Daily Charts - Liquidity Cycle

Markets were mixed last week. Earnings relative to expectations appear resilient with a little more than half the S&P 500 reported. The personal consumption expenditures price index rose 0.3% in March increasing the likelihood of a 25 bps hike this week. It appears the FDIC is moving to put First Republic Bank into receivership.

The 10Y yield was down 14 bps in the US and 9 bps in Canada WoW. USDCAD was pretty much flat. Volatile week for crypto but ended up being a good one, continuing to see divergence between crypto and the ARK complex.

April was a solid month for risk assets. UK was the top performing geography. You would never know multiple banks have failed in 2023, looking at the numbers below.

The Fed is trying to withdraw some of the liquidity pumped into the system during Covid. Over the long run, this trend goes up and to the right. Money supply growth is negative for the first time since the 1960s.

Looking back further in history. Sucking money out of the system, stresses the system. The combination of higher rates and less liquidity should be an interesting cocktail.

It is not only the Fed. JP Morgan forecasts that global QT will accelerate this year as Central Banks let bonds roll off their books.

Below you can see what Bridgewater thinks contracting liquidity means for risk assets (Full paper). They think it will be bad for stocks.

They believe Asia is in better shape than the West.

US debt ceiling is expected to become an issue around June/July.

Drawing down of the Treasury General Account may have mitigated the impact of QE since the debt ceiling was hit.

The US liquidity situation could tighten if the debt ceiling is duly lifted. In this event, the US Treasury would need to replenish its cash hoard, draining liquidity from the private sector in the process. In recent months, it has run down its cash hoard in lieu of borrowing. As a result, the Treasury is about US$490bn below target (equivalent to about one week of outlays), which is roughly how much liquidity it will suck up when allowed to issue more bonds.

The Treasury’s cash balances tend to deplete ahead of debt ceiling deadlines (even those that don’t prove very politically contentious), and then rise sharply as soon as an agreement has been reached. That has the effect of sucking liquidity out of the market.

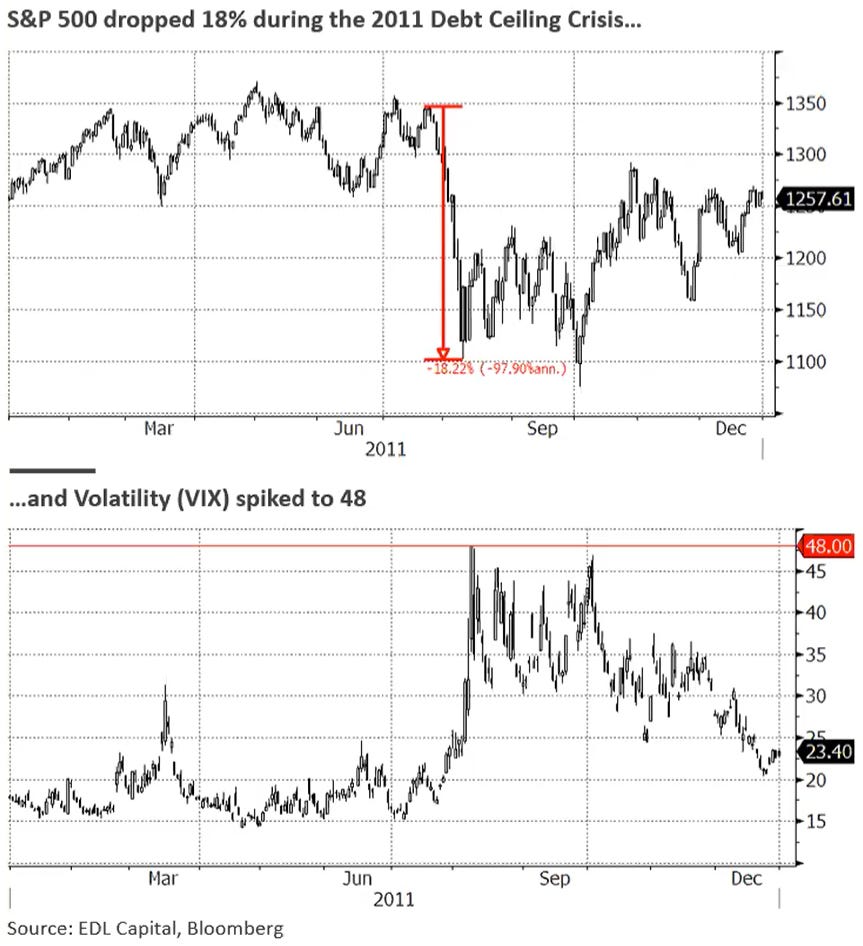

Last debt ceiling crisis was resolved 48 hours before the government was expected to run out of money. It had a rather large impact on equity markets.

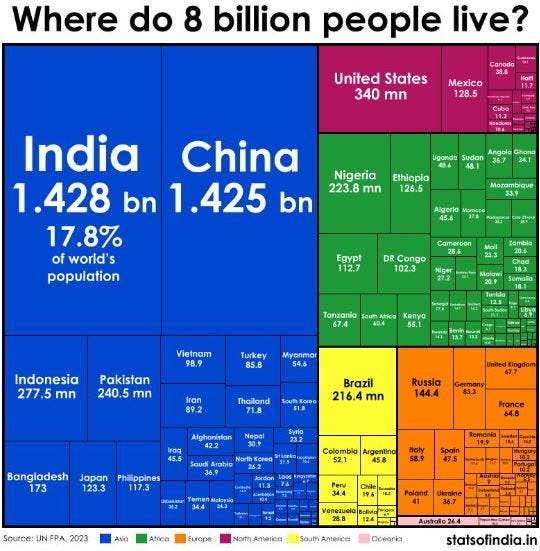

35% of the global population live in 2 countries.

Demographics are much healthier

in one of those.