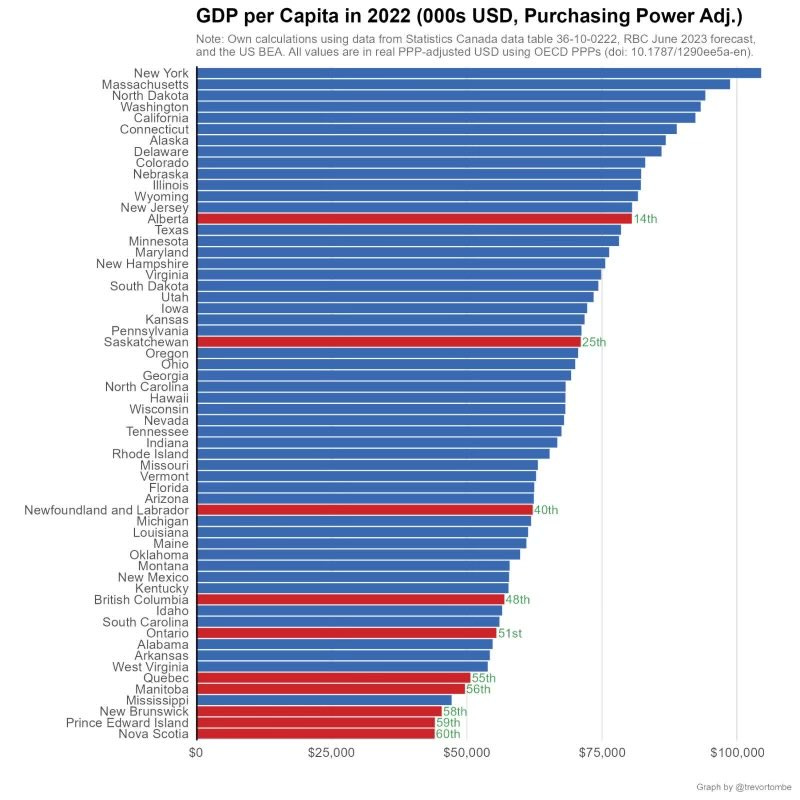

Daily Charts - GDP per Capita & Domestic Supply Chains

Canada has a productivity problem.

Alberta has the highest per capita GDP in Canada but most of the other provinces would qualify as some of the least productive US states.

This is from a 2019 Fraser Institute report contrasting Texas and Alberta’s recent economic performance:

While many factors have influenced the divergent economic outcomes between Alberta and Texas, it is noteworthy that during the past decade the two jurisdictions have taken markedly different approaches to public policy. In Alberta, spending-fueled deficits, increasing taxes, and the perception that its oil and gas investment climate has become unwelcoming have all, to varying extents, hindered Alberta’s ability to compete.

It appears the easiest way to increase GDP per capita in Canada would be to embrace resource development. In 2011, during the last oil bull market, Canada actually had a higher GDP per capita the US.

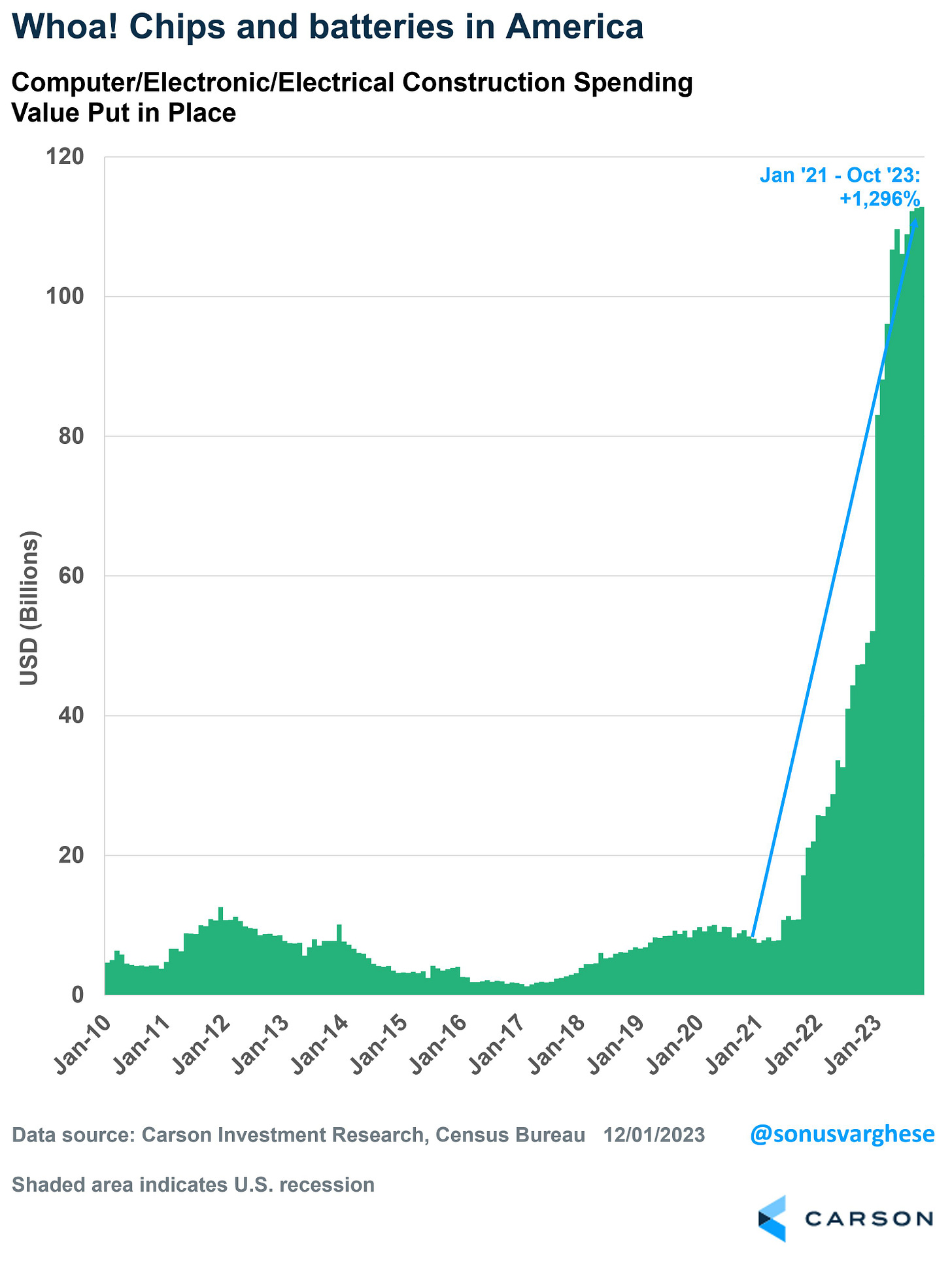

The US has catapulted into the largest oil producer in the world.

Public policy in the US is incentivizing the investment of capital into key industries in the US. The challenge is that supply chains are highly interconnected and are built over decades. You hear stories about challenges with the TMSC fab in Arizona or closer to home, the battery plant in Windosr, having to bring in thousands of Korean workers to run the factory. Is it too little too late?

The US was once the largest steel producer in the world. I think we will look back at the offshoring of US industry to lower labour cost nations as one of the major blunders in history. This may turn out to be one of the times capitalism failed the US. It benefited stock prices but hollowed out industrial capacity. There are strategic reasons why domestic supply chains are important and they’ve been highlighted by issues during covid and as tensions escalate between nations.

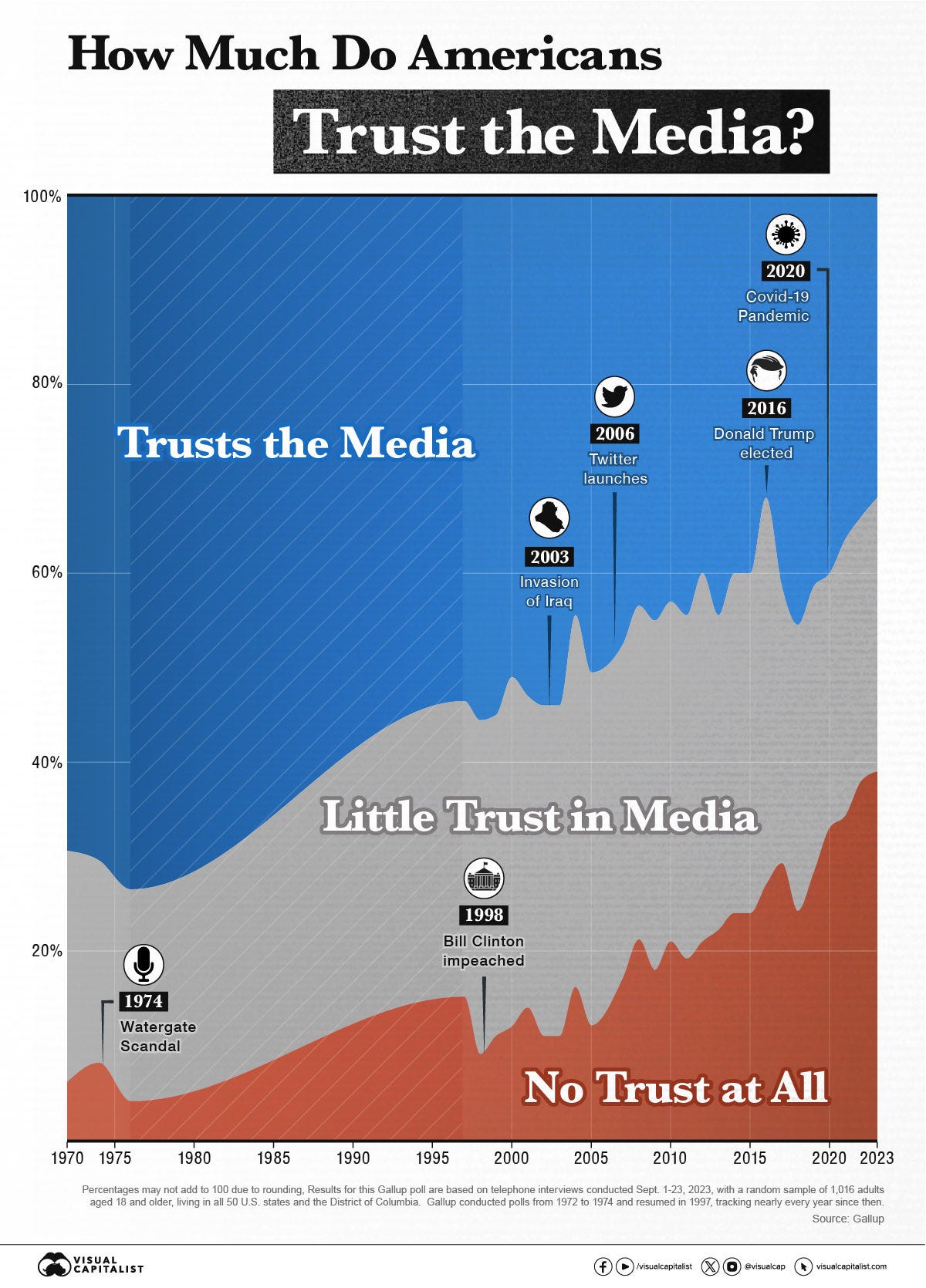

Out of all the post-WWII presidential candidates, the past three elections have the 6 out of the 7 most unfavorable presidential candidates ever.

It probably has something to do with the rise in social media and the increasing lack of trust Americans have in their media. Part fake news, conspiracies theories but with access to more information misreporting by major news outlets can also be challenged.

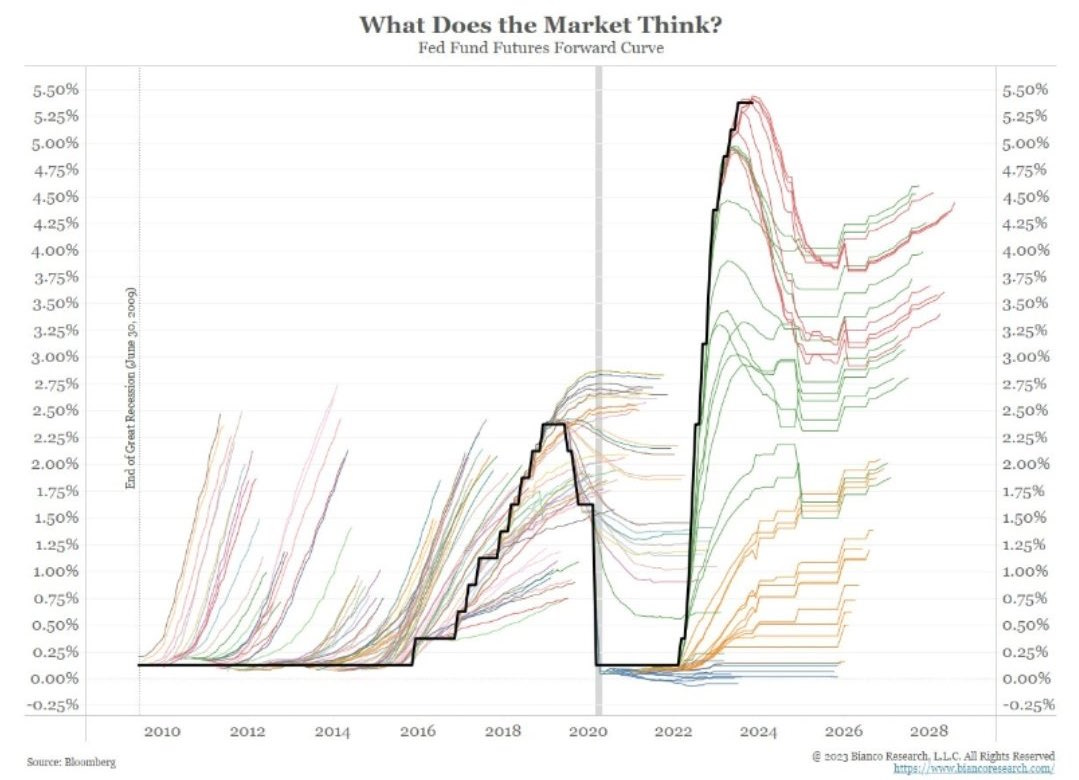

As the market focuses on the forward path of interest rates, is there a point, if it will likely be wrong? Howard Marks has a great memo discussing this dynamic. Focus on what you can control.

There are signs that the price rises that allowed some businesses to make outsize profits during the Covid-19 pandemic are coming to an end, as demand comes back to earth and increasing labour costs bite.

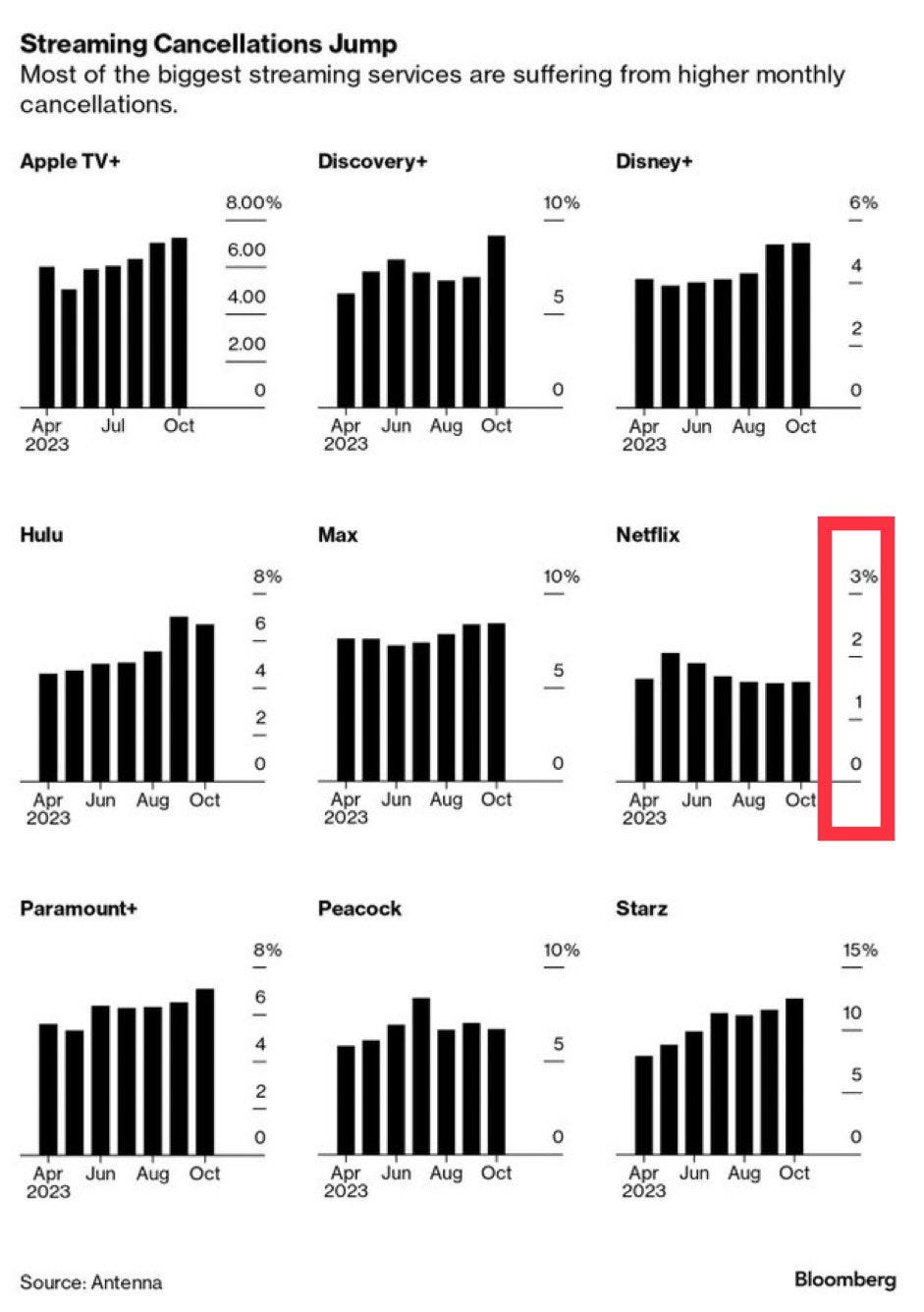

The unbundling of cable packages gave rise to a multitude of streaming platforms. Now they are being plagued by an increase in churn. Netflix stands in a league of their own.

What are you supposed to tip these days? American tipping habits below.

Job postings for remote positions are drying up.