Private Credit has been receiving lots of attention lately. Private Credit is one of the few areas of the market where the move in base rates has benefited the asset class and lenders are now lending at double digit rates. But, too much capital flowing into the asset class where it is difficult to put capital to work, when private equity deal volumes are down could mean lower returns moving forward and less protections for lenders.

The market opportunity was created by higher rates causing losses on bank balance sheets. Losses on bank balance sheets were the reason behind the SVB crisis. The situation is as bad as it was in March but the weakest have fallen and no bank runs at this point. Programs to support bank stability are also still in place.

Bank stability is less of a worry but because of the balance sheet losses, banks haven’t been able to lend, they need to preserve liquidity.

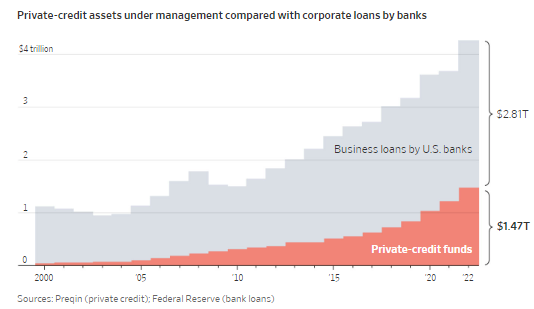

Asset managers have rushed into the lending markets access to Private Credit in the banks absence. Growth has exploded up but this trend started a long time ago.

When I think about the opportunity; have Private Credit funds raised more or less the void left by banks? I would guess that there are segments of the market that are overcapitalized and funds will be force to compete on terms (bad for investors).

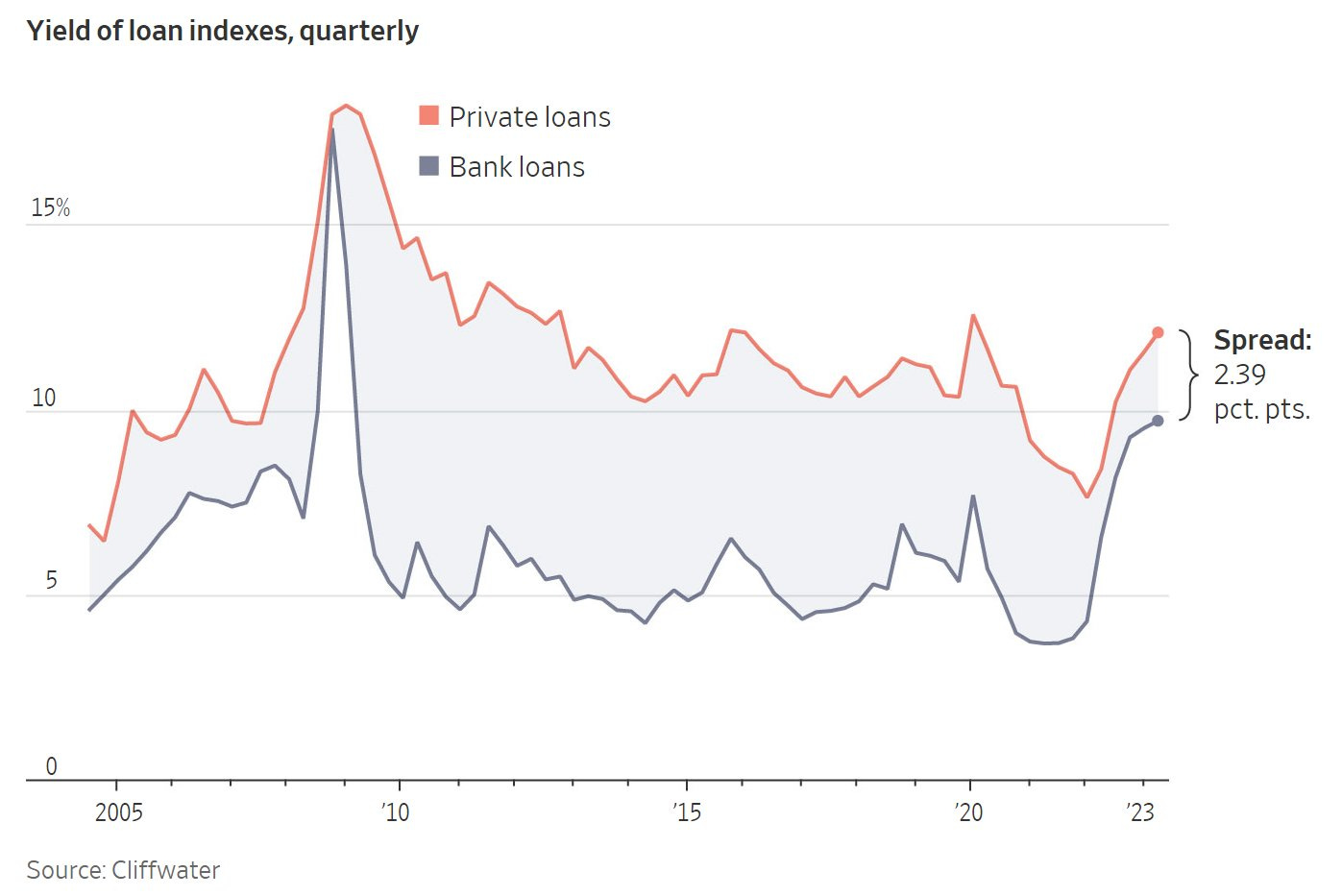

Private Credit pitches high yields to end investors and higher touch relationships with borrowers that hopefully leads to less losses. This chart is from a year ago but illustrates the spread over Treasuries achievable. You often see these loans structured at SOFR+500-700. Floating rates have protected investors in a rising interest rate environment.

But most importantly (I say this sarcastically), they promise low volatility… It is very misleading to compare the volatility of an asset that is priced by the second in the open market vs one that is marked monthly/quarterly by 3rd party auditors. In no way does this illustrate the actual risk being taken.

The lack of real marks is something to be aware of. I’ve yet to hear a story about these private BDCs adjusting valuations for widening spreads in public markets. There have been a handful of Canadian stories in the past few years, highlighting much worse abuses.

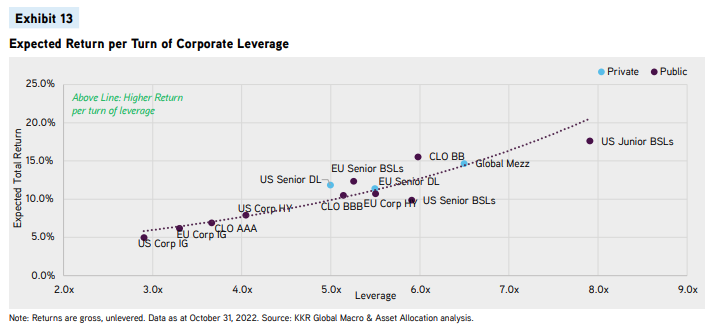

To understand risk, corporate leverage is a good place to start. There are merits to direct lending I buy into, you better align incentives, it can be higher touch, the market is inefficient, to name a few.

The growth in the space has come in the form of non-traded (private) BDCs. Non-traded BDCs provide the illusion of low volatility.

This is Blackstone Secured Lending Fund (BXSL), a publicly traded BDC managed by Blackstone. It has round tripped, up 40%, down to where it started and back up 30% in the past 2 years.

Looking at BCRED, Blackstone’s non-traded BDC, it was a very different story. I took a quick look, there are some differences between the 2 funds, BCRED’s loans are bigger, there are probably nuances around leverage but, I confirmed a few positions are the same in each fund. It probably doesn’t explain the dispersion between the 2 charts. There is an arb here.

Who are the players in the space? For the most it is the largest asset mangers. It has been an asset gathering honey hole over the past 5 years.

With more capital flowing into the space, spreads between private and bank loans have compressed, the Private Credit premium is shrinking. The other metric to look at are covenants but that is much harder to compare.

Last week, we saw the start of a war on fees. KKR and Carlyle offering no carry. This is a funny one, carry does the best job aligning incentives between the investors and the general partner (GP). As an allocator, you want the GP to be financially incentivized to protect capital, with no carry it hardly hurts the GP if a loan goes to 0. 0% management fee and 10% carry would be my optimal structure.

In summary, lots of capital is flowing into Private Credit will make some parts of the market frothy. I buy into the benefits of the asset class that make it attractive, you just need to pick your spots. Those spots probably aren’t available to the mass market.