Daily Charts - Housing

Terminal rates are going much higher. These are the wages being offered at a South Eastern US convenience store chain.

Good article on Canadian housing in Bloomberg this week. I pulled out a few excerpts:

Research from the Bank of Montreal shows that about C$260 billion ($193 billion) worth of such mortgages, or almost 20% of the total market, were borrowed when rates were around lows of 1.5%. Those rates have since climbed to more than 5%.

And while similar strength was seen in other countries whose markets defied the crash, Canadians’ particular enthusiasm for homeownership — along with outsized, immigrant-driven population growth — pushed housing investment to become a larger share of the economy than anywhere else, according to Oxford Economics

That’s exactly what Charlene Willerton is debating now. In March, the speech-language pathologist bought a condo in suburban Vancouver as an investment, even though it meant signing up to pay about C$80 out of pocket each month to cover the difference between her ownership costs and what she could charge in rent. It still seemed worth it: She and her husband couldn’t afford to buy a house big enough for their family to live in, so they wanted to secure what real estate they could as a way to build wealth. But because Willerton used a variable-rate mortgage to finance her purchase, her negative cashflows have ballooned to about C$500 a month.

The fallout also is spreading in Canada, where the ranks of real estate agents alone surged 45% in the last decade. Royal Pro Realty, a brokerage in British Columbia that allows agents to park their licenses for a much lower fee than they’d pay elsewhere, says demand has shot up 23% compared to before the pandemic.

Still, if inflation slows, interest rates may not need to go much higher. And longer term, most economists say Canada’s population growth — the fastest among Group of Seven countries — should eventually provide a floor to home-price declines, with a shortage of housing actually proving the bigger challenge. Various bottlenecks to new supply make it hard to keep up with all that growth, and these will persist after the Bank of Canada’s rate shock fades. Those structurally bullish factors were a big part of billionaire Stephen Smith's rationale for agreeing to buy alternative mortgage lender Home Capital Group Inc. in a C$1.7 billion deal announced Monday. "This reflects my belief in the long-term resiliency of Canadian housing," Smith, 71, said in an interview.

Canadian housing prices have exploded higher in the past 25 years.

Japan’s housing market performance can be attributed to supply dynamics.

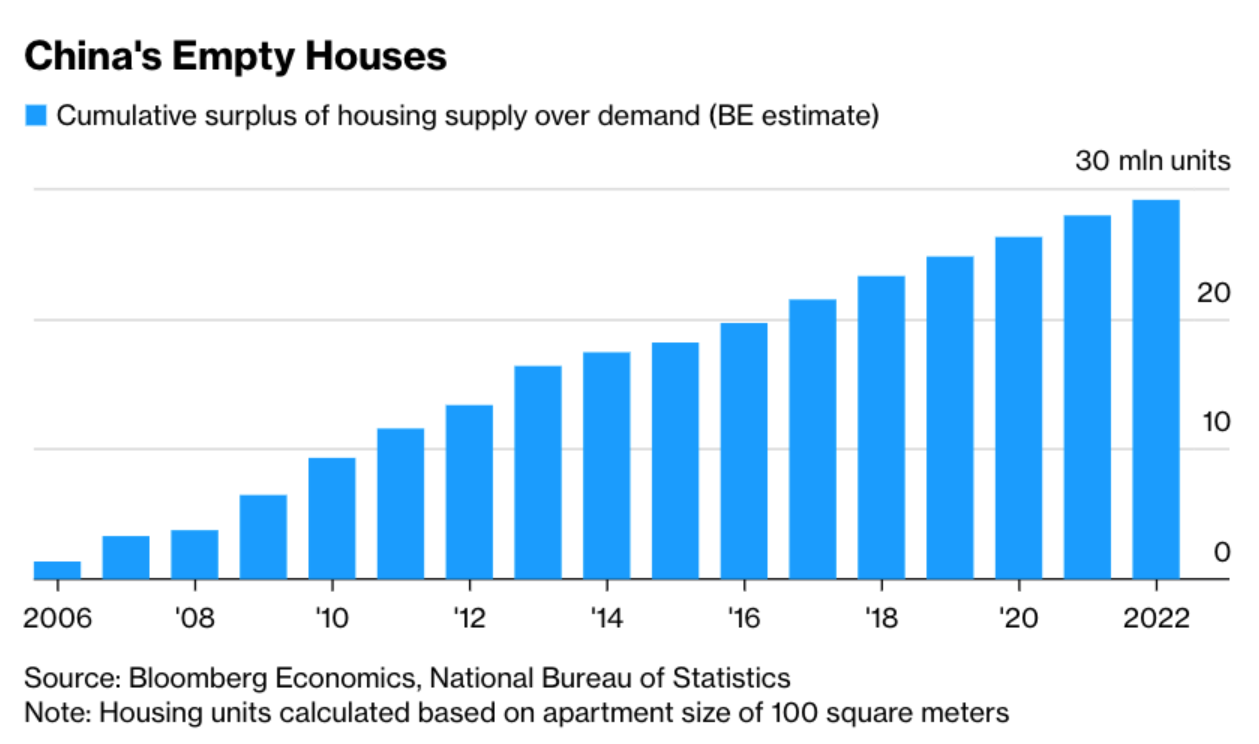

China could run into similar dynamics with demographic growth slowing and excess supply.

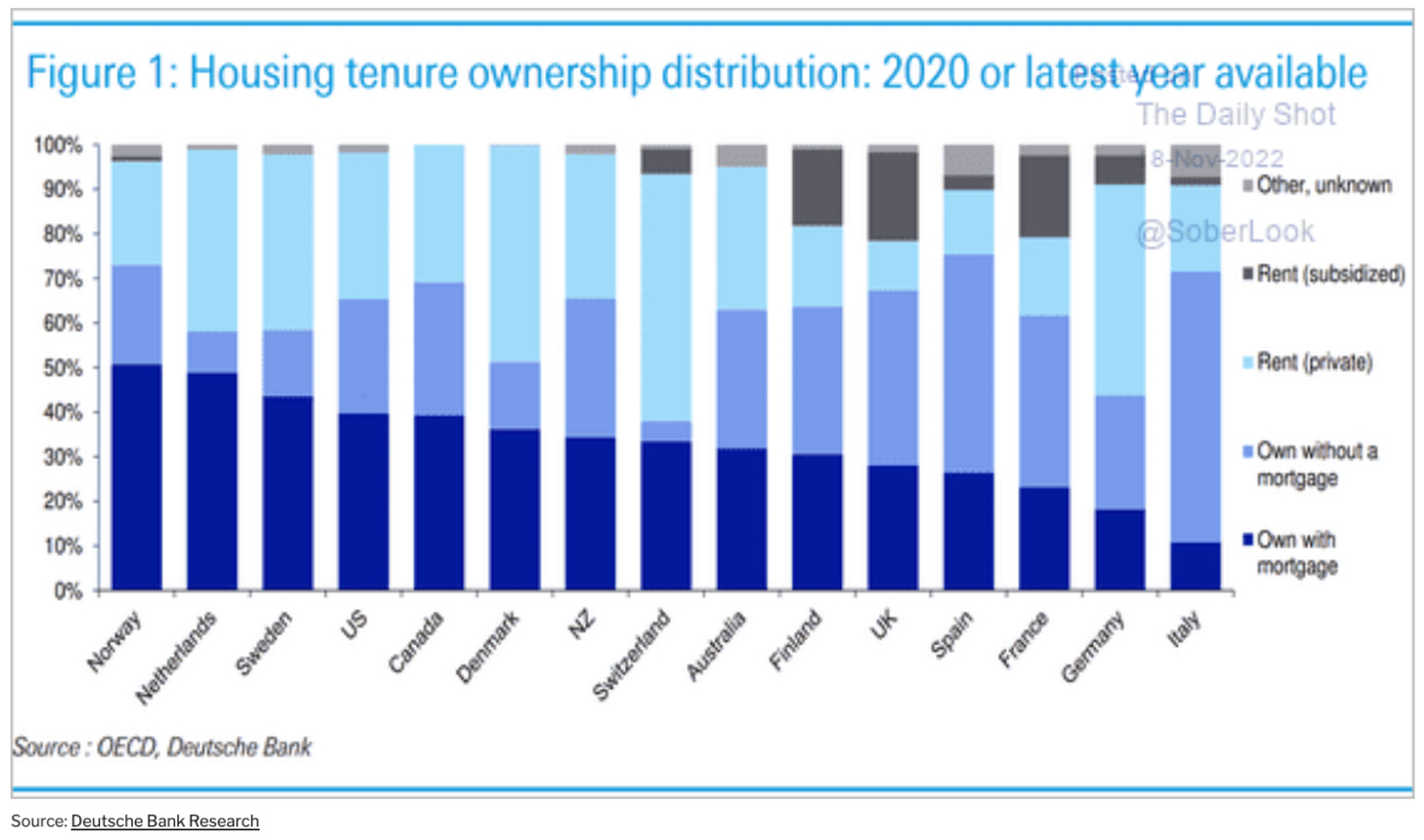

Nordics and North America tend to have more mortgages.

Short term Treasury yields are above cap rates, if they are persistent will apply further pressure to the housing market.

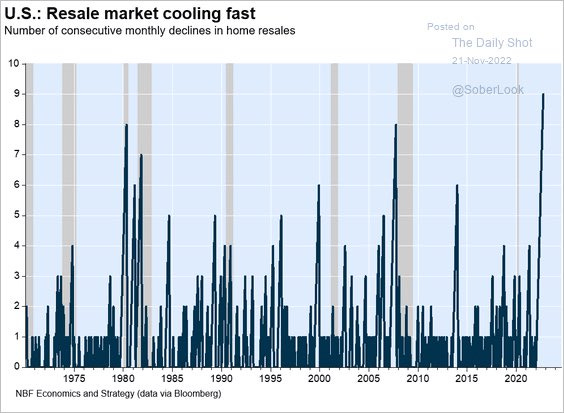

Housing resales in the US have ground to a halt.

Another way to look at slowing sales.

Investors have also backed away from the market.

We are even seeing rent growth falling. Housing market activity should show through in lower inflation.

Consumers are not stressed, no housing crisis like in 2008.

And are still sitting on tons of cash.