Daily Charts - Transitioning to Stagflation

Everybody believes the future will be like the last 10 years and everyone is positioned that way.

Nice interview with Dalio (Link). He also talked about monetary policy being an upper, it’s feels great at first but terrible when you go into withdrawal.

Bridgewater released a paper called Transitioning to Stagflation. They are seeing the strongest near term stagflationary signal in the past 100 years.

This is where they project out real growth and inflation to be 12 months out.

However, markets are pricing ripping, they are pricing in the goldilocks scenario below:

Even if we do get the goldilocks soft-landing. You only have 15% upside to the S&P 500 back to all time highs and likely much more downside if you are wrong. The all time highs were when the economy was running hot, there weren’t worries of a recession and inflation was still “transitory”.

Bridgewater sees the below being the most likely scenario:

More likely, we see good odds that they pause or reverse course at some point, causing stagflation to be sustained for longer, requiring at least a second tightening cycle to achieve the desired level of inflation. A second tightening cycle is not discounted at all and presents the greatest risk of massive wealth destruction.

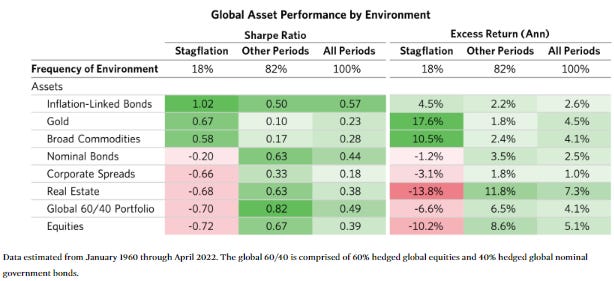

This is how various asset classes have performed historically in stagflationary environments.

Most investors are underweight or have no exposure to commodities, gold and inflation linked bonds. Instead investors are rushing into interest rate sensitive investments like tech. QTD ARK is up almost 25%, the Nasdaq is up 15%. Markets seem to think we have the all clear.

I don’t think any one knows how this is going to play out. It seems like most investors are positioned as if it is a 100% certainty we get a soft landing. To me it is a coin toss and most portfolios are not properly positioned.

Cash is also cited doing well in historical periods of stagflation. I think it will do “less bad” than long only assets that fall as interest rates rise but the difference between now and the 70s and 80s is how deeply negative the fed funds rate is. In the 80s you made a real return on cash.

This morning we got retail sales in across the euro area, and this definitely doesn't look like an economy that's running too hot. The year-over-year number fell 3.7%, which is significantly worse than the 1.7% decline that economists had been expecting.

Retaliating for Pelosi’s visit to Taiwan. China is performing live fire military exercises around the island. The extent of China’s military exercises around Taiwan has massively expanded since 1996 (Link).

Barring only the two worst days of the first Covid shutdown, and when the Fed leaked its intention to hike by 75 bps at it’s next meeting, Tuesday was the biggest daily gain in the US 10Y yield in the past 5 years.

10Y yields had dropped almost a full 1% from its 2022 highs until Tuesday.

High yield investors can finally make a decent yield, although it just barely beats inflation. 16% of the index yields more than 10%.