Daily Charts - Nothing Lasts Forever

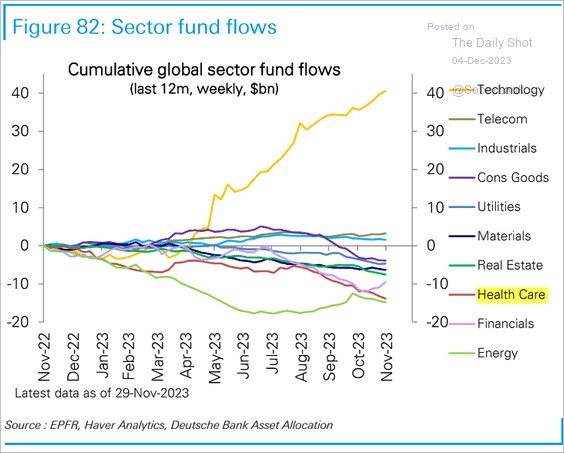

One of the few constants in this world, flows into Technology. As of late, investors have been ditching healthcare stocks.

What are the chances the top companies in the world are the same 10 years from now? These are wonderful businesses but eventually you run into the law of large numbers, how big can these companies get? From the chart below, more likely than not, the biggest companies in the world will be different in 2030.

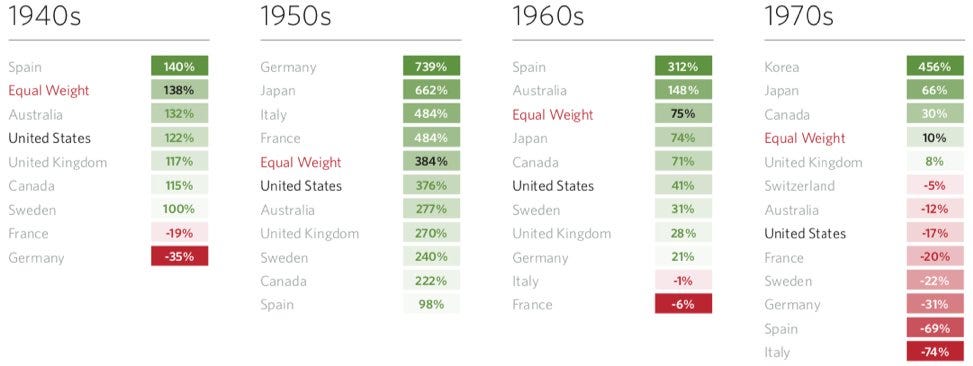

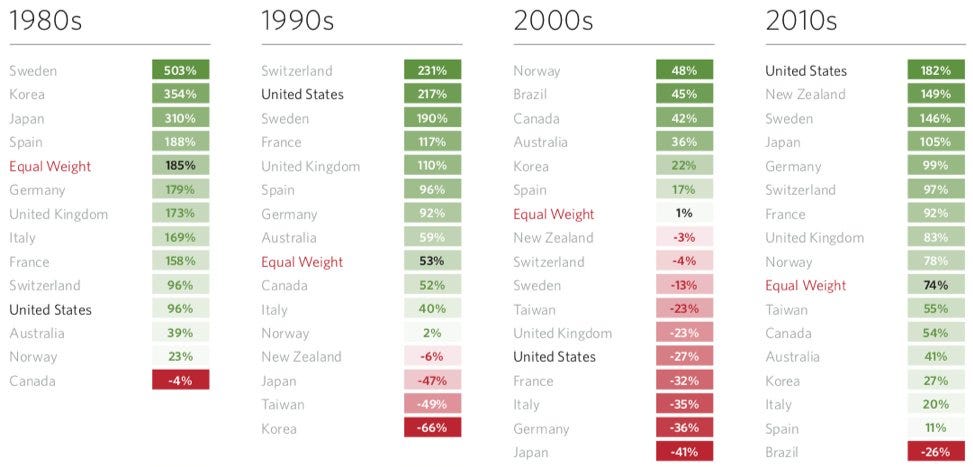

Consider the current market rhetoric of “American exceptionalism”. The current market view is that the US will continue to outperform but looking at the tables below, performance is random and you rarely see an equity market outperform 2 decades in a row. The US dominated the 2010s but it was one of the weaker performers in the previous decade following the dotcom bust; it was one of the best performers in the 1990s but before that you have to look back to the 1920s to find a decade in which US equity performance was better than middling.

Somethings that feels consensus in the moment can change rapidly. This thread during the speculative tech bubble of 2021, highlighted 20 stock ideas, “Going to $500+ B of market cap.” It didn’t end well, below are select names:

AYX: -50%

BOMN: delisted

BYND: -94%

DM: -95%

WISH: -98%

FVRR: -88%

GLBE: -45%

JMIA: -85%

LMND: -78%

UPST: -75%

LTCH: -95%

Equal weight portfolio of the 20 stocks in this thread is -75% since it was posted.

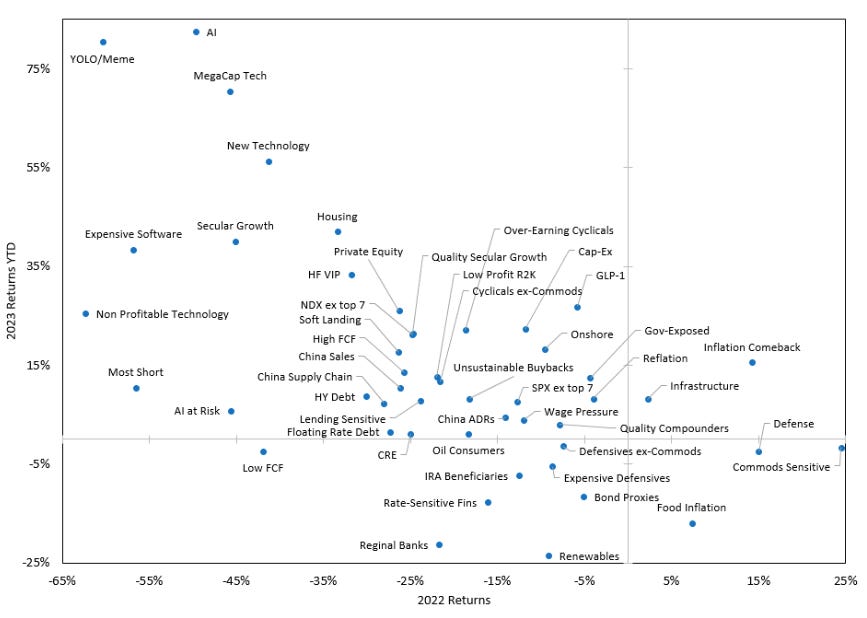

That is even after Goldman’s basket of Meme stocks has only underperformed the AI theme. 2023 has been a reversal of the 2023 trends.

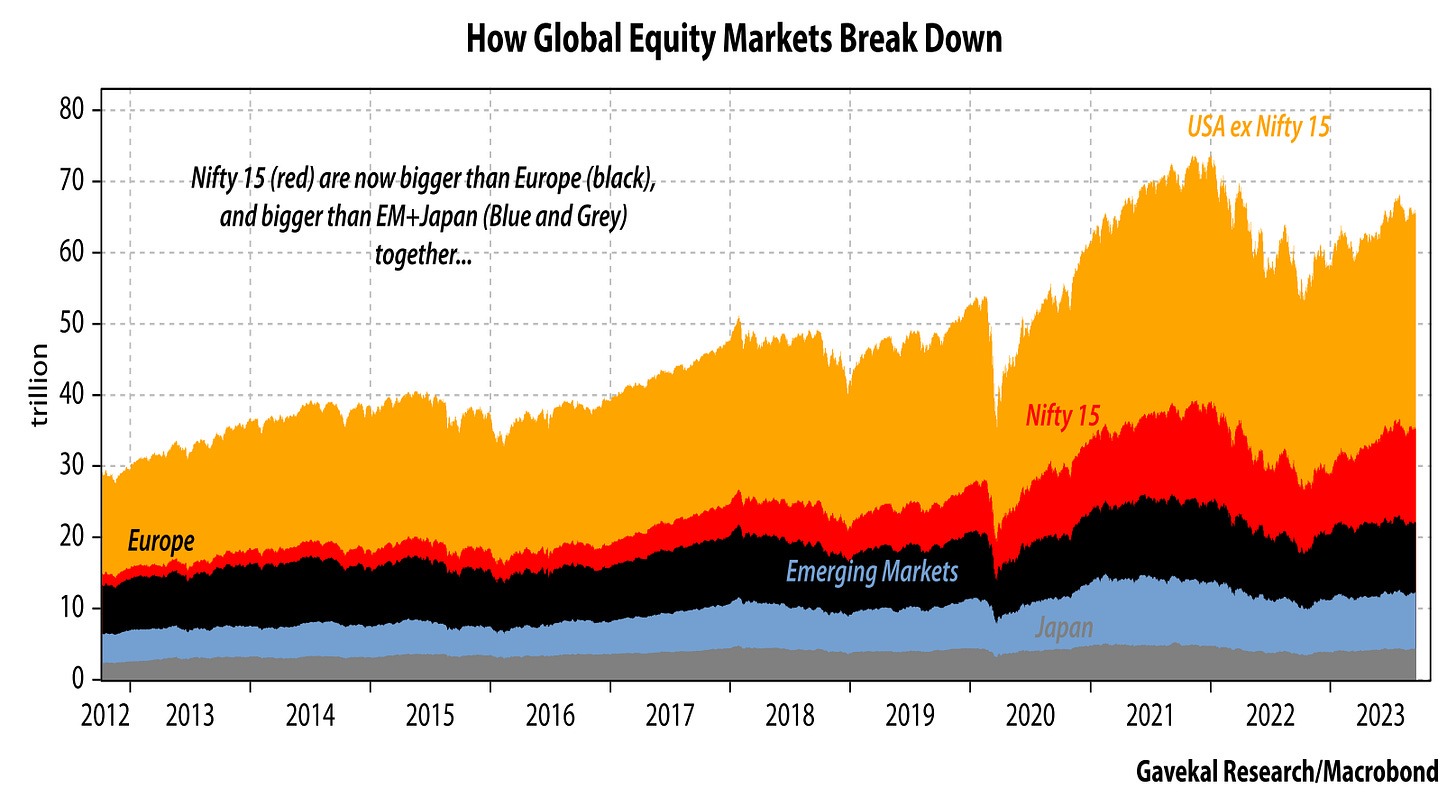

The top 15 stocks in the US are larger the entire European, Japanese and Emerging Markets equity markets.

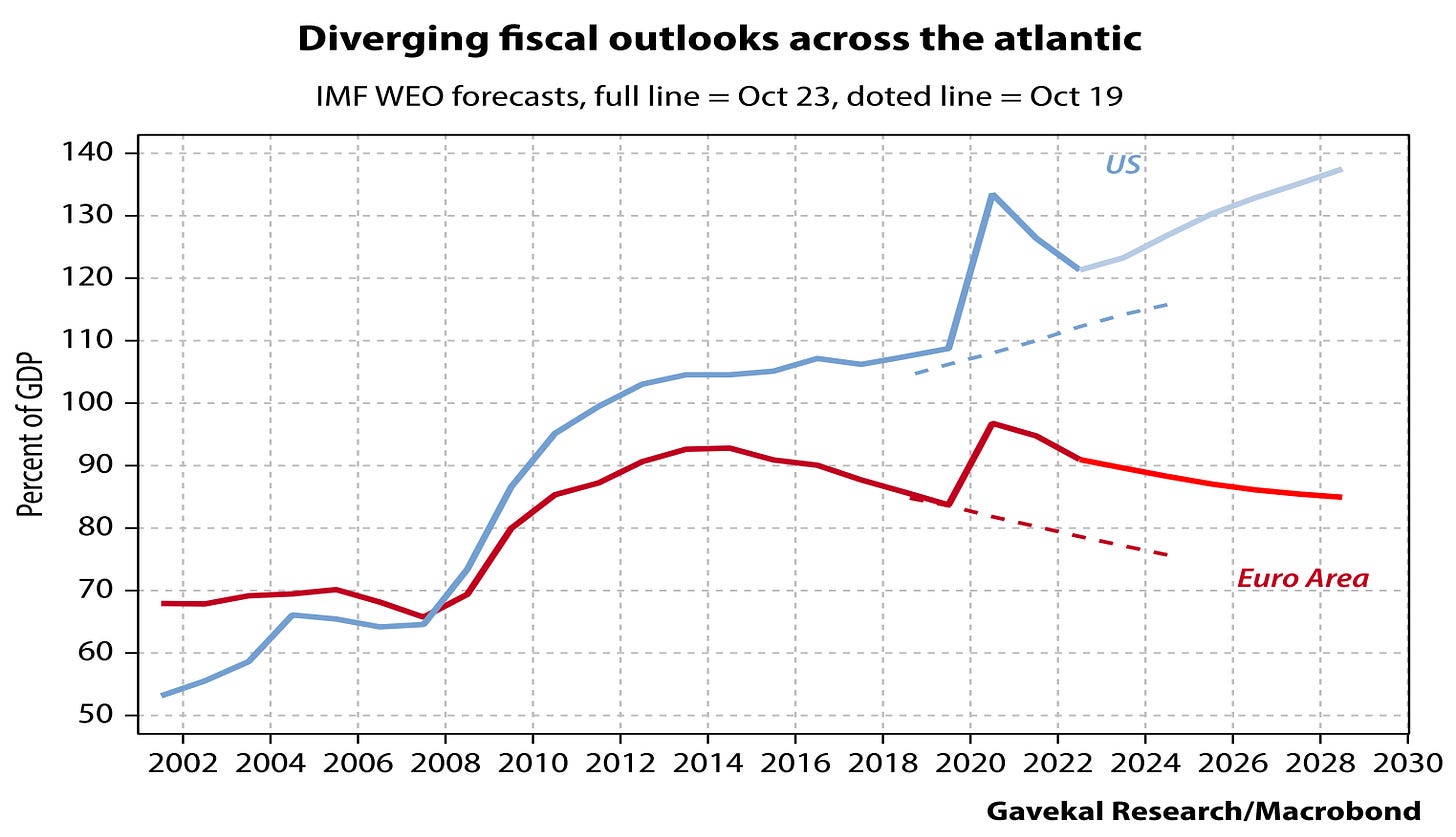

Is US fiscal stimulus pumping US equity markets? The US is running much larger budget deficits than Europe, Canada and other developed markets. Will be the consequences?

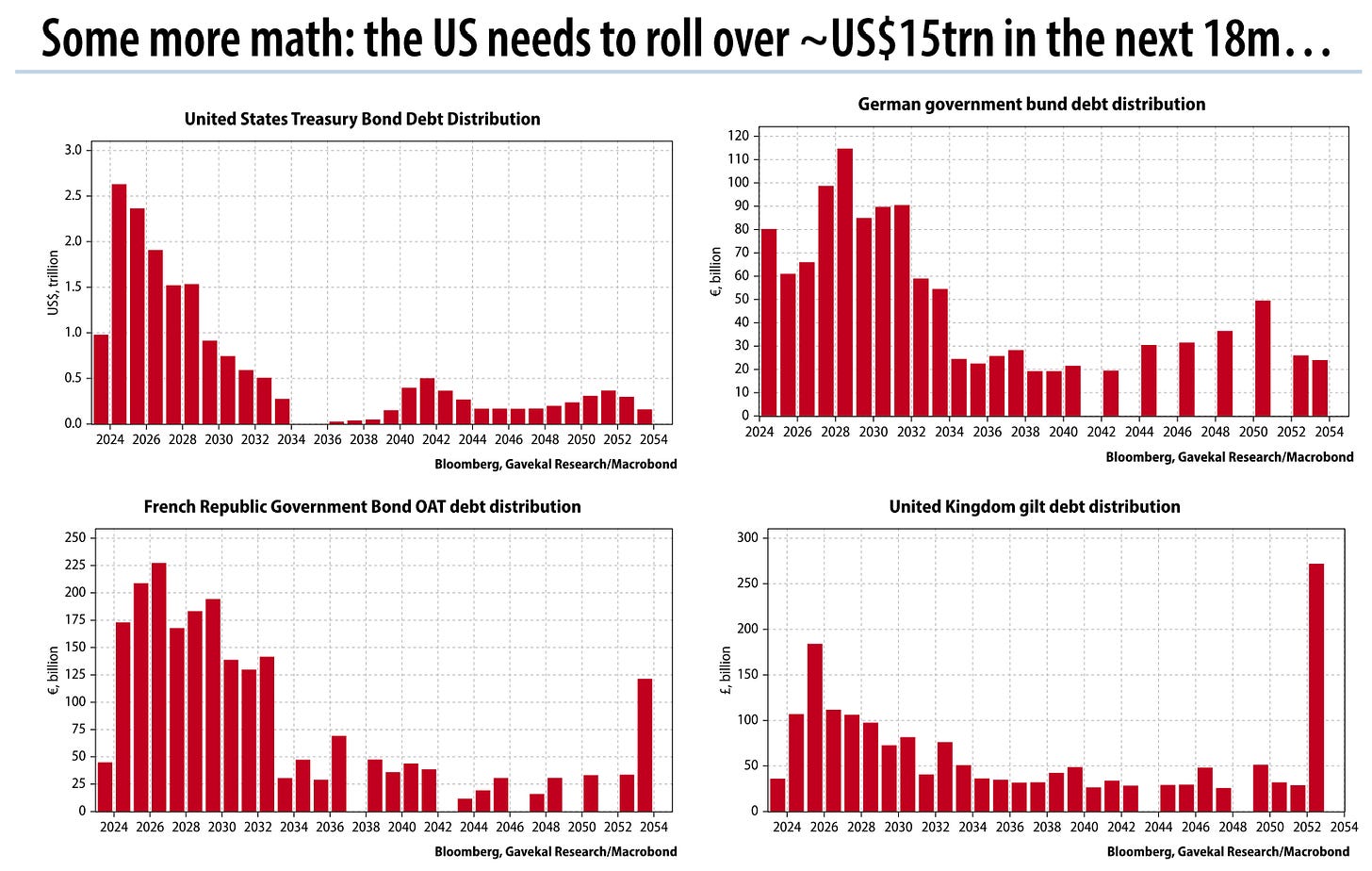

Maturity walls for DM governments ahead; at elevated rates, rolling these debts could be painful.

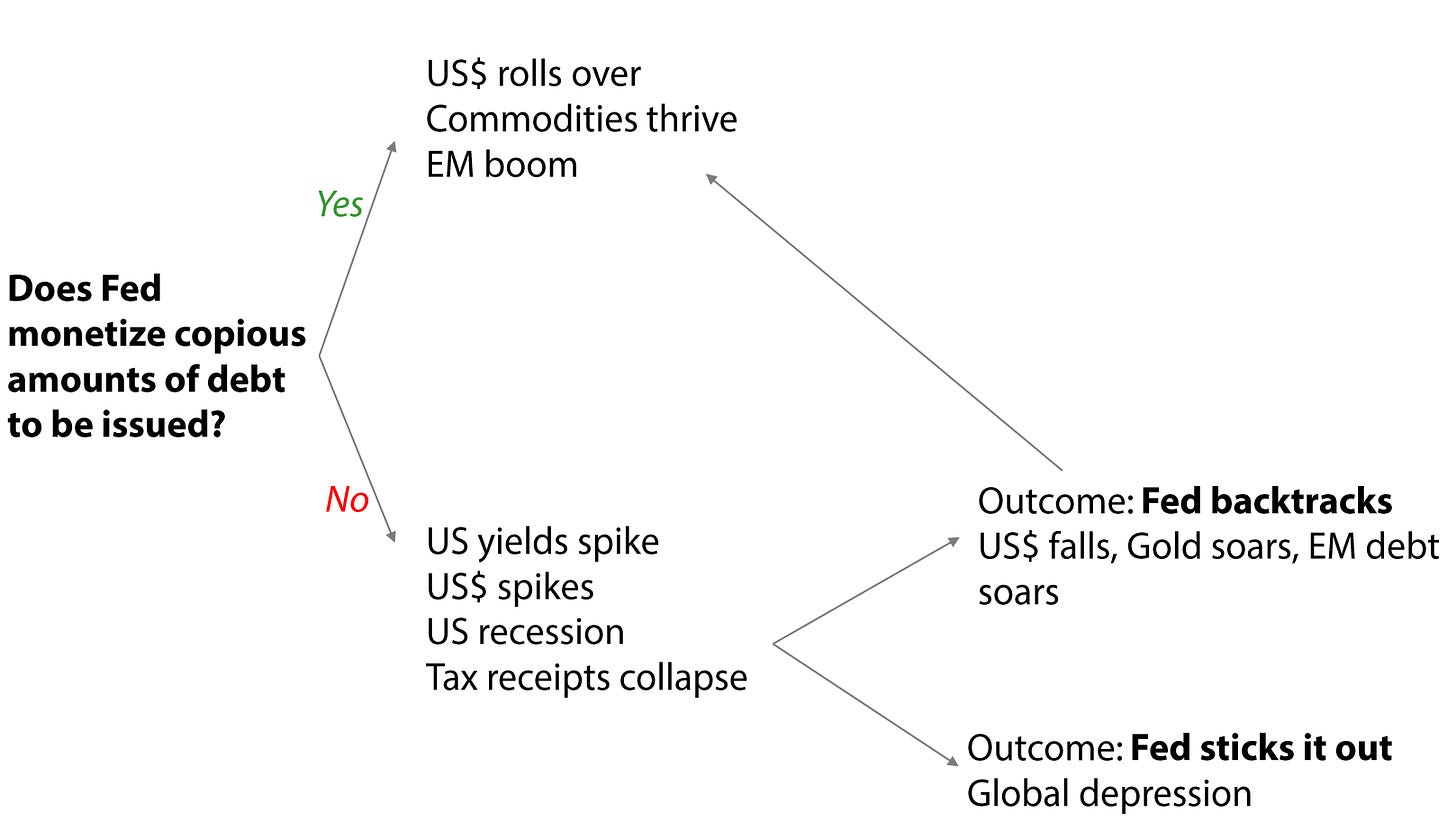

Gavekal questions who is going to buy this debt and the path forward. This is how they think about it and how you should be positioned based on your outlook.

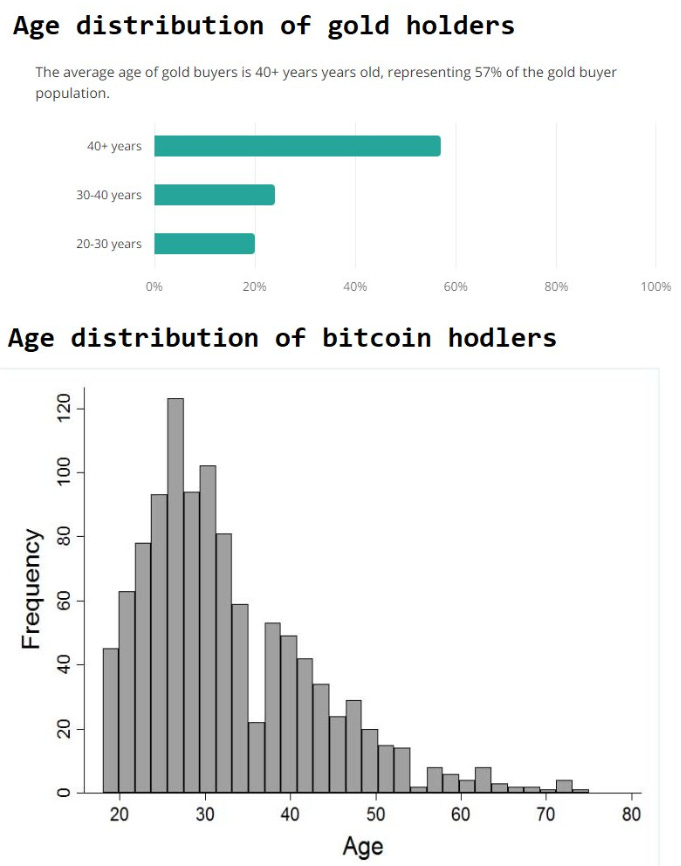

Stores of value could perform well if the DM governments decide to monetize their debts and debase their currency. Now, will gold for boomers or gold for zoomers (bitcoin) be the right horse to back? Interesting age distribution.

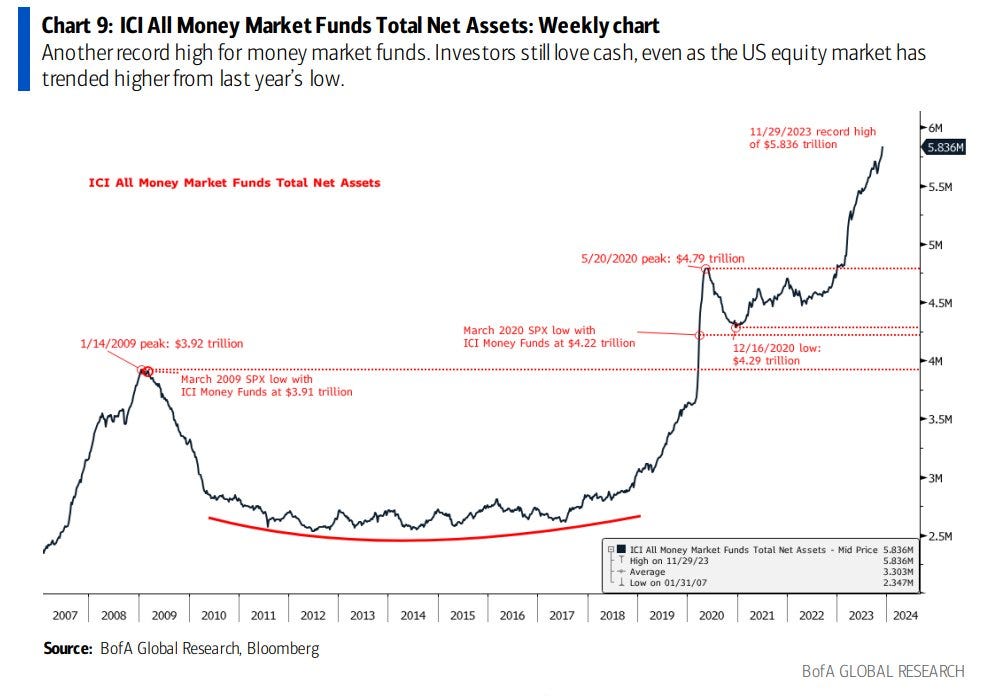

Record amounts of money market cash are on the sidelines. If we go back to QE, will these trillions flow into risk assets?