Daily Charts - Middle East Conflict

The S&P 500 was trading lower for most of last week until Friday, where a mixed jobs report resulted in an equity market rally. Last week saw a reversal from the previous month where Tech rallied and Energy sold off.

10Y yields continued to rise in both Canada (13 bps) and US (23 bps) WoW, leading to more pain for fixed income investors. Commodities sold off as crude was down almost 8%. Precious metals sold off. Bitcoin continued to march to its own beat up 4.1% on the week. CAD weakened against the USD.

Tragic events unfolded over the weekend as Hamas militants invaded Israel resulting in mass innocent casualties. America’s role as global police officer may result in more hostile regimes feeling emboldened, leaving behind the unipolar world. More in the blog post below.

For almost 70 years after the end of World War II, global conflicts declined.Historians call this the Long Peace. The lowest level of interstate conflict came from 1989 through 2011, after the collapse of the USSR, when the U.S. became the world’s sole superpower.

Crude was trading up late Sunday as Iran was linked to the attacks and could result in further crude export sanctions. Past, less intense conflicts have not had a major impact on oil prices.

336k jobs were added in the US in September almost double the consensus estimate of 170k. Canada added 64k job, beating expectations of a modest 20k.

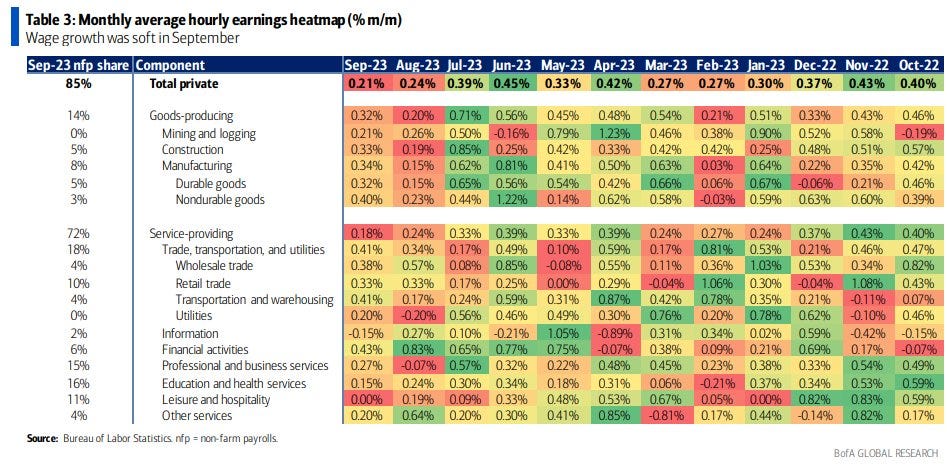

Job growth is coming from a narrower group of sectors, led by hospitality i September.

Wage growth continues to moderate growing at half the rate seen in June.

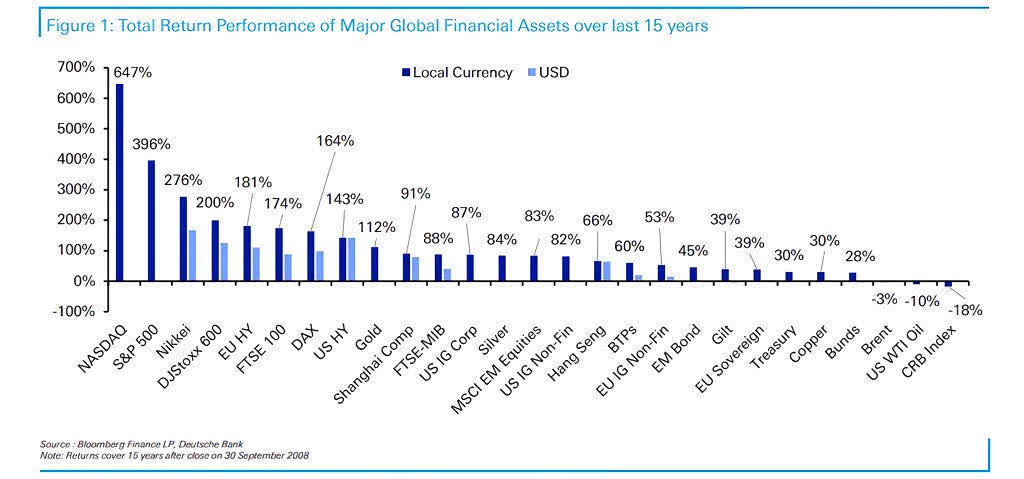

Had we known, you should have but the QQQs and enjoyed life on the beach. Over the past 15 years, the Nasdaq delivered a return of 647%. Other markets did well but nowhere near the tech dominated Nasdaq.

Looking back 15 years, small companies were trading at a premium to large companies.

Fast forward… The trend has reversed.

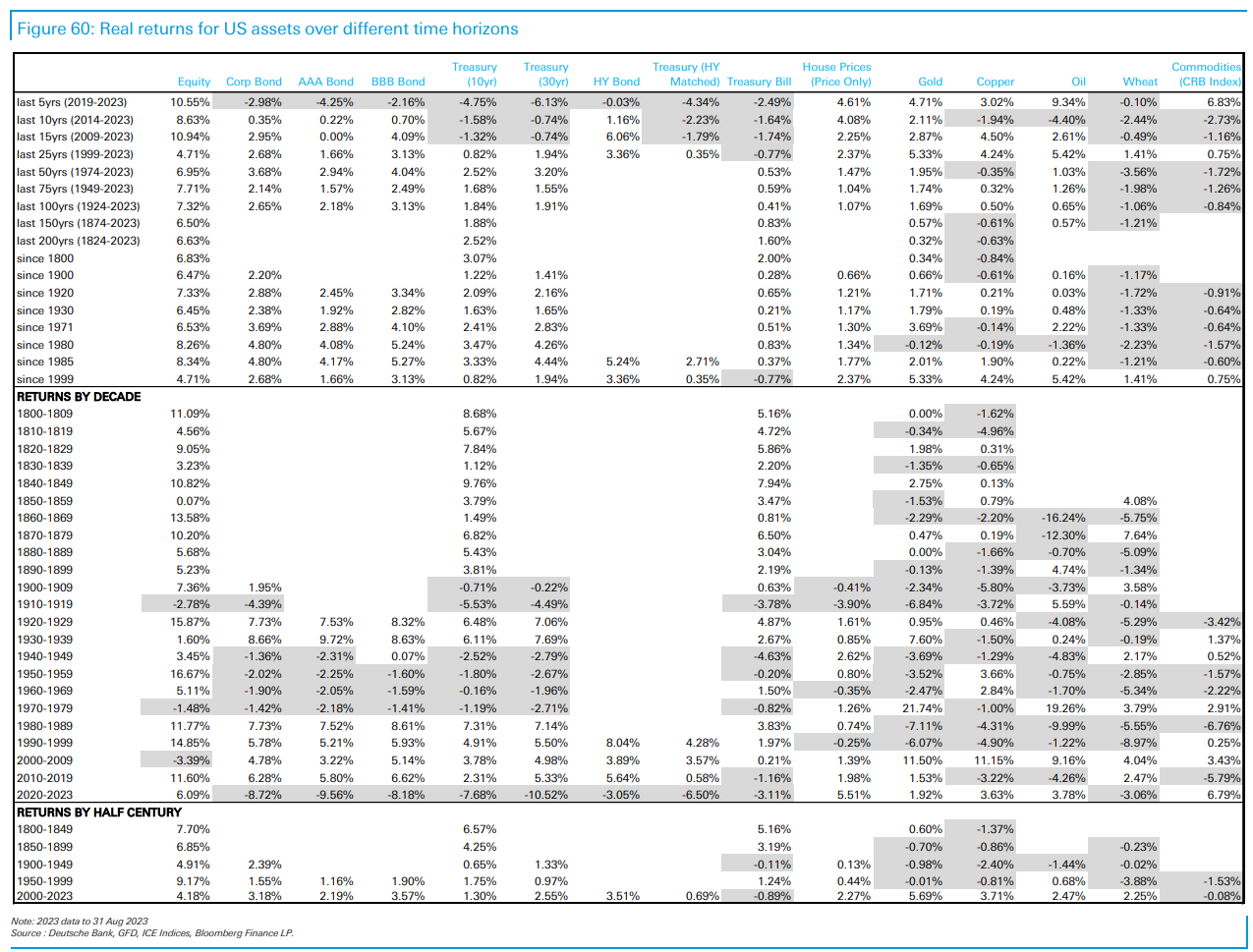

A few interesting charts of long term asset class returns (You’ll have to click in to read). US equities tend to deliver positive real returns but negative decades do happen. Bonds went through a dark era between the 40s and 80s where they consistently delivered negative real returns. Gold and commodity returns are sporadic.

Other developed markets. Canada has actually had an amazing run. Since the 70s most regions’ real equity returns have been positive 3-4 out of 6 decades. Noting, stocks don’t only go up. Looking at bonds, the 1980-2020 looks to be an outlier rather than a norm.

Combining the two, looking at real 60/40 portfolio returns, the period between 1980-2020 very well could have been an outlier rather than the norm. It has been the place to be.