Daily Charts - RIP SVB 🪦

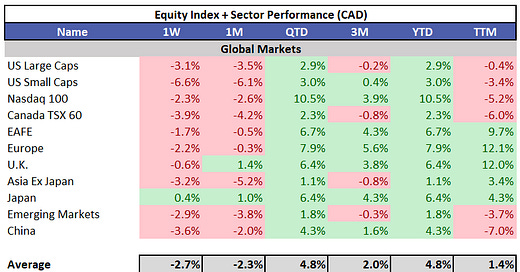

The week was dominated by bank failures. Silvergate started the party, by Thursday fears had spread to Silicon Valley Bank (SVB) and by the end of the weekend Signature Bank had also failed. Markets broadly sold off on fears that these failures would spread to other areas of the financial system and the economy. Equity investors of these institutions will be wiped out but by Sunday night authorities announced they will backstop deposits, which was the main question mark and cause for concern headed into the weekend. Due to these events, Financials were the worst performing sector on the week.

10Y yields in the US were down 25 bps and 35 bps in Canada WoW. Mainly driven by a flight to safety due to the bank failures and speculation that this could prevent the Fed from hiking much further. Overshadowed, the Bank of Canada announced they would be holding rates steady diverging with Fed policy, this led to CAD selling off 1.7% WoW. Silvergate’s failure (Crypto’s main tradfi bank) led to poor crypto performance.

SVB was the largest bank failure since the Global Financial Crisis. I will run through what happened at a high level. If you are interested in learning more, I’d suggest this article from Mike Green, this paper from JP Morgan Asset Management and we will also be circulating a more detailed note to clients.

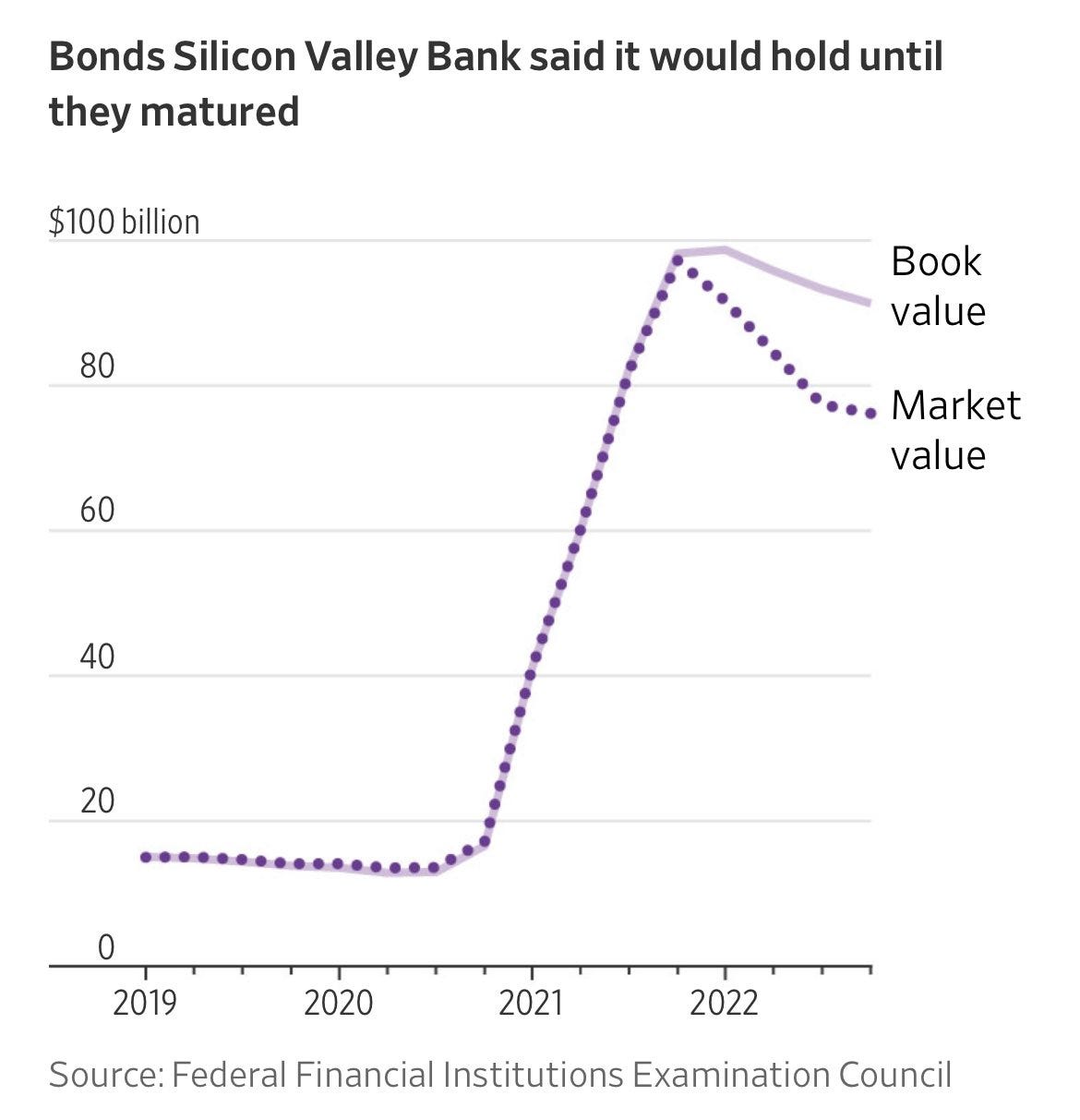

SVB reserves spiked as tech boomed. The bank was much larger than at any point in the last 5, 10, 15 years.

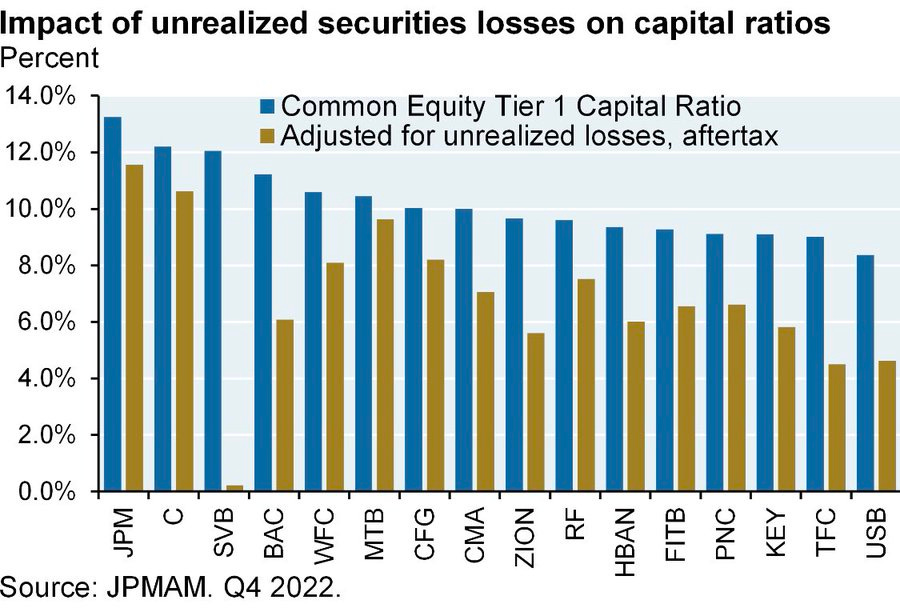

As tech cooled off, rates rose and cash burning start-ups began drawing cash, a problem surfaced. SVB had taken major losses from rising rates due to terrible risk management. They were reaching for yield/returns by buying long duration Treasuries and MBS. Some are arguing the Fed’s zero interest rate policy encouraged this behavior.

Treasuries while, risk-free in theory, rising rates led to mark to market loses. This is not an issue if they weren’t force to sell but the bank was technically insolvent. A prominent VC blogger pointed this out on Feb 23.

A bank run ensued. Despite the bank being in sound financial condition prior to Thursdays, investors & depositors reacted by initiating withdrawals of $42B in deposits. It is interesting to note the virality of the bank run, social media enabled hysteria to spread faster than previously imagined.

There were two reasons there was a bail out of depositors (equity investors lost everything). The first, contagion and runs on other banks. After watching what happened to SVB, depositors at other institutions would begin withdrawing cash creating further bank runs. That is how Signature Bank got caught in the cross hairs.

Secondly, SVB was a major bank partner to the venture eco-system. Start-ups and other entities were unable to access their accounts and there were concerns they would have to take a hair cut on deposits ranging from 10-50%. Start-ups worked throughout the weekend trying to figure out how to make payroll before the announcement about the bail out was made.

What does this mean moving forward? Maybe the Fed is forced to pivot because things are breaking. I doubt it but that’s what was beginning to be priced into the market. I think the Fed will continue to tighten but this is an indication of what will happen when the next thing breaks.

BoC Fed divergence could spell trouble for the Canadian Dollar if commodities aren’t rallying.

Geopolitical strategist, Marko Papic thinks global competition is a good thing. Resources will be directed away from useless technology apps into investments that advance society. We have gotten complacent and this new pressure will create diamonds. Nice 20 minute watch.

Marko questions whether smartphones were good for society.

Louis-Vincent Gave was on MacroVoices, he discusses the death of US Treasuries, geopolitics, energy and Asia.

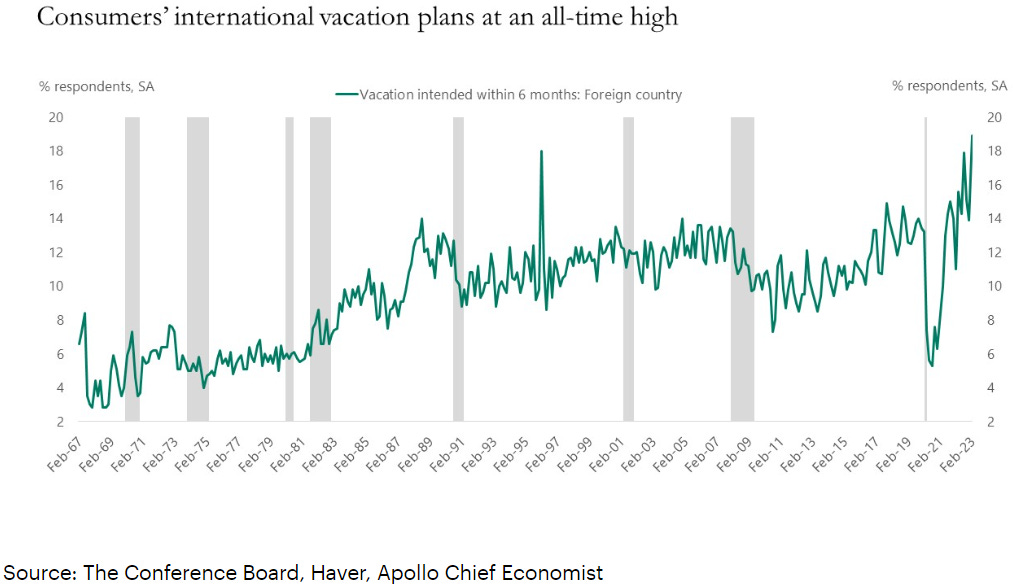

2023 Chinese flights now pointing to 15% above 2019 levels. Louis talks about how the China reopening underwhelmed energy markets.

Revenge travel. The Conference Board asks US households about their travel plans, and the latest survey from February shows an all-time high in vacation plans to a foreign country. We could see similar dynamics in China.