Daily Charts - Inflation, Education & Canada

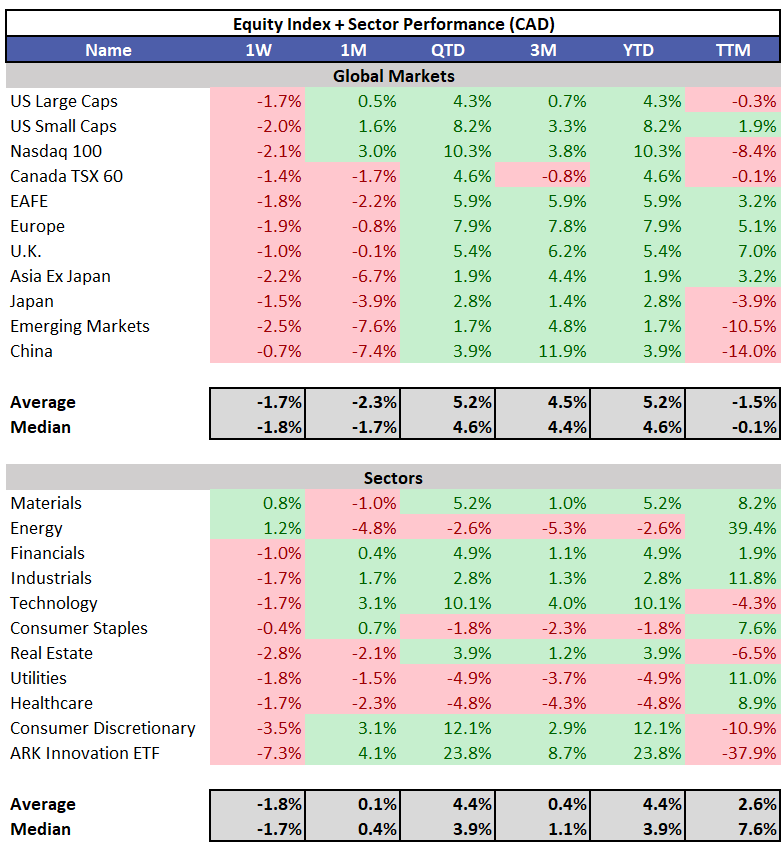

Markets continued to price in the reality that rates will be higher for longer. It was the worst week for the S&P 500 since mid December. Energy and Materials are the only sectors that posted positive returns WoW.

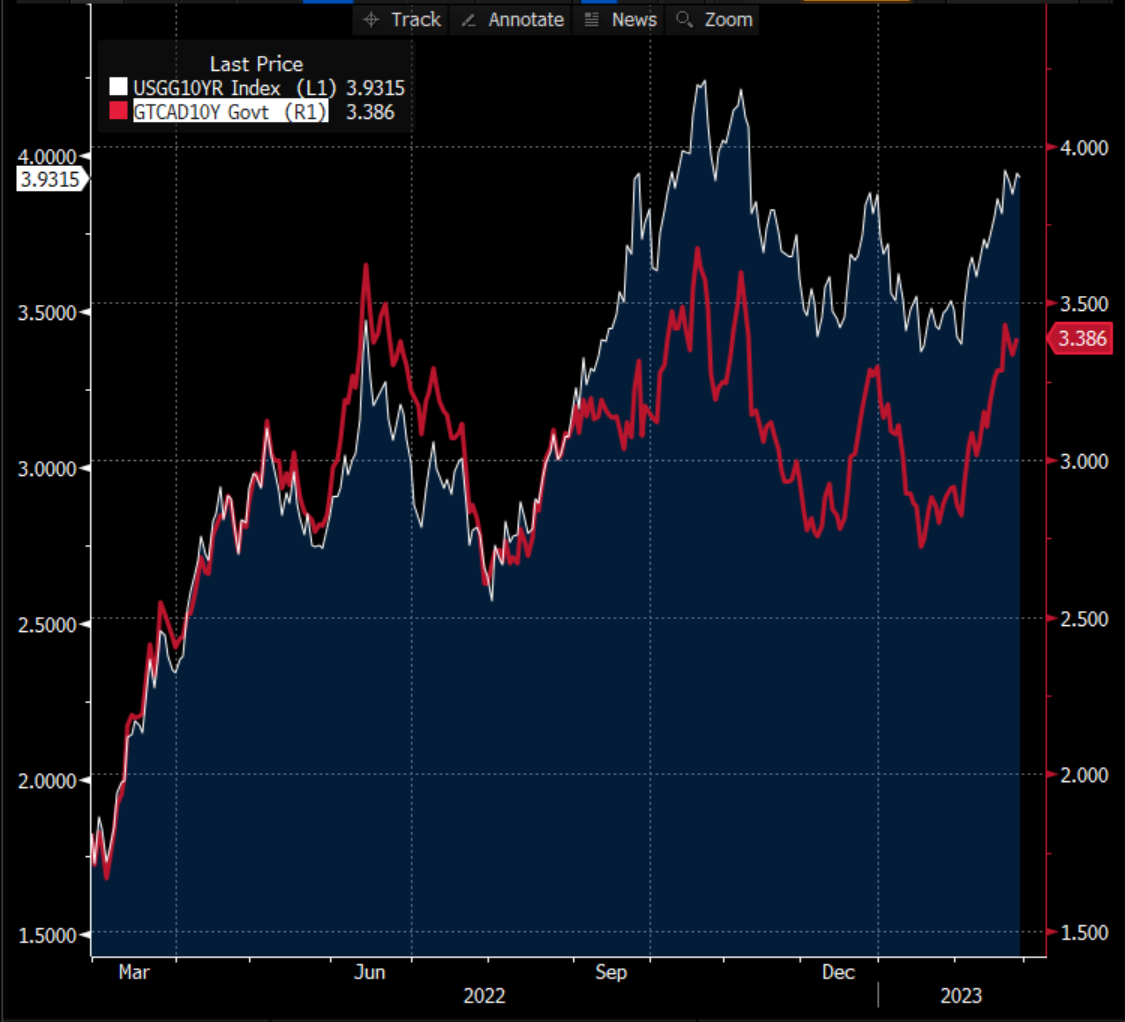

10Y yields were up low double digits in both Canada and the US. Yields are now higher in Canada and the US than we were to start the year.

Rising yields provided a continued headwind for fixed income investors. USD advanced 1% WoW against CAD. Precious metals and crypto sold off.

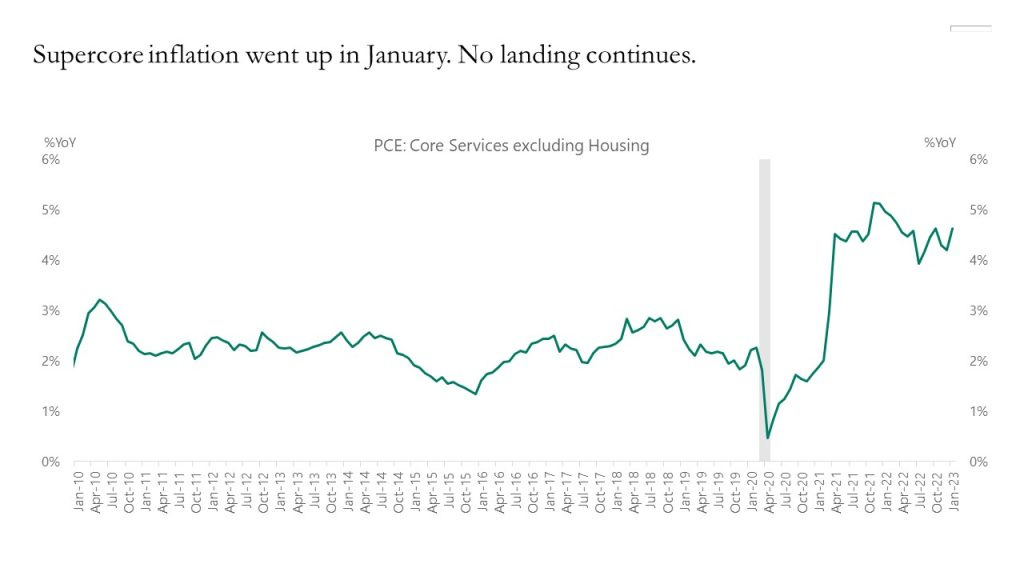

The PCE inflation data that came out on Friday, showed core inflation excluding housing increased to 4.6% in January.

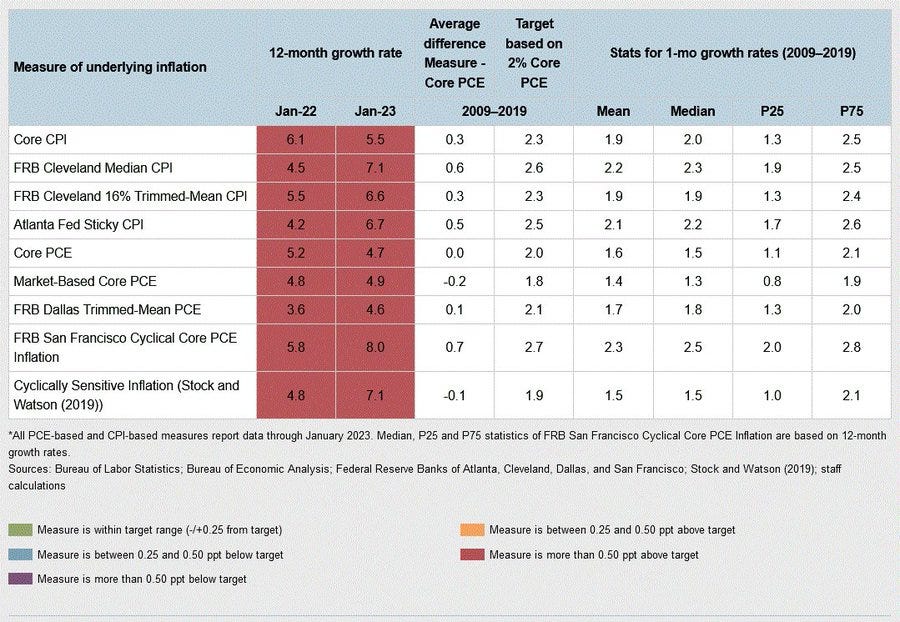

Dreams of a quick Fed pivot are quickly fading. 7 out of 9 important inflation measures are now higher than a year ago.

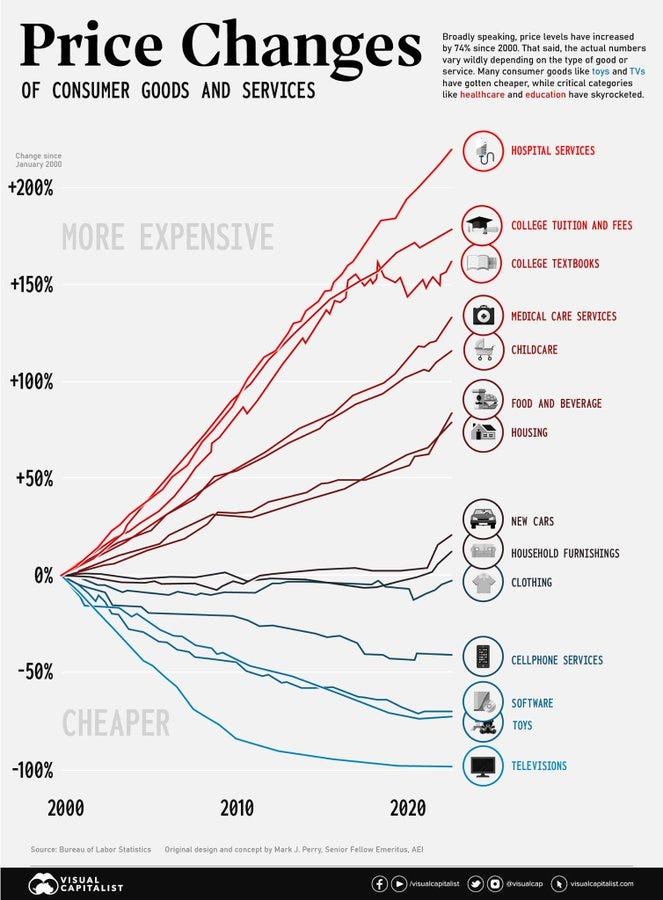

What do many of the categories in red have in common? Government intervention. Healthcare and Education prices have skyrocketed at a much faster rate than CPI.

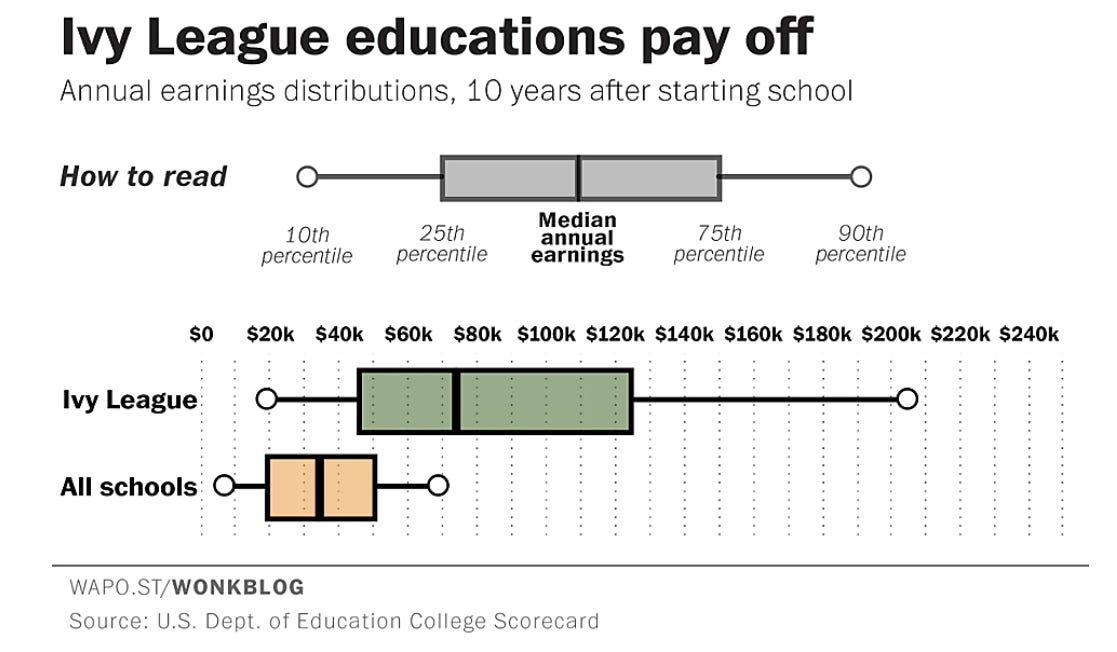

Ben Hunt wrote a great article (you may need to go incognito to view the article) on rising education costs, frivolous spending and how the US education system is creating a caste system.

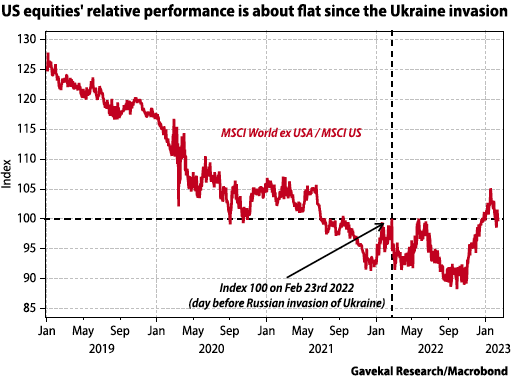

It’s been a year since Russia started a war in Ukraine. US assets outperformed after the invasion, but have now given those gains back.

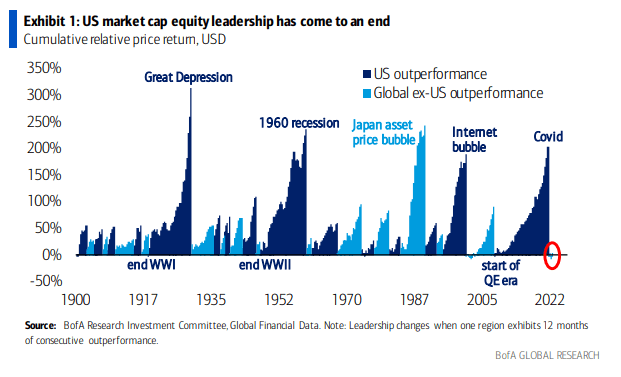

Signs that US outperformance could one day reverse

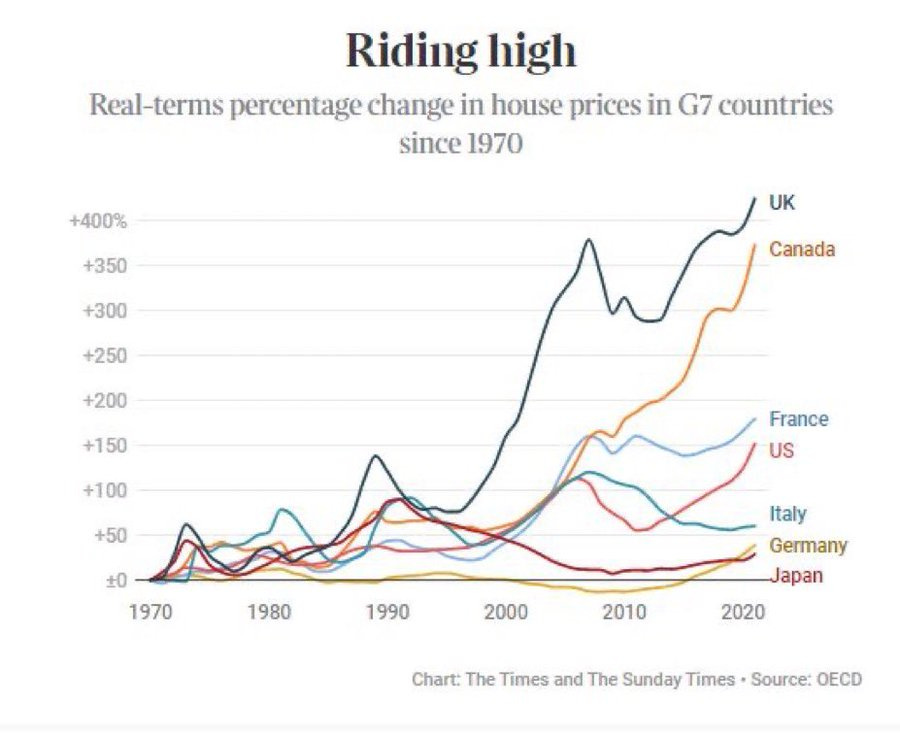

The new millennium marked a turning point for Canadian Real Estate and Canada was one of the few markets that didn’t correct in 2008.

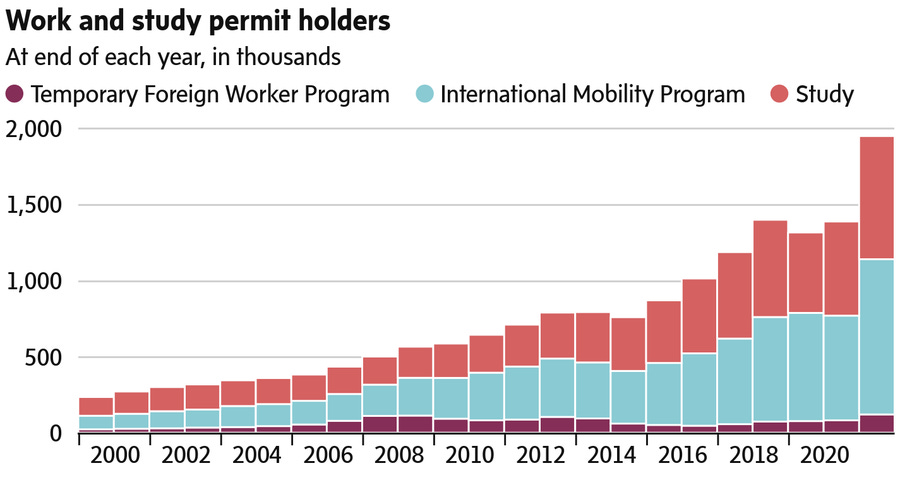

At the end of 2022, there were nearly 2M people in Canada with temporary work or study permits, an increase of 560K (40%) from a year earlier. This is on top of 400k permanent residence welcomed. Putting immense pressure on Canadian housing.

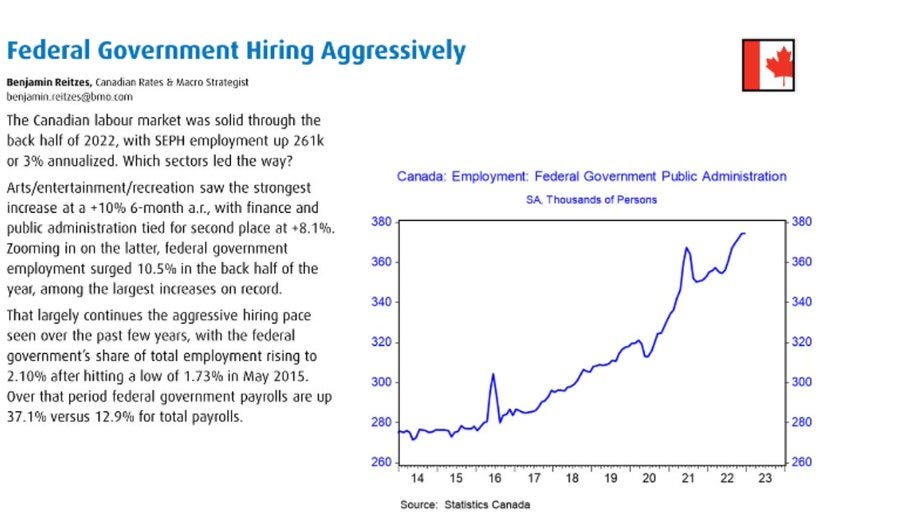

The Canadian Federal Government is contributing to a tight labour market. Government headcount up 30% in 5 years.

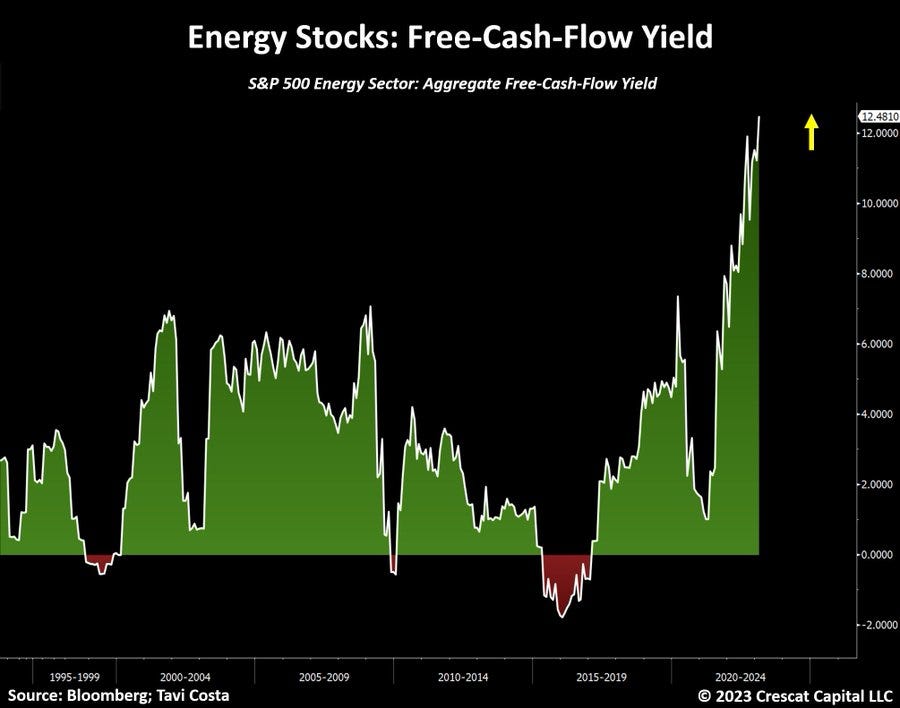

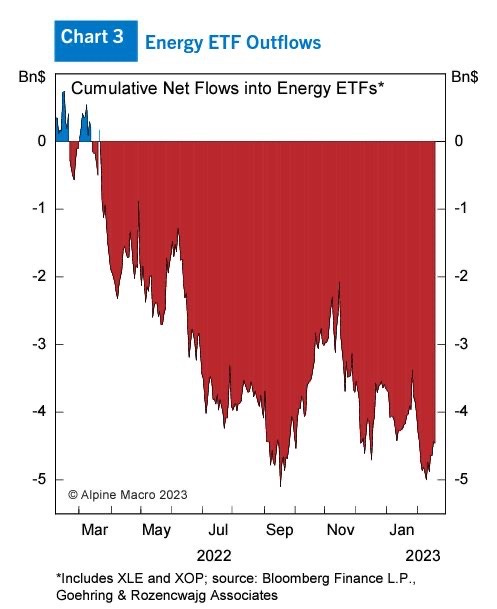

Energy stocks are again trading at their cheapest level in history on a free-cash-flow yield basis.

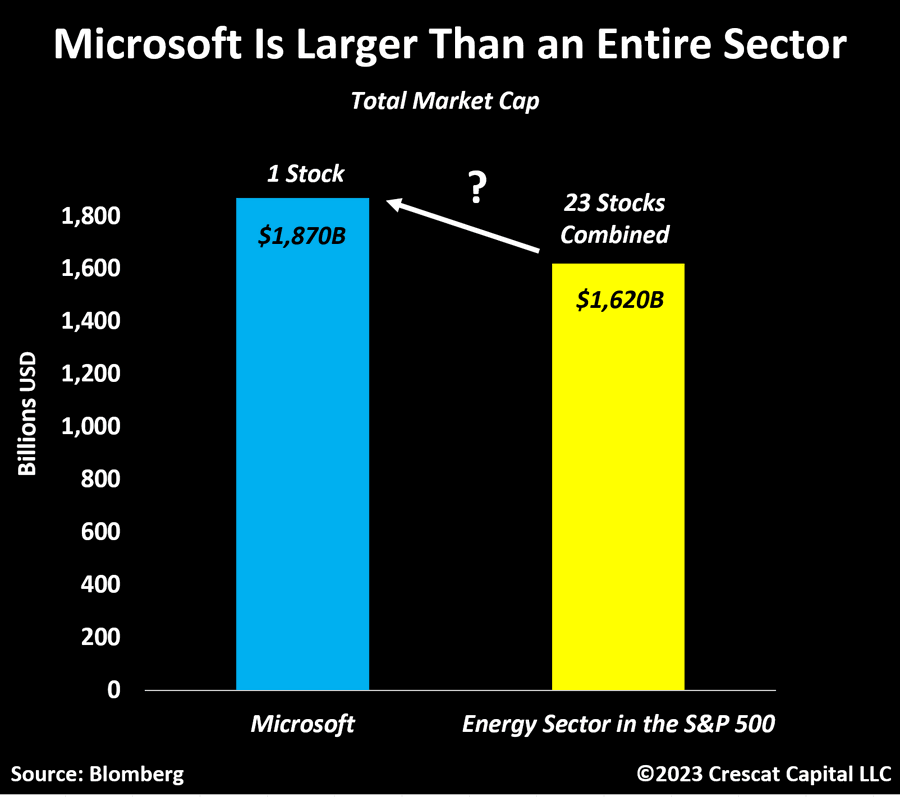

Investors would rather invest in tech.

The sector is still unloved. The energy sector represents about ~11% of S&P 500 profits but only 5% of market weighting.

This is pretty cool.

s