Daily Charts - Other Themes For 2023

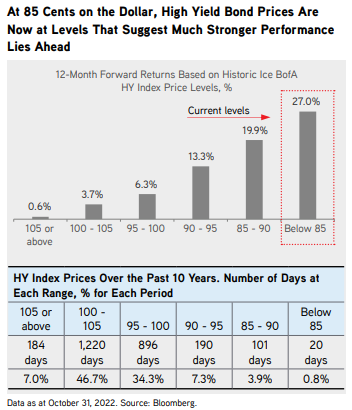

Buy the Dip?

Numerous firms tout buying the dip because markets were off 25%. Nothing stopping a market down 25% from falling another 25%. I’m pretty sure Jerome Powell would love “Buy the dip” be erased from our collective vocabularies. Now that capital is not free, the question should be approached from a fundamental perspective, earnings and the multiples we should pay for those earnings, back to the basics.

Same thing in credit, spreads aren’t particularly wide. High yield has traded off par because rates rose. Assuming a great forward return because of mean reversion is silly, high yield could trade back to par if rates fell but that likely coincides with a recession so tread carefully.

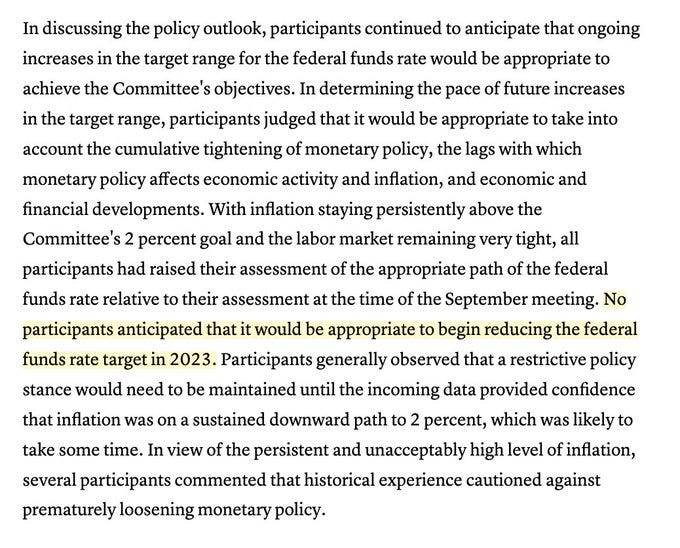

Don’t Fight the Fed

Jeff Gundlach makes it sound easy and maybe it is that easy. It certainly worked in the depths of Covid. It probably makes sense to ensure the Fed is on your side before you go max long.

This is from the recently released Fed minutes. I think they need a catalyst (something breaks, a much higher unemployment rate) before we get a pivot.

Devil’s Advocate: If inflation subsides, we likely end up in a QE world eventually, maybe the market can look through short term turbulence.

Fiscal Policy Driving the Bus

Western Central Banks have reloaded their monetary guns by hiking rates, they now have a few bullets in the chamber. Once those bullets are used, fiscal policy will dominate. Russell Napier talks about this.

Emerging Markets over the US

Louis Gave discusses these themes in this article and podcast.

He talks about China’s reopening exporting inflation around the world, US has a debt problem and change in market leadership.

Emerging markets are also much cheaper than the US.

Negative Yielding Debt is Gone

There is no longer any negative yielding debt in the Bloomberg Global Agg Index. Friends don’t let friends by bonds that pay you back less than you initially invested 10 years later in nominal terms. It is crazy in hindsight.

Developed markets also have a debt problem that they will likely have to inflate their way out of eventually. This means it is essentially impossible to make money in real terms.

Geopolitical Risk and the Death of Globalization

We’ve seen peak globalization and global cooperation. Some even argue the US is at war with Russia and China. This is inflationary.

Tensions also present tail risk. Whether that is Russia using nuclear arms, trade war escalations or other issues with China. The world is reliant on Taiwanese semi conductors for our modern lives.

Lower Global Trust

Assuming US Treasuries will not deliver a return above inflation over the long run and after the US confiscated Russian fx reserves, global Central Banks will look for uncensorable stores of value that are less likely to be inflated away. Central Banks may buy more gold and crypto enthusiast will hope Bitcoin finds a use case here.

Changing of the Guard in the S&P 500

The top five stocks in the US represented 25% of the value of the S&P 500 at one point. Will we see new companies and industries lead the S&P 500?

You can argue technology enables better business models and we should pay more for them. You can also argue that excess profits will attract more competition and businesses in the digital age can be disrupted as quick as they capture market share. Ex. Out of nowhere ChatGPT has led to speculation that Google could be disrupted.

What’s interesting is the elevated S&P 500 margins have been driven by technology companies.

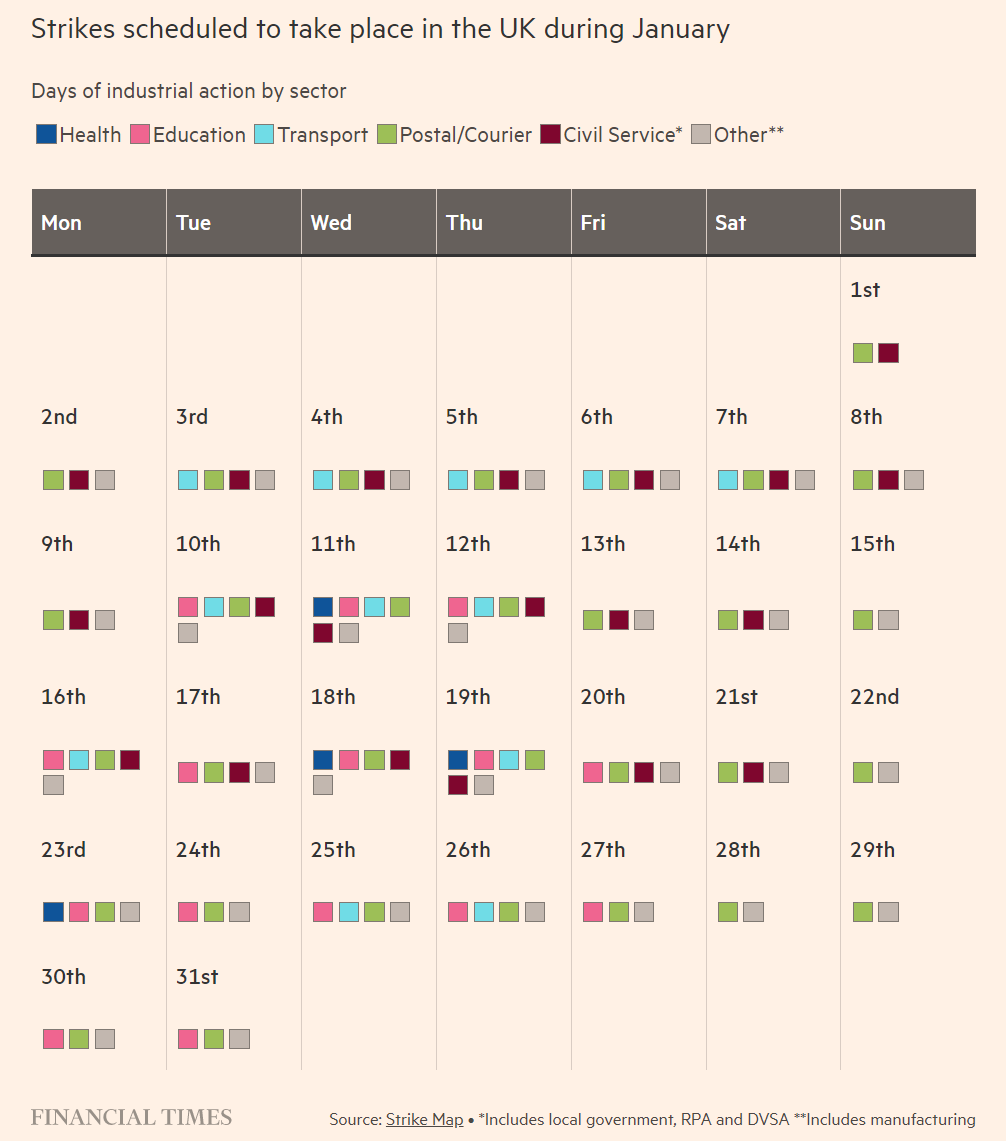

Strikes

As we are currently observing in the UK, workers eventually become fed up with their loss of purchasing power. I think we see more labour disruptions in North America.