Daily Charts - Inflation & Canadian Housing

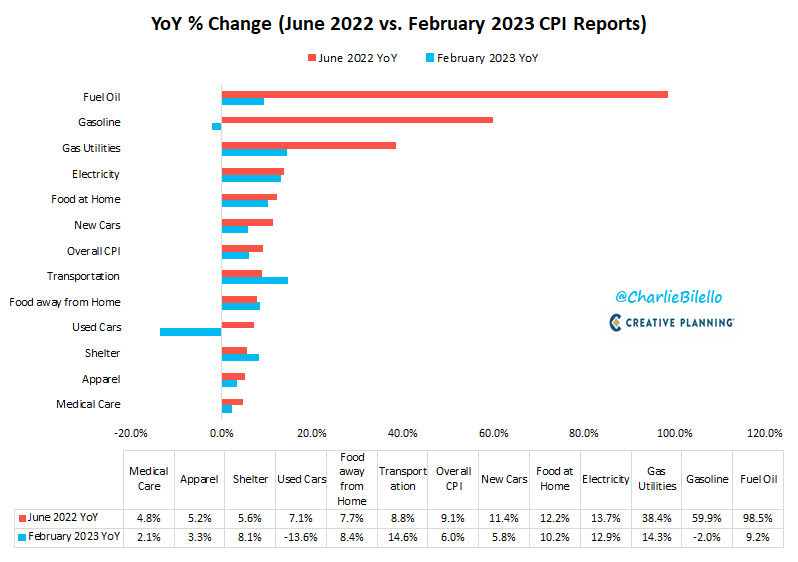

US CPI has moved down from a peak of 9.1% last June to 6.0% in February. Energy inflation has eased since last summer but inflation remains quite broad based.

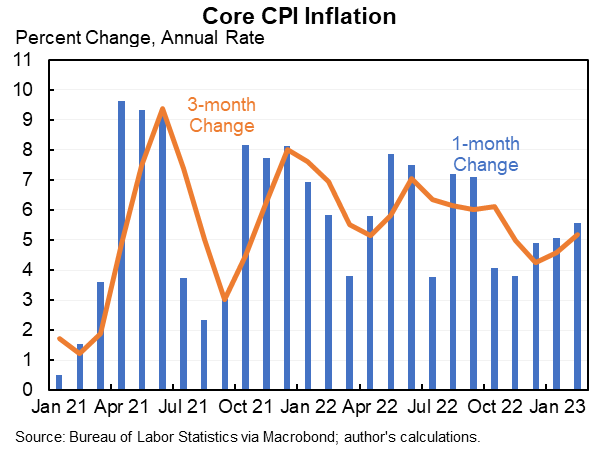

Looking at Core CPI, inflation remains stubbornly sticky. This month’s annualized core inflation is still above 5% and rising vs previous months.

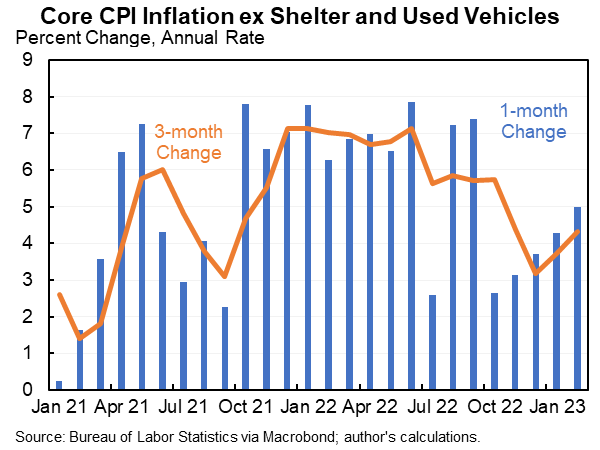

Looking at Supercore CPI, removing shelter and used vehicles, it has increased four straight months.

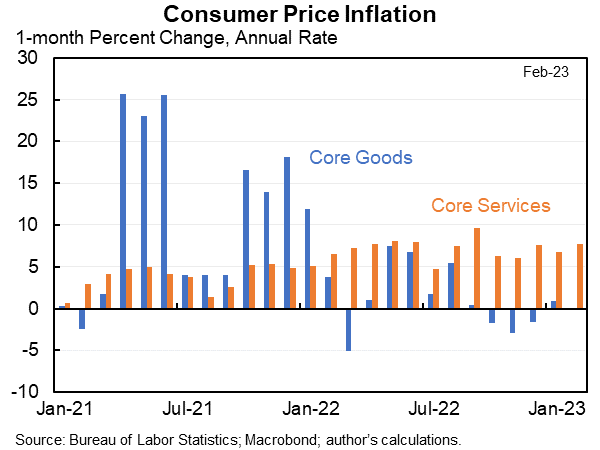

Inflation has steadily shifted from goods to services. Services inflation are expected to be stickier.

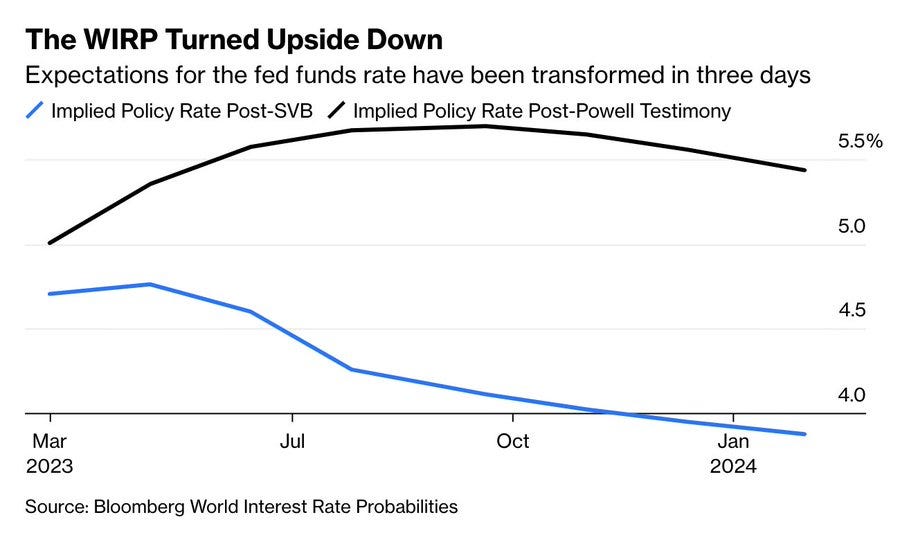

Now we are in an interesting situation. Due to the bank failures, market is now pricing in interest rate cuts but inflation looks sticky. This can be interpreted as:

1. A few cuts by end of year.

2. The average of rates staying course and something breaking, requiring emergency rate cuts (think Covid rate cuts).

There is a divergence between the financial economy and the real economy. Real economy is running hot but the financial economy is fragile and might not be able to stomach rates at these levels. This leaves us with two options:

Stop hiking, roll the dice and hope we’ve done enough that inflation will slowly decline

Powell surprises the market and continues hiking to kill inflation

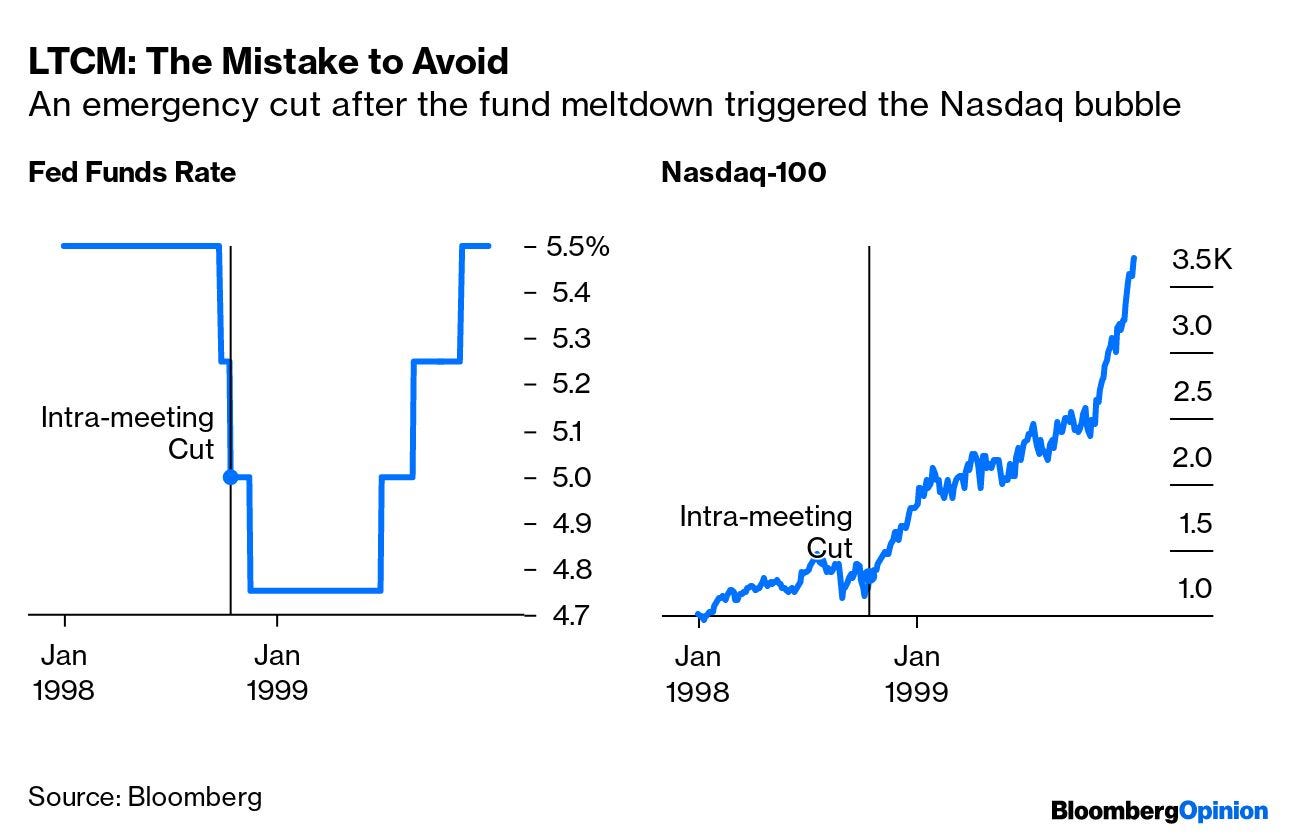

Let’s hope this is not a mistake like LTCM in 1998.

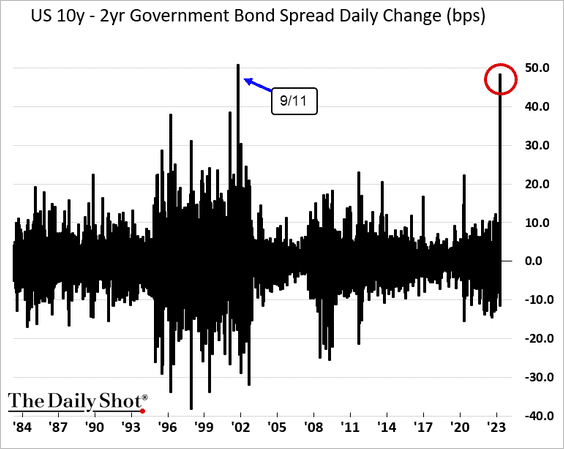

The Treasury curve has steepened sharply in response to the collapsing banks.

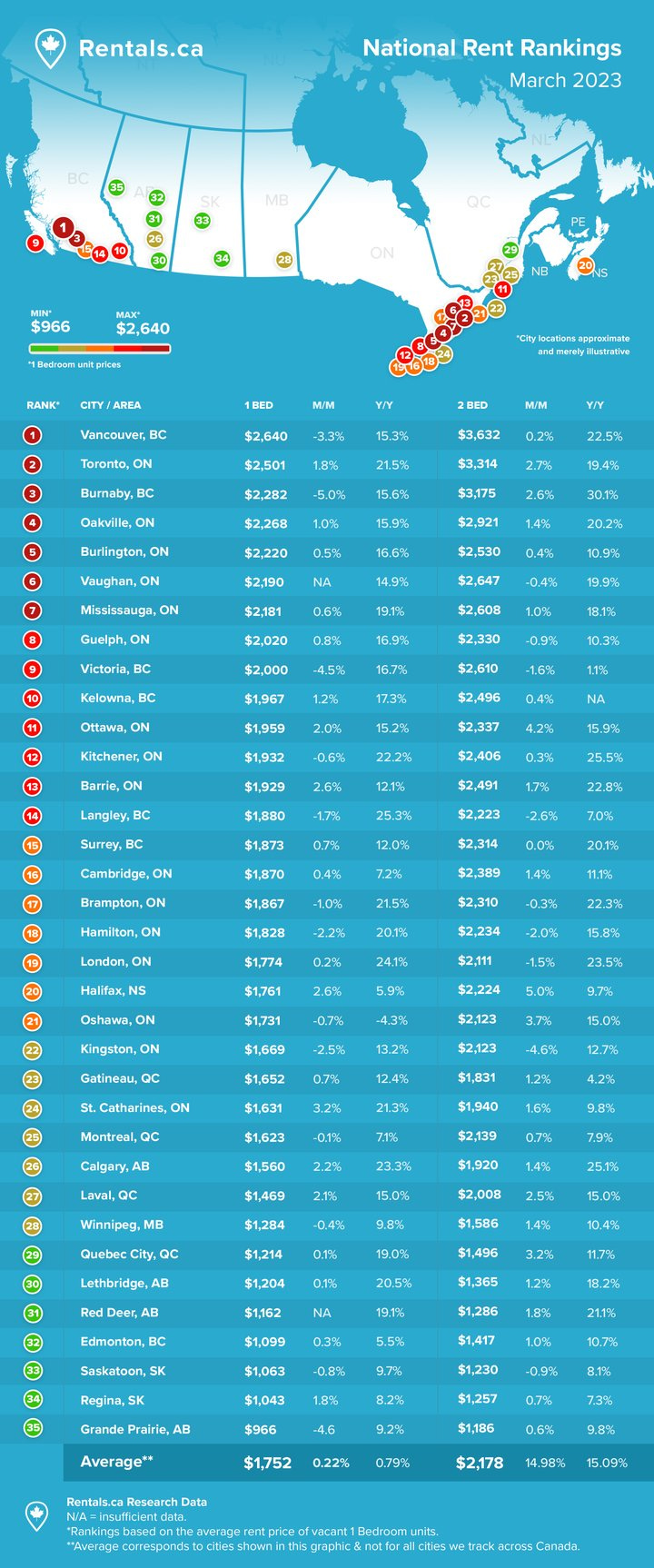

Rents are not showing any signs of easing. Insane YoY numbers. This is a problem and a divergence from the US. Wages are not keeping up with these increases, this will flow through to lost purchasing power for renters.

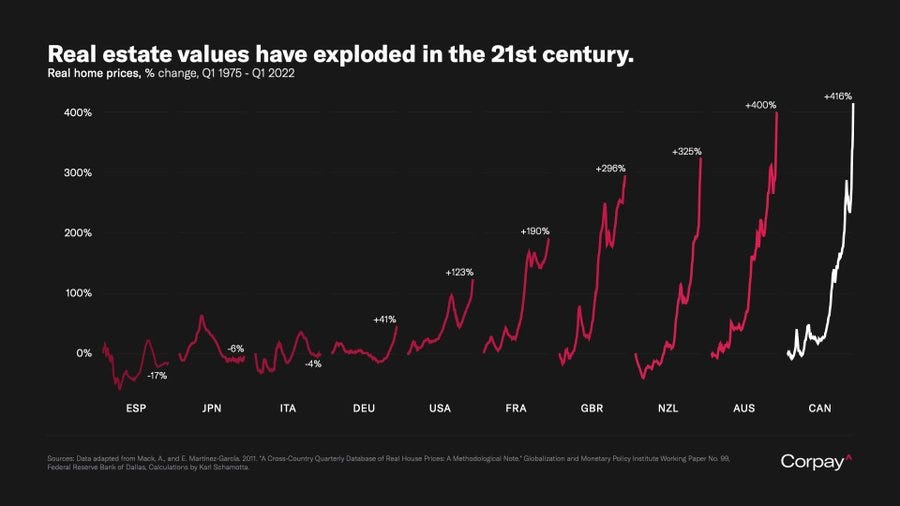

Canadian housing has gone on a gangbusters run since 1975. Leader of the free world.

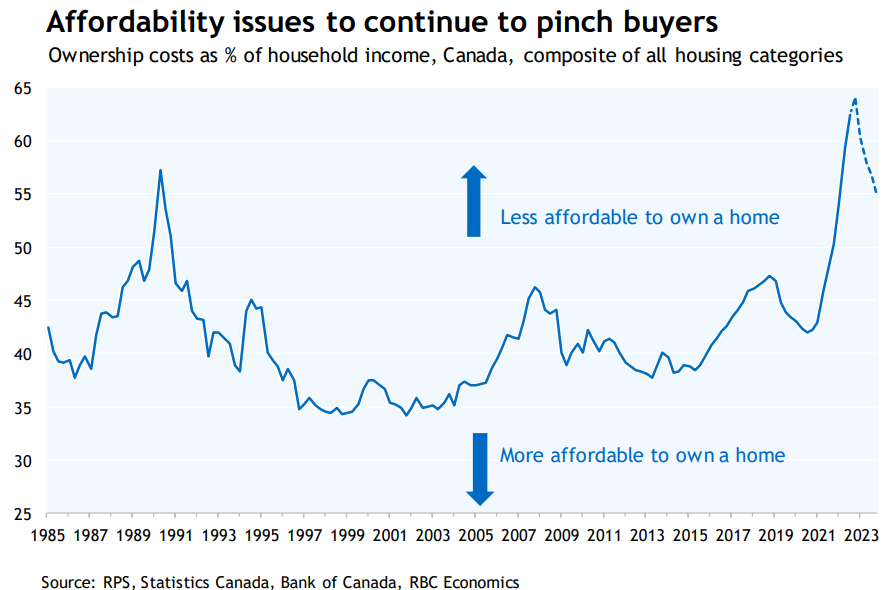

It has gotten to a point of unsustainability, ownership costs as a % of household income are at the highest point in history. Mortgage rates will ease or housing prices will fall, it is hard to believe the current situation is sustainable.

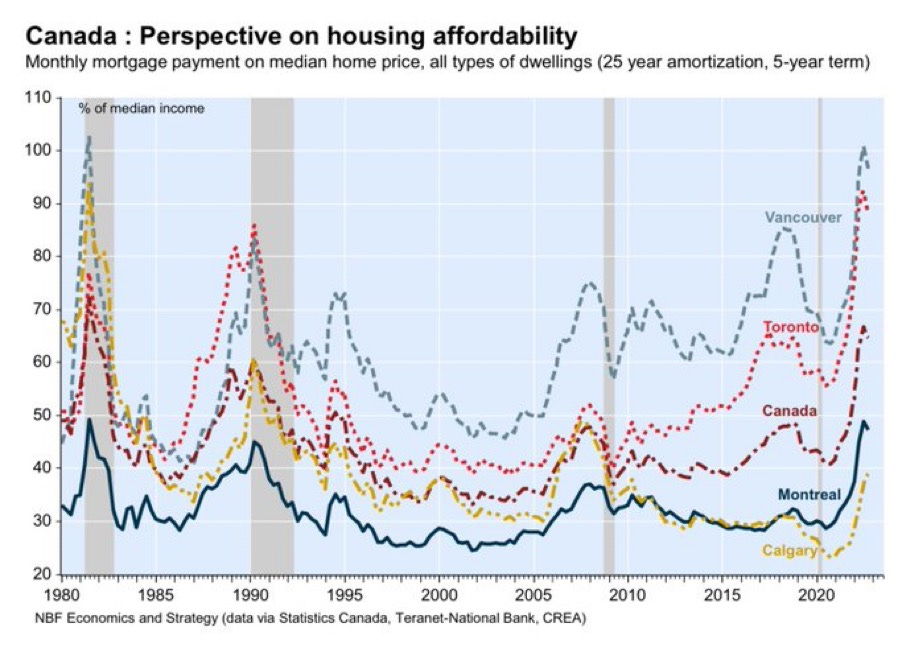

Breaking out Toronto and Vancouver, it is even more insane. Monthly mortgage costs on a home consume over 90% of the median income in those cities. This is only applicable to new buyers, buying at these prices and current mortgage rates.

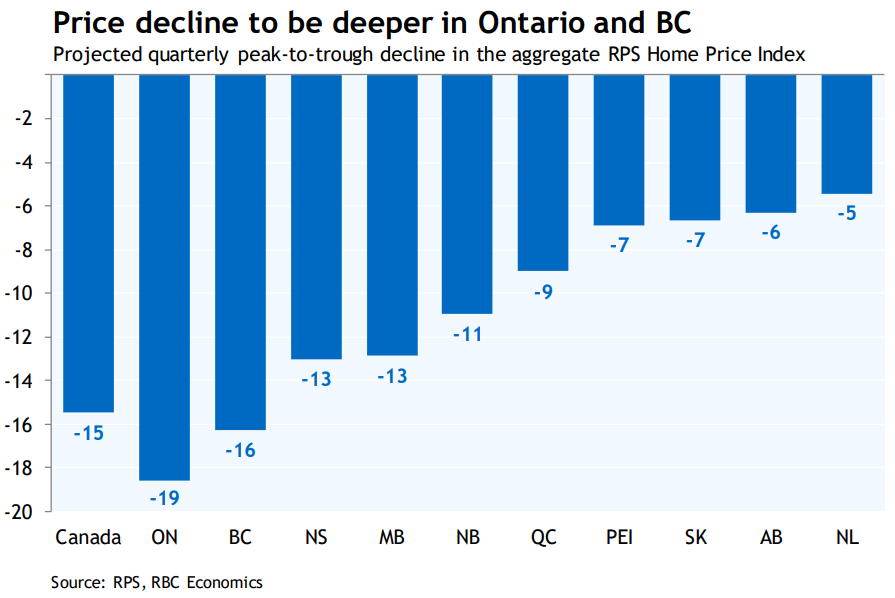

Ontario and BC have led the country in terms of price declines.

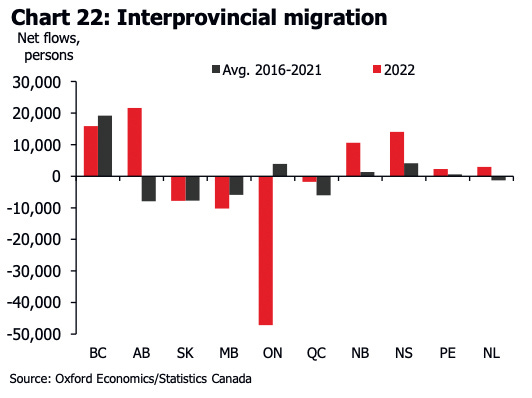

Eyewatering housing prices are causing people to leave Ontario.

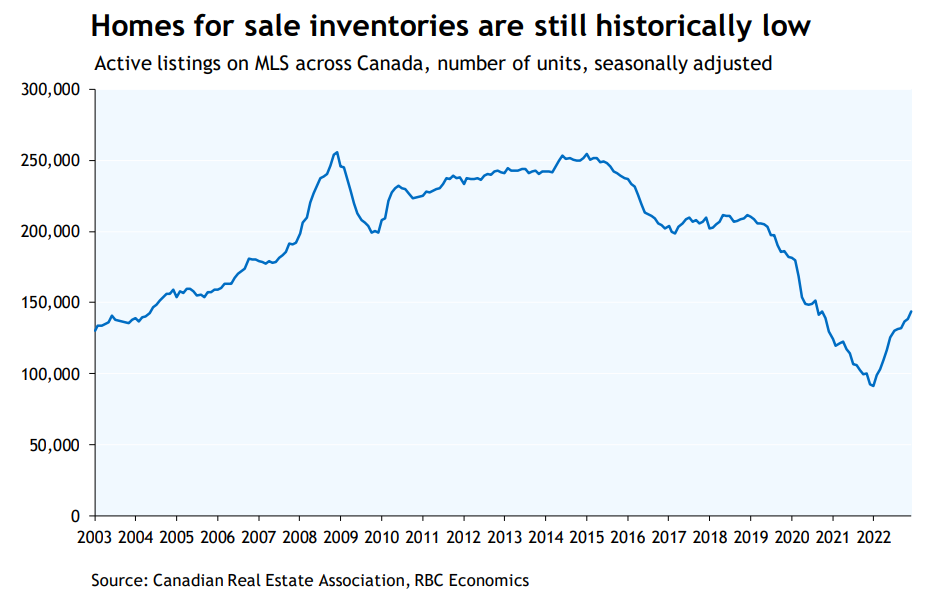

Housing supply remains incredibly tight, which is supportive for prices.

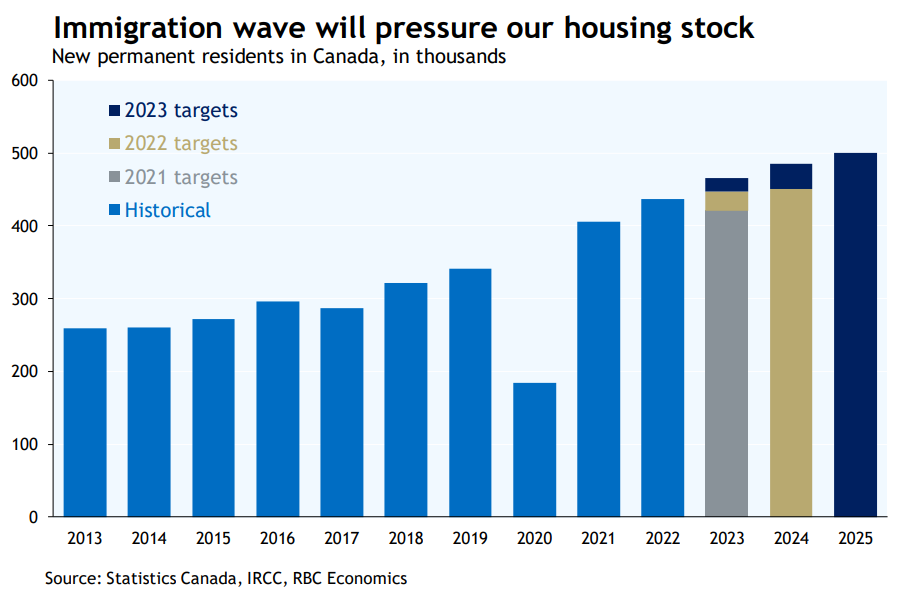

And immigration will continue to pressure housing prices if we aren’t building enough supply.