Daily Charts - Mag 7 Update

This is what the average Family Office asset mix looks like in 2023. Doesn’t look much different from what you’d see at a Pension or Endowment. Cash balance feels

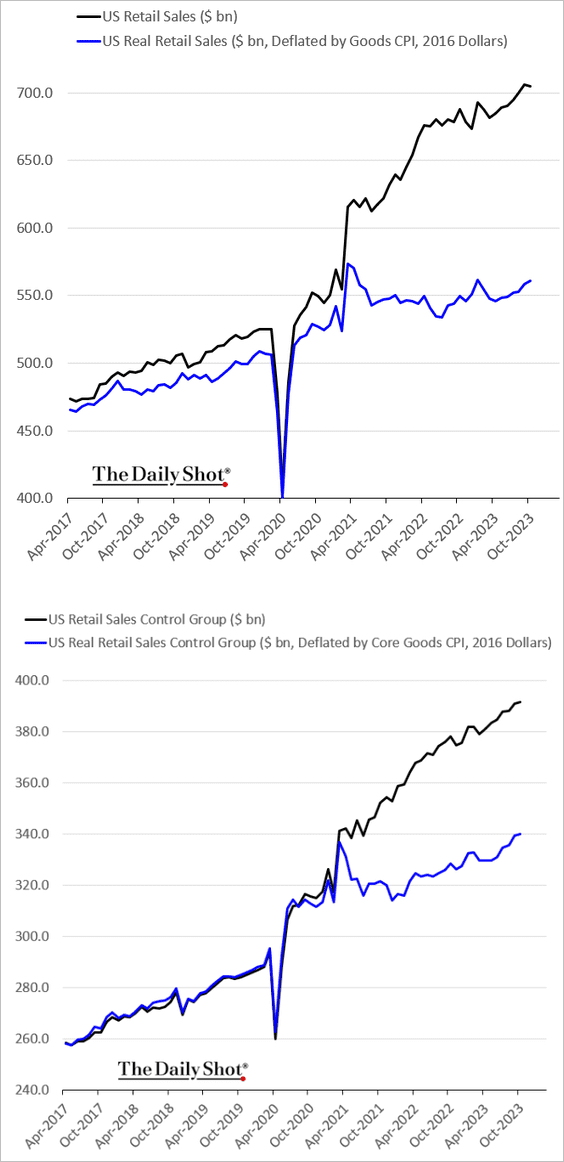

Nominal sales are rising but it’s amazing to see that retail sales numbers have gone nowhere in real terms since 2021.

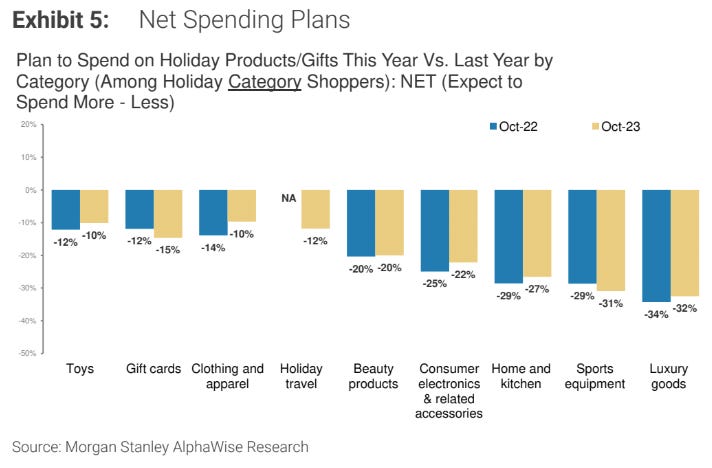

Holiday shoppers say they will try to cut back on Holiday spend this year. They said the same last year though.

Another indicator of consumer health, road travel in the US is stronger than any other September as vehicle miles hit a seasonal record.

It seems consumers like the idea of spending less as cost of living rises but aren’t prepared to do it until actually forced.

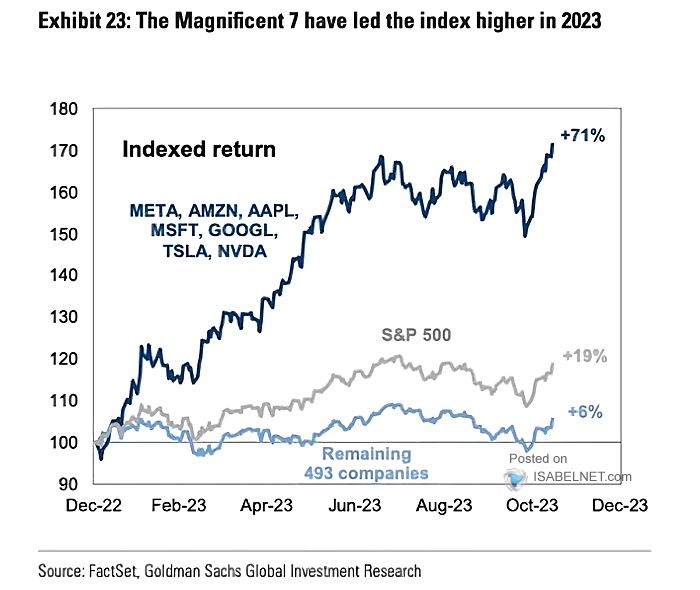

Your periodic update on the thing that is working. Post Q3 earnings, the magnificent 7 continue to dominate 2023.

Hedge fund exposure to mega-cap tech is in the 99th percentile. At the start of 2023, exposure was in the 12th percentile. Safe to say it is crowded now.

Deciding to allocate to the Nasdaq 100 over small caps this year would have generated you over 40% outperformance. Should have bought the QQQs and headed to the beach.

The Mag 7 trades at a premium to the market at 29x vs the rest of the market at 16x.

The Mag 7 is expected to grow faster than the rest of the market and has done so over the previous decade.

They do have superior margins to the rest of the market. I buy the argument that these are not optimized either.

I’m still traumatized by the “day in the life” of a tech employee videos from the pandemic. Fat to trim.

The risk to the Mag 7 is that they’ve gotten too big to grow at rates that justify their valuation. They are expensive, valuation gives you a smaller margin of safety but they are not an egregious bubble.

If you want to hear the bear case for the Mag 7, these guys are apparently short and think it is a bubble. They touch on it in the first 10 minutes.

Where can you find cheap tech behemoths? China. Alibaba has been left for dead, it was down 10% yesterday after it beat earnings expectations but news broke founder, Jack Ma was selling almost $900M of stock. It is trading at 10% below its 2014 IPO price and almost 75% below its highs. It trades below 10 times forward earnings. Not to mention, geopolitical concerns are also impacting the stock.

One more NBA chart, taking you into the weekend. If you are a 7 foot tall American male, you have a 1 in 10 shot of reaching the NBA.