Charlie Munger on compounding your life.

Nike staff memo from 1977.

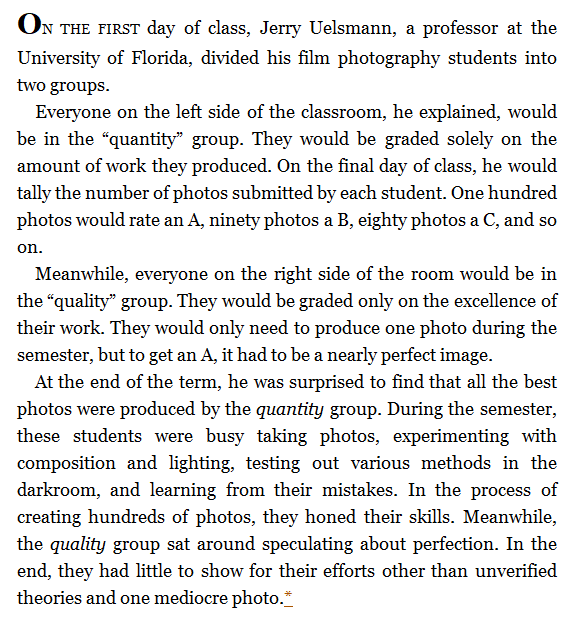

Quality vs Quantity.

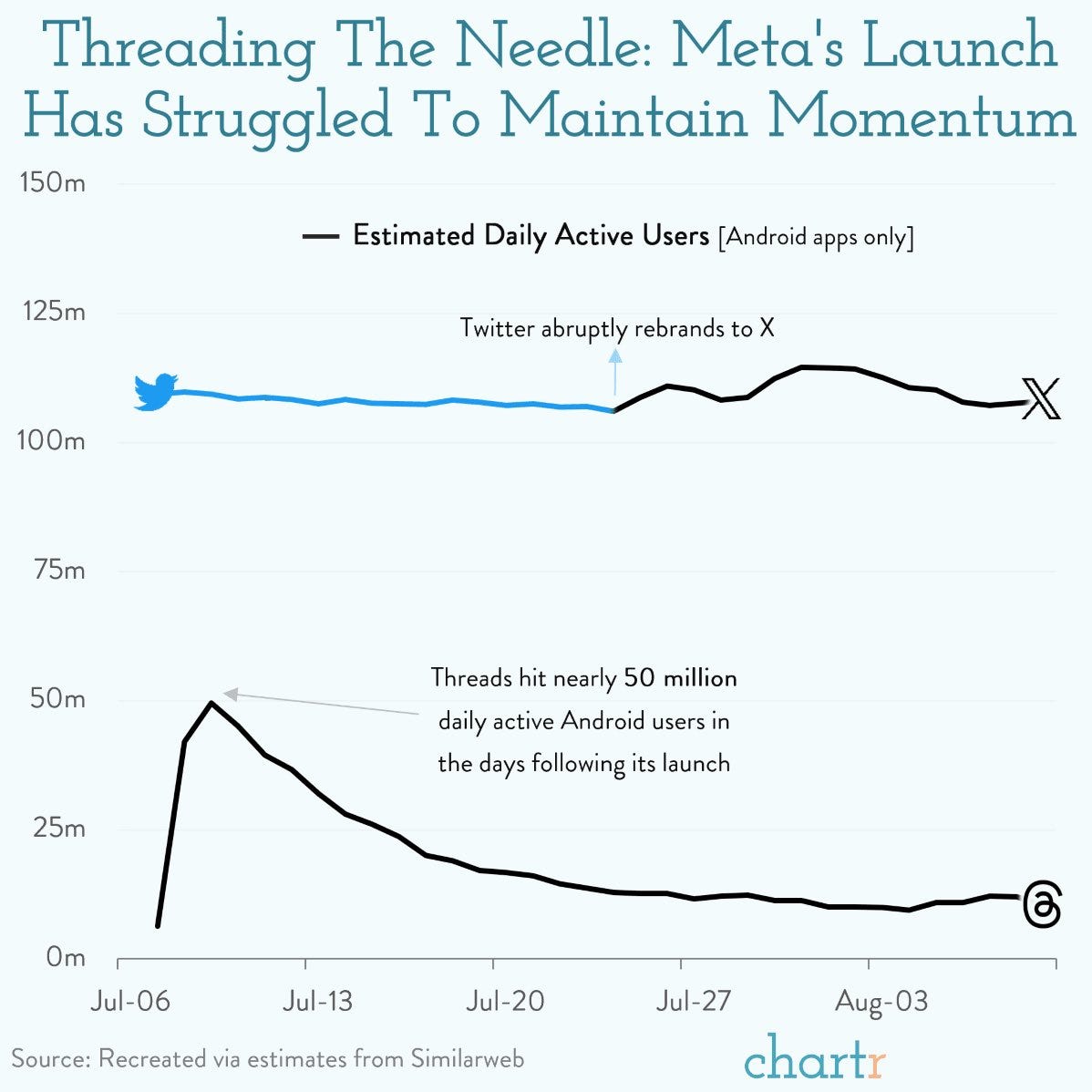

Instagram Threads was a bust.

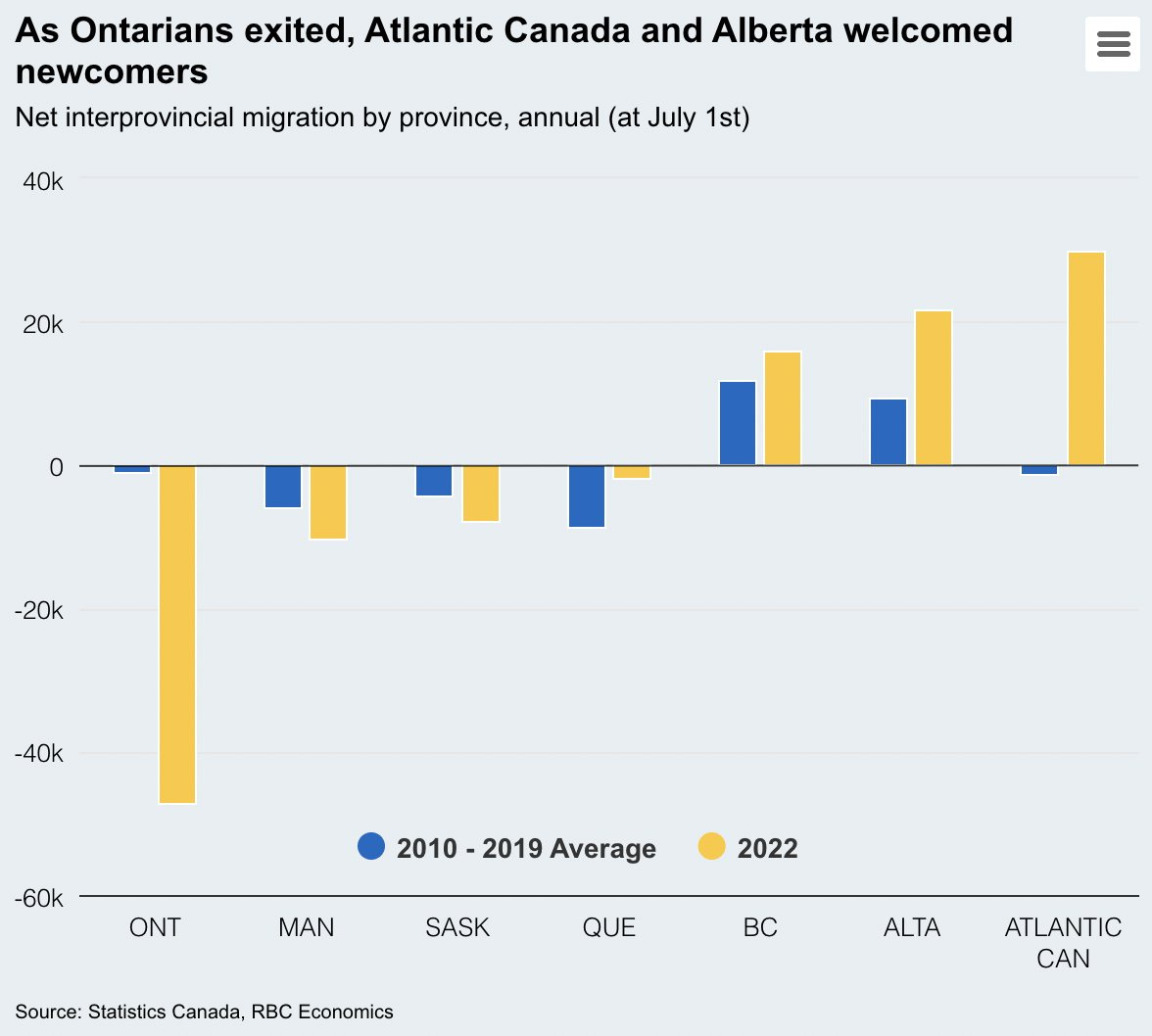

Ontarians are on the move to Atlantic Canada.

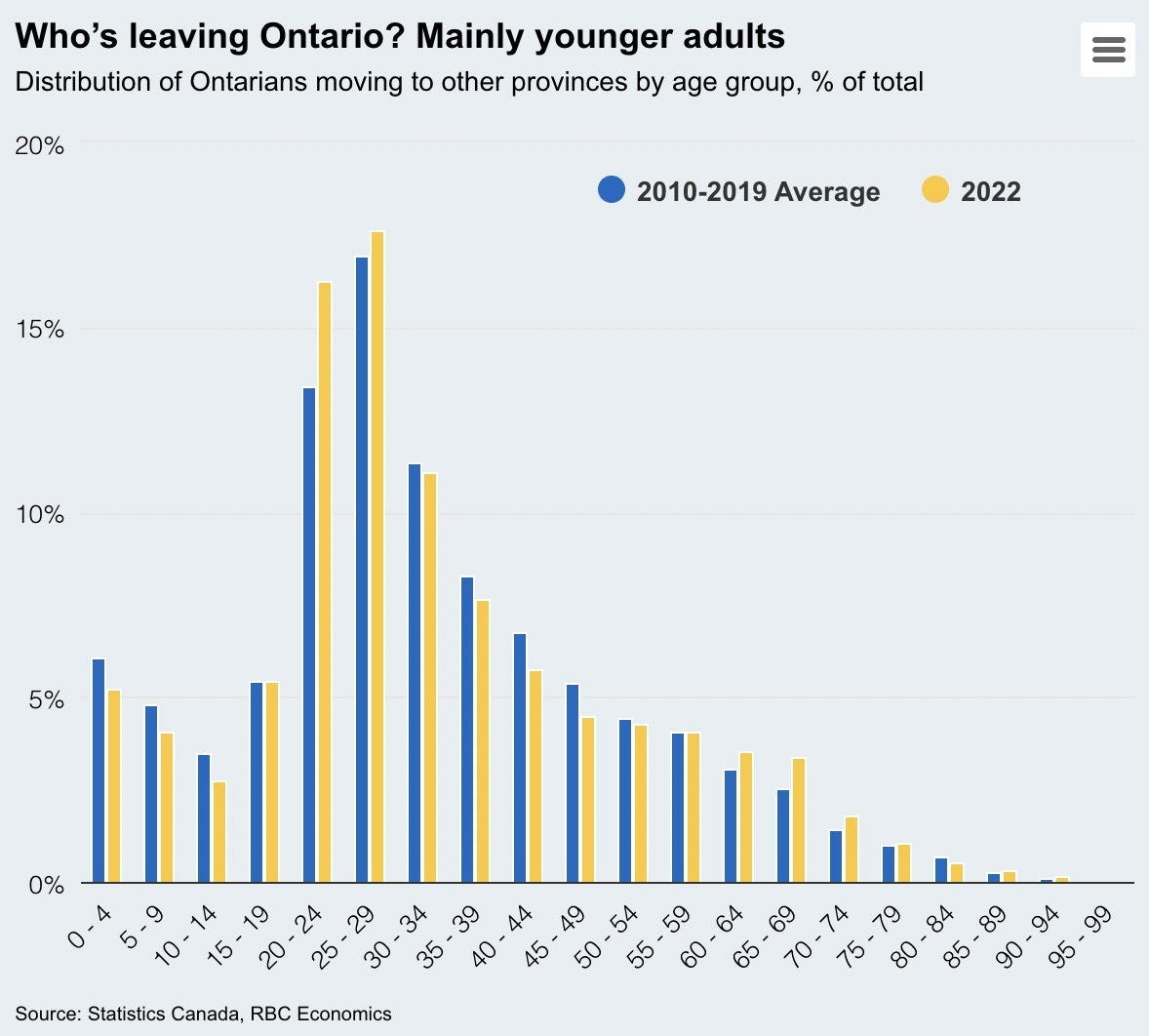

It is mostly young people leaving but, that has always been the case.

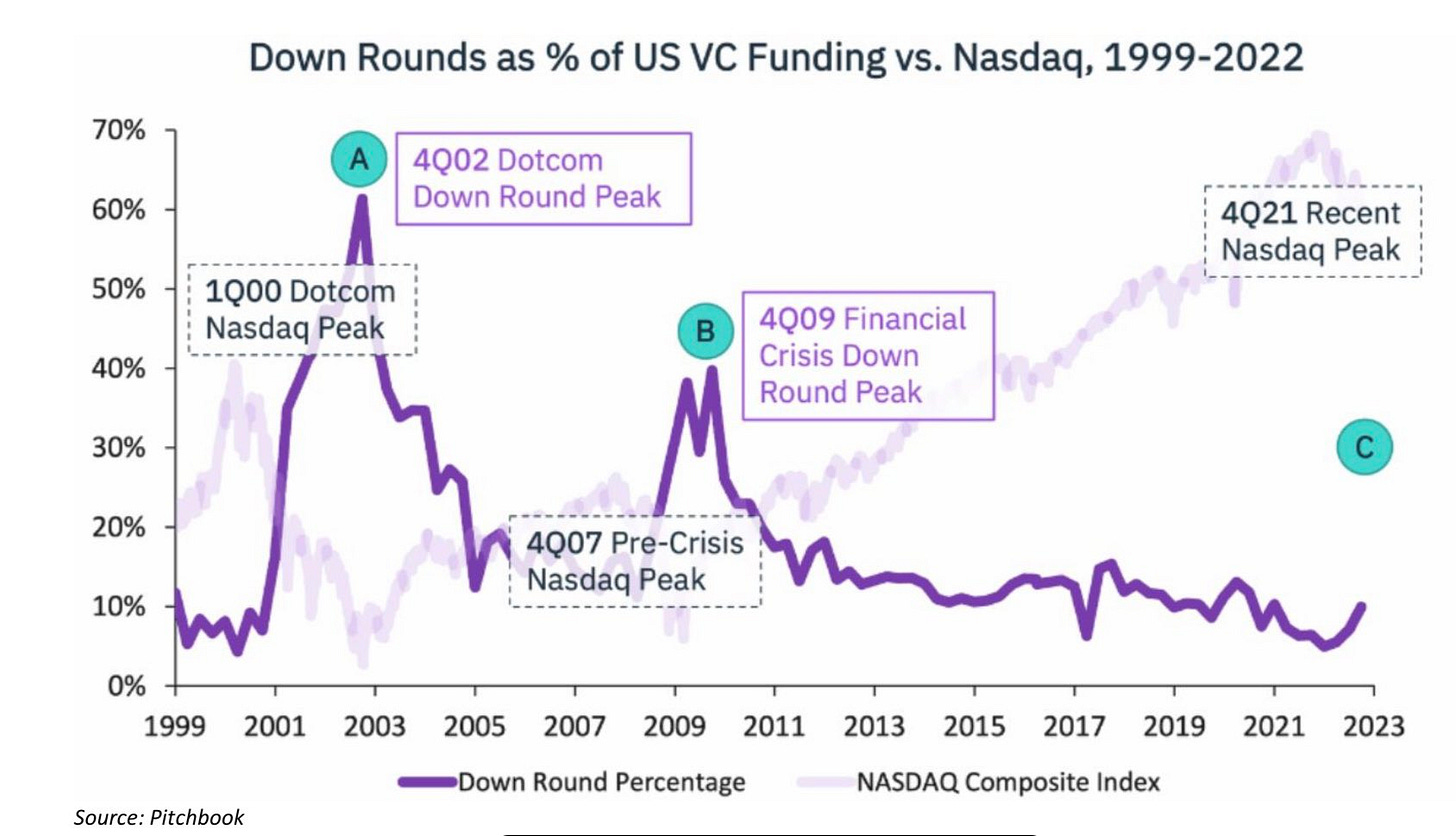

Down rounds have not hit the VC market nearly as hard as previous recessions. What we’ve seen so far is small potatoes.

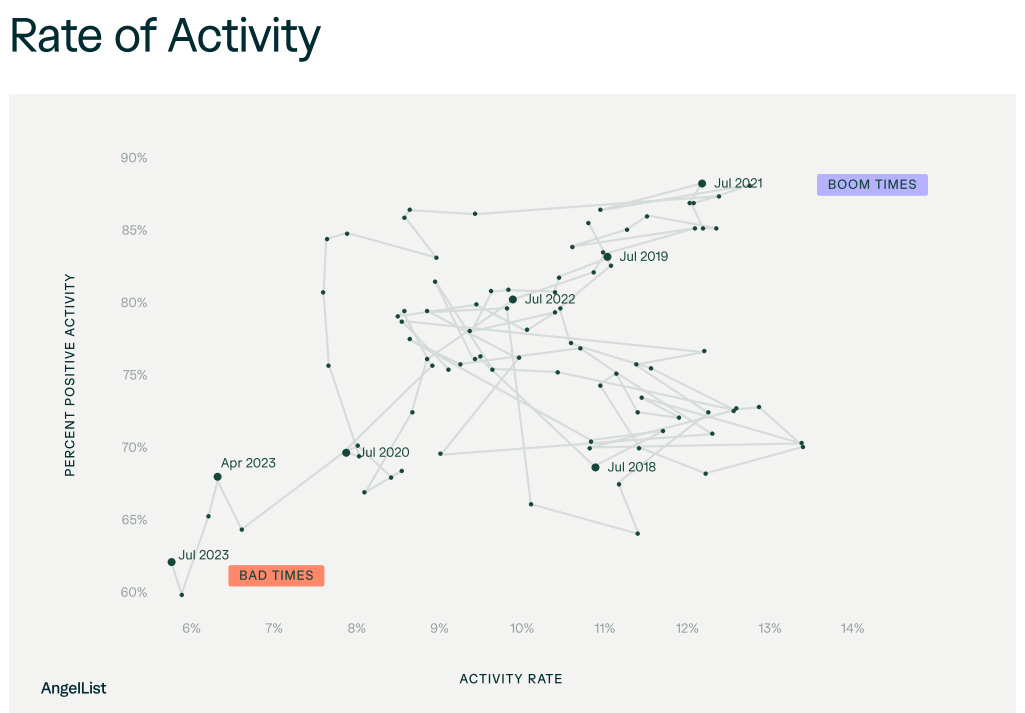

VC Activity rate hit a new low, while positive activity netted out at the second-lowest rate ever observed in the dataset. 5.25% of active startups on AngelList raised a round or exited in Q2. Combining this lack of investment activity with the fact that, of the deals getting done, only 62.8% were positive.

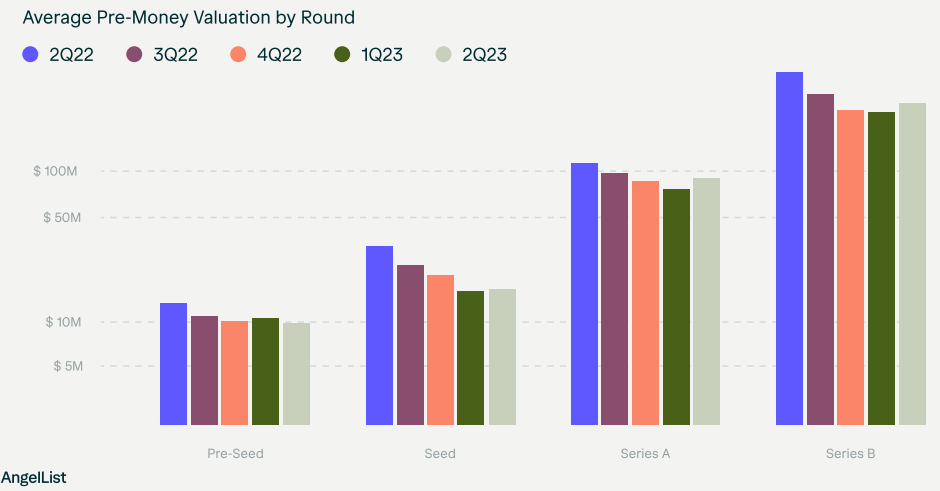

Average valuations actually went up in Q2. Pre-seed valuations declined by 8.2% over the previous quarter to $9.2M, seed-stage valuations increased by 4% to $23.5M. Series A valuations grew by 17% to $80.7M, and Series B valuations grew by 12% to $252M.

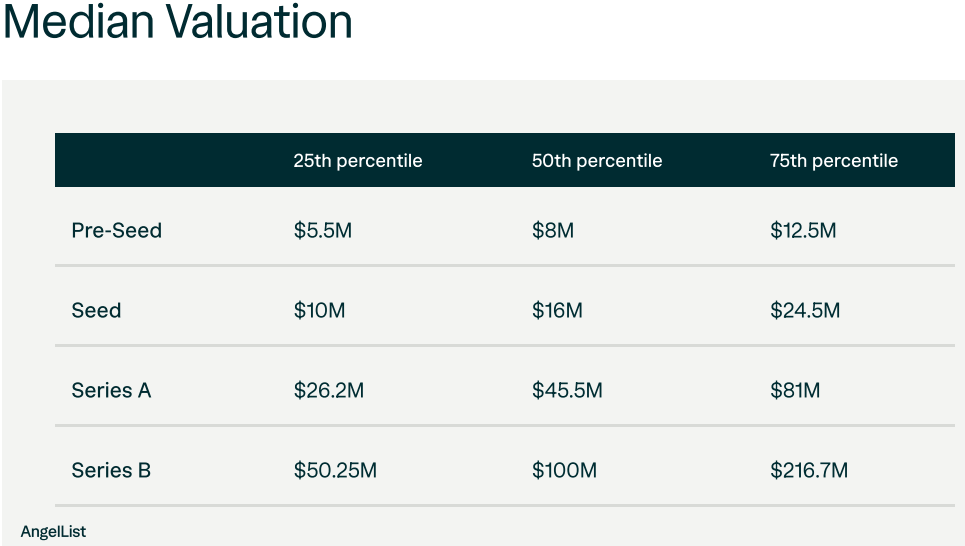

Unlike average valuations, median valuations (50th percentile) for startups on AngelList showed material declines over the previous quarter. Median pre-seed valuations declined by 20% to $8M, seed-stage valuations declined by 11.1% to $16M, Series A valuations declined by 20.1% to $45.5M, and Series B valuations declined by 33.3% to $100M.

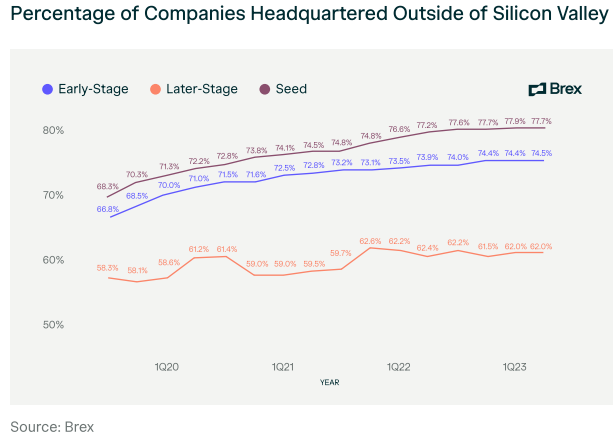

More early stage companies are headquartered outside of Silicon Valley compared to before the pandemic.

Miami and Austin are the winners and Boston is the loser, I wonder why?

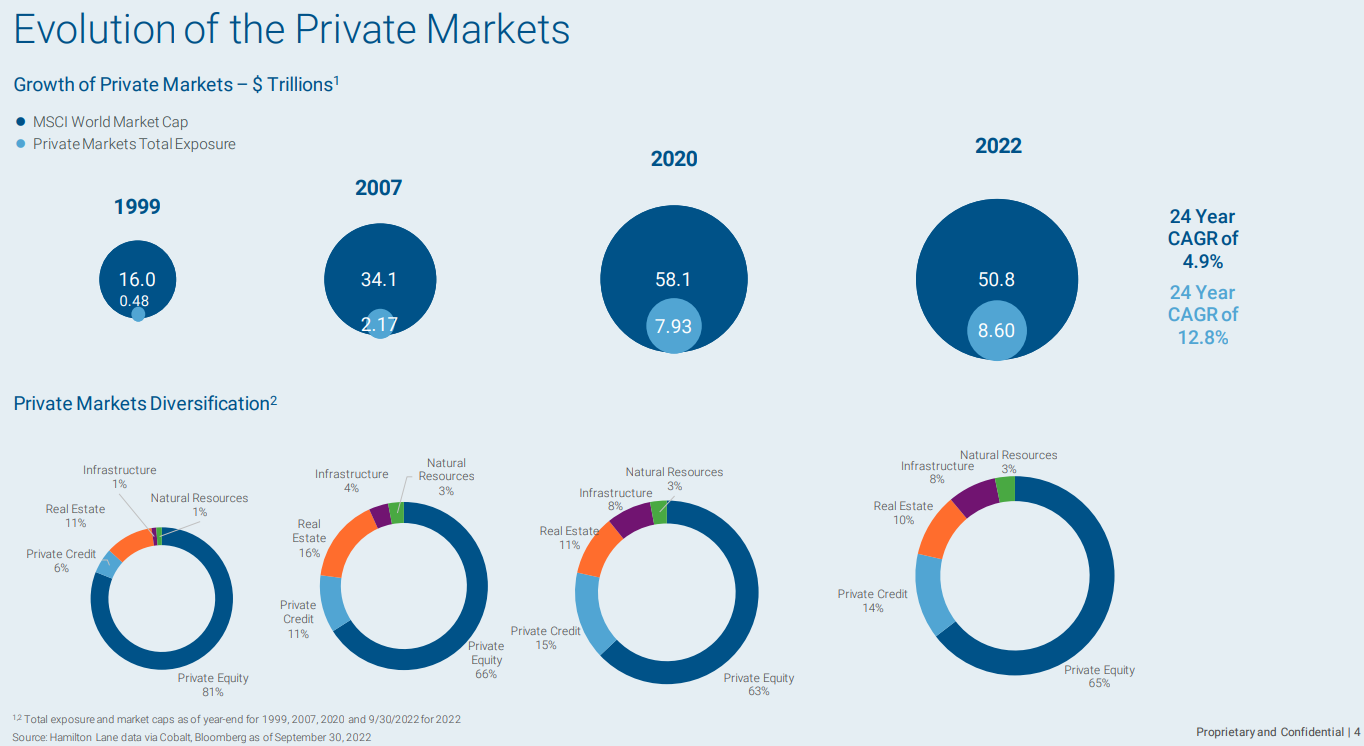

Private markets continue to grow, growing 12.8% a year since 1999. 60% of $8.6T is private equity.

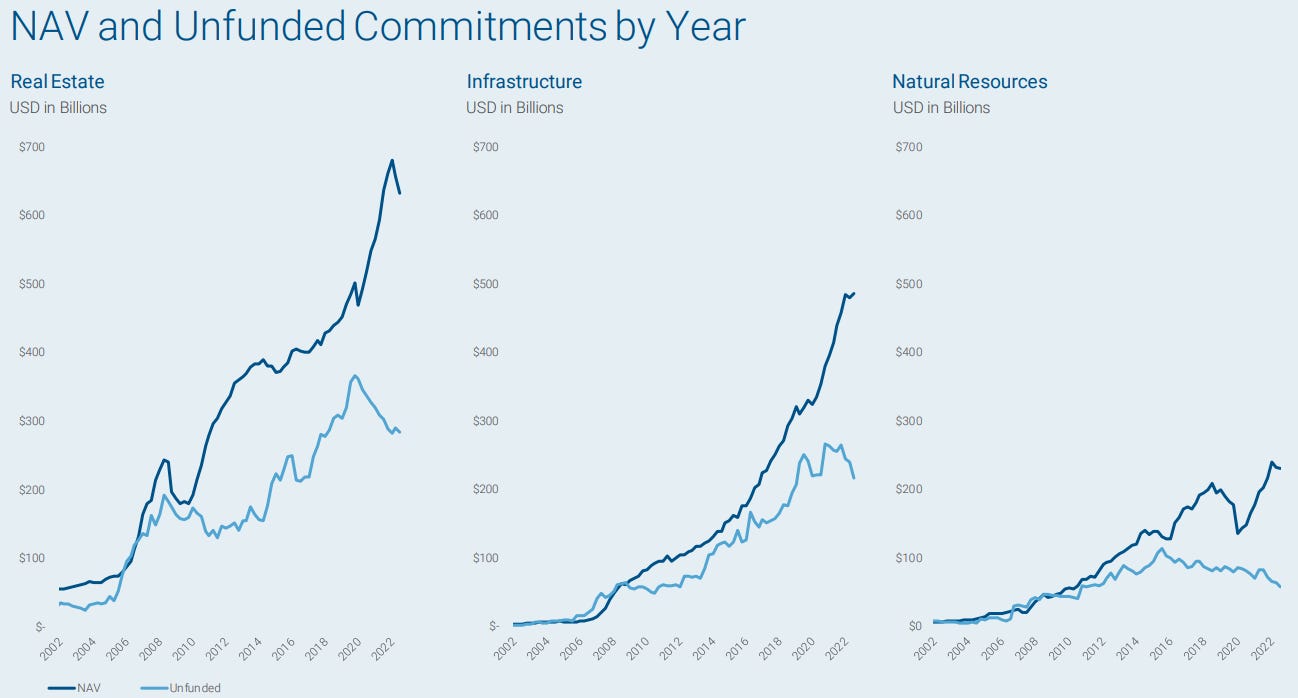

There remains hundreds of billions of dry powder earmarked for real assets.

Private markets have delivered higher returns than public markets over the past decade. This is a contentious point depending who you talk to, I buy it for the most part.

Stonks 📈📈📈