Daily Charts - Geopolitical Tensions

Toronto office occupancy index now at 43% of pre-covid levels

43% is pretty much in line with the North East US and California. Texas has seen a closer to 60% return to office. Office is a real witch’s brew.

Elevated rates has driven increased bankruptcies in the US, the most US bankruptcies to start the year since the global financial crisis.

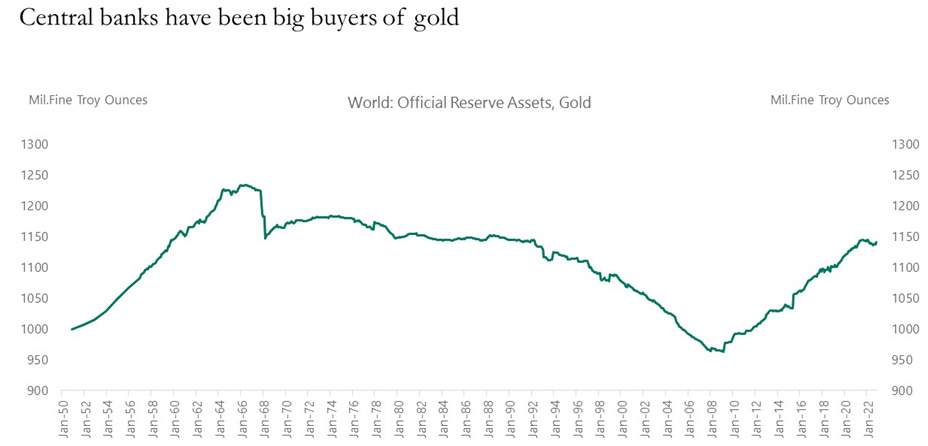

Gold purchases have accelerated during periods of uncertainty as an insurance policy.

Central bank purchases are at levels not seen since the 90s.

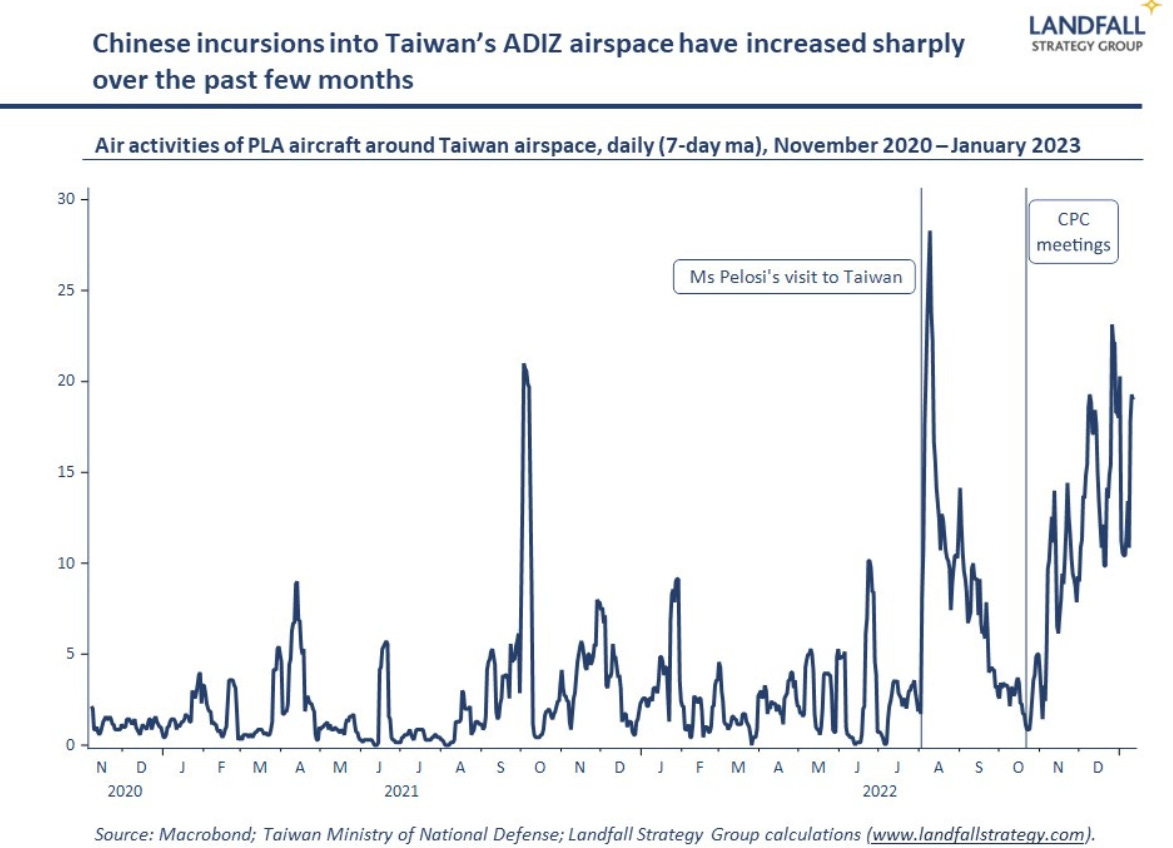

My colleague Danny G believes markets are mispricing tail risk associated with the war in Ukraine. Peter Zeihan lays out why the war might just be getting started. Xi might be visiting Russia in Feb.

China has been increasingly flying through Taiwanese airspace since Pelosi’s visit.

If war did happen, the East far outnumbers the ageing West.

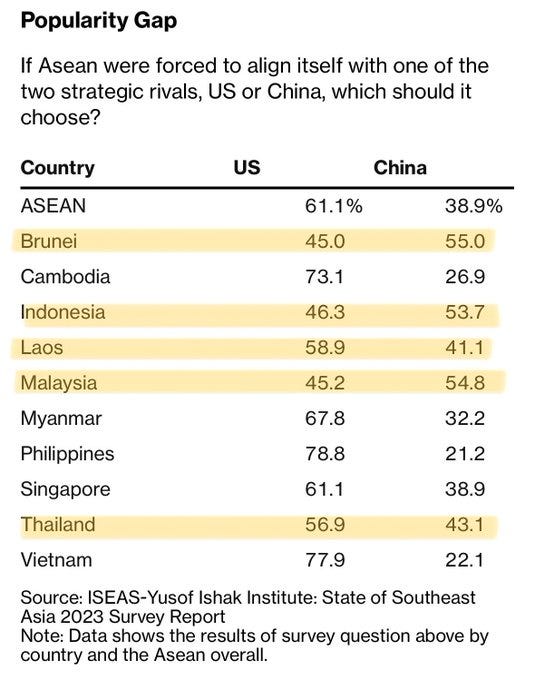

“I pledge allegiance to China!?” The world is not always aligned with American views.

Despite a slowing, ageing economy Japan is still the worlds third largest economy. China was the clear rising star over the past 20 years.

Every Province in China missed their GDP target.

World food price index is now below its pre-invasion levels after spiking higher in 2022.

If another EU member decides to leave the Eurozone, we will be standing by with the name ready to go.