close with 6.5 percentage point rise.

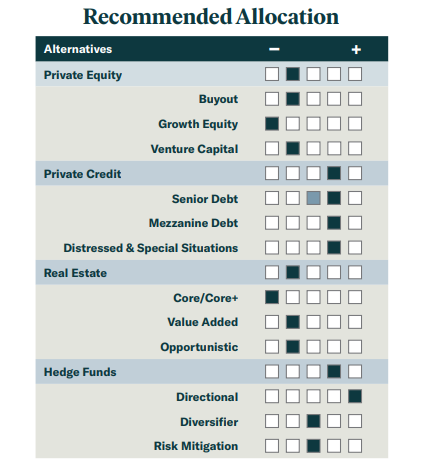

BCA thinks active stock pickers (directional hedge funds) able to navigate a choppy market and private credit are most attractive right now.

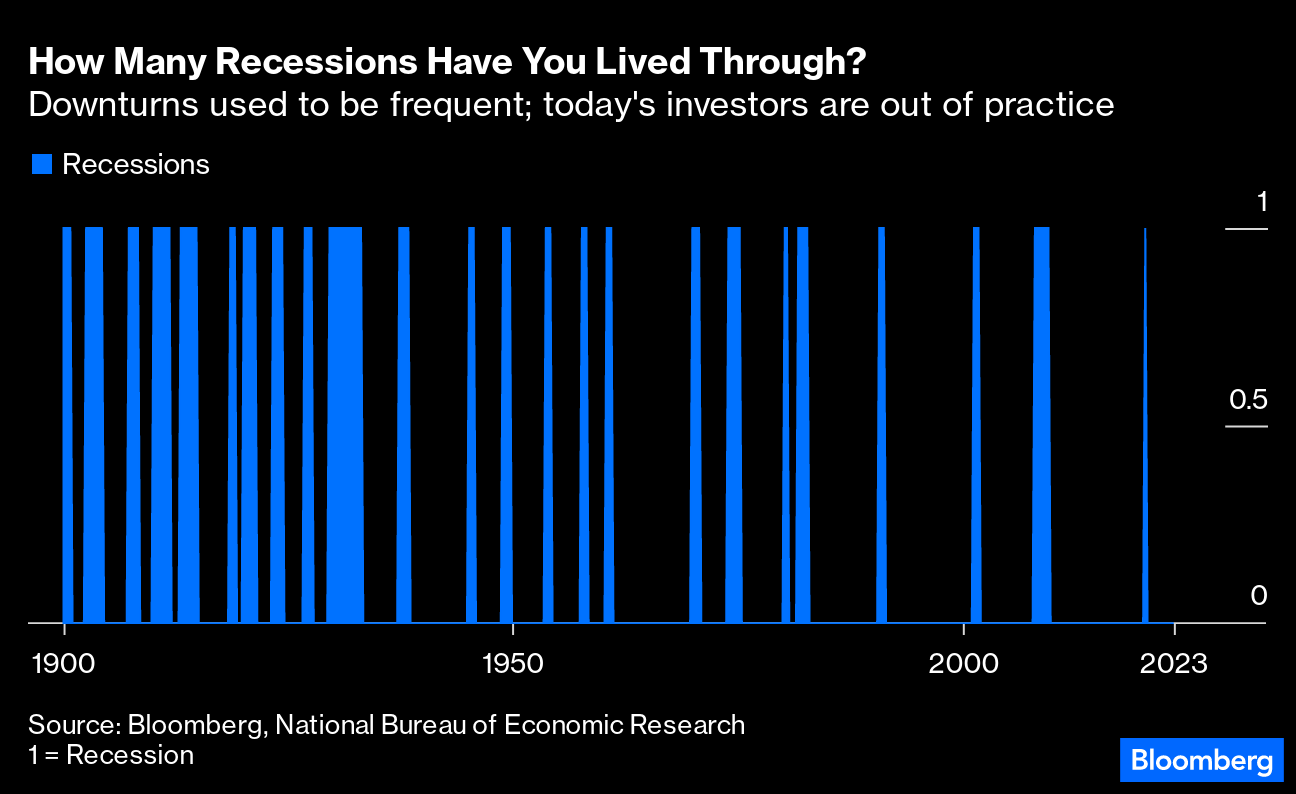

Central banks have learned how to massage the economic cycle.

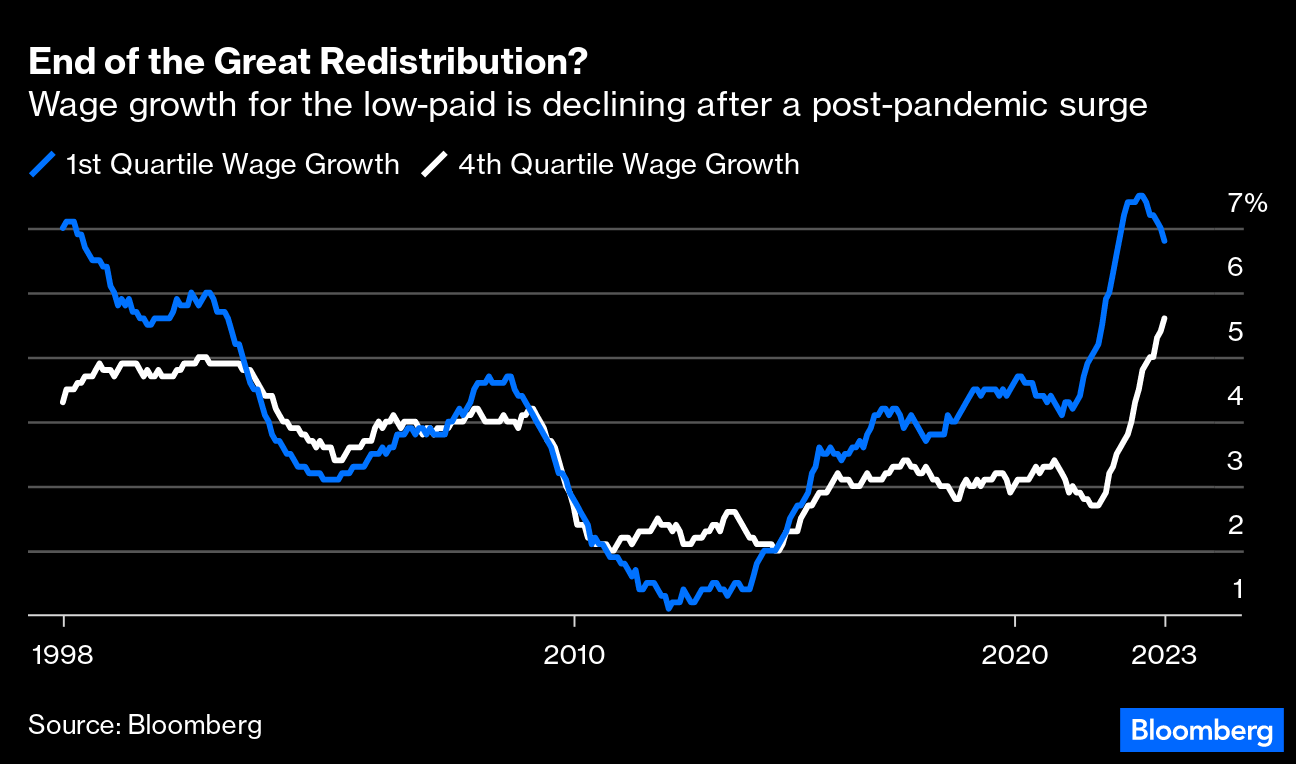

Wage growth for the lowest paid workers is beginning to slow.