Daily Charts - MrBeast

The market sees the Bank of Canada (BoC) hiking at least another 0.5% by the end of the year. With that being said, the market has been underestimating the BoC all year, as seen below.

Current policy makers have never been in an inflationary environment like we are currently experiencing, they are essentially flying blind. This is from Lael Brainard’s speech, less than a year ago (Link):

The currently elevated level of inflation is driven by COVID-related disruptions. As these COVID-related disruptions subside, most forecasters expect inflation to move back down toward the Federal Reserve's 2 percent long-run objective on its own. That is the sense in which currently high inflation is likely to be transitory. In that regard, the August monthly CPI reading was the first month with a notable retrenchment among COVID-sensitive categories like hotels, used cars, and rental cars.

Not only does the Fed have any idea of what’s going on, markets aren’t great forecasters either, as seen by the green lines below.

Currencies are normally mean reverting beasts, could suggest going long JPY and short USD. With that being said, the policies implemented by the Bank of Japan mark a change and historical relationships could be breaking down.

From Apollo:

There are about 4500 publicly listed companies in the US, and about 16% are zombies. A zombie company is a firm that has existed for ten years and had an interest coverage ratio of less than one for more than five consecutive years. After the financial crisis in 2008, interest rates were kept at zero for a decade, and low borrowing costs made it possible for many firms to continue to operate. With high inflation and rising interest rates, the number of zombie firms is likely to come down as the costs of capital continue to rise. For more discussion see this Fed publication and this BIS publication.

These companies that can barely make their interest payments are at risk of going bankrupt.

Last week, institutional traders bought $8.1 billion worth of put options. They bought less than $1 billion in calls. This is 3x more extreme than 2008.

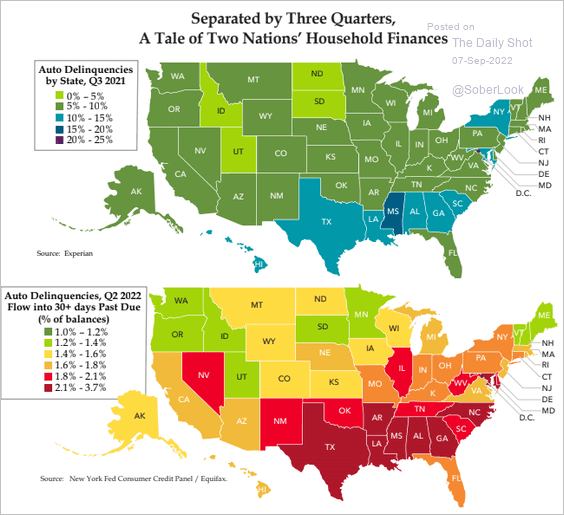

The US consumer is starting to weaken.

Hard to find a country that is growing their crude production, resulting in a tight market and elevated prices.

With the energy crisis in Europe, some countries are reducing their gas demand more than others.

The Ethereum network’s switch to proof-of-stake consensus mechanism is equivalent to turning off power in the Netherlands.

Distribution of Bitcoins across Hodlers.

This was a super interesting interview with Balaji. The guy is not a fan of our current institutions. He see’s the world going much more digital. He released a book called the Network State where he lays out a thesis for the world’s first online/crypto state (Link). Lots of hot takes in the podcast. Brain food for the weekend.

The Balaji talk reminded me about how we underestimate online communities. MrBeast who you may or may not have heard of has 104 mm subscribers, has multiple videos with over 100 mm views. For comparison, game 6 of the Stanley Cup Finals had 5.8 mm viewers.

This clip of MrBeast highlights the commitment it took to get him to where he is today.

This guy is a big deal, this was earlier this week at the launch of his new burger restaurant (Link).