Daily Charts - Steve Jobs and Family Businesses

ECB has their head down and continue to hike.

Shopify is cutting about 1800 employees. The stock was up about 25% yesterday.

The Steve Jobs Archive put together some wonderful content from his life including speeches, interviews and correspondence from him. This podcast is a good summary and here is the full book.

I’ve highlighted some key excerpts below.

People are everything.

Speech at Palo Alto High School graduation in June 1996.

Don’t be a career. The enemy of most dreams and intuitions, and one of the most dangerous and stifling concepts ever invented by humans, is the “Career.” A career is a concept for how one is supposed to progress through stages during the training for and practicing of your working life.

There are some big problems here. First and foremost is the notion that your work is different and separate from the rest of your life. If you are passionate about your life and your work, this can’t be so. They will become more or less one. This is a much better way to live one’s life.

[The] risk factor quotient goes down as you encounter the real world. Many [people] find what they believe to be safe harbors (lawyers and accountants), only to wake up ten or fifteen years later and discover the price they paid.

Make your avocation your vocation. Make what you love your work.

The journey is the reward. People think that you’ve made it when you’ve gotten to the end of the rainbow and got the pot of gold. But they’re wrong. The reward is in the crossing the rainbow. That’s easy for me to say—I got the pot of gold (literally). But if you get to the pot of gold, you already know that that’s not the reward, and you go looking for another rainbow to cross.

Think of your life as a rainbow arcing across the horizon of this world. You appear, have a chance to blaze in the sky, then you disappear.

Be aware of the world’s magical, mystical, and artistic sides. The most important things in life are not the goal-oriented, materialistic things that everyone and everything tries to convince you to strive for. Most of you know that deep inside. Think back on this spring—the last three or four months—when you are winding down high school, know where you are going next year, and begin to really have strong intuitions about the world you will encounter. Maybe you see an image of yourself in Paris, sculpting in an artist’s studio as the setting sun shines in the paned windows. Maybe you’re in India, running a hospital for poor children, and you hear the distant clatter of the outdoor marketplace in the early morning. Maybe you see yourself in a recording studio laying down a track for your album. Maybe you see yourself alone in a rented room at 4:30 in the morning being the only person alive to understand a new law of physics you just figured out.

Whatever it may be, I bet many of you have had some of these intuitive feelings about what you could do with your lives. These feelings are very real, and if nurtured can blossom into something wonderful and magical.

A good way to remember these kinds of intuitive feelings is to walk alone near sunset—and spend a lot of time looking at the sky in general. We are never taught to listen to our intuitions, to develop and nurture our intuitions. But if you do pay attention to these subtle insights, you can make them come true.

“I always tried to coach myself on not being afraid to fail.”

1996 interview with Fresh Air radio host Terry Gross.

G: Do you think that when you were ousted from Apple that people kind of wrote you off? I mean, here you are with these big successes now.

SJ: Oh golly, I don’t know. I’m sure that a lot of people did, and that was fine. It was a very painful time, as you might imagine.

TG: What, to be forced out of the company you created?

SJ: Oh, of course. That was a very painful time, but you just march forward, and you try to learn from it. One of the things I always tried to coach myself on was not being afraid to fail. When you have something that doesn’t work out, a lot of times, people’s reaction is to get very protective about never wanting to fall on their face again. I think that’s a big mistake, because you never achieve what you want without falling on your face a few times in the process of getting there. I’ve tried to not be afraid to fail, and, matter of fact, I’ve failed quite a bit since leaving Apple.

CS Family 1000 Report was released. They define a family business as the following:

The founder or his or her family owns at least 20% of the company’s share capital. The founder or his or her family controls at least 20% of the company’s voting rights

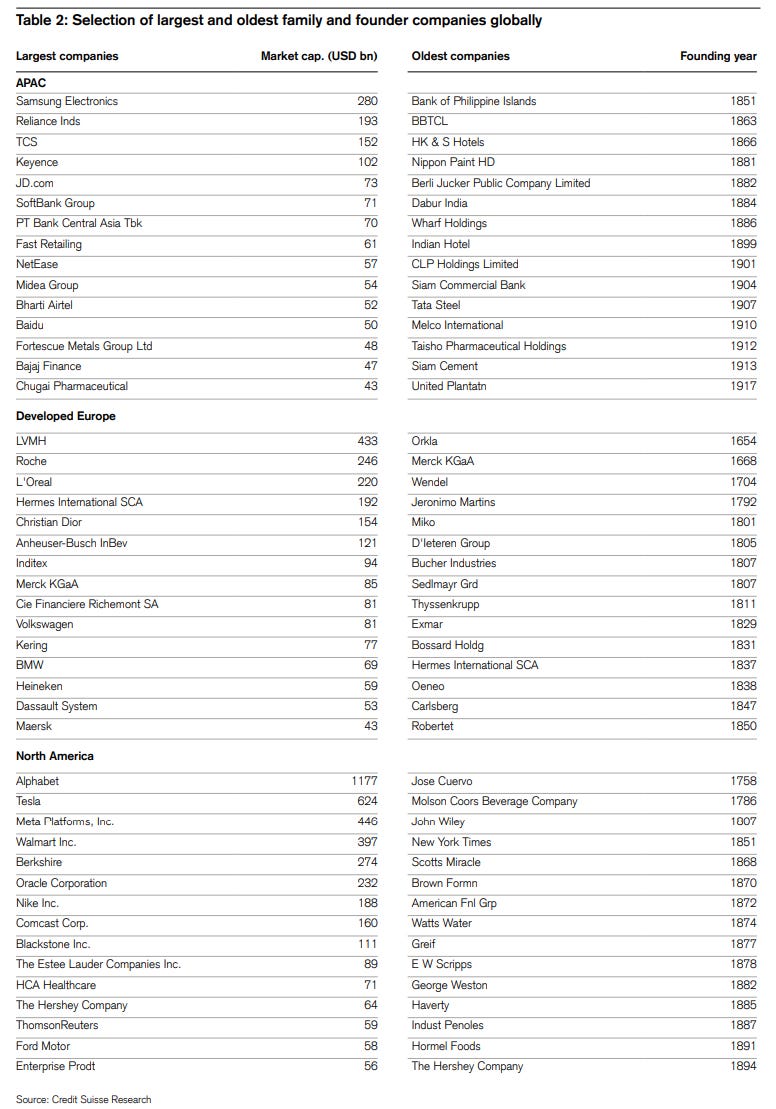

Some of the world’s largest family businesses below.

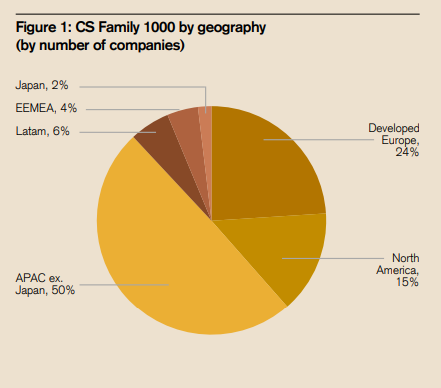

Fifty percent of the universe is in Asia Pacific, with developed European family-owned companies making up 24% of the database and North America contributing 15%. This regional mix is very similar to previous editions, with a concentration of family-owned listed companies in the emerging world.

Info tech is under represented when it comes to family businesses. This must be driven by the VC funding model.

Generation 2 is the sweet spot for family ownership.

Family businesses tend to use less leverage.

CS’ universe of family businesses have outperformed the non-family owned universe since 2006.

From the Knight Frank high net worth report. 31% of families are focused on capital appreciation, capital preservation is the next most important objective.

Of the cities attracting private capital investment, US metropolises accounted for 67% of the total volume, with Paris the only non-US cities to feature in the top 10. While eleventh overall for total private investment (cross-border and domestic) in 2022, London was top for cross-border private capital with US$2.5 billion. Overall, this accounted for 44% of the total private investment into the city and 15% of total global cross-border private investment into cities in 2022.

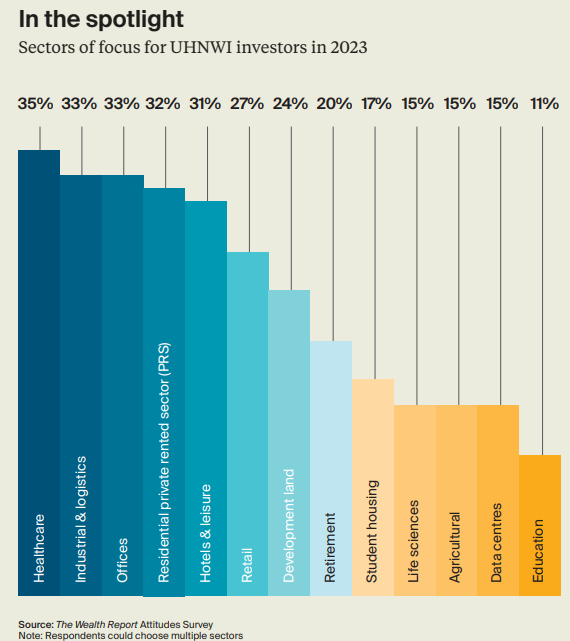

Healthcare is the hottest sector for Ultra High Net Worth families.