Daily Charts - S&P 500 Hitting YTD Lows

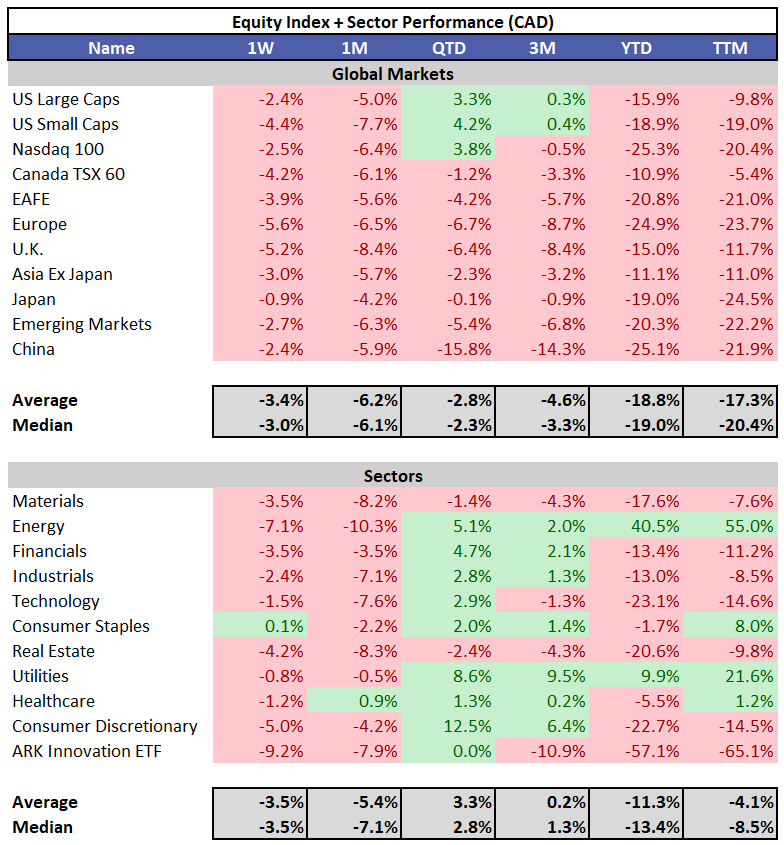

A second consecutive ugly week for markets. The Fed hiked 75bps as expected. Canadian inflation came in at 7%, better than 7.3% that was expected. Sentiment taking a turn for the worse, things starting to get ugly as equity markets bled lower across the board.

S&P 500 is now approaching its low on the year.

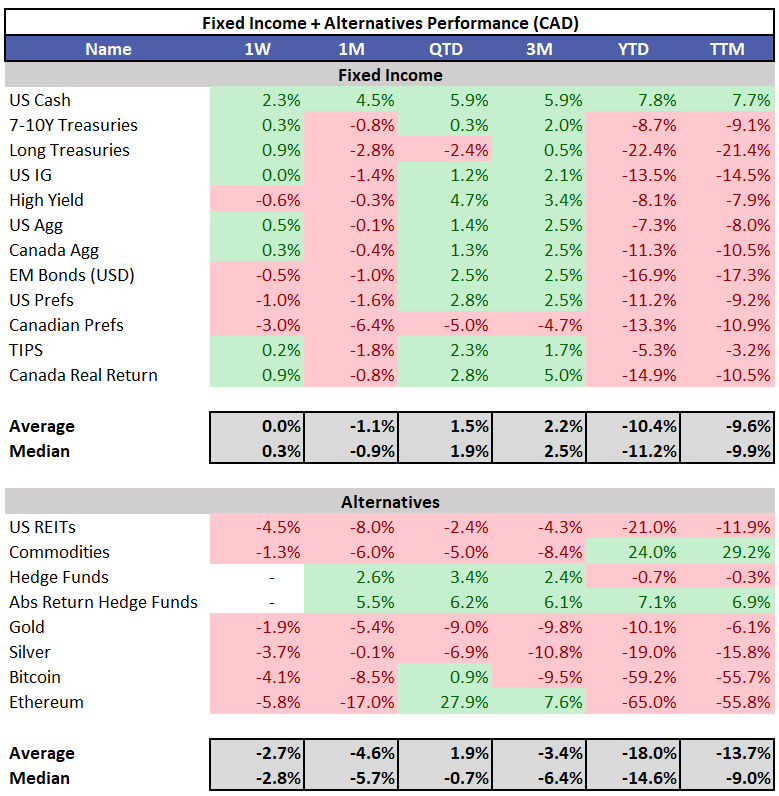

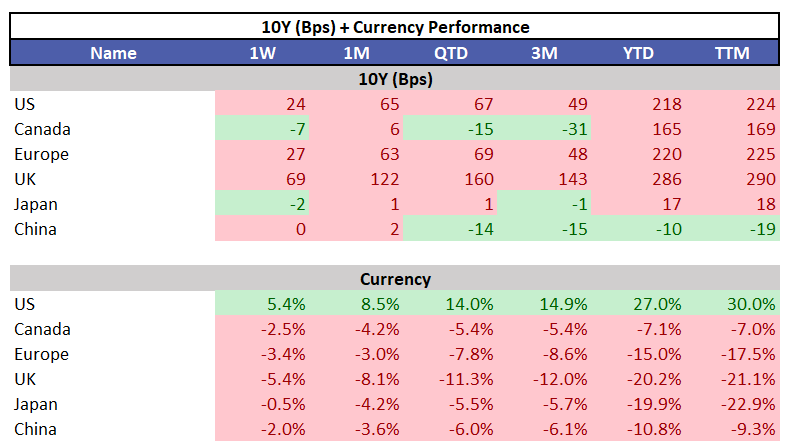

US yields were up 24 bps on the week but due to CAD weakening, fixed income will look positive in the chart below. Canadian yields actually fell likely due to the positive inflation number.

WTI ended the week below $80 for the first time since early January. Even gold was down almost 2%. Nowhere to hide.

UKs new gov’t unveiled enormous tax cut package (largest since 1972), leading to pressure on Gilts/GBP. GBP opened down another 3% Sunday night. Additionally, the BoJ intervened in currency markets to defend the Yen last week.

The only place to hide this week was in the USD. Dollar milkshake theory seems to be playing out as the Fed tightens and stresses the global financial system. As they continue to raise rates we will see more and more stress on the system; until a systematic risk forces the Fed to pivot. On news of a pivot, assets like gold, Bitcoin and tech probably rally.

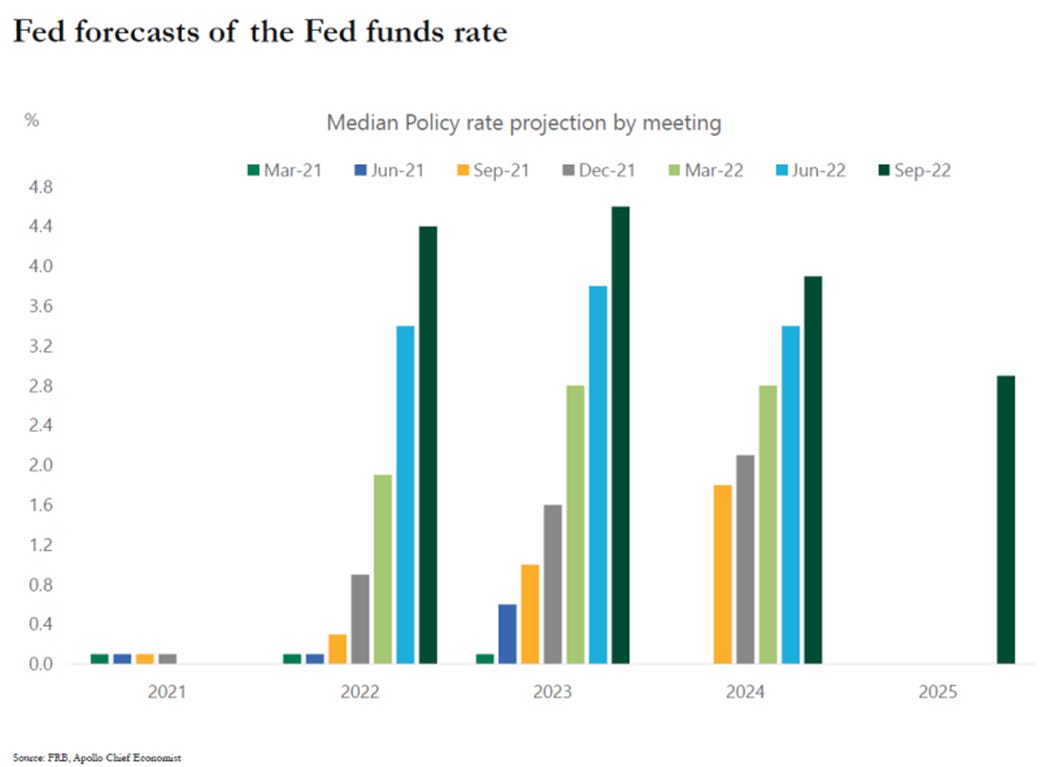

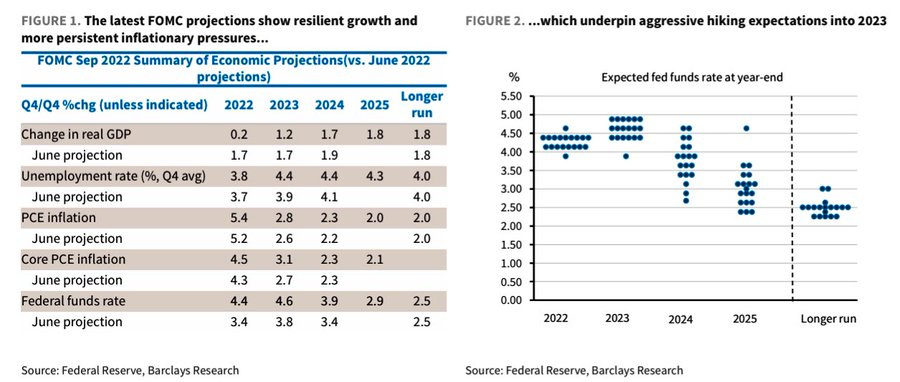

In March 2021, the FOMC thought the Fed funds rate would be zero at the end of 2023. Now they think the Fed funds rate at the end of next year will be 4.5%. It seems the market’s denial that rates will remain elevated is starting to shift.

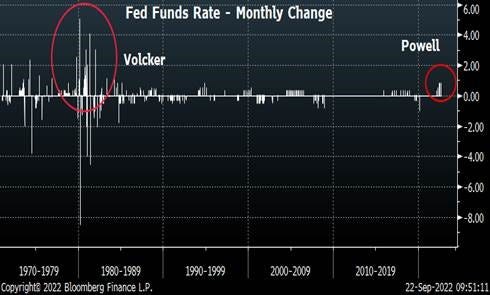

If Powell starts hiking rates by +100bp then it might be appropriate to compare him to Volcker. Right now the difference remains glaring. Volcker hiked by more than 200 bps on multiple occasions.

The Fed’s economic projections do seem extremely out of touch. They are predicting a golidlocks scenario where the unemployment rate remains below 5%, we have positive real GDP and inflation cools to below 3% over the next 2 years.

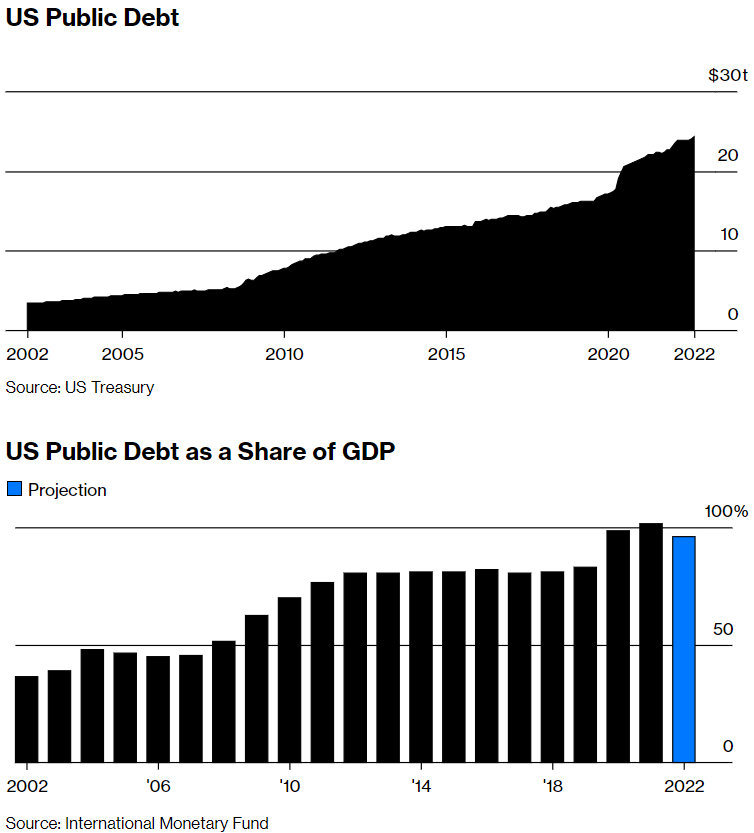

Note to Treasury holders. US has debased their debt through inflation, reducing debt to GDP at the expense of bond holders.

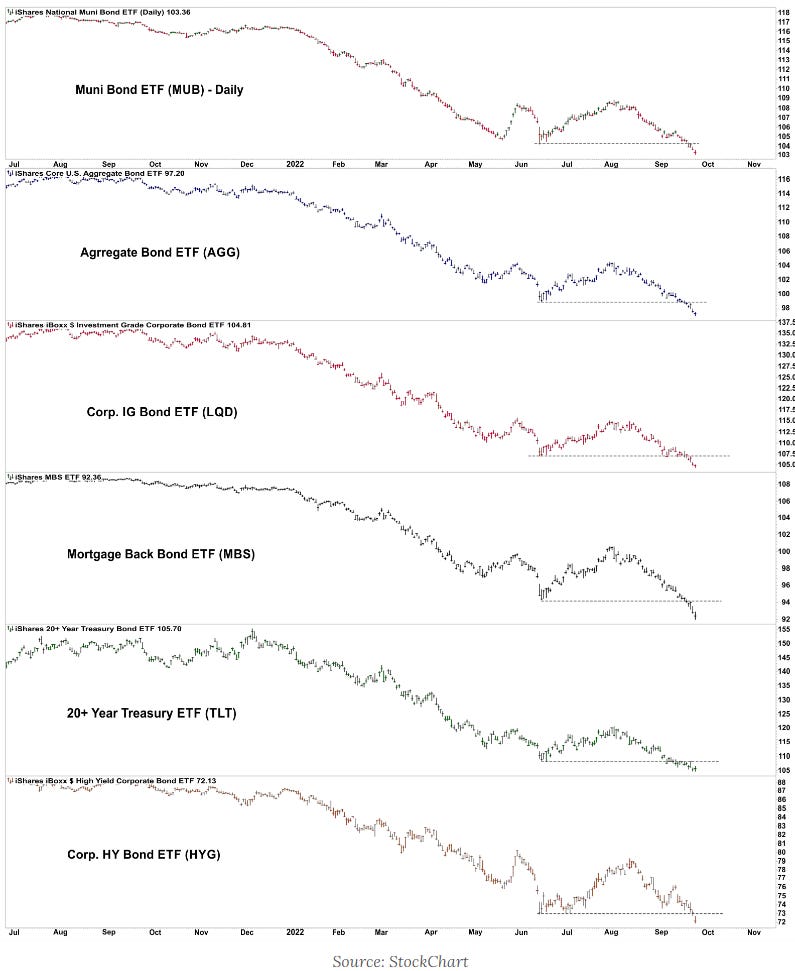

What are thought of as safer investments, fixed income has been slaughtered this year.

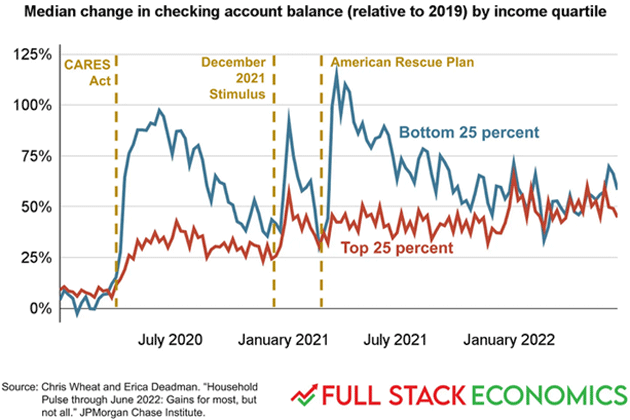

The change in checking account balances since 2019 for the lower 25% income quartile. Even after a year of inflation, the poorest group still has more than 50% cash in the bank than it did before COVID. In percentage terms, their lot improved even more than the top quintile.

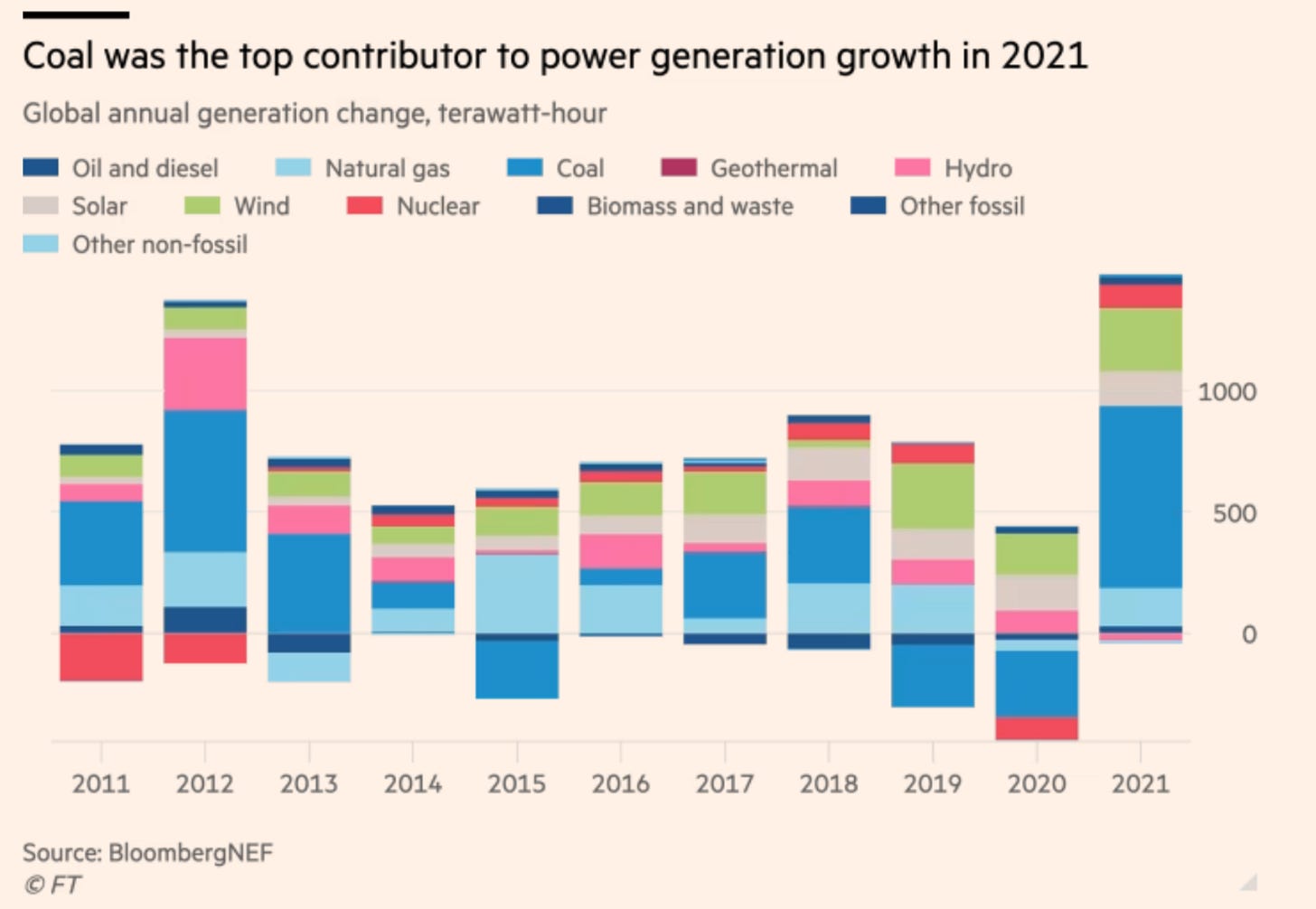

Coal was the top contributor to new generation in 2021. This was even before Russia invaded Ukraine. China, India, the US and Germany led the growth in coal-fired power, largely driven by high gas prices, growing electricity demand and severe drought hurting hydropower.

Canada has been a failed to bring LNG to global markets. Sad.

As I started writing this last night, my twitter feed was in a cheery mood, buckle up.