Your monthly reminder that office is in trouble. Vacancy rates continue to rise above 15% in major metros. NYT had a good article to help visualize how much vacant office space is out there.

Toronto is in a similar situation except vacancy rates were below 2.5% as recently as 2019. There was an article in the Star over the weekend declaring we are never going back.

The cities that had the longest commute time are struggling to get their folks back. And here in Toronto, the number one issue for the tech community is the commute time. And they can’t get people back.

There are 26.6 empty Empire State Buildings worth of vacant office space in NYC.

Other metros like Chicago, LA and Houston are also struggling with a glut of office space.

Cities will struggle with lost revenue from workers leaving. This is the big difference between Manhattan and Houston, the dependance on high paying jobs working in the city. In response, NYC is discussing introducing a congestion tax for drivers between $9 and $23 per vehicle to raise revenues.

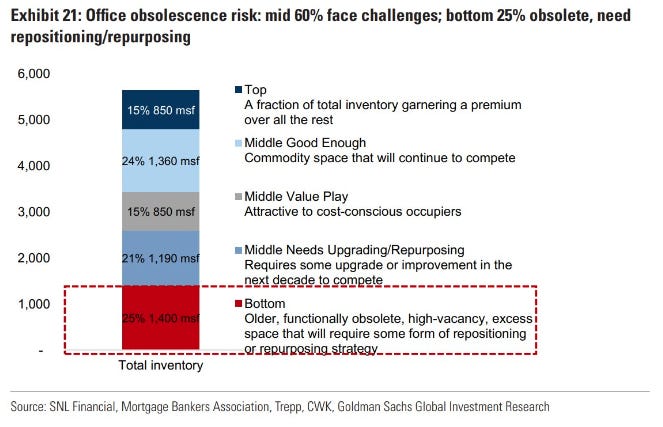

Goldman expects the bottom 25% of office to face obsolescence, bottom 60% will be challenged. Notably, the top office space will garner a premium.

Zooming out, offices represent only 14% of total CRE assets in the U.S. If we think about this another way, the market capitalization of one company, Apple, is—at USD 2.6 trillion—larger than the entire capitalization of the U.S. office sector, at just over USD 2 trillion.

There was an article in the Globe over the weekend calling out private asset owners for not marking their books. Think twice before subscribing to any private REITs, it is probably worth 30% less than the NAV reflects.

It will be those assets that are forced to roll their debt that run into problems. They can’t afford higher rates and maintain debt levels given new valuations. Leverage is wonderful on the way up but is very painful on the way down 😬. When you see Brookfield or Blackstone defaulting on debt, it is this situation.

In the chart below, the hypothetical example shows how the value of a USD 100 million office building would decline to USD 72 million if cap rates increased from 4.5% to 6.25% (holding NOI constant). If the borrower were to look at refinancing the loan at this lower valuation, keeping the loan-to-value ratio constant, the borrower would have to contribute an additional USD 18 million in equity to get the refinancing done.

It hasn’t been bad news for all real estate.

Most REITs are trading below the last reported NAV.

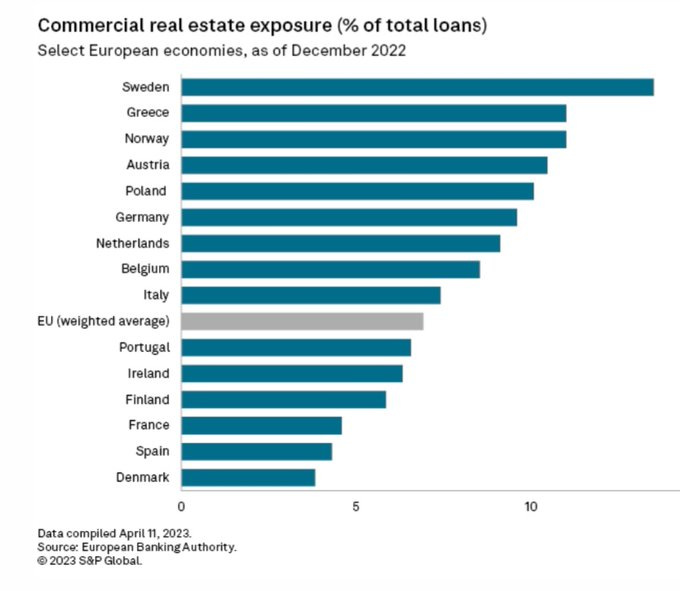

A recent scenario analysis by Bloomberg found that a 5% write-off in CRE could wipe out on average 39% of large Nordic banks' 2023 pretax profit.

Office isn’t the only zombie real estate sector. Issues with regional malls have been brewing for some time. There is an auction for a defaulted mall in Waterford CT. The Crystal Mall backs $81mm of CMBS debt in UBSBB 2012-C2. The appraisal has dropped from $153mm at issuance to $13.3mm today. Current bid is $3M (Link). Would you rather own a 535,000 sqft mall or a bungalow in Toronto?

I’ll take the mall. With redevelopment, it has the potential to +10 fold.