Daily Charts - Goldilocks? Might be a Stretch...

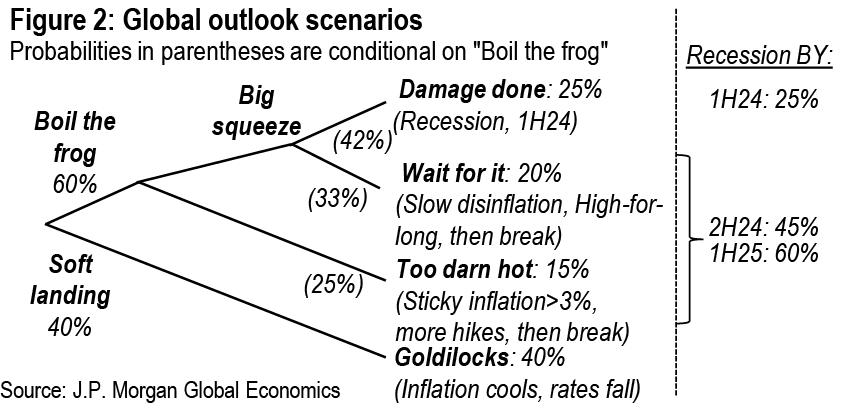

JP Morgan updated their outlook, they’ve increased the likelihood of a soft landing to 40%. They still put a 60% probability on trouble ahead. Broader equity markets to continue to ignore economists and seem to be positioning for the soft landing.

The 58% JP Morgan put on a “then break” is visualized below. Fed cuts are normally not an orderly process but rather emergency reactionary cuts to try to save the market.

The 2007 hiking cycle caused cracks that led to spiking vol and the 2019 cycle was paired with Covid that sent vol soaring, as measured by the VIX.

Fast forward to today, the VIX has ground to levels not seen since 2020. It means demand is low and the cost for hedging is cheap. Markets are not fearing a crisis.

After some dovish comments from a Fed governor yesterday, March rate cut odds doubled from 15% to 32.5%. The market is pricing in an orderly 4 cuts in 2024. It is fair to also interpret this as the average expectation and not necessarily the path of rate cuts.

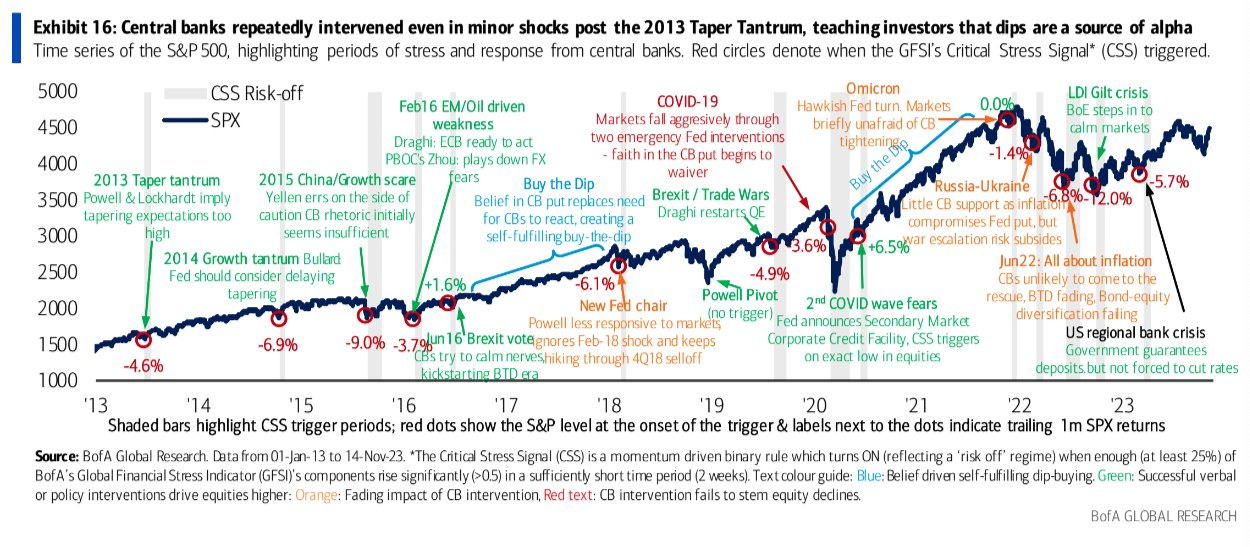

The market obsession with calling the rates peak is because investors have been rewarded in the short term if you were able to call it.

Equity markets may be acting the way they are because at any sign of trouble over the past decade Central Banks have come to the rescue teaching investors to buy the dip.

Equity markets do not have a great track record sniffing out a recession beforehand. 81% of equity market losses occur during the actual recession.

Since the end of October we have seen a very large easing in financial conditions that financial markets have celebrated.

The most shorted stocks have reacted very favourably to easing financial conditions.

Consumers have also seen relief at the pumps with the price of a gallon of gas fall more than 60 cents below the year’s peak in mid-September and lower than at almost anytime in 2022.

But higher rates are biting the most vulnerable consumers, auto delinquencies are approaching 30 year highs.

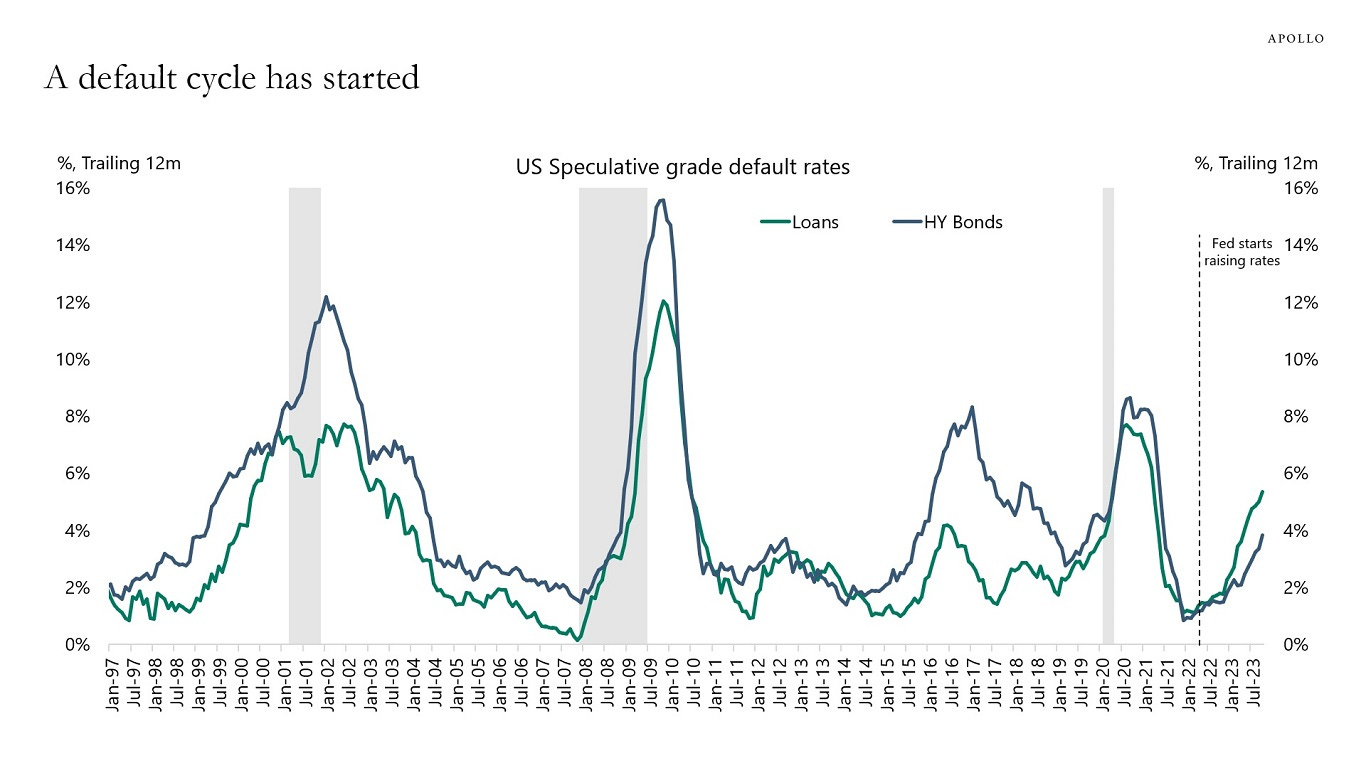

Over levered corporates are also continuing to default.