Daily Charts - Inflation, Recessions & BTC

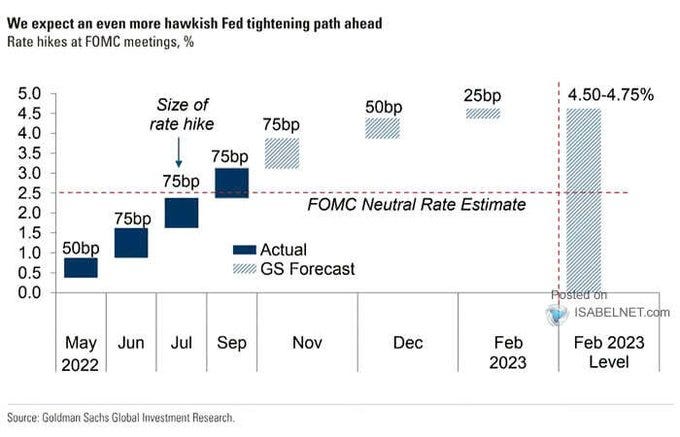

Goldman expects another 150 bps of hikes before the Fed hits pause.

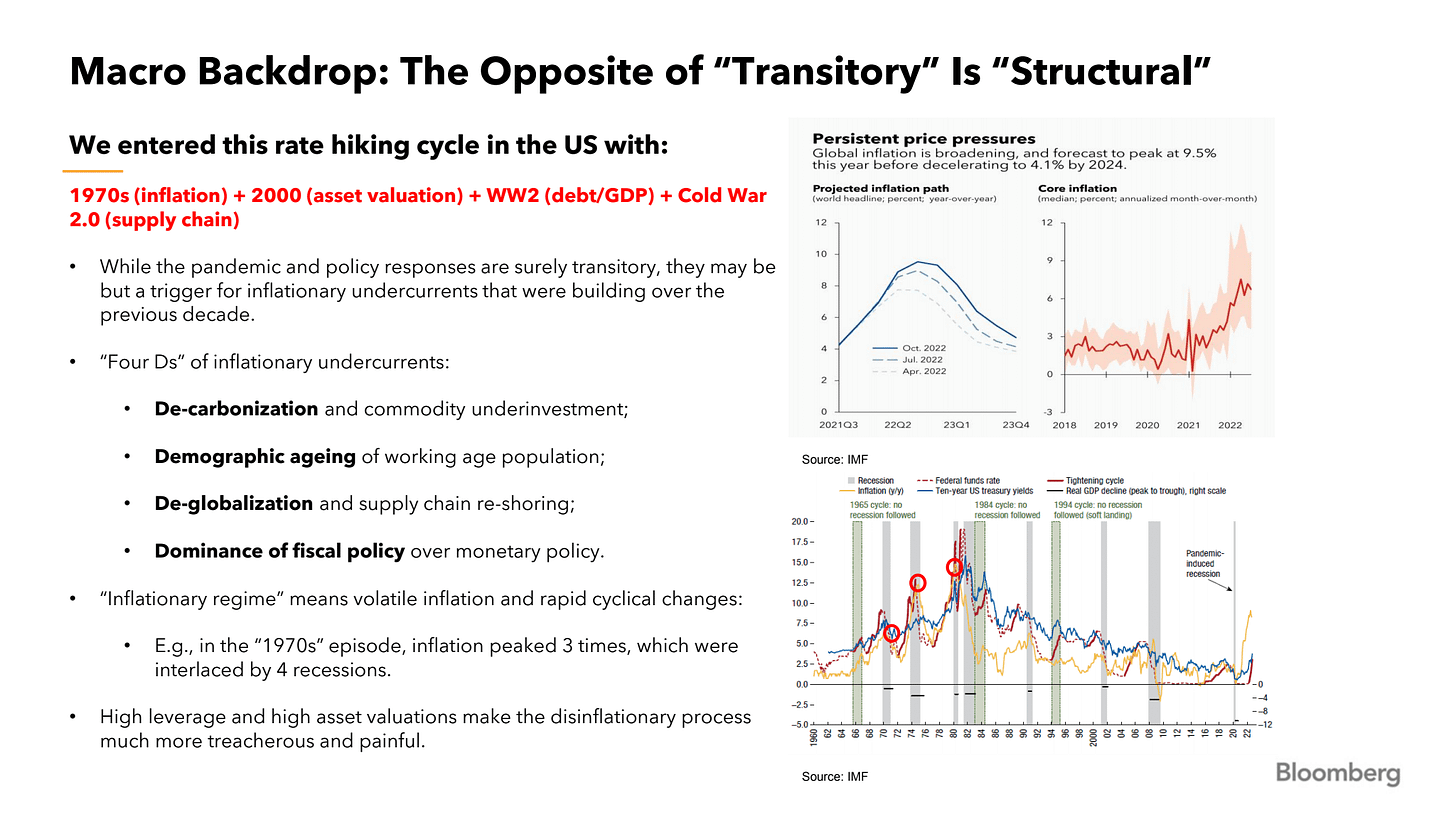

Good deck looking at how various assets perform in inflationary environments. He flags the line below, which highlights how precarious our situation is:

1970s (inflation) + 2000 (asset valuation) + WW2 (debt/GDP) + Cold War2.0 (supply chain)

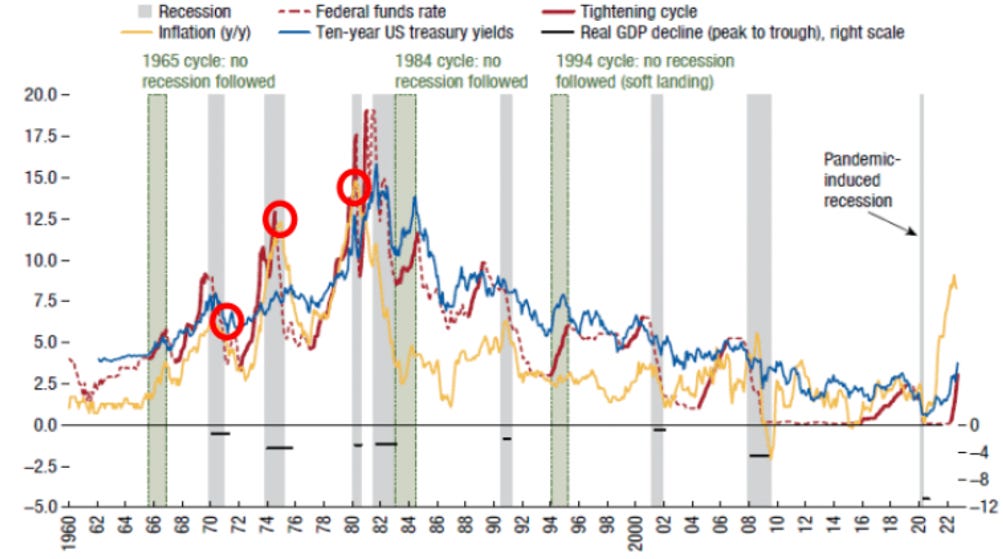

In the 70s they had to bring rates above inflation to kill it. Therefore, we shouldn’t be shocked if hiking to 4.75% isn’t enough to cool inflation. On the other hand, we have much higher levels of debt, that acts as a multiplier on the effect of rate hikes.

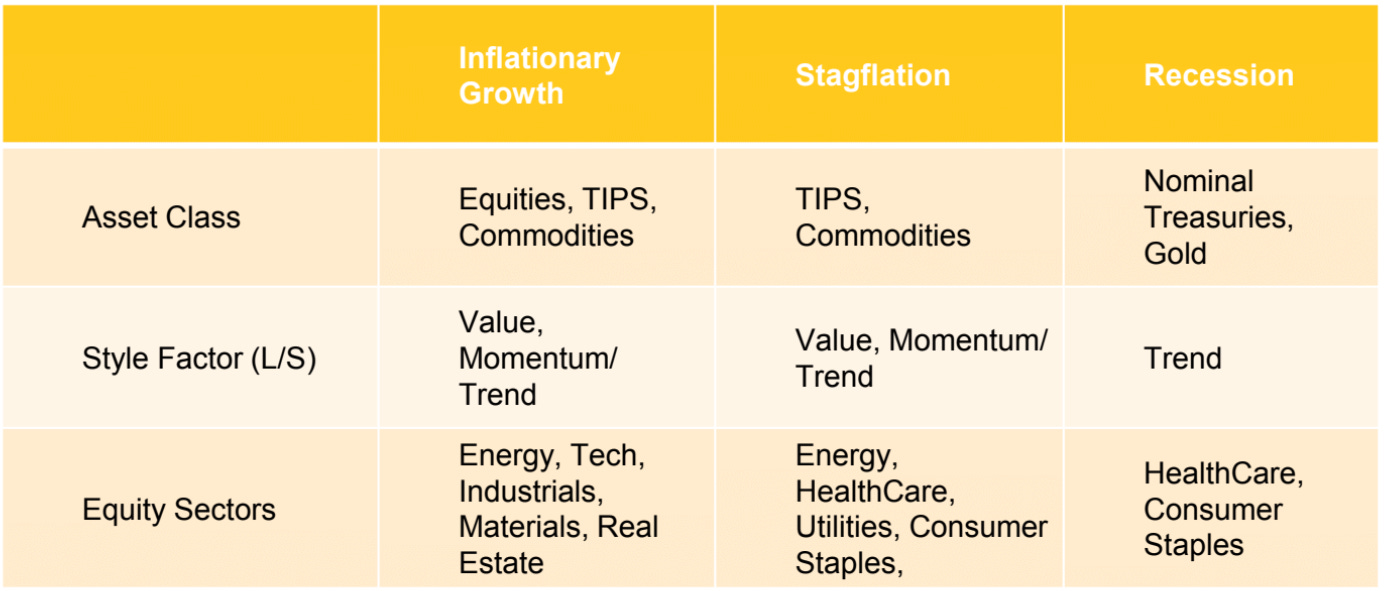

These are the specific assets that have historically performed well in inflationary environments. Commodities and TIPS are under owned.

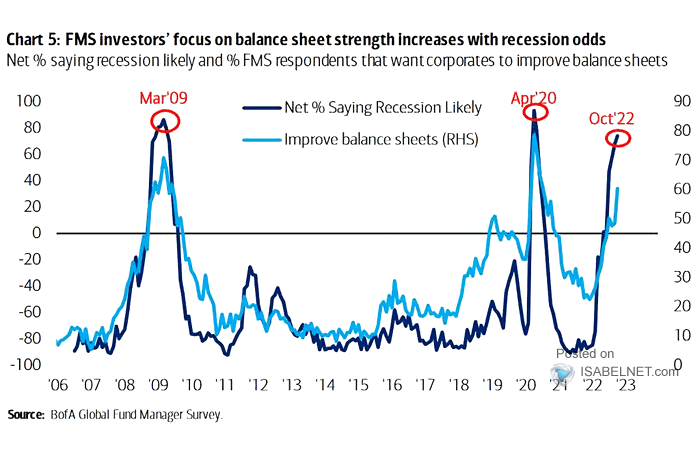

About 80% of fund managers think a recession is likely in the next 12 months.

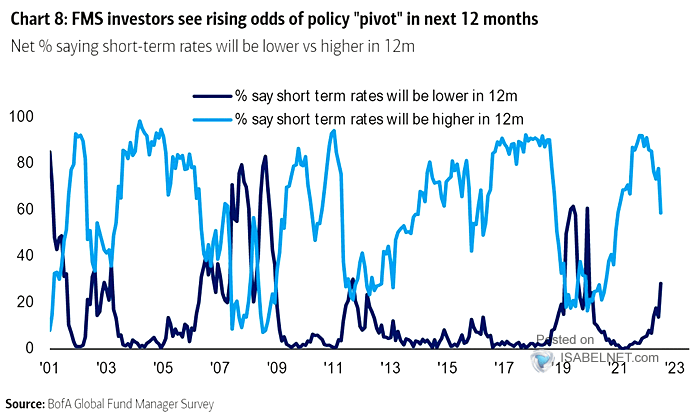

Fund managers are split on whether short term rates will be higher or lower in the next 12 months. The majority still think higher.

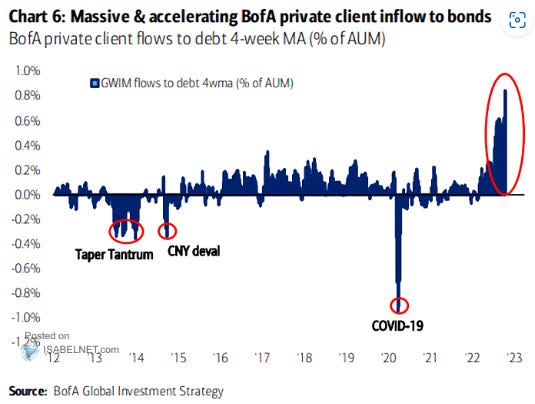

Private clients are increasing their allocation to bonds. This is probably a function of investors capitulating on “stocks only go up”. If inflation remains an issue, bonds are not attractive.

With the news in China over the weekend, the Hang Seng index that tracks Hong Kong stocks is back at levels seen in 2000.

You have to go back to the Great Financial Crisis (2009) to find a September with fewer loaded import containers at the Port of Los Angeles. A more than 25% decline from the previous 2 years.

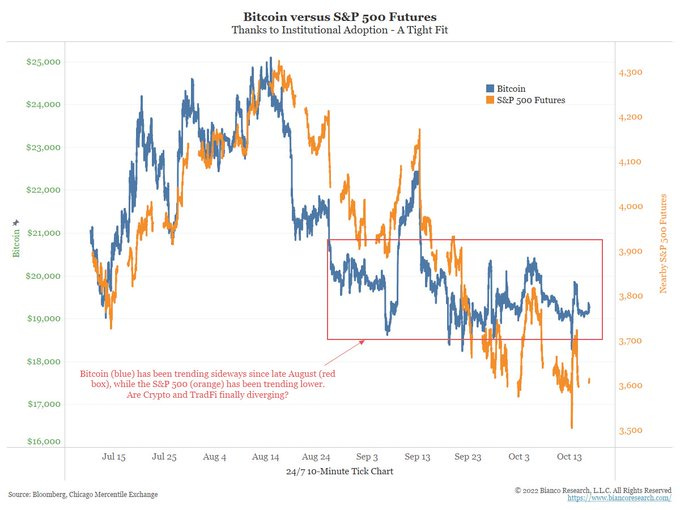

Since late August, Bitcoin has begun to diverge from the S&P 500. Bitcoin was flat through September, while the S&P 500 was down.

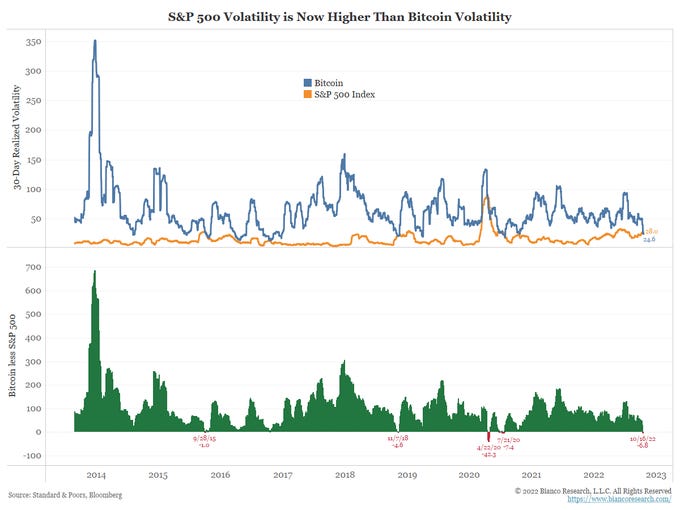

Bitcoin’s 30-day realized volatility has fallen below that of the S&P 500. This is only the fourth or fifth time since 2013 that stocks have proven more volatile than Bitcoin. It does not last long. This is probably a function of the speculators/euphoria/gamblers being flushed out.

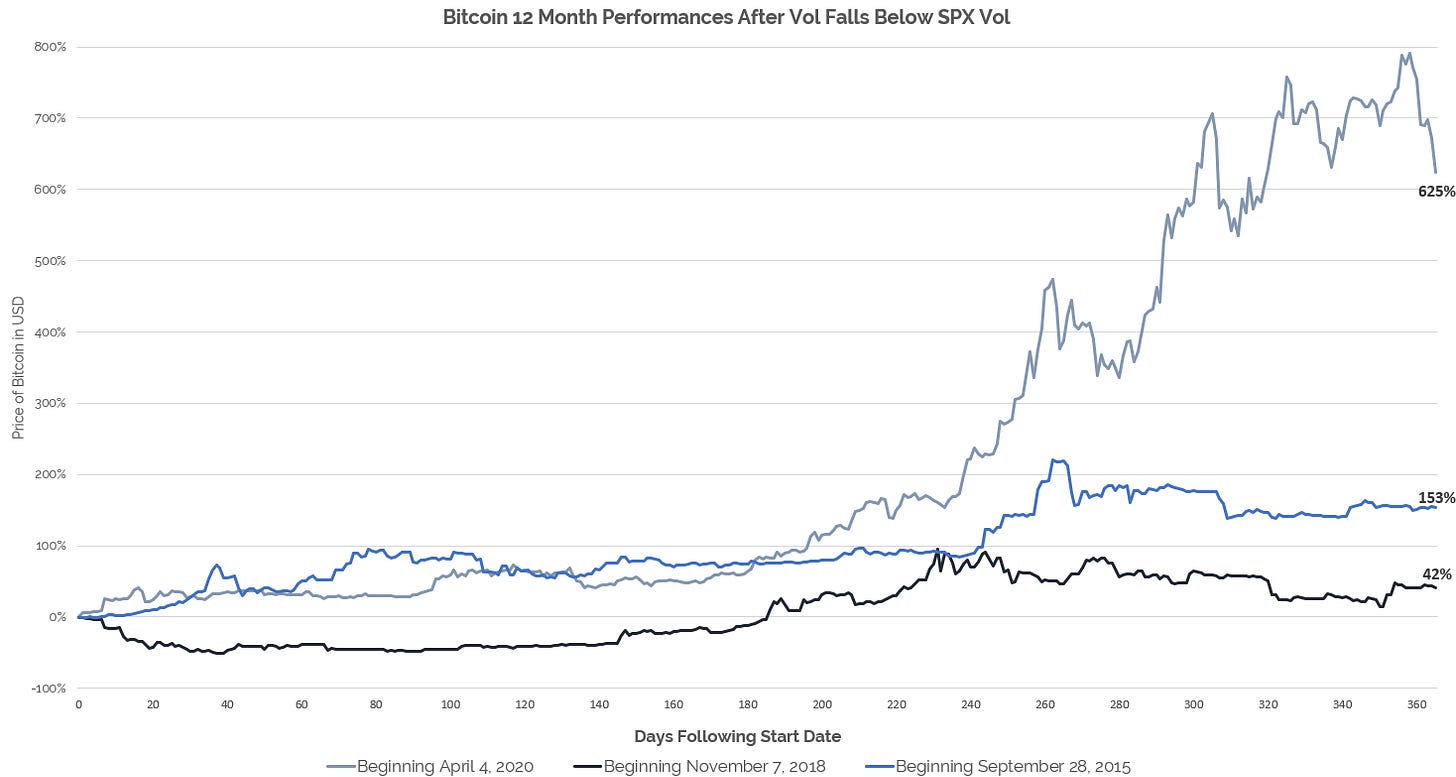

This is the 12 month forward performance from the points highlighted above. When this happened in 2018, Bitcoin still had another 50% to fall.

Maybe Twitter could use the cleaning off house Musk is threatening. They’ve almost doubled their headcount since 2018.

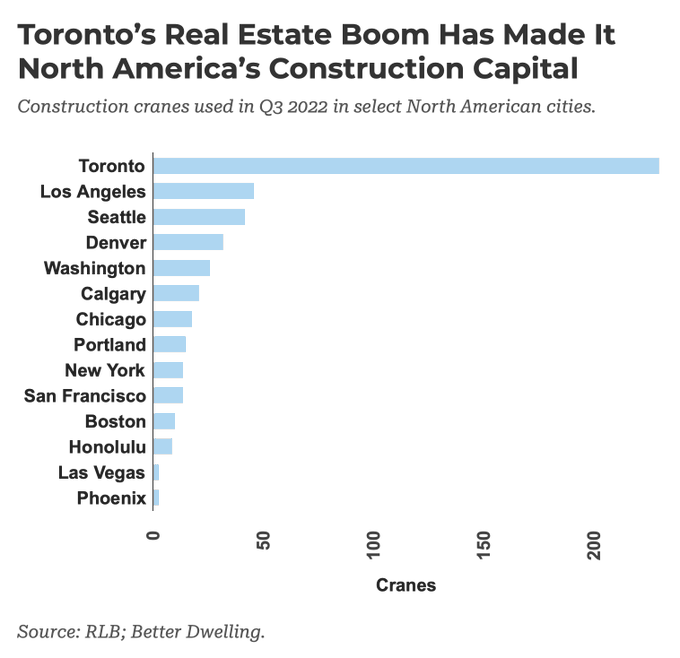

Toronto is building at unprecedented rates compared to the rest of North America.