Daily Charts - Garbage Rally

It was a funny day in the markets, Ark is up 15% in the past three days.

Bed, Bath & Beyond is up 18% in the past 2 days after reports that they defaulted on debt payments and are on the verge of bankruptcies… Yes, it doesn’t make sense. Yesterday felt like we were back in the middle of the pandemic in the meme stock craze.

Investors are getting excited that the pause and cuts are coming. It will be interesting if the recent price action gives the Fed cloud cover to be more aggressive.

Morgan Stanley highlighted some pretty interesting similarities between Jan 2001 and this Jan. By march of 2001, index plummeted 20%. Same garbage led the rally in Jan 2001 and then plummeted in Feb 01. Does this rhyme?

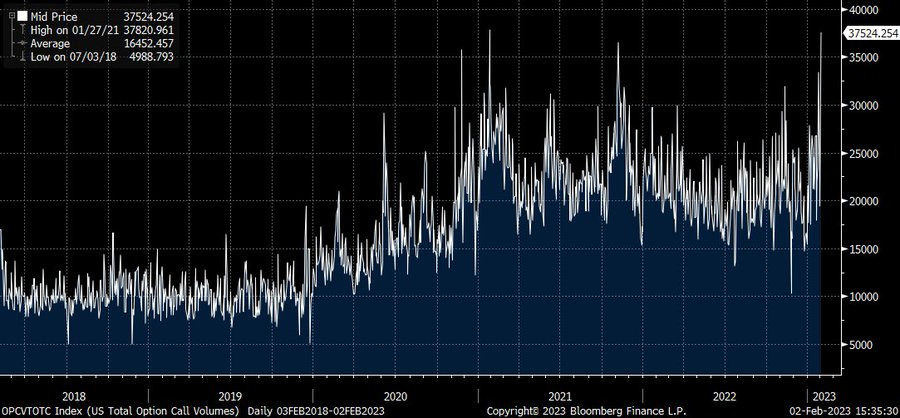

A record amount of total call volume today.

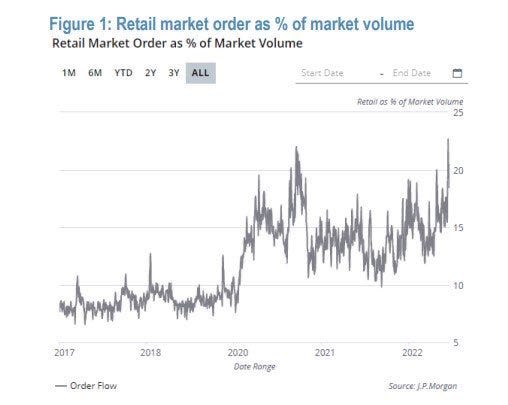

The call volume probably coincides with retail trading as a % of total, it surpassed its early-2021 meme stock peak.

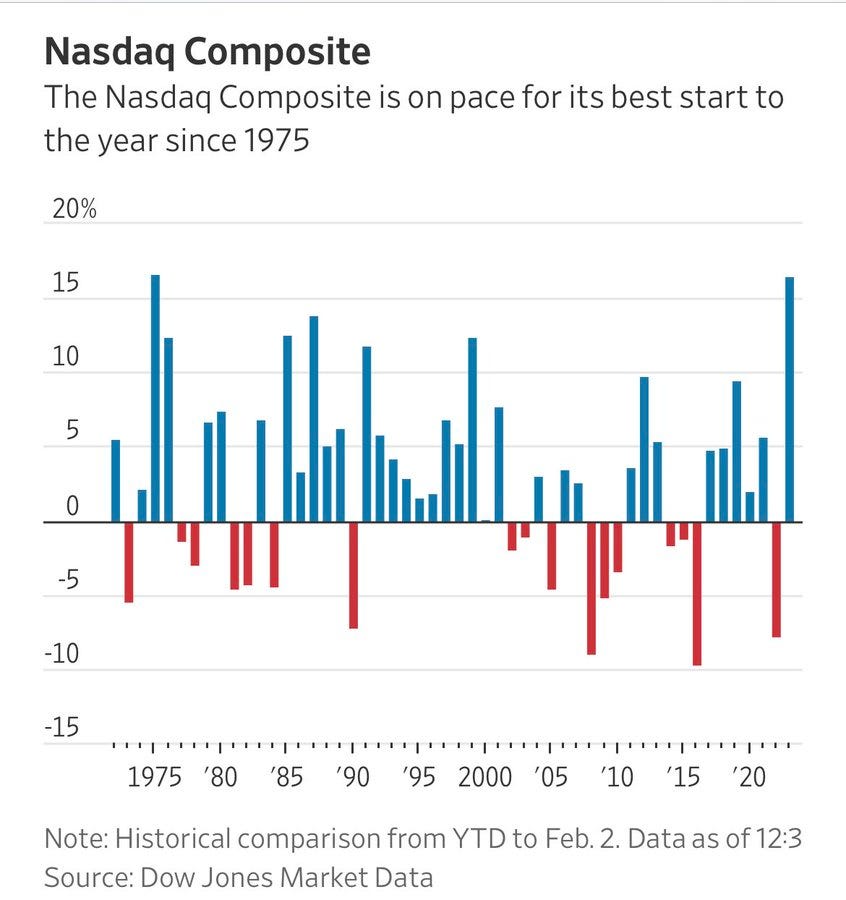

NASDAQ is off to it’s best start to a new year since 1975.

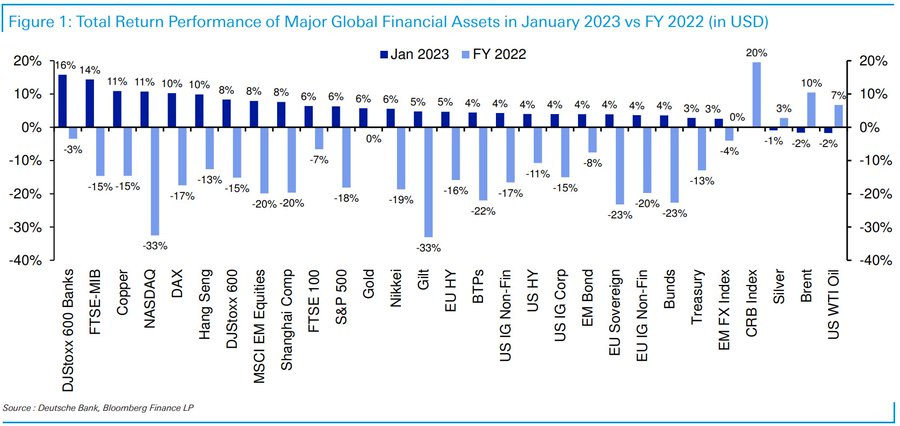

What didn’t work last year, is working to start the year.

Earnings expectations have begun deteriorating but that has had the opposite impact on the market valuations.

Job growth in the US is expected to slow significantly in 2023 compared to 2022.

Despite strong job gains, real wages are lower today than they were in December 2019 for every industry except retail trade and leisure and hospitality.

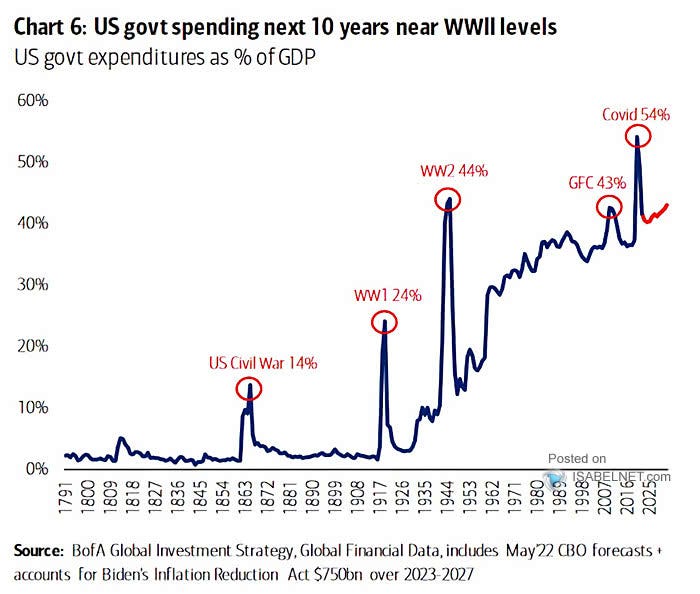

US government spending as a share of GDP is expected to rise over the next 10 years.