Daily Charts - Recession Signs

More than $3 billion exited the $36 billion iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) on Monday. That’s the biggest one-day outflow since the fund’s inception in 2002 and almost 10% of the fund.

The Fed has been hiking aggressively but nowhere near the pace of 1980 and slower than 1973.

Hikes are taking a toll on earnings. Five years ago, the US had the smallest normalized proportion of negative earnings surprises of any major region, but today the US has the highest proportion of negative surprises. Potential warning signal. Meanwhile, the magnitude of the beats continues to decline and in now below the post GFC median.

Magnitude of earnings revisions are nowhere near recessionary territory though.

In the event of a US recession, Goldman Sachs predicts that S&P 500 earnings could fall by 11% in 2023

Goldman’s hard landing scenario see’s the S&P 500 retreating another 22% from current levels. This is not their base case.

The market is pricing in a soft landing but the previous occurrences of soft landings had inflation and unemployment in closer equilibrium.

Historically:

Equities bottom AFTER a recession has begun, generally ~3-6 months.

Equities bottom after Fed is done hiking (‘87 = exception).

Earnings contract around the start of a recession.

Multiples compress heading into recessions.

All the regional Fed indices (such as the one from the Dallas Fed) are now in contraction, pointing to a slowing manufacturing sector/economy.

How high will the unemployment rate get next year? If we are going to see a recession that cools inflation, expect a march upwards.

If there is going to be a recession and there are currently signs the economy is slowing, we haven’t entered it yet and that would point to equities having further downside.

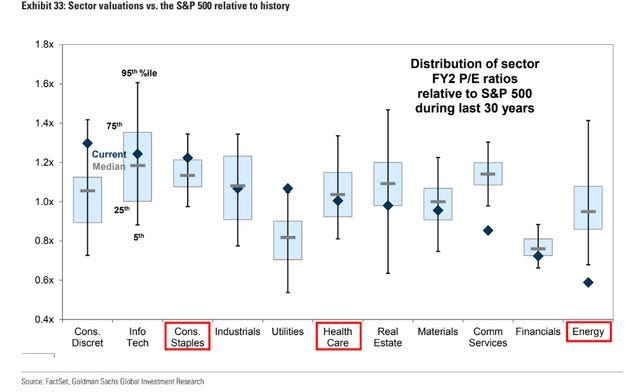

Goldman flagged the sectors they are favouring headed into 2023. Health care, Consumer Staples, Energy, Telecom and Consumer Durables. Notably underweight tech.

Distribution of sector P/E ratios relative to the past 30 years within the S&P 500. Energy and Communication Services stick out as cheap, mind you, earnings can fall.

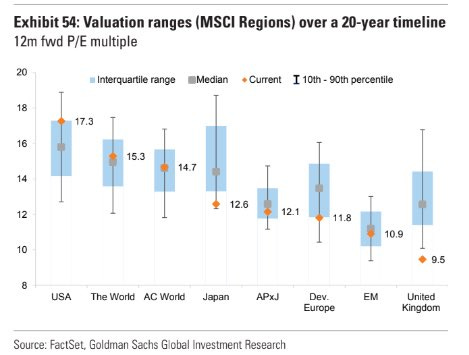

Looking across geographies, it does not happen often that UK equities are valued cheaper than emerging market equities.

Dr. Pippa Malmgren was on Macro Voices.

In January (7 weeks before the invasion of Ukraine), a Russian oligarch’s mega yacht parked atop the most important cable for space connectivity and underneath it submarines cut the cable (in 2 spots) to remove around 6.5km of cable, under normal circumstances it would have been considered an act of war. She covers WW3, China’s covid policy, CBDCs, Trump and more.