Daily Charts - KKR: The Times They Are A-Changin’

Reviewing KKR’s Endowment and Foundation Survey: The Times They Are A-Changin’. It’s worth reading the summary to get the gist.

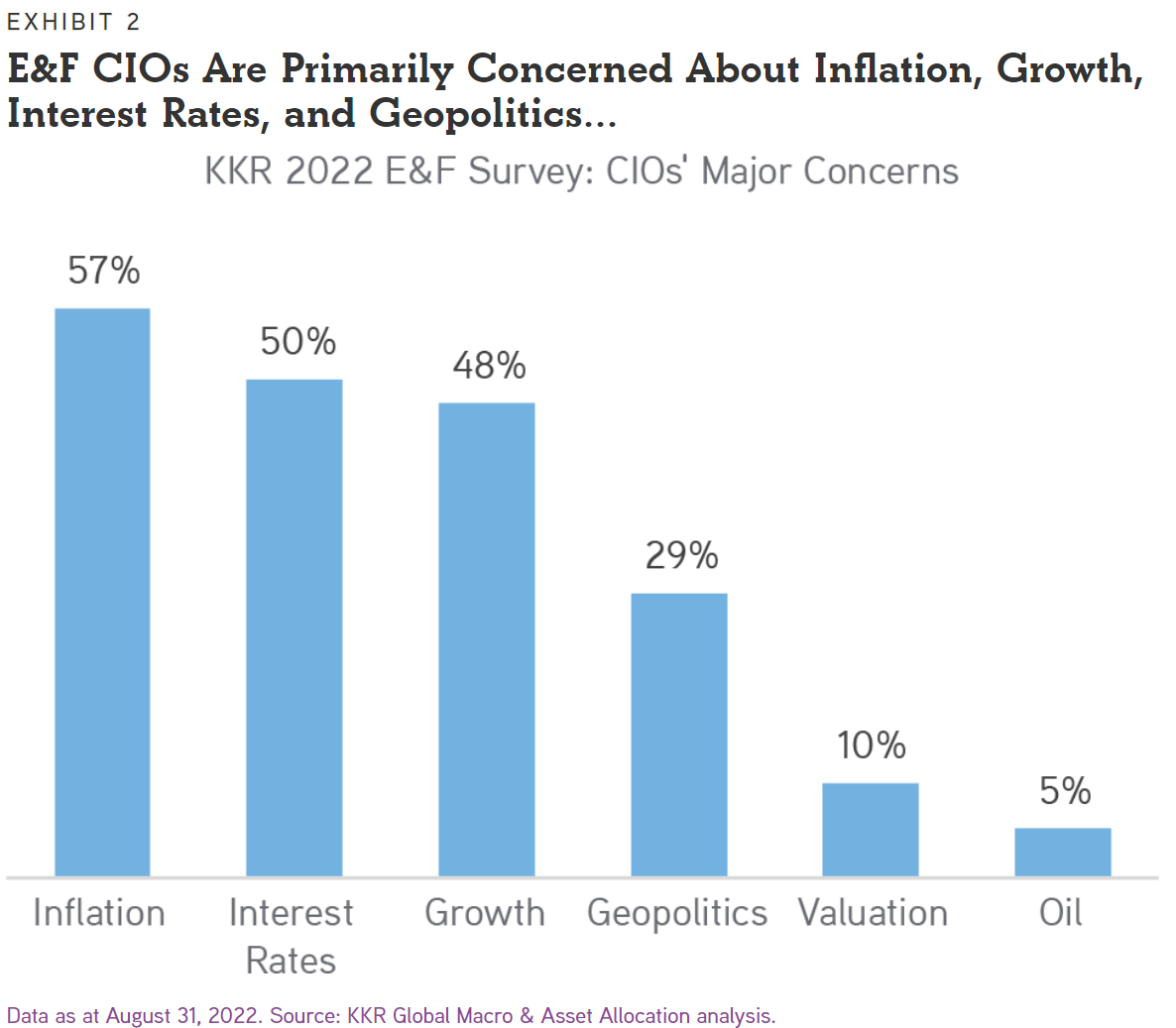

CIO’s are most worried about inflation and interest rates. They go hand in hand, no surprise here.

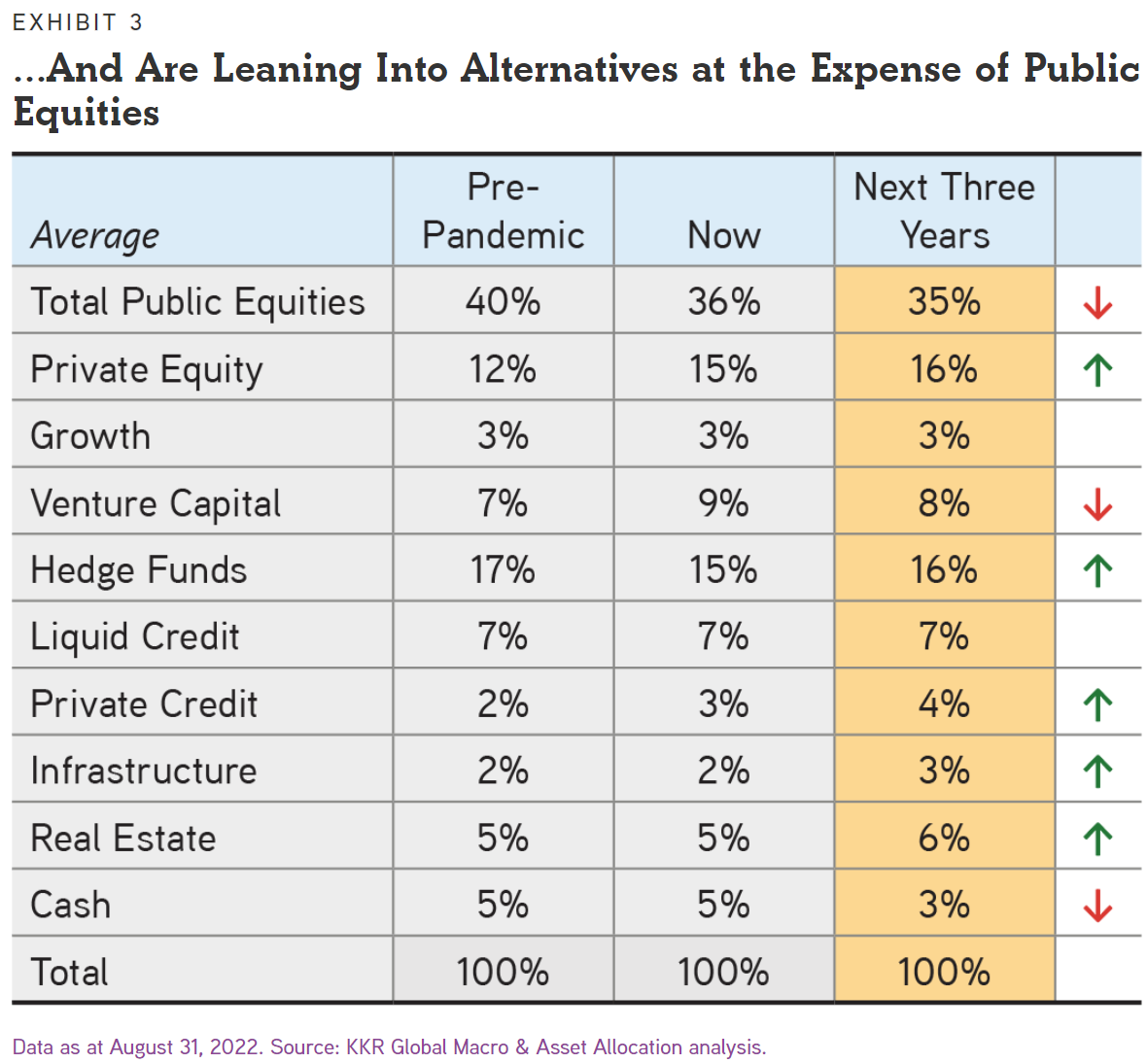

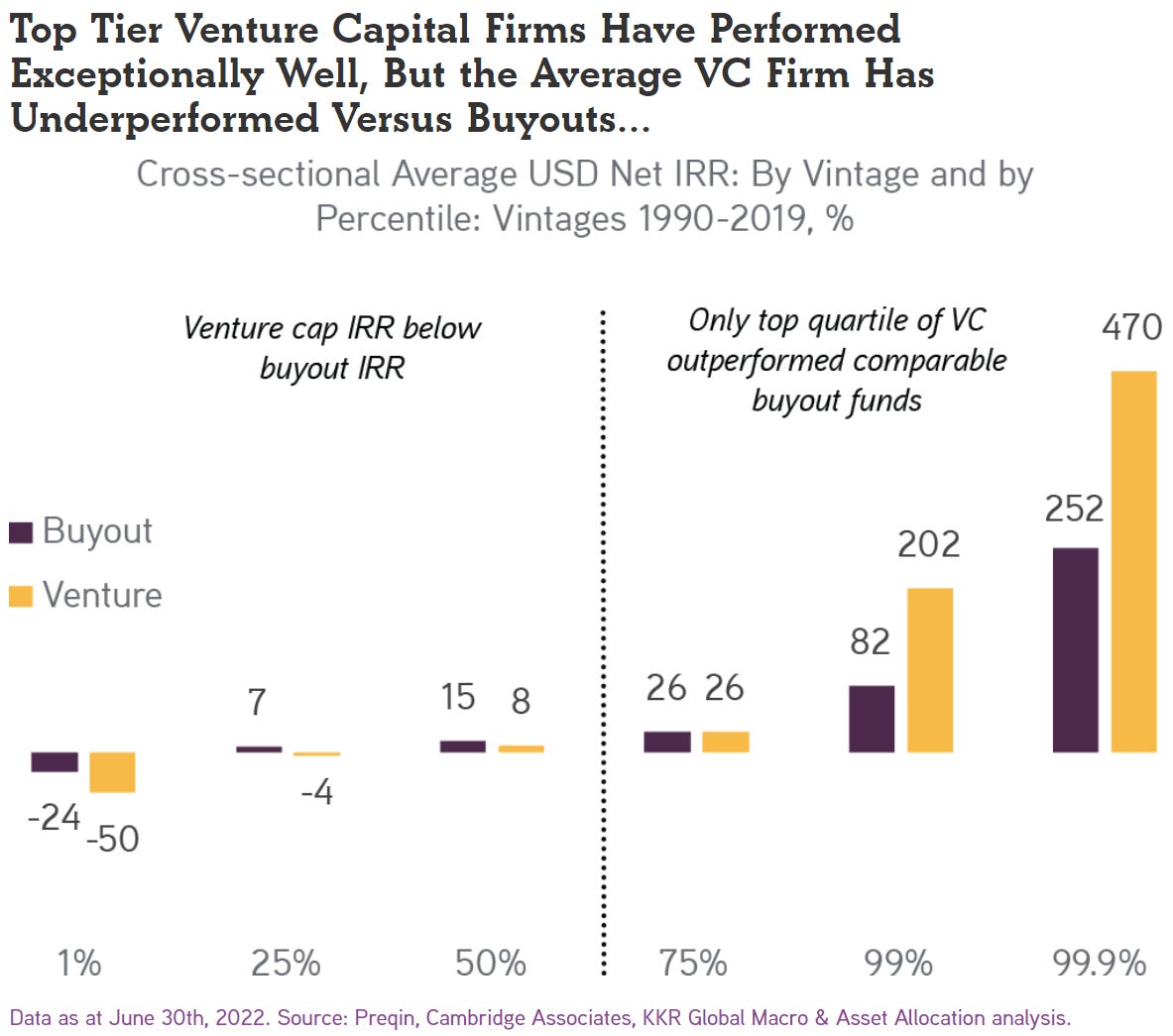

CIO’s want to reduce exposure to public equities and venture, to reallocate to hedgies, infrastructure and real estate. Essentially, reduce investments that are very sensitive to interest rates and rotate to asset classes that should do better in an inflationary environment.

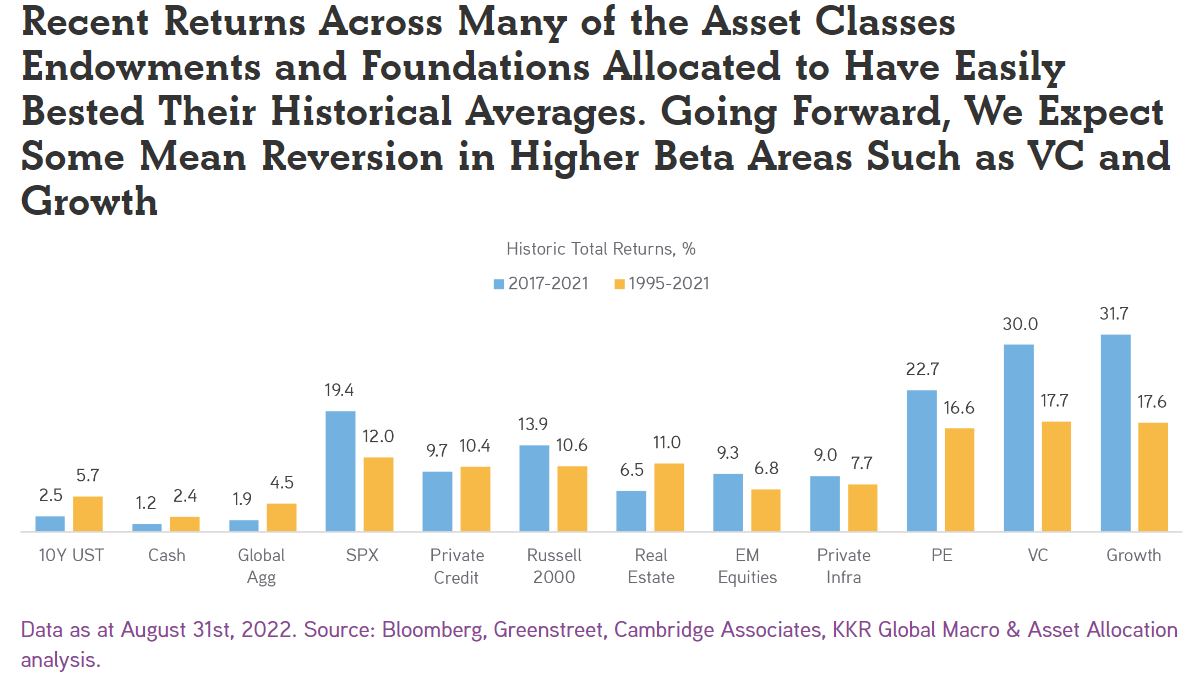

It has been an extraordinary 5 years of asset class returns. Maybe this marks the peak of the bubble inflated by ZIRP? At the very least, the returns we’ve become accustom to over the past 5 years are not the norm.

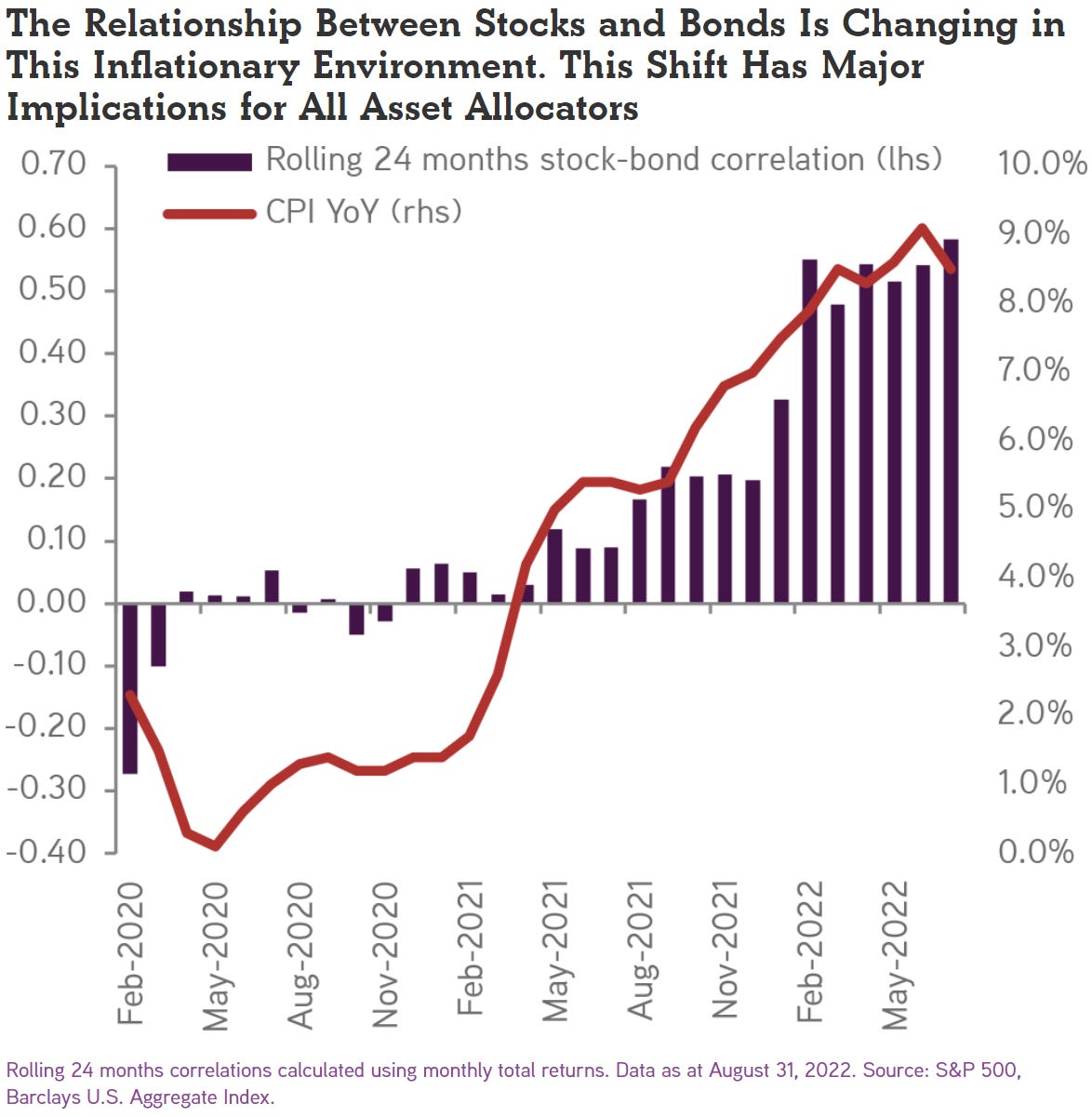

The biggest change to portfolio management has been the shift in stock-bond correlation. This has major implications from a portfolio construction perspective, especially for retail investors who don’t own alts. If rates continue to rise as both the Fed and BoC have hinted at this week, you will get clocked.

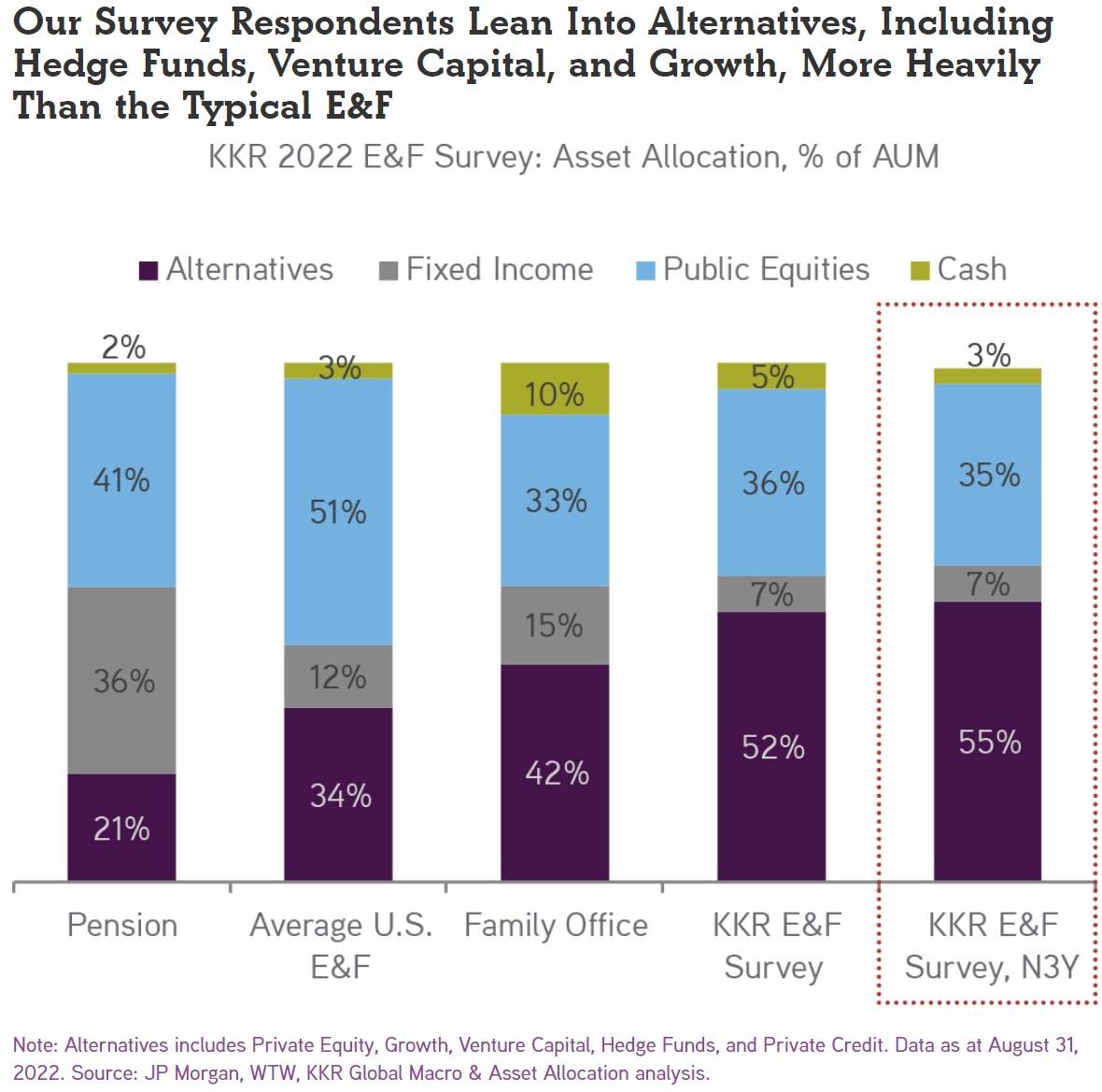

Endowments & Foundations are leaning heavier into alternative investments. The market turbulence will test this philosophy as we are watching UK Pension funds get into a bit of hot water driven by liquidity issues.

The UK Pension funds are having to offload illiquid investments at a discount to raise cash.

E&Fs had broadly higher exposure to alts than other investors across all categories except real assets. The overweight to venture was a boon but now may become a headwind for venture exposures that did not take advantage of the liquidity window.

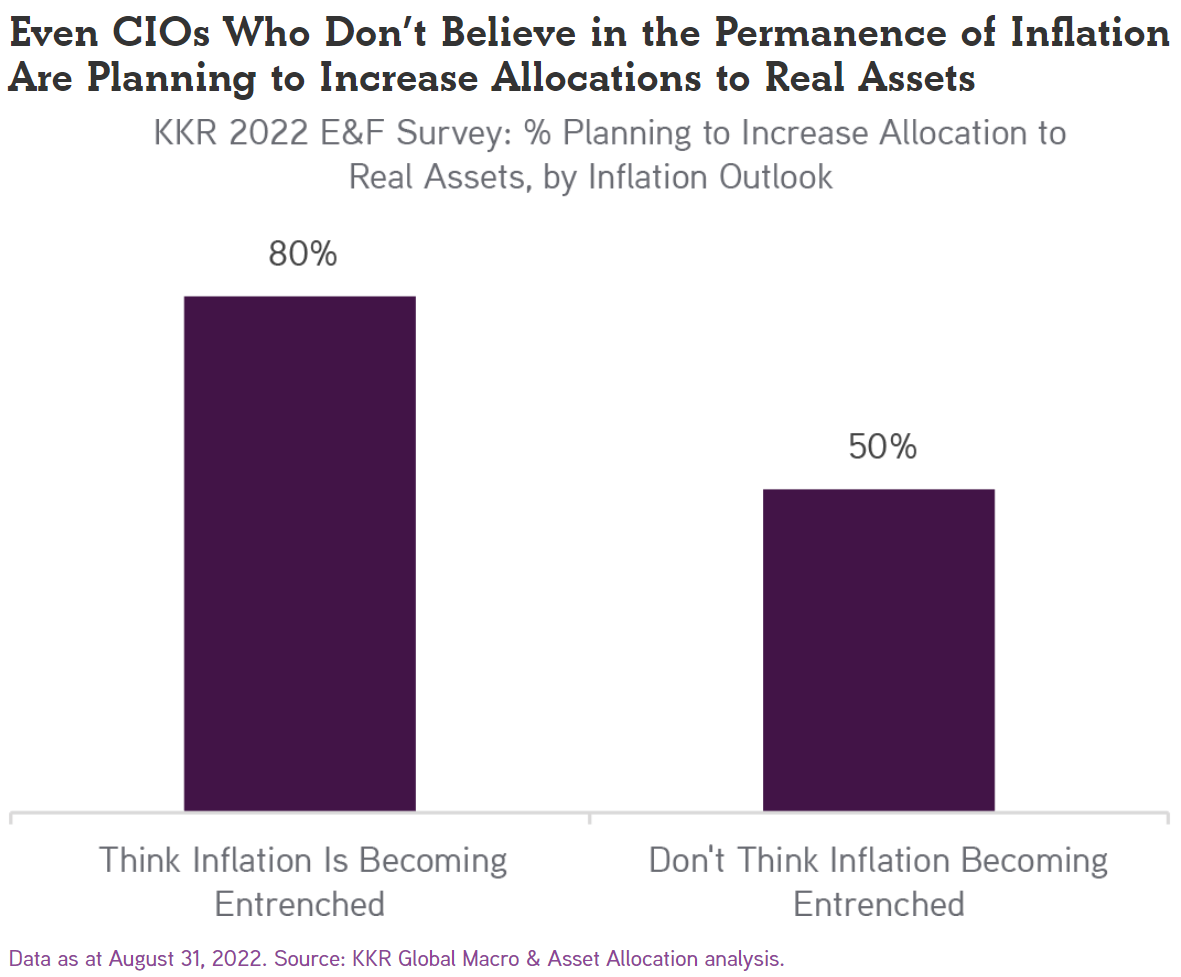

Regardless of their forward view on inflation, the emergence of inflation acted as a catalyst for CIOs to increase exposures to real assets. Real assets are expected to perform decently as inflation hedges.

KKR believes venture is only a truly superb asset class if one can gain access to the best managers.

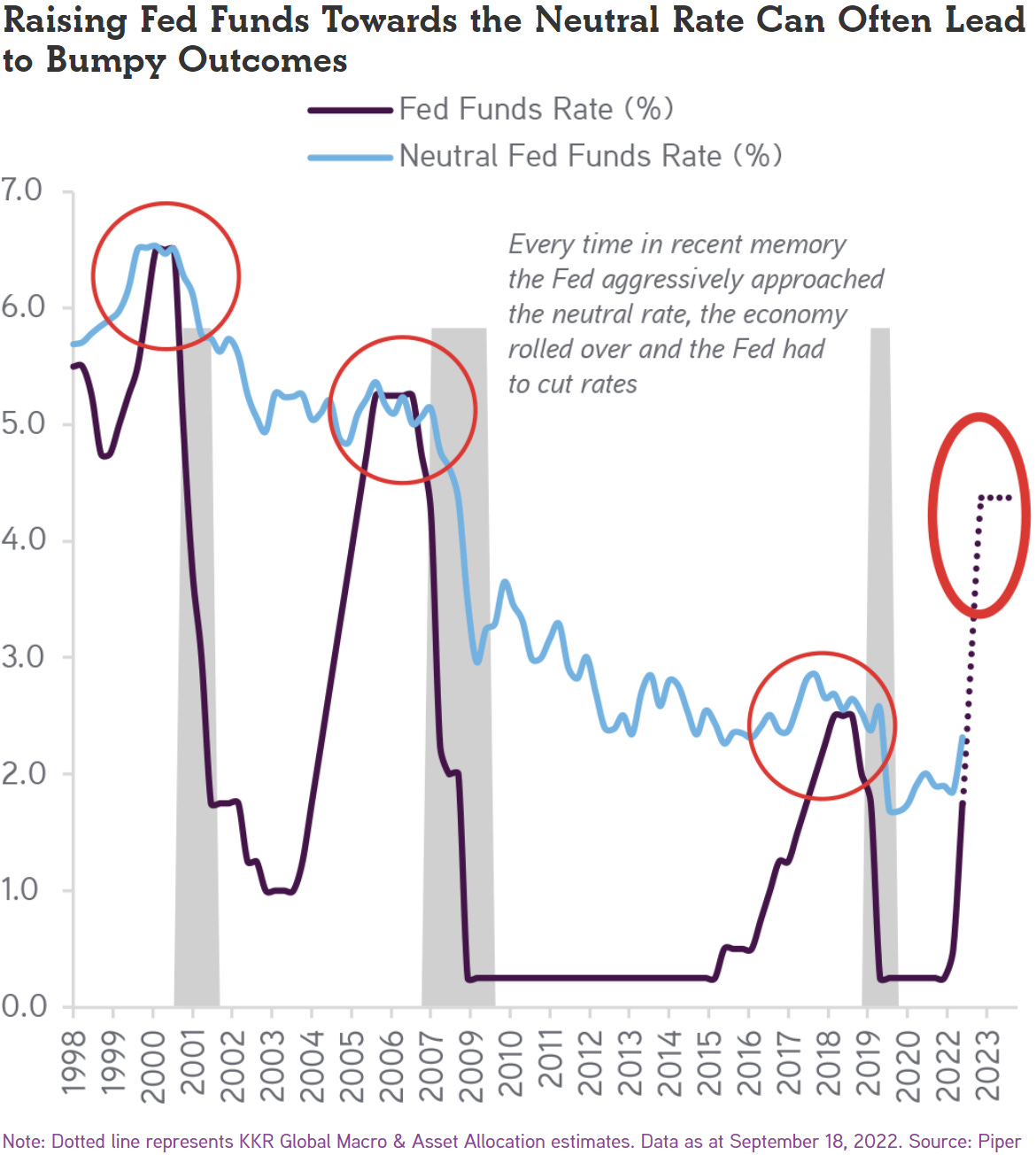

Previous attempts at raising the Fed Funds Rate to the neutral rate has led to the economy rolling over.

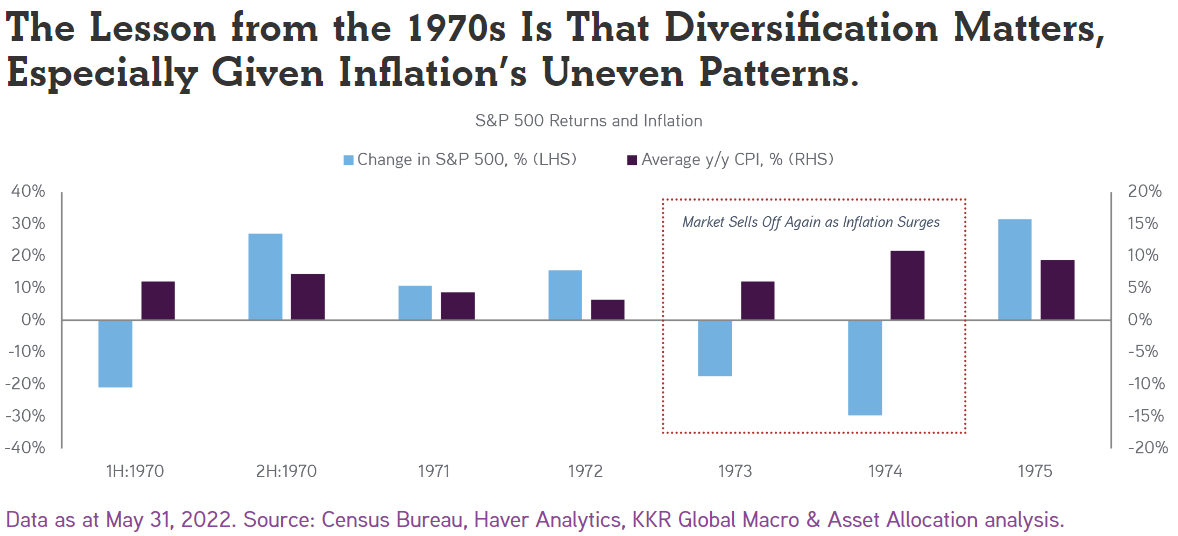

In the 70s, we saw inflation reemerge after a premature victory was declared leading to deep equity market sell-offs.

ZIRP broke the real economy by destroying labor productivity. How? Corporate mgmt used ultra cheap money for risk-free market financialization, not for investment in people, technology and new facilities.

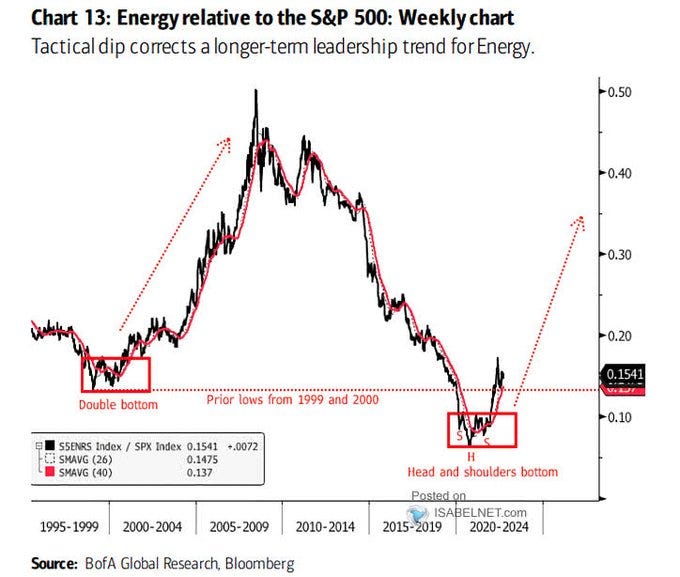

Will we see energy equities hold the trend?

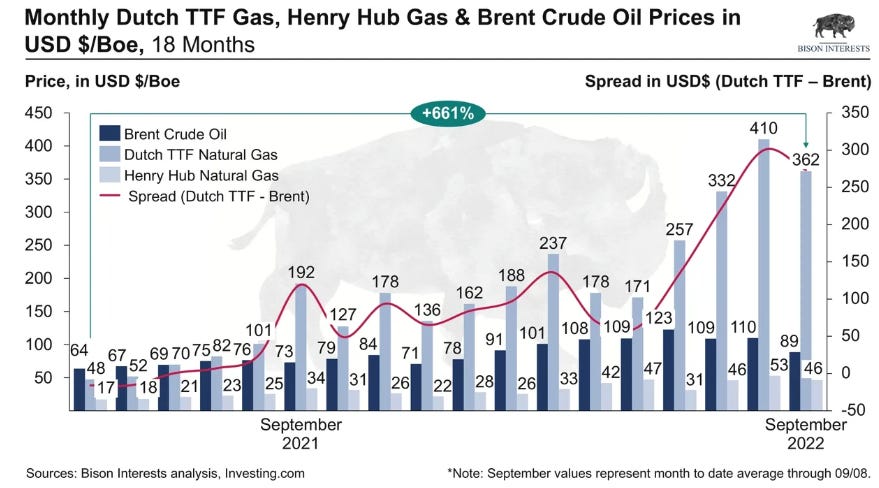

Natural gas prices in the EU are currently the equivalent of $362/barrel of oil.