Daily Charts - Recession Indicators

A handful of recession indicators, on top of things such as the yield curve are flashing red.

New lows for the US Leading Indicator index. This indicator has a 100% hit rate on anticipating recessions with a 7-8 months lag.

Another indicator, this is the cyclical engine of the economy losing momentum. Housing & goods as a % of GDP are losing momentum.

Another set of indicators, when ISM new orders fall below 47 and buildings permits growth fall below -20%, it has an almost perfect hit rate.

Citadel has now generated more returns than Bridgewater, over $65B since inception. That’s a lot of performance fees.

The offshoring of the US domestic semi-conductor happened after the dot com.

Now, the US is dependent on Taiwanese chips, looking back, hard to believe we let this happen.

Adopting electric vehicles could mean we become dependent on China and their rare earth metals. After watching what happened to Europe with Russia, it is something to consider.

From Johan Authers

Of large cap core managers, 62% beat the S&P 500 to notch the highest percentage since 2005, when 66% beat the index. More to the point, this was the first year that a majority of active managers beat the S&P since 2009. Last year brought an end to more than a decade of persistent underperformance by active managers:

It was the FANGs’ fault. “The fact that many managers simply do not hold the top five companies at the same weight as the index has been accretive to portfolio performance,” analysts at Strategas including Ryan Grabinski wrote in a note earlier this month. As 2022 started, the S&P 500 was dominated to an unprecedented extent by its biggest five stocks.

After a decade of underperformance, macro managers finally won one.

The majority of active managers underperform in the long run.

23 days into the year the Valkyrie Bitcoin Miners ETF is up 98%, safe to say there is still capital chasing speculative assets.

Interesting podcast on the USD (Link).

Choose your fighter, Buffet with the big Apple exposure.

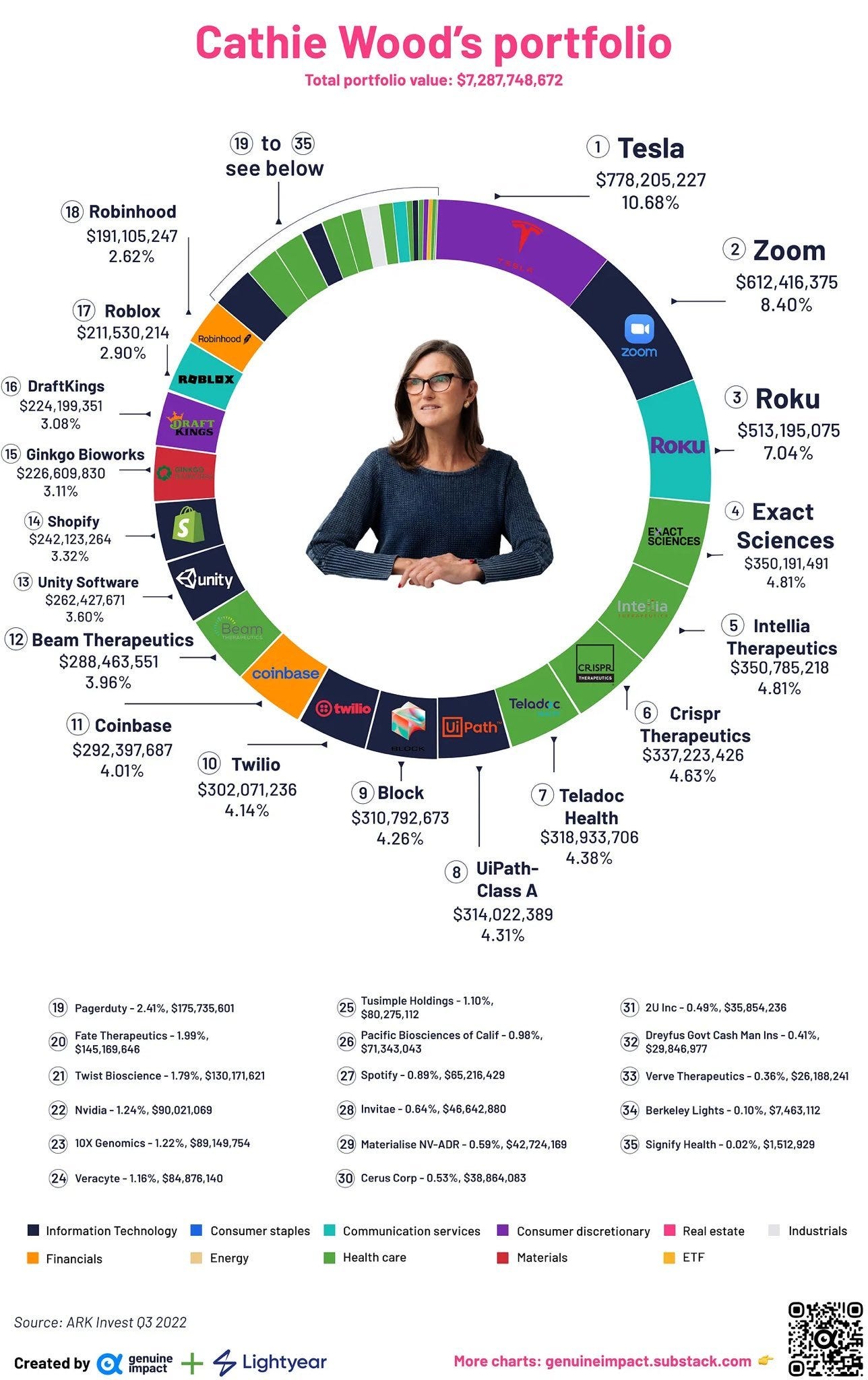

Wood, with the long duration tech portfolio/ playing for a pivot portfolio.

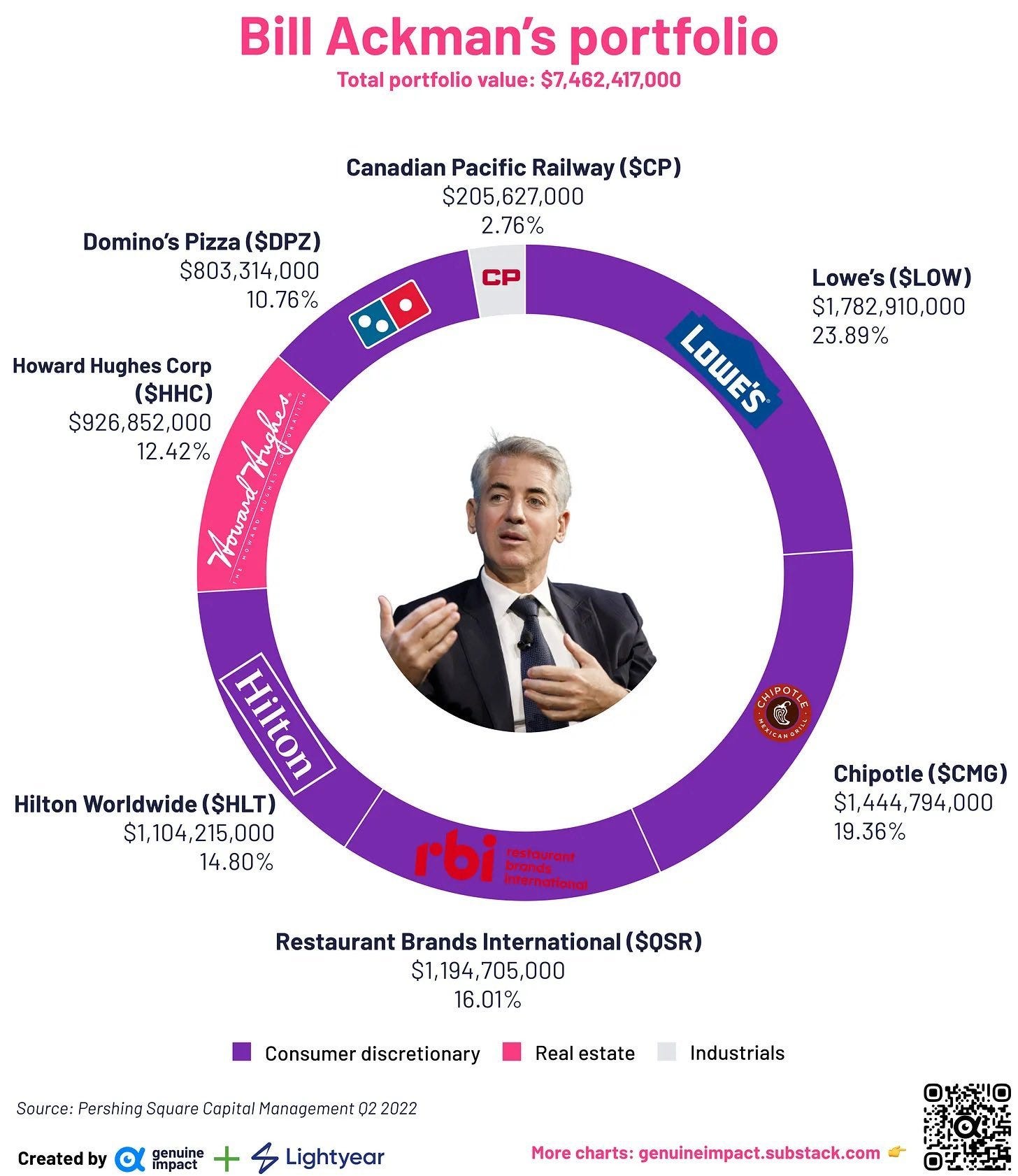

Or Ackman.

Buffet’s portfolio would be my choice as Wood’s seems highly speculative and Arkman’s is over weight in the restaurant industry. jmo