Daily Charts - GDP Contraction

Declining real wages are a cause for concern as workers make less on a real basis.

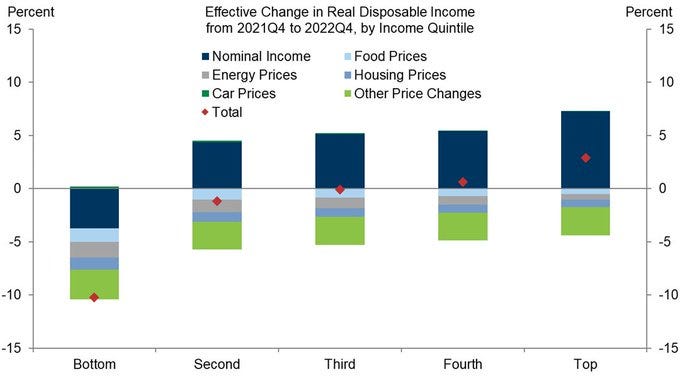

When broken out by quintile, it’s not as bad. Inflation disproportionately affects the bottom quintile, they only represent 7% of consumption. You could imagine this leads to unrest though.

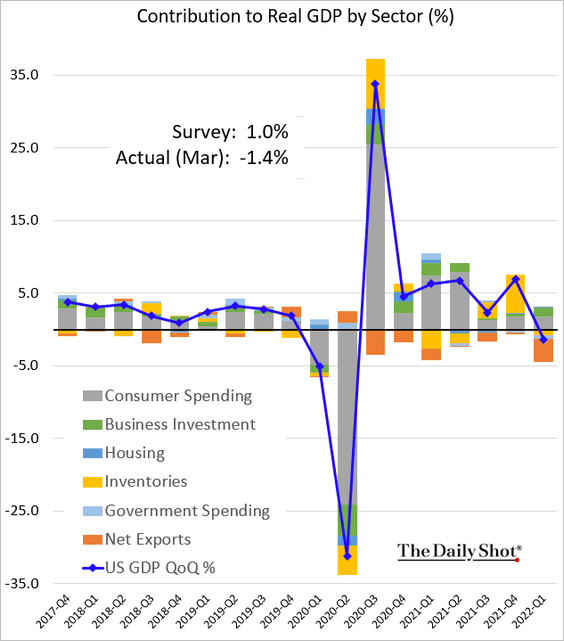

First contraction in Real GDP since 2Q2020, -1.4% q/q ann. vs. +1% est. & +6.9% in prior quarter; personal consumption softer at +2.7% vs. +3.5% est. & +2.5% in prior quarter.

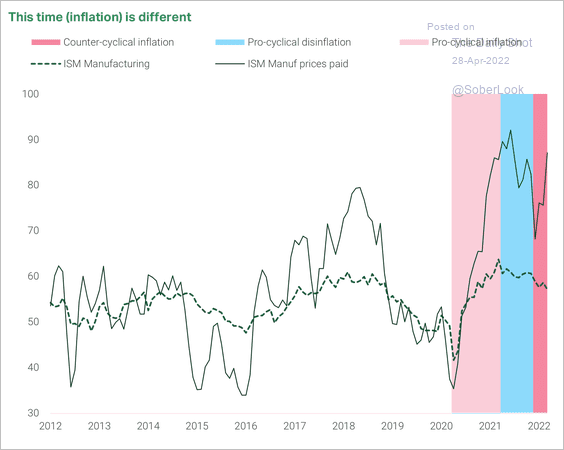

During the start of the pandemic recovery, inflation was procyclical as economic activity accelerated. This year, however, activity is slowing while producer prices accelerate. It will be painful to hike into a weakening economy.

Since 2013, every time the S&P 500 went negative y/y, the Fed either stopped tightening or began loosening… This time unemployment is at all time lows and we have only hiked 25 bps… They are stuck.

To make matters worse, rates can only rise so much until the debt burden becomes overwhelming (Left axis is monthly interest expense in billions).

With the lockdowns in Beijing imminent, supply chain problems will likely persist.

The stay at home trade was a bust…

Jim Cramer stock promoter extraordinaire.