Daily Charts - Money Supply

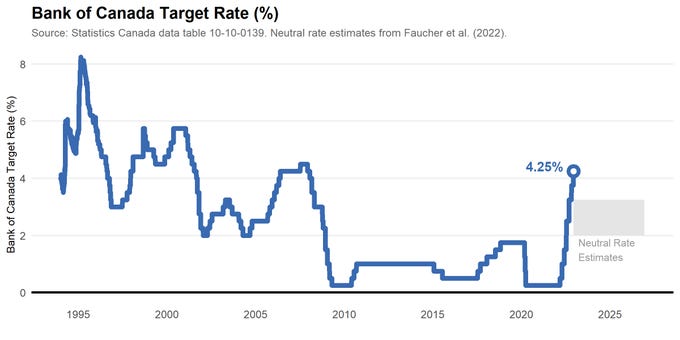

The Bank of Canada raised its target interest rate to 4.25%, up 0.5% this morning. Up from 0.25% at the start of the year. Fastest pace of increases since 1995. They signaled they would consider pausing hikes moving forward.

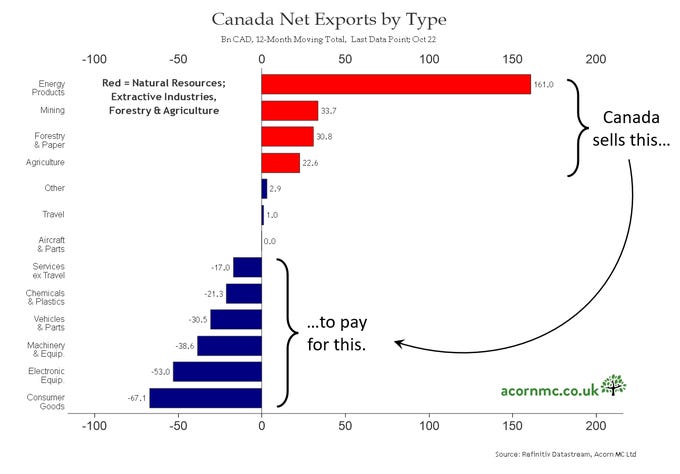

Cool chart showing Canadian net exports. Canada exports natural resources to pay for goods. If only there was appetite to develop and export our natural resources.

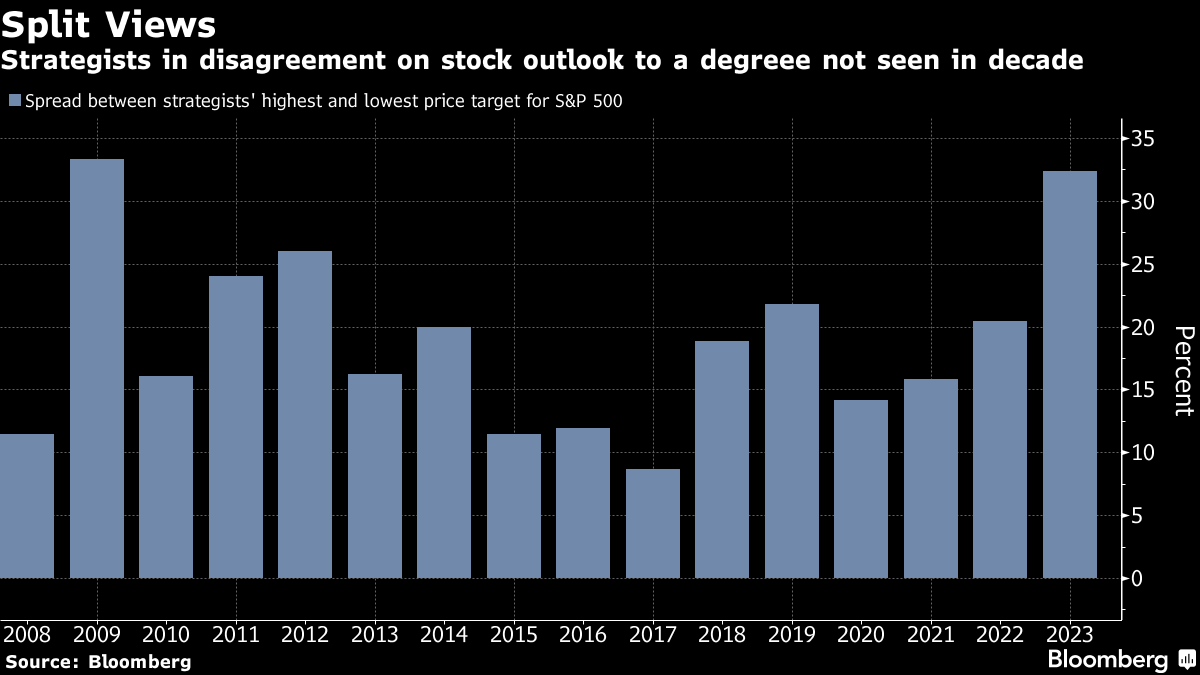

The dispersion in S&P 500 estimates for the coming year is the highest in more than a decade. This chart shows the spread between the highest and lowest estimates back to 2008.

Even in 2009 the average expectation was for stocks to gain. Even though stocks have sold off this year, which should set them up well for 2023, this is the first year this millennium in which strategists have predicted an outright decline.

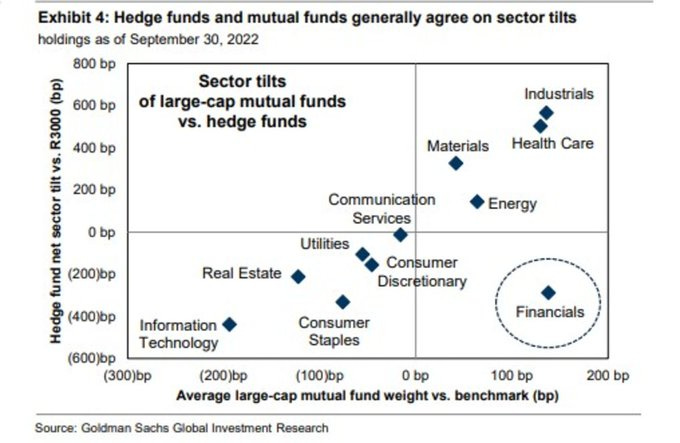

Current sector tilts are consistent with positioning for a soft landing. Hedge funds and Mutual funds disagree on the performance of Financials.

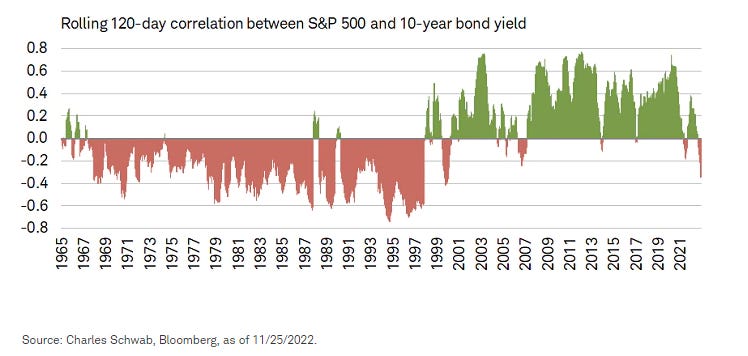

10-year bond yields and the S&P 500, a correlation that has flipped through 180 degrees in the past two decades or so. Headwinds for stock and bond portfolios.

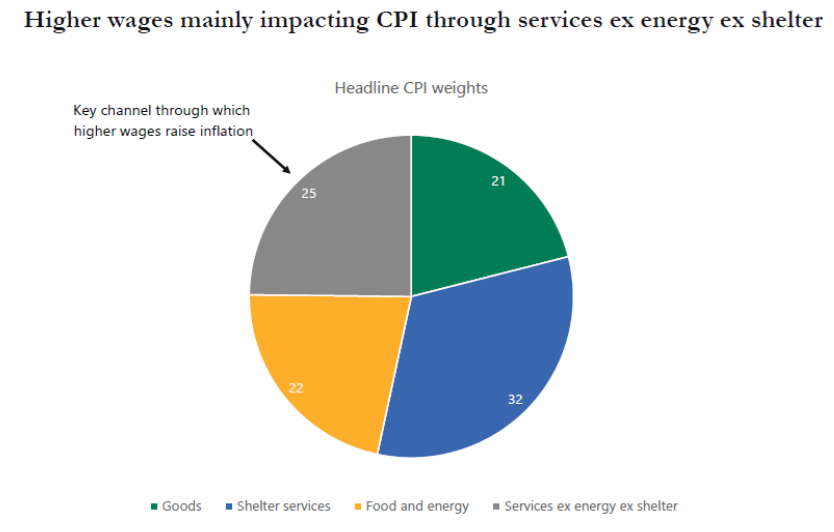

Wage inflation has a weight of 25% in the CPI basket via Services ex-energy ex-shelter. The transmission channel is that higher wages in consumer services such as restaurants and hotels increase the price of eating out and staying at hotels. The impact of higher wage inflation on the remaining 75% of the CPI index is more complex. With inflation currently at 7.7% and declining rent inflation, declining car price inflation, declining transportation inflation, declining import price inflation, and elevated inventory levels, we may not need a dramatic amount of demand destruction and a significant increase in the unemployment rate for inflation to come down to the Fed’s 2% inflation target.

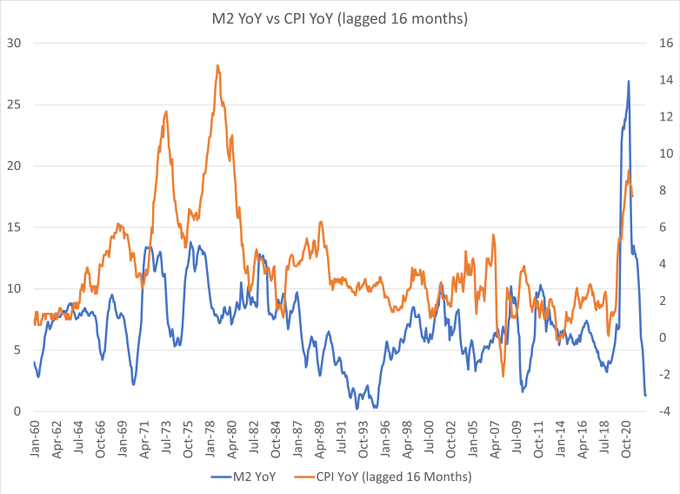

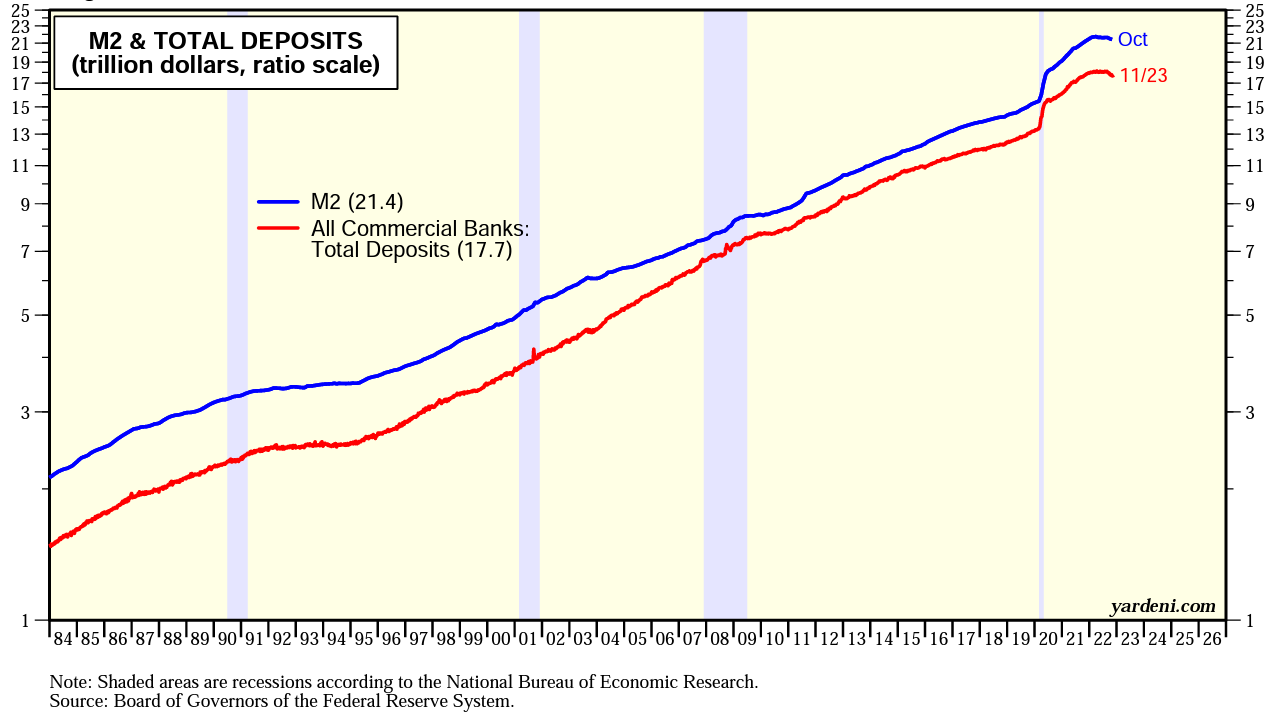

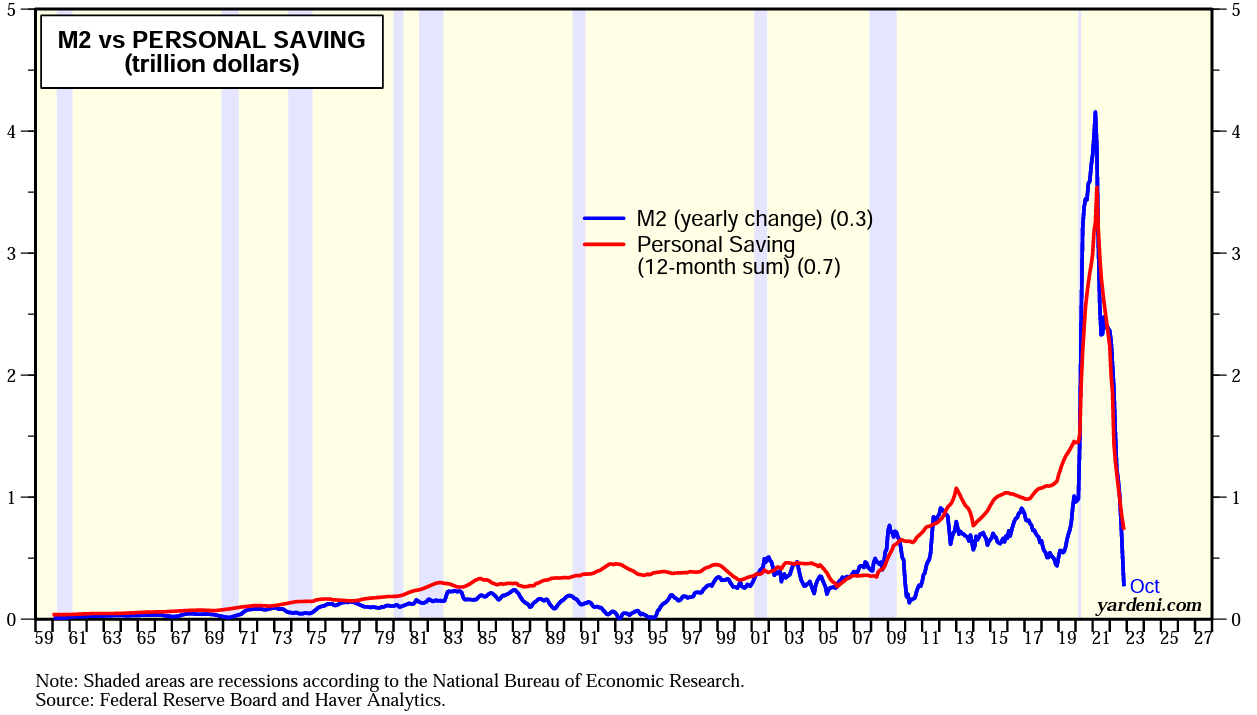

If you believe Fed/Money supply (M2) is behind inflation, maybe we will see inflation cool.

M2 is now declining per above, it has fallen 1.5% since peaking at a record high of $21.7 trillion in March. In the grand scheme of things… it’s not much.

The year-over-year change in M2, has been moving in near lockstep with the 12-month sum of the personal saving rate; money supply has stopped rising as Americans have stopped accumulating new savings.

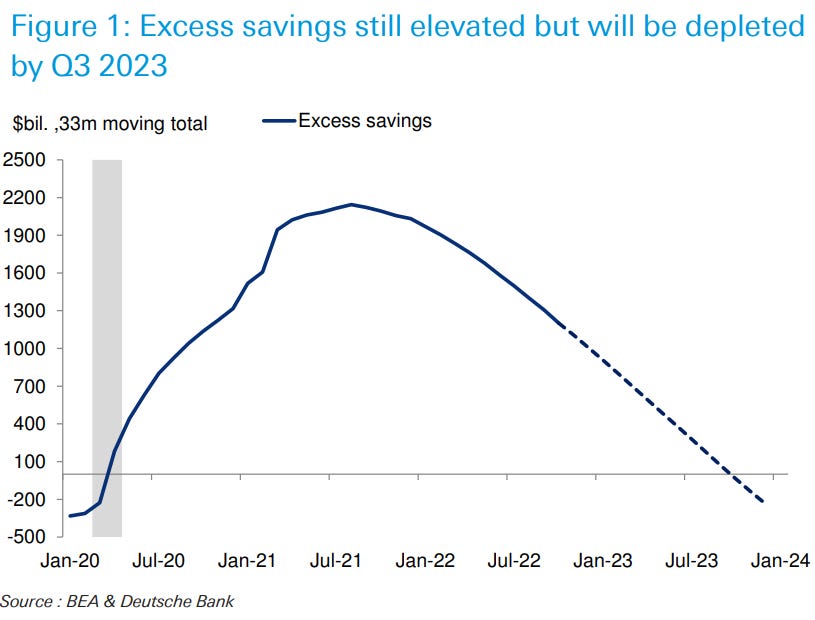

The Fed will need to continue draining savings to get back to pre pandemic levels.

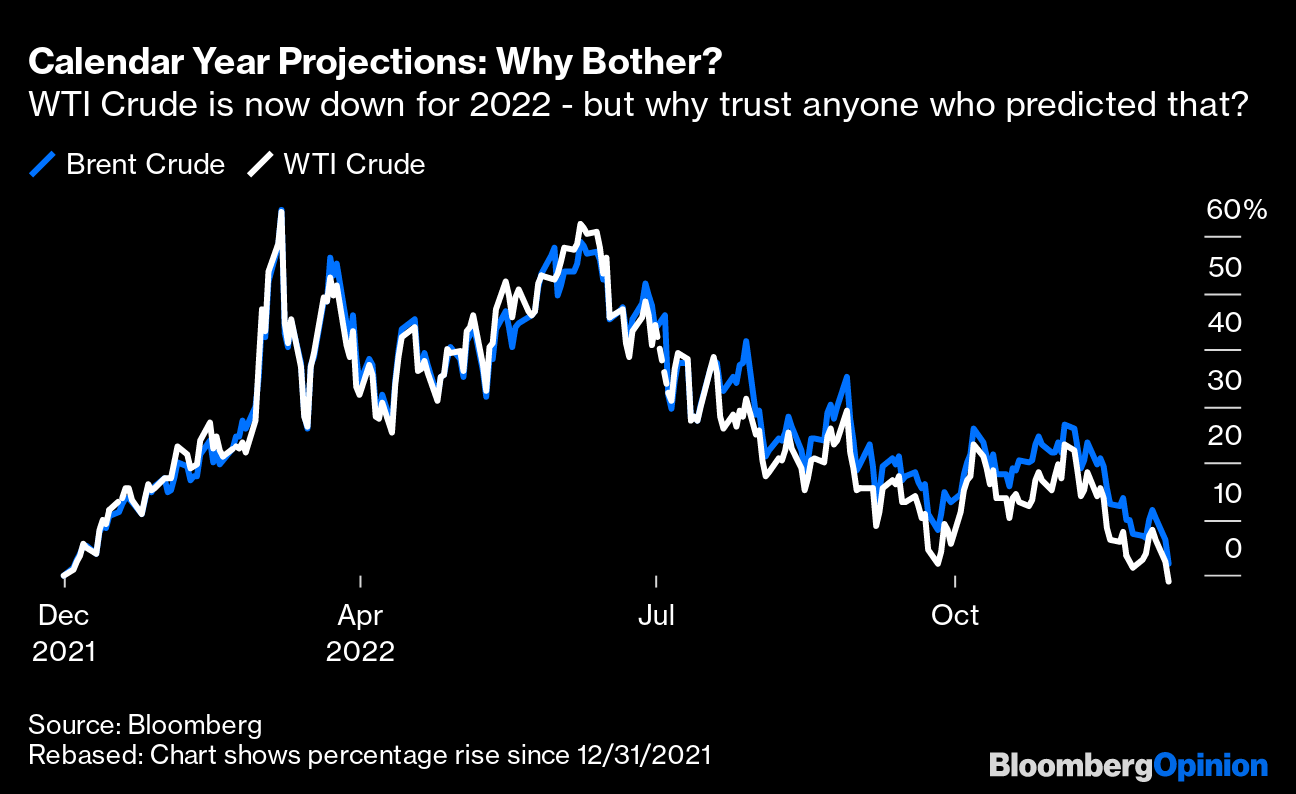

As of Tuesday’s close, WTI is slightly lower than they were on Jan. 1, while Brent crude futures have given up almost all of their gains. An energy analyst who predicted a rather dull and flat year for the oil market, with prices ending the year much where they began, would have been right.

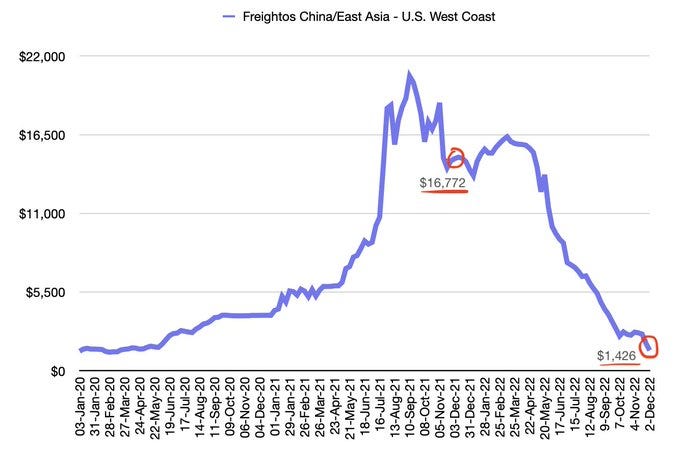

Container prices have also round tripped and are down to pre-covid levels.

The CNBC FTX cold take super cut, reason to be careful around the talking heads…