Daily Charts - Inflation and Interest Rates

If inflation subsides, the Fed will have their full toolkit available to them to prop up asset prices. If inflation is sticky, it will wreck havoc on asset markets. Only time will tell what we get.

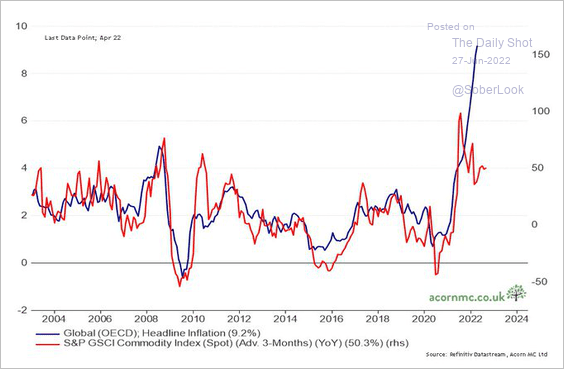

Commodity prices have diverged from inflation. Hopefully, this relieves some pressure.

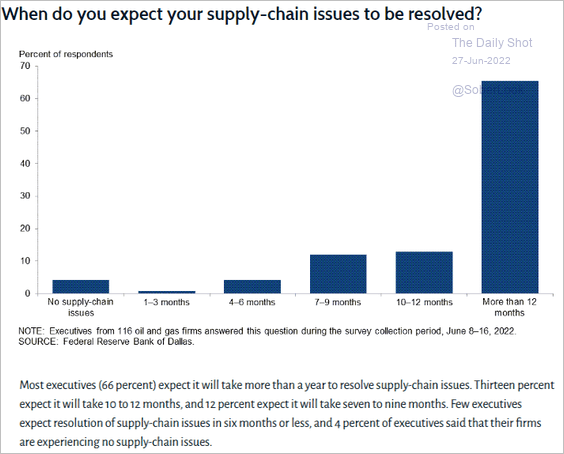

Businesses still expect supply chain issues to take more than a year to resolve themselves, not helping the inflation equation.

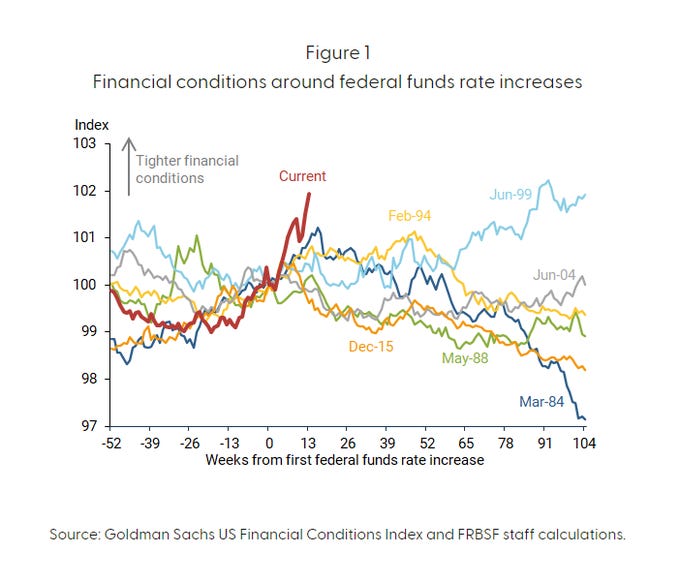

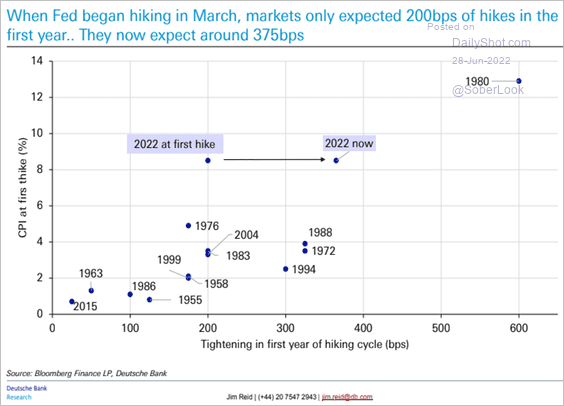

The speed with which financial conditions have tightened really sets this period apart from past hiking cycles.

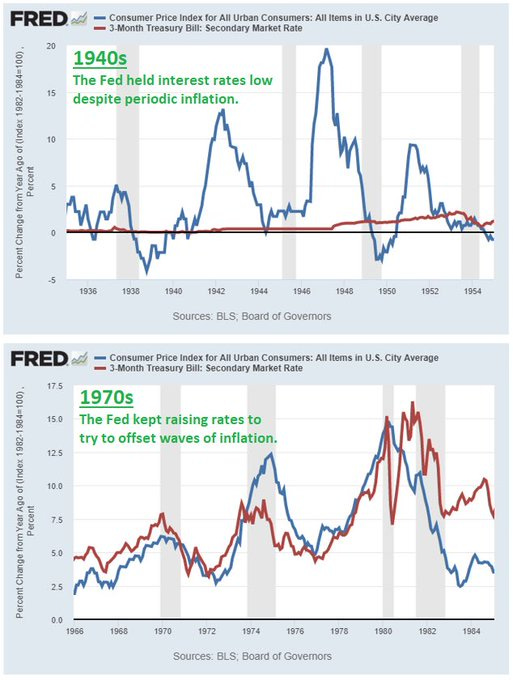

Exploring previous hiking cycles…

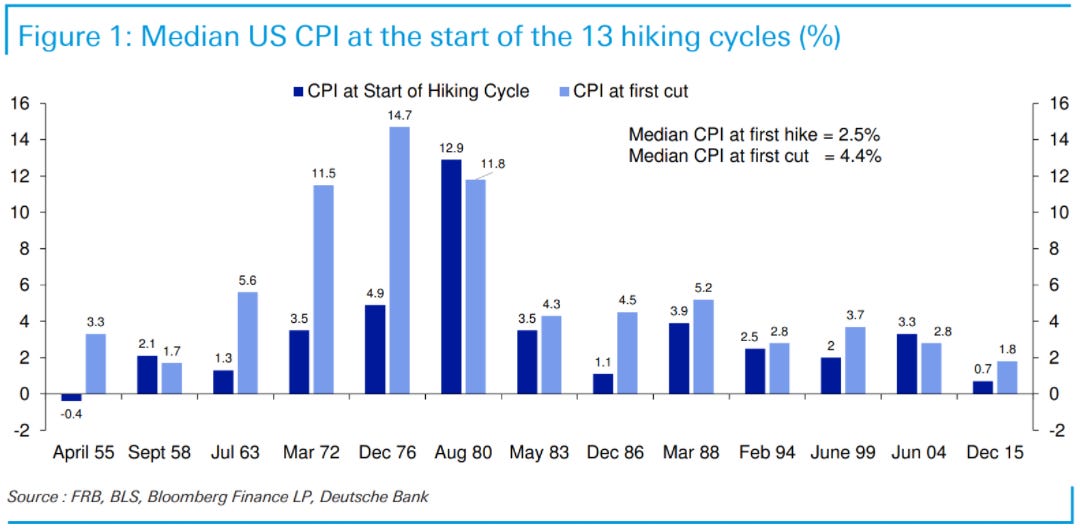

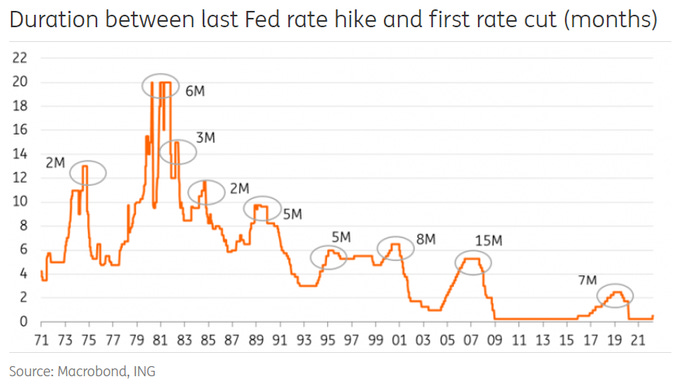

History shows that it’s quite plausible for peak rates to stay in force only for a matter of months, and for easing to start while inflation is still quite high. The only times the Fed waited for inflation to drop below 2% before cutting were in 1959, and again in the different world of 2019. A few more stats below:

Median CPI at the first hike was “only” 2.5% so the Fed has always tried to lean against inflation relatively early in the upswing. However, this time round they didn’t hike until we hit 8.5%.

Median CPI at the first cut was a still high 4.4%. This supports the notion that in normal times the Fed looks ahead rather than at the current level.

The median time from last hike to first cut was only 4 months

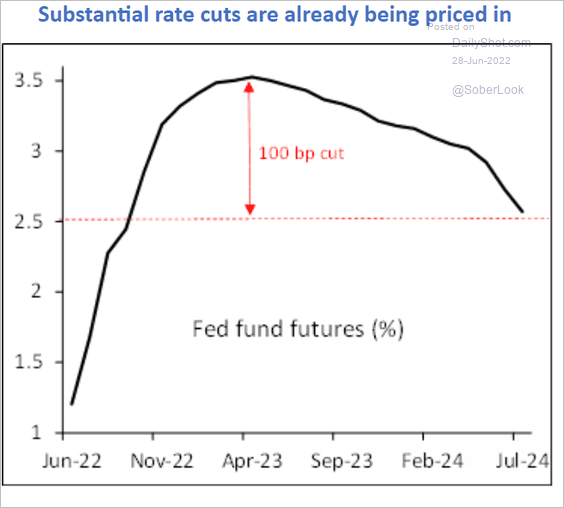

Historically, once the Fed is comfortable that inflation is trending in the right direction, it starts easing.

Market has priced in an extra 1.75% of hikes since the first rate hike in March.

Market has been rallying, looking past the hikes and already thinking about rate cuts.

There is a historical precedent in the 1940s of an inflationary period that subsided without aggressive hikes.

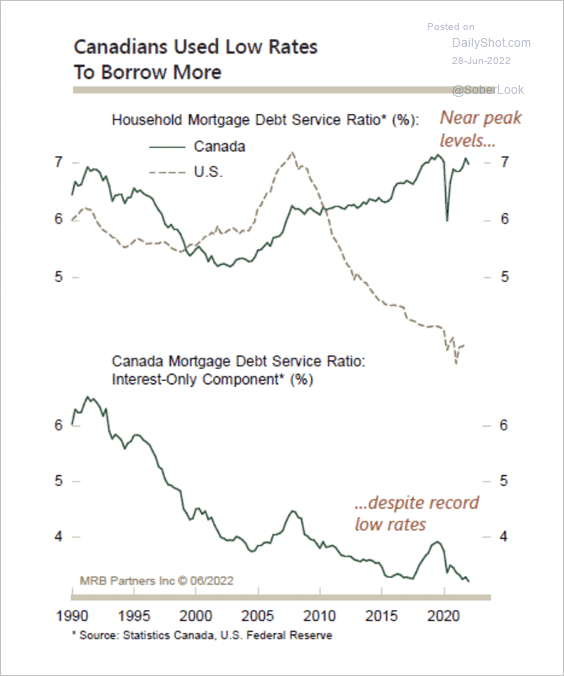

Canadians are much more burdened with debt payments than Americans.

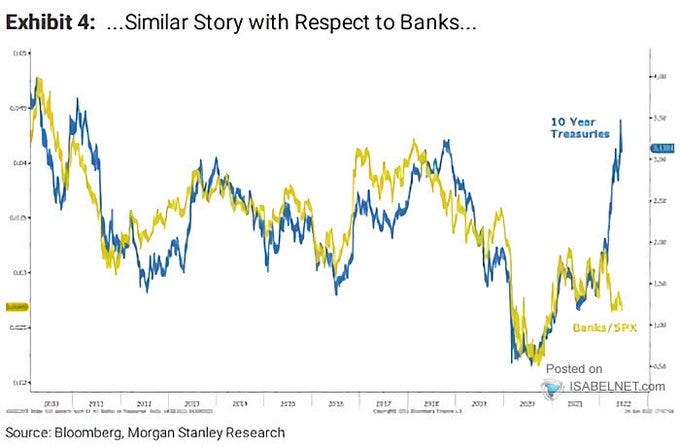

Banks have diverged from the 10Y yield. Signaling a potential weakening economy.

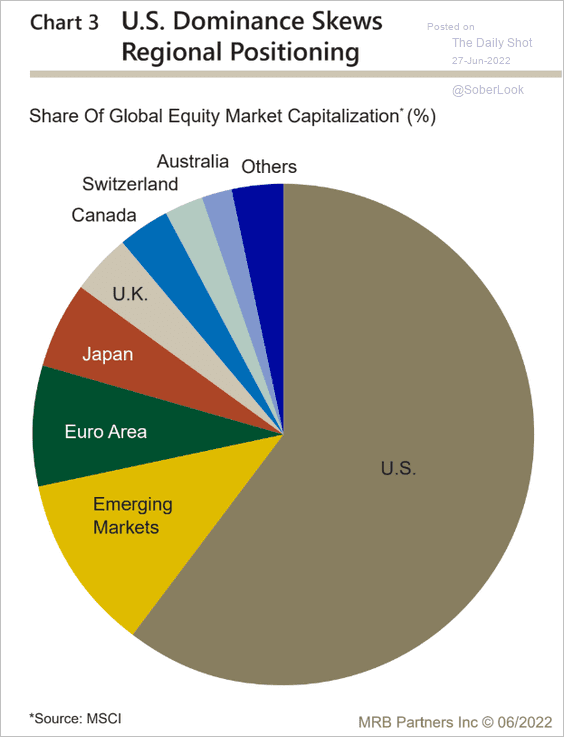

US dominates the share of global market capitalization. It is historically elevated and the US only represents 16% of global GDP.

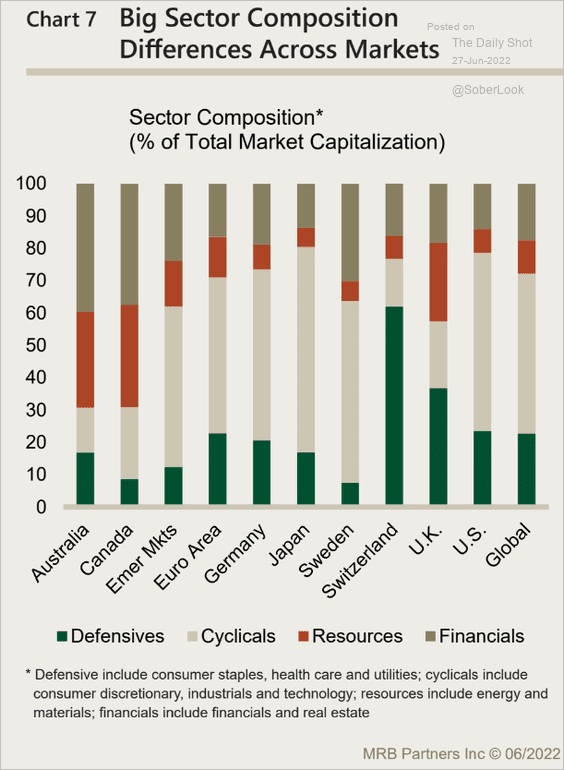

Aussie and Canadian resource based economies mirror each other from an index composition perspective. We are underweight healthcare and tech vs the global index.

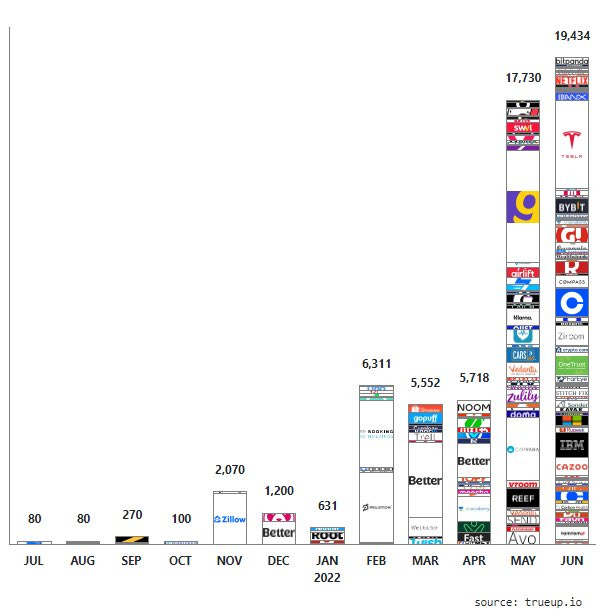

The Tech layoffs continue to stack up.

The current state of the energy crisis in Europe.